Watching any financial media the past couple weeks is full of bullish stock market news. The DOW hit a new record a couple days ago and nothing seems to shake the markets bullish confidence.

But there are deep problems brewing within the economy.

And these problems are causing a divergence between the stock and bond markets . . .

… but remember the bond market takes a longer-term view of what’s going on. I think people are taking a longer-term view on our economy, our economy growth, and where they think policy’s going – said Gary Cohn, Former Goldman Sachs President and Trump Economic Adviser, in an interview with Jim Cramer.

Since bond investors take the “longer term view”, recent falling yields signal the market is expecting lower growth. Possibly a recession.

Meanwhile, a rising stock market is signaling higher growth and pricing in a bullish future.

What do we make of such contradictory views? Let’s look at some key economic trends.

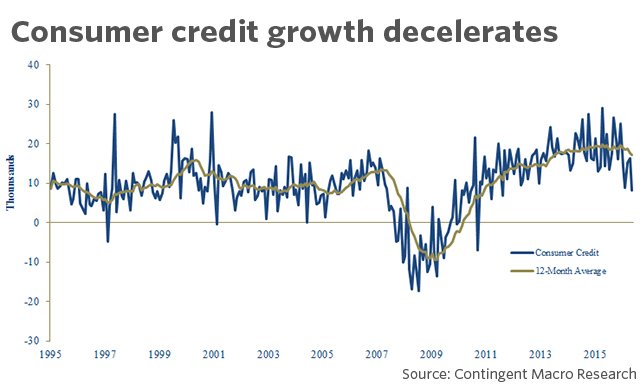

Recent data from loan markets are showing significant deceleration. And there is no sign of this trend changing anytime soon. . .

“Carmageddon” has been unfolding throughout 2017. Auto loans are down a whopping 66% from their 2016 peak. The growth in new loans are only 1/3 of what they were last August, 10 months ago.

Making matters worse, auto loan delinquencies are trending upwards. . .

This is squeezing the auto market. New loan growth is collapsing while current outstanding loans are souring. This is the worst case scenario.

Most car companies are still wooing bullish investors with optimistic future sales forecasts. For example, even as auto loans dry up and growth slows, TESLA’s stock has soared. They are now the 4th largest automotive company worldwide. And they merrily estimate to sell over 500,000 of their cars by year end 2018. . .

Real estate loans year-over-year have been cut in half from their 2016 peak of almost 8% to the present rate of 4.6%. This is roughly a 40% decline from a year ago.

At this rate, commercial bank loan creation will contract (turn negative) within the coming months. This will be the first time since the Great Recession – almost a decade ago.

Even the greatest of market bulls can’t find a reason to defend this slowdown of loan originations.

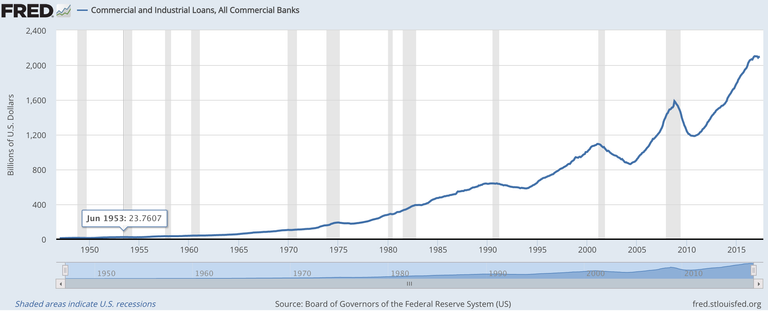

I highlighted last week that the Commercial and Industrial Loan markets have a historic correlation with recessions. The last 30 weeks have seen C&I loans stall and even begin declining.

A falling C&I, along with the significant drops in auto-loans, real-estate loans, and the recent dismal consumer credit data – is flashing recession. I don’t see how economists aren’t more vocal about this all-around general deceleration.

Especially the Federal Reserve. . .

How is any of this good news for the near future?

I wonder what the Fed Governors make of all this. . .

Janet Yellen wants the market to take her confidence in this economic recovery seriously. Therefore the tightening seems appropriate after a near decade of accommodative Fed policies.

But these rate hikes are only making things worse. . .

The Fed tightening paired with anemic growth is a hazard. In a time of such ample deceleration in the loan origination markets, wouldn’t the Fed usually cut rates to incentivize loan originations? Yes, they historically have.

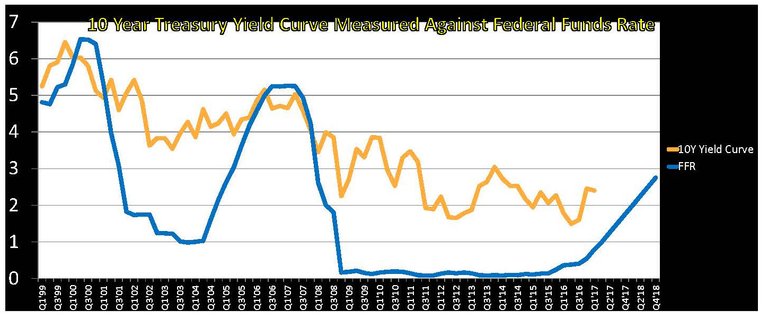

If the Fed continues at this current rate hike path, the yield curve will invert. An inverted yield curve has preceded the last 7 recessions, going back into the 1960s.

The last two times the yield curve inverted was in the years 2000 and 2006. The inversion and subsequent recession that began in the year 2000 caused NASDAQ stocks to plummet 80 percent. The following inversion caused the Great Recession in which the S&P 500 dropped 50 percent and, according to the Case/Shiller 20-City Composite Index, home prices fell over 30 percent – Michael Pento on Bloomberg.

The inverted yield curve is the ultimate spread between two dominant perceptions. The Fed and the bond market. . .

The invert is caused when markets predict deflation and recession, but the Fed predicts inflation and growth. If the market contradicts the Fed, confidence is weakening.

The only ways to reverse the inverting yield curve is if long term yields increase suddenly. This would be from inflation and GDP rising. Since I expect no sudden increase in GDP or inflation, this isn’t likely.

The other way is for the Fed to reverse raising their short term rates and instead begin lowering them. But compared to past rate cuts the Fed’s balance sheet is bloated at $4.5 trillion. And rates are still near 0, not giving them much to cut from . . .

If the economy continues its slump downward, which I see no reason it shouldn’t, then long term rates will fall accordingly. And if the Fed continues tightening, the economy will worsen and the yield curve will invert.

But if the Fed reverses from such tightening, that will completely shock market confidence. And investors will scramble to reprice almost everything.

Either way, the near term is looking very dim.

And the longer term is evermore uncertain. . .

Repost from my Blog: link in about me.