Hey all,

Today was a relatively green day in our stock market. Let's further analyze what we witnessed today and discuss what we could possibly expect for the coming days. I will also talk briefly about a stock that is currently hot, why it's hot and what we can expect.

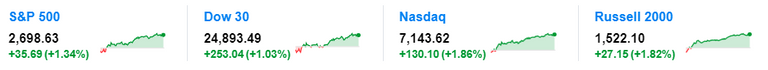

Market Indices

Our market indices have been recovering at a healthy rate compared to it's volatile movement last week, as inflation scares begin to subside. An interesting thing to note is that the Russell 2000 pulled a positive 1.82% today, which is the highest daily percentage it has seen in the past five months.

What to Expect

It's only been about a week and a half since we saw markets dip to some of the lowest prices in 2018. We are still on thin ice and these inflationary scares still could trigger a bearish pull. While our markets have overall been performing well this past week, we need to be cognizant that we aren't safe yet, as many stocks are still nearing all time highs.

Stock That's Hot

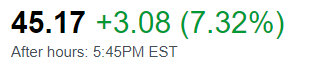

Cisco ($CSCO) has just released their earnings report at market close.

"Cisco Systems Inc reported its first rise in quarterly revenue in more than two years, which also topped analysts’ estimates, as the network gear maker’s years-long efforts to transition to a software-focused company begins to take hold" (Reuters). They've beaten their earnings by $0.04 and, as of the time of writing this, are up after hours today.

With this being Cisco's first rise in quarterly revenue in more than two years, we should expect a lot of excitement from the consumer side. I would expect a lot of buy-ins at market opening tomorrow. Long term, I believe Cisco is a great company to hold as they are truly a leader in their industry. The price may continue to have a bit of biased growth tomorrow, but we should see a new consolidation price soon to follow.