I saw this in an article yesterday...

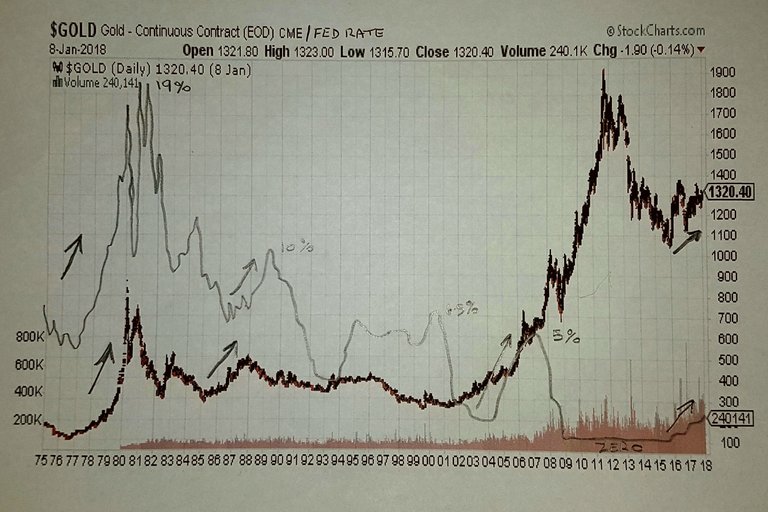

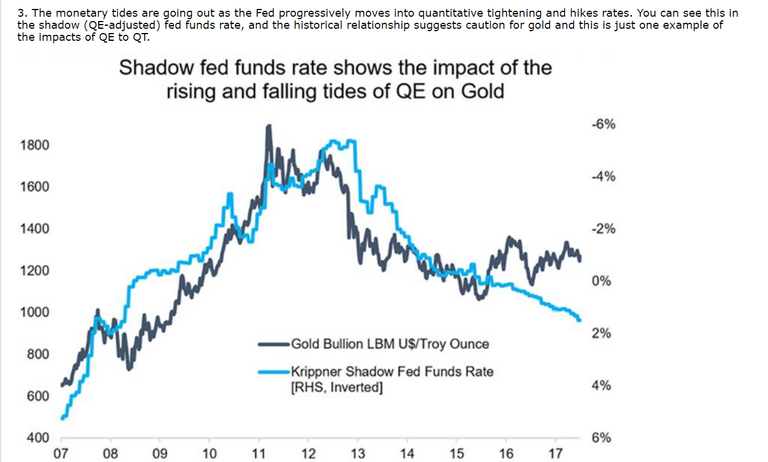

So we all need to be really worried, because QT (rising rates) means that gold is dead in the water. I'm calling bullshit on that. Forgive my hand drawn overlay, but I did it very carefully, and stretching back to 1975 there are plenty of occasions when rising rates have coincided with rising gold price. Their chart only goes back to 2007. What it doesn't show is that from 2004 to 2007 rates rose from 1% to over 5% and gold advanced from $400 to $700. The same thing happened in the late 1970's and mid/late 1980's. The same thing is happening now.

Rising rates aren't always good for gold, but they often are. We don't need to think that QT will be bad for gold. Between 2000 and 2011 gold rose from $300 to $1900. During that period we had rapidly rising rates, rapidly falling rates and prolonged low rates. I hate it when writers make the facts fit their agenda. You always need to look back through 2 or 3 full financial cycles before you can even begin to draw conclusions.

The rising rates back in the 1970's and early 1980's were directly correlated to the massive increase of the money supply when the US went off the "gold standard". In addition, it was unlawful for Americans to even own gold bullion coins until President Reagan, restored that right. There was a large pent up demand for gold. With this latest tax reform and announcements from several international companies, it seems the net effect of offshore dollars pouring back into the US should have a similar effect on the price of gold, especially as a "safe haven" play. The bonds owned by the FED are junk, I can't imagine who would even buy this nonsense. QT we know who the seller is, the only question is who is the buyer?