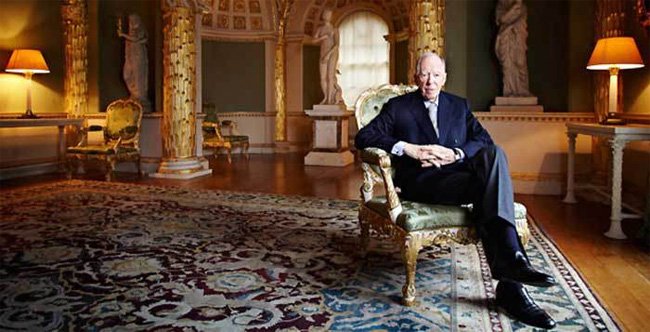

Almost exactly a year ago, arguably the most famous name in global finance, Rothschild, and in this instance Lord Jacob Rothschild, said this:

“The six months under review have seen central bankers continuing what is surely the greatest experiment in monetary policy in the history of the world. We are therefore in uncharted waters and it is impossible to predict the unintended consequences of very low interest rates, with some 30% of global government debt at negative yields, combined with quantitative easing on a massive scale.”

That is only part of what he said and this was only part of a full article we wrote outlining why gold tends to go up when shares go down. It is certainly one worth revisiting here. One cannot understate the power this name has wielded in finance for over 250 years.

Late last week he was out again with his annual report and this is what he had to say:

“We do not believe this is an appropriate time to add to risk. Share prices have in many cases risen to unprecedented levels at a time when economic growth is by no means assured. The S&P is selling at 25 times trailing 12 months’ earnings, compared to a long-term average of 15, while the adjusted Shiller price earnings ratio, which averages profits over 10 years, is approximately 30 times.The period of monetary accommodation may well be coming to an end. Geopolitical problems remain widespread and are proving increasingly difficult to resolve. We therefore retain a moderate exposure to equity markets and have diversified our asset allocation towards equity investments where value creation is driven by some identifiable catalyst or which are exposed to longer-term positive structural trends.”

fort-russ.com

This comes fresh after our recent article where Ray Dalio, the head of the world’s largest hedge fund, likewise warned people to get some of their money into gold before this plays out.

Whilst, as Rothschild and Dalio say, shares valuations are hitting new highs, gold is effectively bouncing along the bottom. Even so, this year gold has outperformed both the S&P500 and Dow Jones.

In Australia, our stronger Aussie dollar has taken most of the shine off those 11% USD spot gains, up only 1.3% so far this year. That said, everything is relative and our own All Ords is up only 1.4% and depending where you live, property has even seen declines.

As Lord Rothschild warns, the whole setup looks particularly fragile at the moment. When, not if, financial markets correct, history tells us gold and silver will languish no more.

This is an original article posted today for Ainslie Bullion

If you haven't already started buying gold and silver maybe it's time? Cheers mike

Even if you have already started @mikenevitt! Keep at it 😉

Thanks for the comment.

NOM

The language was great, word selection was perfect.. Nice pace of writing...

Great comment @hafizulislam. Thank you for your input.

"Even so, this year gold has outperformed both the S&P500 and Dow Jones."

Which year does this text refer to?

This year @stimialiti. Yahoo interactive charts are one source and a June based article from investing.com cited something similar at https://www.google.com.au/amp/s/m.investing.com/analysis/gold-has-outperformed-the-dow-s-p-500-year-to-date-200193053%3fampMode=1

Excellent well written & insightful post, the monetary markets fascinates but also perplexes me!

Perplexing indeed @lizelle. You are not alone there. We are in unprecedented times!

Supeb

Gald you found the content valuable @sureshgajera.

He should know, they engineered the entire system of collapse. Silent weapons for quiet wars. These people are the enemies of humanity.

An increasingly common idea @lost.identity

From what I've heard I would tend to agree with you.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by nolnocluap from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews/crimsonclad, and netuoso. The goal is to help Steemit grow by supporting Minnows and creating a social network. Please find us in the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

This post has received a 0.78 % upvote from @drotto thanks to: @banjo.

The Aussie dollar will take another hit once the RBA cuts rates again. That should fair well for gold (in AU terms).

It does seem unjustifiably high, but in my mind all the fiat currencies are ultimately equally worthless so it's a relative race to the bottom.

That is true, although it will be interesting to see if the RBA stays in that race or if they bail out and stick it to the exporters. It's the same choice of all other nations really - deflation or inflation. But considering the deflation path makes all the regulators look bad, and inflation is easier to blame on others, my money is on inflation.

I think the dynamics will be interesting. Mike Maloney sees both inflation & deflation happening, either in rapid succession or even simultaneously in different areas of the economy. Bluntly put, it's a train wreck!

silver is my bet. Grossly under valued.

Agreed @landserve... the peoples' money

great article

Thanks for the comment @owenwat

Hey, Jake...thanks for the warning. It was after all, you and your family orchestrating this whole debacle. But thanks for the warning...like we don't sense that everything is about to go BOOM.

It does have a ring of irony about it doesn't it @lesvizable

This was an amazing read, well done! I appreciate the work you put in to distill such a complex matter into something even I can understand!

Thank you for your readership and support @timitwist!