March 2020 goes down in history as one of

the darkest periods for global financial and stock markets yet. The

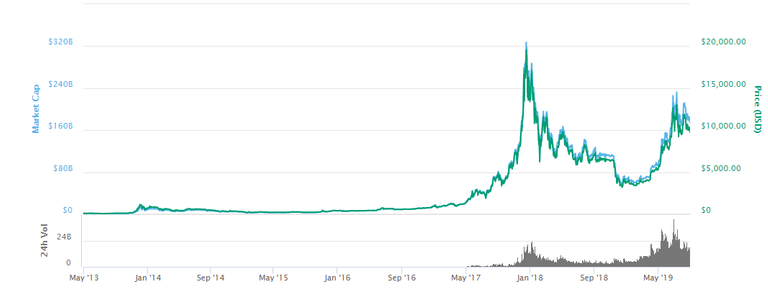

cryptocurrency market has not been spared either as popular coins like Bitcoin

suffered one of their heaviest single day losses to date.

World markets crash

Growing fears that the rapidly spreading Coronavirus is getting out of control are bringing down markets. Major indices suffered heavy losses and in some cases, trading had to be stopped as authorities battle to contain the fallout.

Surprisingly, it is Bitcoinâ a digital currency that is governed by a different set of rulesâwhich appears to have incurred the worst losses.

During a certain week in March 2020, it took less than 48 hours for Bitcoin price to drop by some 60% before stabilizing at around $4000.

This seems like a crashing reverse!

Many had been hoping that Bitcoin would, just like gold, act as a safe haven asset in times of crisis. (Gold has managed to maintain a steady value during this period.)

Instead, Bitcoinâs volatility increased sharply and those liquidating their coins in this period suffered steep losses. Bitcoin and the entire crypto market, unlike stocks, do not have circuit breakers that automatically halt trading if certain thresholds are breached.

Bitcoin monetary policy

Ironically, prior to this drop, there had been pressure on Bitcoin price to actually go up because of the expected halving, an event that sees the block reward being reduced.

When Bitcoin was created, it had a preset monetary policy,

Posted from my blog with SteemPress : https://africablockchainmedia.com/news/what-drives-bitcoin-price/2020/04/06/