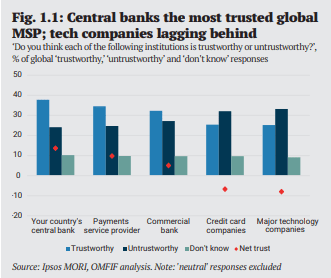

A recent survey by Ipsos MORI, analysed by Official Monetary and Financial Institutions Forum (OMFIF) a forum for central banking, economic policy and public investment, asserts that central banks are more trustworthy issuers of currency than tech firms.

Central banks score the highest net trust rating (more than 13 percentage points), whereas major tech companies have a net trust rating of almost negative 10 percentage points. The survey was conducted in 13 countries through an internet-based questionnaire for the most efficient reach in all countries.

However, the studyâin which respondents from 13 countries participatedâ makes a notable distinction. According to findings of the study, it is central banks from developed statesâwhere there are strong institutions as well as the right checks and balancesâthat score better than tech companies yet the story is quite different in developing countries.

Tech companies and other commercially oriented players stand a better chance of seeing their digital currencies being accepted elsewhere.

The caveat

There are many reasons why this is the case. To begin with, strong institutions (which ensure public entities like central banks adhere to their mandate) are quite rare in much of the developing world.

This means management of an entity such as a central bank, can sometimes act contrary to their mandate without getting penalized. There is no deterrent for bad behavior apparently.

The established ground rules of issuing or printing of currency and its management are often violated in the name of national security or for the sake of

Posted from my blog with SteemPress : https://africablockchainmedia.com/news/central-banks-most-trusted-but/2020/02/17/