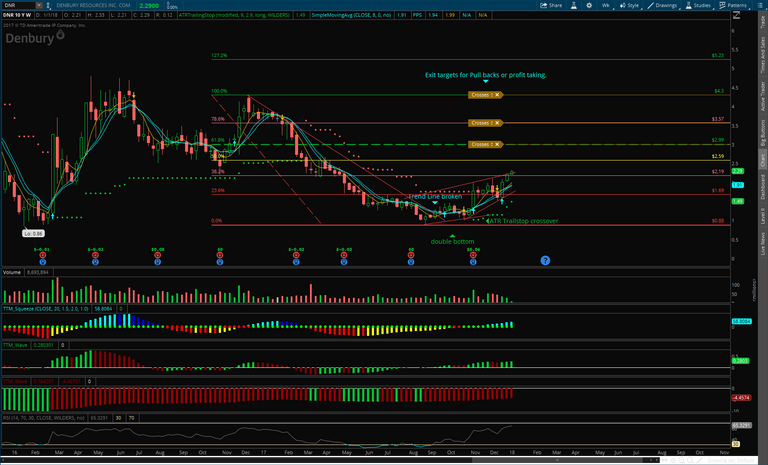

I have same ticker 2 charts for y'all here. We are looking at the Daily and Weekly of Denbury Resources or DNR. This stock is driven by the price action of oil, or crude. Since we have a military that is in full training mode, and 1 Trillion infrastructure bill coming, you cannot build or fight wars with solar, wind, and recycling. :) That said, I expect crude to continue and thusly most energy stocks. even the micro caps.

Denbury has caught the attn of some analysts as well. Revenue and net income have reported very well this last year and appear to be on track to outperform yoy (year over year). I would buy this outright, (and have) currently holding 400 shares at a 2.16 cost basis, and looking to add more on a dip. I will be adding to this position next 3 months and taking profits at the 618 coefficient or the 100 all depends on the price action or what my studies are telling me.

So here are the charts have a look and if you don't have a trading acct, if you want to get your feet wet (without options), you can open a robin hood acct for free. I believe trades are free on there as well. I don't have one tho so I really don't know. GL Happy Trading

Crude futures are pulling back off trend line resistance. If you haven't taken this trade yet, I would wait a few days maybe a week for crude to have some profits taken off the table. You can see the chart and price action here...

http://tos.mx/wneAWd