To everything - turn, turn, turn

There is a season - turn, turn, turn

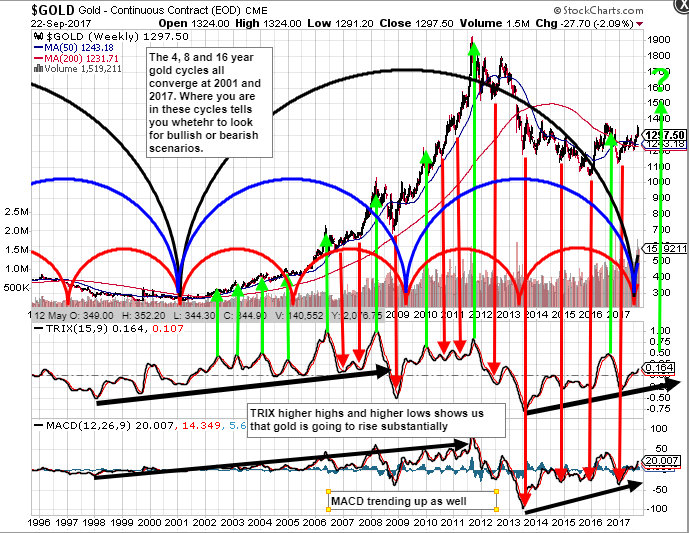

The Byrds made a very good point. It applies to financial markets too. Not everyone realises that because they are 'man made', they inherit the same cyclical nature. There's an inbuilt 'heartbeat' which shows up very clearly when you stand back and view from a distance. In the case of gold, there's a well documented 4, 8 and 16 year cycle. They all converge on 2001 and 2017, marking these years as significant price LOWS. It doesn't tell you what price will do in the next week, or even the next month or two, but it does tell you where price is going for the next several years. We should be looking for an underlying 'big picture' move up into the 15 year cycle high, but the high itself should come in the middle of the 2nd or 3rd 4-year cycle. That means either 6 or 10 years from the cycle low in 2017. That equates to 2023 or 2027. Lows should come in 2021, 2025 and then a major low into 2032.

Looking back, the MA(200) provided ultimate support following the 2001 low (apart from the 2008 financial crash low). The MA(200) is currently around $1244. All of this tells me that when we're doing our technical chart analysis, we should be favouring bullish counts and outcomes for the next couple of years with an expectation for bearish scenarios into 2021. My strategy is to sit, hold and ride the market up to the year 2023, take profits and try to figure out if we're going to see the ultimate peak 4 years later.

Ecclesiastes 3:1-22, proper citation to the Author of all things.:)

This post recieved an upvote from minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond