Sometimes it's a good idea to take a step back, zoom out, and look at the forrest - not the trees, or the leaves.

Taking a look at this 12-year long section of the Silver price, the last few years have been rough for Silver Stackers - showing a move from $50 down to the $14 range. Price has been moving "sideways" over the last couple of years. A strong consolidation, like what we are seeing here, is very supportive of a future move upwards.

But, I have great confidence in the fact that Silver, as a precious metal, will not lose its' value over the longer term. In fact, most Silver market experts have already called the bottom for Silver - and I agree that we have seen the bottom. On top of that, demand for silver to be used in industry is projected to increase over the next several years - making silver more scarce. This is not to mention the fact that the top 15 silver mines, worldwide, have been reporting falling ore grades for several years running - making silver more expensive to mine, and more scarce. So, economics 101 says that rising demand, paired with falling supply, equals increased price. It's not rocket science.

Even a bonehead will be able to make a good bit of profit by buying silver and gold - but only if they buy it right now, while the price is still very low. Once the silver price starts to run up, everyone will want in to buy some - but there won't be any to buy. Silver premiums are already on the rise, and bullion dealers are taking longer to make their deliveries on orders. I think silver sellers will disappear once silver starts passing $24, $25, maybe $26. If you don't have any before then, you are S.O.L.

This long, bowl-shaped chart formation is a strong sign of a very healthy bull-market starting right now. The price movement will likely be trending upwards for the next few years. During the next few years, we will see a couple of "blow-off tops." I will likely take one of these opportunities to take some profits and - if the real estate market comes down again - buy some land, and/or a house.

For me, the best scenario would be to see the precious metals asset class move way up, and the real estate asset class go through another "popping of the bubble" scenario. I think (and hope) that this is a likely set-up for me to take advantage of in the future. I have been planning for this exact scenario for about 7 or 8 years, getting into a large position of precious metals while the price is absurdly low.

What do you think? Will my ideas come to realization? How many more years will it take for us to see the Silver price run up? What are you planning to do with your own Silver stack?

DISCLAIMER: I am not a financial advisor. Anything in the above content is meant for educational/entertainment purposes only. Do not make trades based on this article. I am not responsible for any financial gains or losses you make in regards to this information.

Join CoinBase to Trade Cryptos

I like your ambitious outlook and I wish silver would go to $26 dollars soon. AISCs for an OZ of silver is dropping below $12.00 for most of the majors and in some cases lower than $10.00. I also see supply outstripping demand by about 5%. Anything can happen though.

How are mining costs declining when ore grades are declining? Is the price of diesel/oil really so low that it's having a large effect on lowering their costs?

I don't see Silver at $26 any time in 2019 - maybe $19 by years end. Actually, I believe gold will run to $1400 in order for us to see $19 silver. That would put the Gold:Silver ratio back down to about 75:1. After that, silver might be able to go on another run, but it might take another 3 or 4 years?

🤡

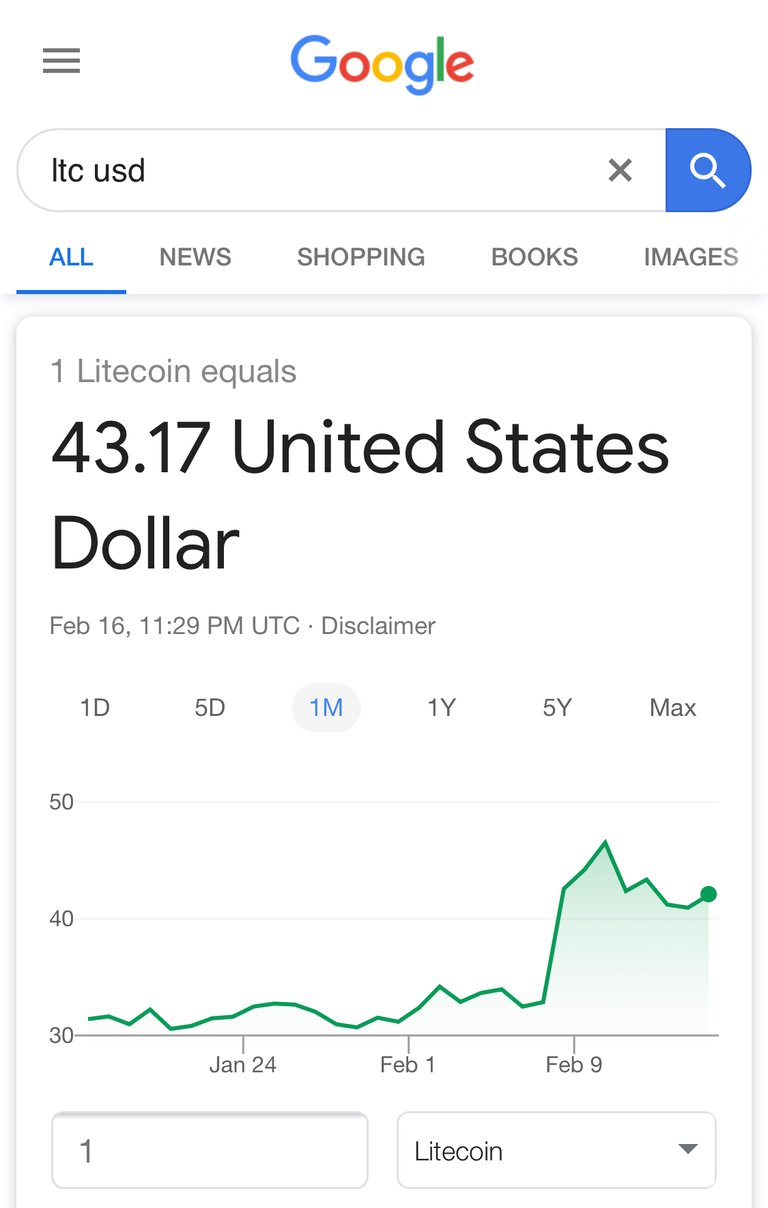

To me it just looks like Silver big dip coming! I finally think crypto’s are going up again, however I don’t think this means squat for silver! Lol silver is in longest bear trend of all and I think it could continue all the way back down to $3! Ever since the bubble at 50 silver has been going down, and then bitcoin and crypto’s were invented and metals lost their luster! Ltc is silver to btc and is higher lol! 😂

Luckily I dumped my physical silver stacks and silver stocks in the 50-45 and then down as low as 22/ oz range, so not buying it back just yet! Wow, that reminds me I sold my physical gold and rhodium years ago for cheap bitcoin!

I bought my first BitCoin about 3 years ago. The transaction took forever. I bought some Silver bullion a couple of months ago, using BitCoin. And, STILL, the transaction took forever!!! I am not impressed with BTC any more. It does not have a very strong use case.

LiteCoin is much more interesting! I own some. I think it will be much more successful, in the future, than BitCoin will be - because it could actually be used for an instant payment system.

Did you see the news the other day? JP Morgan just issued their own crypto, called JPM Coin, and they will be using it for one of their payment systems, which deals with about $6 Trillion annually. You didn't think these big corporations were going to use somebody else's crypto network to run their payments on, did you? So, no BTC, ETH, LTC, XRP, etc. will benefit from this - or, not very much. All by themselves, JP Morgan just blew up the total market cap of all cryptos in existence by a factor of about 55 times.

As far as silver going to $3 goes... ? That's impossible. I won't explain why, but it is actually impossible - unless somebody finds the largest, most shallow, richest silver ore deposit in the history of... ever. I don't believe I will ever even see $10 silver again in my lifetime. But, I do know more about silver than I do about cryptos. And, I know that 7 years ago, silver was at $50 - so it can go back up to $50 (at the very least) again in the future. The U.S. Treasury Debt Clock says silver would be equal to over $600 per ounce, if the value of the dollar were not devalued by its' current 96% devaluation from 1913. So, I think silver actually has a ton of room to go up - especially when the Dollar loses its' status as the World Reserve Currency.

I wish you luck, and pray that your Trezor Nano never runs out of Internet, or electricity, or comes too close to a powerful magnet, or experiences the effects of an EMP, or gets wet, or gets too hot, or gets stolen or lost. Then, you'll probably be just fine!

Hua, i transact btc all the time and it is quick now? Quicker than silver in the mail that is all I know!

Oh silver can and will go to $3 because the paper markets the price is backed on has always been said to be a ponzy of unbanked comex derivatives! Meaning the price is based on fake silvers, too many fake silvers make the price go down! For sure when the paper silver market collapses, and the flash crashes hit there will be price reset happening! Silver has been manipulated and I’m just waiting for a big capitulation candle way under 10 for starters! The whole JPMorgan silver etf for starters, lol idk about JPM and their crypto! I’d rather have btc than anything remotely close to JPM! LOL as for emps I keep my keys on paper in physical silver bitcoins!Ironic hua Lol! When the internet goes down we’ll just go back to trading big stones, but backed by BTC this time around!

Well, Spot price may well crash, temporarily below $3 if, and, or, when the paper markets completely fail - but that would only reflect the fact that the entire Paper Silver B.S. manipulated market (not Physical Silver) had completely failed. And, I never have, nor will I ever own fake, manipulated paper silver - because it's just about as valuable as paper dollars are. They are both headed to ZERO, IMHO. At that time, NOBODY with physical metals will be selling the real deal for the fake, paper price - so, no way - real physical silver will never be the same value as toilet paper. We are actually talking about 2 separate things - you're talking about paper "SLV" notes and I'm talking about real ounces of physical silver. The price may temporarily be linked, but their real VALUES are very, very far apart.

My articles are only in regards to physical silver and gold stackers - people who hold the real thing in their own two hands. When the paper markets fail, the stackers holding the real thing will be enriched, overnight.

You’d be surprised how easily the sheeple can be manipulated, and do forget! It is more like they will remember how prices were always at 3 and how they totally missed it! If paper market says $3, there will always be somebody out there either willing or forced to sell an oz or silver on eBay because some other bubble finally popped up and this time it is going to be different! I’m just speculating worst case scenarios for you man!

I get you. I'm thinking I won't be parting with my real silver until it's way over $50. There is so much wild speculation out there that it's actually hard to make a plan on when to bail out of the physical. You said in an earlier post that the last $50 top was a "bubble," but I don't think it was - not really. I don't actually think real silver will be in a real bubble until it's well over price levels that we currently think are unimaginable. I will not be surprised to see it over $250 sometime during my life. I will be seriously considering when I should be taking profits once it's over $100. It will be a tricky thing to watch it go up and down on a whip-saw, which I believe it will start to do sometime soon.

OMG!!! @coolbowser just DEVASTATED my entire life! He knocked out my entire weekly rewards with a single downvote. There goes my 2 cents!!! Whatever am I going to do now?

"Estimated author rewards last week:

0.107 STEEM POWER

0.094 STEEM

0.003 SBD"

Well, dang! There goes my retirement plan! :D

OMG! @bi5h0p is a clown! 🤡

Congratulations @bi5h0p! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOP