Hi, everyone, thanks for reading through my last post and for upvoting it, I was so encouraged, thanks a million times.

Let's have a recap of the last post, shall we!

My last post was titled "Application of information technology in financial accounting statement". We learned some few things about the impacts and influence of information technology to the field of accounting. Hope you agreed with me that any technology to be adopted in the field of accounting must comply with the principles, rules, and objectives of accounting such as the cost-benefit principle, the control principle, and the compatibility principle. The post dwelled more on the positive impacts or advantages of technology, especially information technology on financial accounting procedures.

To serve as a reminder, the impacts discussed include; availability of software tools for accounting processes, correct estimation of income, revenue and losses are made possible, Financial auditing became easier, income taxation, word and graphics processing, electronic fund transfer, image processing, and electronic data interchange were also made possible by technology advancement.

The technology to be adopted in the field of accounting must also possess the following characteristics; Compatibility, completeness, reliability, improve accuracy, credibility, increase functionality, flexibility, high-speed data processing ability, clarity and precision, high attention, appropriateness, better external reporting, up to date and timely, to mention but a few.

Read my last post here

Image from Pixabay, CCO Creative Commons

The post dwelled only on the advantages and positive impacts of technology on the field of accounting that made @osariemen to drop a question-like comment in the comment section of the post, trying to know about the sidedowns or disadvantages of technology as regards the field of accounting. I tried to answer the question lightly in the comment section and I promised him to make a post on the disadvantages of applying technology to accounting procedures and processes.

Hope this post will add to one's knowledge and ease your curiosity

Lets begin!

Among all the characteristics of a proposed technology to be adopted in accounting as discussed previously, the concluding part of the last post briefly made mention of "system flexibility". Since accounting procedures and processes are dynamic rather than being static, technology to be adopted must be flexible. Financial institutions must embrace changes, developments, and various business opportunities and there will be a need to adapt to this changes and made a necessary adjustment to the existing system, a process referred to as system upgrade. Such a system that can offer this feature is said to be flexible. Hummmmm! here is the beginning of a big problem.

Flexibility of a system is the loophole used by financial thieves to perpetrate all sorts of evil deeds (fruad), especially the hackers. I will start to discuss the disadvantages of applying technology to accounting procedures from this point of view.

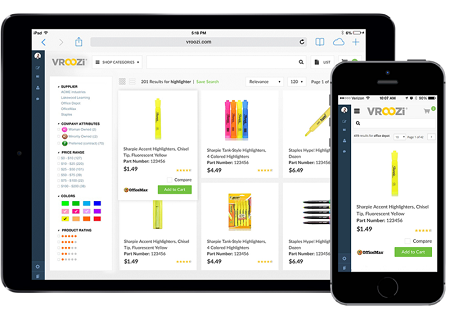

Image from Pixabay, CCO Creative Commons

Downsides of the application of technology to various aspects of financial accounting

There are many disadvantages of technology to financial accounting but only a few of them are obvious, you know why? it is because computing and its various applications have been incorporated into humans lifestyle, it seems we can not do without it. Nowadays, it is becoming very difficult for a chartered accountant to make a simple calculation off hand, he or she must always press the calculating machine. As scientists will say, part of the body under utilized will become a vestigial structure.

Some of the disadvantages to be discussed includes; potential fraud (caused by system flexibility), technical issues, misleading and incorrect information, insecurity, Changing technology, high cost of training, human elements,

System flexibility and simplicity give rooms for potential fraud. Most accounting software is user friendly and is with update feature, due to the hacker can easily run a malicious program on the system once the firewall is broken, thereby achieving their aim. Big organizations make use of cloud technology whereby software data are stored in the cloud (database). This software data can be accessed by hackers and information thereof is a good instrument in the hands of fraudsters. The financial information can be altered or such information is used for various fraudulent acts.

By NDashM - Own work, CC BY-SA 4.0,

It is also vulnerable to someone within the organization who has access to the system and financial information (usually software engineers) to engage in petty theft known as pilfering. I had little experience with pilfering when I was serving as a graduate youth corps member in one of the popular Banks. It happens that one of the software engineers at the head office wrote a software program to deduct one naira in all customers accounts in a month, he installed the program on the server. He was clever enough to disable both the E-mail and phone alert for such deduction and open a separate bank account for the deduction. There are over ten million viable customers of the bank, so the man usually gets over ten million Naira every month.

The one Naira deduction is a little amount of money to be ignored by individual customers but the accumulation of such ridiculous amount of money is huge. The man was able to make those deductions for good five years. During an audit process when the auditor noticed that a particular account contains numerous one Naira deposits from numerous bank customers with huge withdrawals. The auditor makes the required findings and after various technical and physical findings, the man was caught. I later learned that some top managers were also involved in the fraud.

Financial information such as credit card numbers and employers tax identification in the possession of hacker can be used to create business loans. Some of these credit cards are used to make online transaction and sorts of fraudulent acts. Due to technology advancement, some process of accounting could be hijacked by fraudsters and possibly create fake financial statements or records and bank transaction alert for clients and claims that such transaction has been made so that the ordered online goods and services can be delivered.

Image from Pixabay, CCO Creative Commons

Conclusion

It is important that business owners and financial institution should diligently protect financial information. Individuals should always be conscious of all financial information and know the importance of the details of financial information.

Do not give the details of your account such as credit card number and pin, ATM pin, online banking ID, Token ID to the third party. It is necessary to observe these little precautions to ensure maximum security of our assets.

References

http://smallbusiness.chron.com/advantages-disadvantages-computerized-accounting-4911.html

https://bizfluent.com/list-6370175-disadvantages-computerized-accounting-systems.html

http://smallbusiness.chron.com/technology-limitations-accounting-34162.html

https://itstillworks.com/disadvantages-accounting-software-1965.html

https://www.nibusinessinfo.co.uk/content/advantages-and-disadvantages-accounting-software

@Rubies, thanks for making us know the disadvantages of technology in Accounting, but I must tell you that Technology has done more good than harm in the field of accounting. Technology advancement has enhanced its various ways of application. Financial information is the most sensitive part of Accounting which people seems to ignore sometimes. Last week, I nearly got defrauded, I wanted to sell some steem, the guy arranged a fake bank alert and scan a fake bank statement to me, claiming that he had paid and expect me to send the steem to him. Thank God that I have access to my online financial statement, that was what safed me.

You are correct @oluwabori. A Financial statement is an important instrument for hackers, it can be manipulated to suit their purpose once they can access it. Thanks for reading my post.

Now we have a good financial expert using today's technology. But I think the flexibility f technology is not it's fault, but that of human that want to compromised what has been securely protected by technology. I think that's what is refer to cybercrime which also technology can be used to detect. Well done @rubies

Thanks for your comment @steepup

Hi @rubies!

Your post was upvoted by utopian.io in cooperation with steemstem - supporting knowledge, innovation and technological advancement on the Steem Blockchain.

Contribute to Open Source with utopian.io

Learn how to contribute on our website and join the new open source economy.

Want to chat? Join the Utopian Community on Discord https://discord.gg/h52nFrV