My conclusion:

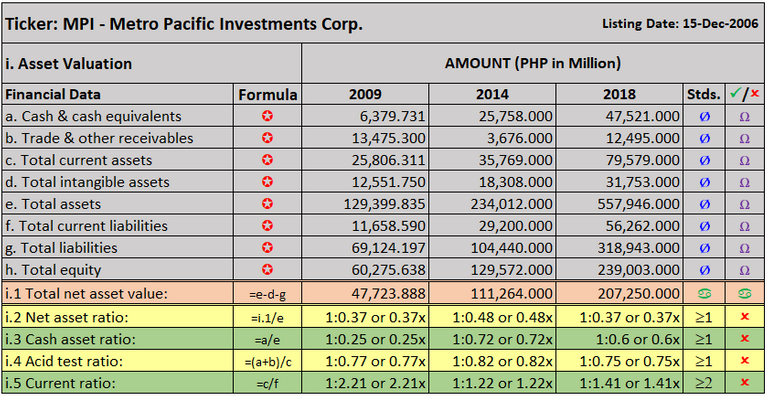

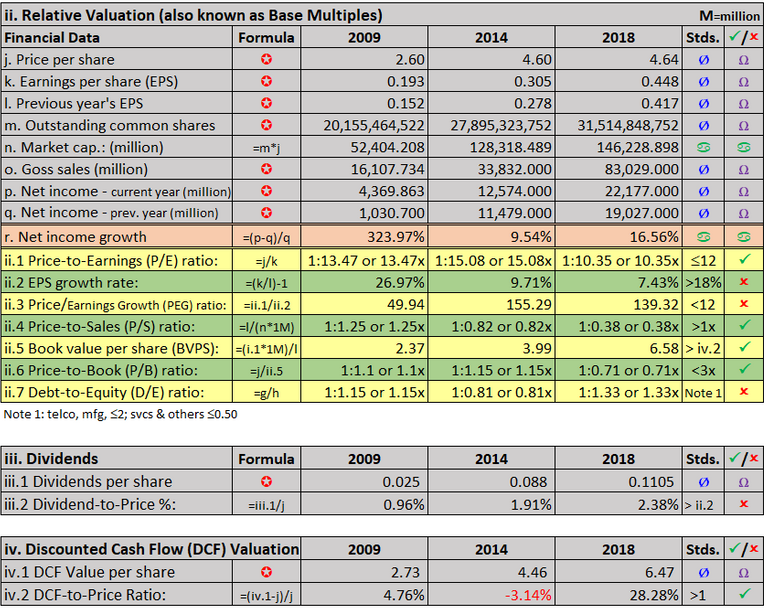

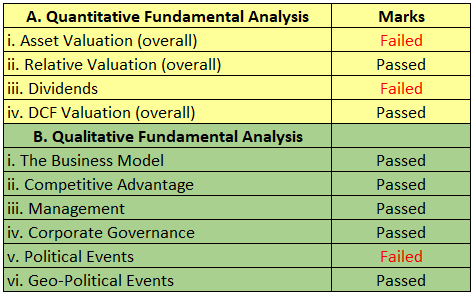

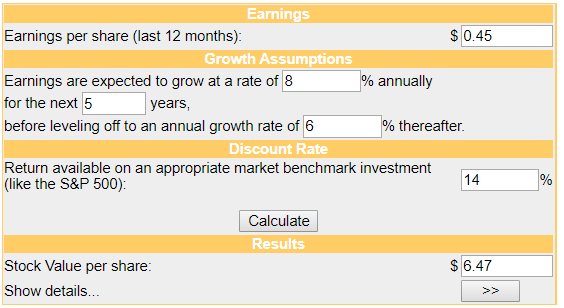

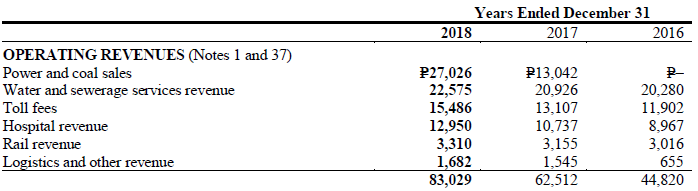

A long-investor will always observe for an opportunity that gives value to an investment; that having good dividends and P/E Ratios. Though MPI P/E Ratio above standard, the dividend-to-price ratio is way below the EPS growth rate of 7.43%. An investor looking for a good dividend yield at least equal or above the EPS growth rate. Even if yesterday’s closing price at PHP 3.66 is 43% above premium from my DCF, this ticker never attracts me. Although MPI water and sewerage services contributed 27.19% of its revenue, it’s the second revenue generator only aside from power and coal services of 32.55%.

Let us see how it pans out the political woes that MPI induced by no less than the President of the Republic of the Philippines. If the depressed price revisited the price on 31-Dec-2009 at 2.60 then it's about time to look at this seriously. But then again, the key here is the regulatory risk, 27.19% is a huge slice of the pie.

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of these securities.

Please upvote and follow me on https://steemit.com/@php-ph