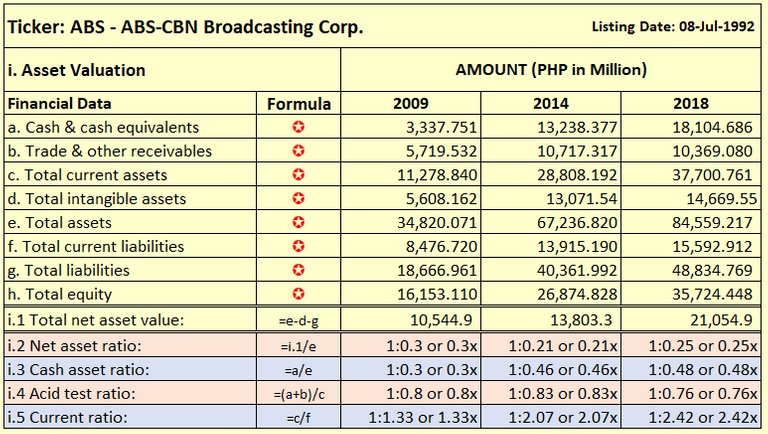

I have done this analysis every year for 14 years now with the comparative period interval of 5-year. The last column with heading 2018, should be for 2019 but audited financial can be released only as early as 15-Apr-2020 with a maximum extension of 1 month if any. So, I will update this data by then and for the time being, 2018 audited financial data is in place.

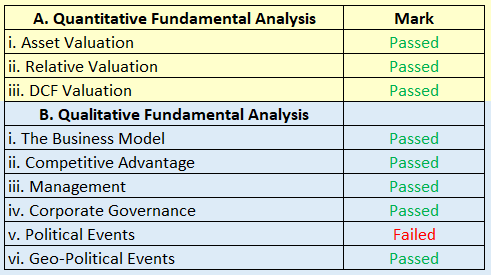

The Quantitative Financial Analysis Considerations.

In items i.2, i.3 & i.4, the minimum benchmark for these ratios should be greater than 1x. But companies in different industries have different needs, so acceptable ratios differ from one industry to another. For the services sector, the ratio that falls below 1:1 or 1x is below the standards. Mark: Failed.

Current Ratio: 1:2.42 or 2.42x is above normal. A minimum benchmark for the current ratio is 1:2 or 200%. This means that a firm has the ability to cover its current liabilities in the short term. But then again, companies in different industries have different needs for liquidity. So acceptable ratios differ from one industry to another. Any current ratios of less than 1:1.75 or 1.75x for any industry are below standard as well. Mark: Passed.

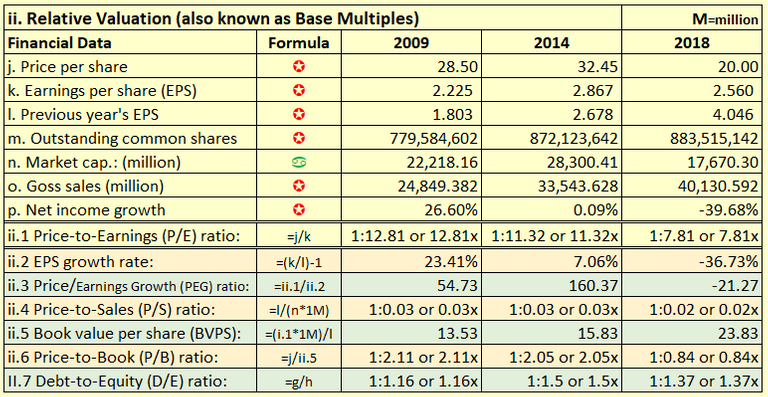

P/E Ratio: 1:7.81 or 8x is an excellent level. The most common P/E for any industry are as follows: Below 12x is above standard (cheap), 12x-25x is median standard and more than 25x is below standard (expensive). Mark: Passed.

EPS Growth Rate: -40% is extremely bad. A normal EPS growth rate for any industry is above 18%. If this rate is in negative territory, it should be excluded from the PEG ratio calculation and does make it null. Mark: Failed.

PEG Ratio: -null-. The PEG ratio is considered to be an indicator of a stock's true value, and similar to the P/E ratio, a lower PEG may indicate that a stock is undervalued. Mark: Failed.

P/S Ratio: 1:0.02 or .02x at this level is exceptional. The lower the P/S ratio, the more attractive the investment. Price-to-Sales provides a useful measure for sizing up stocks. For this industry sector, the normal P/S ratio is lesser than 1x. Mark: Passed.

Book Value Per Share (BVPS): PH 23.83. When a stock is undervalued, it will have a higher book value per share in relation to its current stock price in the market. The measure is used mainly by stock investors to evaluate a company's stock price. Mark: Passed.

P/B Ratio: 1:0.84 or 0.84x. A lower price-to-book ratio could indicate that a stock is undervalued. Again, these vary from industry to industry. However, most value investors may often consider stocks with a P/B value under 3x as their benchmark. Mark: Passed.

D/E Ratio: 1:1.37 or 1.37x is superficial. The acid test ratio measures the ability to pay short-term liabilities while the D/E ratio measures the long-term leverage. Higher leverage ratios tend to indicate a company or stock with higher risk to shareholders. Investors will often modify the D/E ratio to focus on long-term debt only because the risk of long-term liabilities are different than for short-term debt and payables. Capital-intensive industries such as manufacturing, and telecom tend to have a debt/equity ratio above 2, while tech or services firms could have a typical debt/equity ratio under 0.5. Mark: Failed.

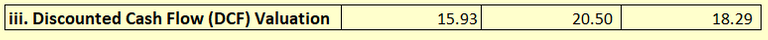

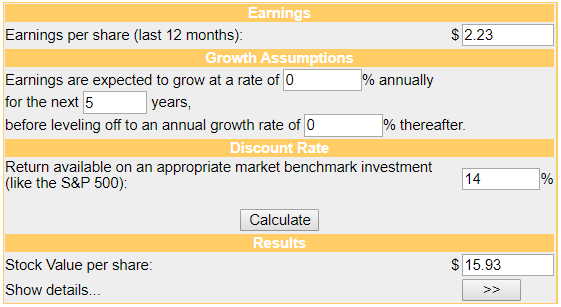

2009 DCF Value:

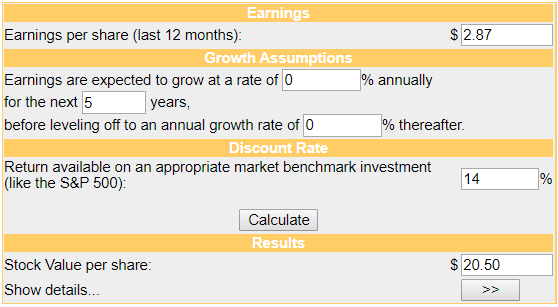

2014 DCF Value:

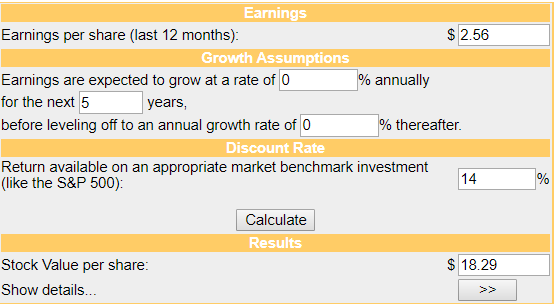

2018 DCF Value:

Based on the DCF calculation, the 2018 DCF value is 18.29 which is higher than today’s market low price at PHP 16.00. My assumption here is within the industry standard. The services sector is not a risky investment after all compared to consumer products. Why a discounted rate at 14%? The Philippine interest rate usually stands at 6-7% and diverges from one financial institution to another then adds another 7% for a market risk premium (this is constant in DCF calculation). In a high-risk investment, another 7% needed to be considered as an acceptable standard, like property and financial sector.

My Qualitative Financial Analysis Considerations.

The business model:

Ang punto ng business model ay tinitingnan ng isang mamumuhunan kung gaano ba ka di pangkaraniwan ang negosyo ng isang kompanya at di ka ba mabubuhay kung wala ito o gaano ba kadali ang buhay kung mayroon nito. Sa larangan ng pamamahayag konbenyente ka ba kung wala ito? Sa panahon ngayon at sa pagsulputan ng tinatawag nating “social media” hindi na talaga ganun ito kahalaga. Subalit naisip mo ba kung gaano kahirap ang buhay kung walang radio at telebesyon noong circa 1946? Sa mga panahong iyon ang pangangailangan at malaking papel na ginagampanan nito sa lipunan na ginagalawan ng ating mga ninuno ay hindi maipagkaila na ito ay isang pangangailangan.

ABS has an undisputable history in the broadcasting industry. This entity has been around since June 13, 1946. The station suffered a setback upon the declaration of martial law and if you’re a baby boomer like me, you knew exactly what happens to ABS during that darkest era of their existence and how it regains its glory after the EDSA revolt in 1986. But if you are born in these millennia then this event can only be heard and searched on the internet and if you’re into full details of this historical event, you can even look at the archived in our national library. Ang marka ko: Pasado

Competitive advantage:

Ang konsepto ng competitive advantage ay halaw sa kung gaano ka ba kagaling sa iyong mga kalaban? Gaano kahusay at kagaling ang iyong serbisyo o produkto at kung gaano ito angkop sa pamayanan.

ABS (kapamilya) main competitors are GMA7 (kapuso), TV5 (kapatid) and CNN Philippines and among others. ABS head-to-head with GMA7 in all aspects of multi-media broadcasting. They both claimed on the top spot, depending on which media audience measurement agency squad you are in. For the financial side, GMA7 is not quite impressive as ABS in my valuation test. I will soon publish my comparison by these two giants in Philippine broadcasting arena soon. It is no denial that ABS edged up GMA7 on its existence as GMA7 has been around a little later since March 1, 1950. Ang marka ko: Pasado

Management:

Karamihan sa mga mamumuhunan (capitalist), ang pamamahala sa isang kompanya ay isang napakahalang aspeto para ang isang negosyo para maglagak ng puhunan. Dito nakasalalay ang isang matagumpay at maayos na pagpatakbo ng isang kompanya para ang iyong pera ay lumago. Ito ang aspeto ng isang negosyate kung saan kailangan nyang pag-aralang mabuti ang kakayahan at kridibilidad ng mga namamahala (management) ng kompanya na pinaglagakan ng iyong puhunan. Dahil sa isang pagkakamali lamang ay maaring ang iyong puhunan may mawalang parang bula.

Even the best business model is doomed if the leaders of the company fail to properly execute the plan. While it's hard for retail investors to meet and truly evaluate managers, you can look at the corporate community and check the resumes of the top brass and the board members. How well did they perform in prior jobs? Have they been unloading a lot of their stock shares lately?

Corporate Governance:

Bilang isang negosyante, kailangan mong alamin ang lahat ng aspeto sa kompanyang iyong paglagakan ng puhunan. Bawat kompanya ay may kanya-kanyang polisiya na kadalasan ay itinago ng mga tagapamahala sa kanilang mga mamumuhunan (stakeholders).

Corporate governance describes the policies in place within an organization denoting the relationships and responsibilities between management, directors, and stakeholders. These policies are defined and determined in the company charter and its by-laws, along with corporate laws and regulations. You want to do business with a company that is run ethically, fairly, transparently, and efficiently. Particularly note whether management respects shareholder rights and shareholder interests. Make sure their communications to shareholders are transparent, clear and understandable. If you don't get it, it's probably because they don't want you to.

The Political Events:

Ito ang isang aspeto ng kinatatakutan ng isang negosyante. Oras na kinalaban mo ang isang namamahala ng estadong pamahalaan, tapos na negosyo, mahihirapan kang magtagumpay sa mga adhikain mo para sa isang matagumpay na kompanya.

ABS-CBN has known critics for Duterte Administration the reason their license is in jeopardy not to be renewed. In case this is the fate of ABS means the company is in limbo and stakeholder value become worthless. On the positive note, the Duterte Administration has the remaining 2 ½ years only in power, that’s not a too long time to wait for its long-term stakeholders.

The Geo-Political Affair:

Ito ay ang mga pangyayaring pampolitika ng mga banyang bansa. Halimbawa may geyera sa isang bansa ang kompanya ba na pinaglakan mo ng puhunan ay maapektuhan sa nasabing geyera?. Kadalasan ang isang kompanya ay nangungutang sa banyang bansa para pantutos sa pagpapalago ng kompanya. Ito ba ay maapektuhan sa matas na interest oras gumalaw ng husto ang interest rate? Iilan lang yan dapat na isaalang-alang bago mag lagak ng puhunan sa isang kompanya.

The impact of tumultuous geopolitical affairs on the company’s growth is one of the biggest concerns for every investor. The said geopolitical conflicts could damage a company’s growth. On the economic front, the global growth outlook is murky too. Financial Analyst cited that conflict of this nature could downgrade not only its domestic economic growth but global growth as well and that economic growth is crucial to every company’s financial stability.

My conclusion:

Firstly, why waited 15 long years to invest in ABS? Honestly, yearly DCF results never allowed me to. I am heavily reliant on the results of these tests. On 5-year period intervals; FY-2009 28.50 vs 15.93; FY-2014 32.45 vs 20.50; and 16.00 (on today’s low price) vs 18.29. It is even higher on a yearly basis test. If passed my valuation and it’s below 20% of DCF results, it’s time for me to seriously consider it. Again, don’t get me wrong, my DCF price at 18.29 is 266.32% premium from ABS all-time high on 04-Oct-2000 at PHP 67.00.

Secondly, almost all benchmarks are in a passing mark except for the results on my quantitative numbers that concern me the most. The net income growth and the EPS growth rate. These growths are troublesome for me despite the consistent increase in sales. I can only suspect based on the notes to the audited financial statements that due to high interest-bearing loans and borrowings and high production costs. On the other hand, book value per share (BVPS) is consistently delivered good results and my discounted cash flow (DCF) as well and it is way higher than today’s market low price at PHP 16.00.

Thirdly, due to its political squabble. The franchise of ABS is set to expire on March 30, 2020. With the management whom not in good term with this Administration (Duterte), I can only guess based on history; a) Lopez’s may sell it to this Administration’s (Duterte) allies to maintain its network stability and buy it back later even at a premium. Sounds familiar! Well if you’re a senior citizen now and still kicking, you exactly knew what I mean! So, if you’re heavily invested in this ticker, you should be aware to set up your stop loss and be ready to unload if it happens. But as I said earlier, 2 ½ years from now is just around the corner and doesn’t affect that much to a long-term stakeholder.

Finally, the complete details of their business model, competitors, management, and corporate governance can be found at ABS annual reports and can be downloaded at the Philippine Stocks Exchange's (PSE) website.

As I always said, there are no right or wrong valuations. It all depends on your risk tolerance and your due diligence. In short… it’s you and you alone can decide!

DISCLAIMER: I'm not a Certified Financial Planner. Published herein is my personal opinion and should not be construed as a recommendation, an offer, or solicitation for the subscription, purchase or sale of this security.

Please upvote and follow me on https://steemit.com/@php-ph.