The repo market (the market in repurchase agreements) is a bit arcane (and I’m not even going to try to explain it in way that makes sense since it’s far from my areas of expertise).

But there’s been some strange stuff going on there over the last few months. The Federal Reserve has been pumping massive amounts of emergency money into the market. But it’s not getting all that much attention. Had you heard anything about it before reading this post?

Sure, it’s gotten some coverage (here, here, and here for instance), but not much.

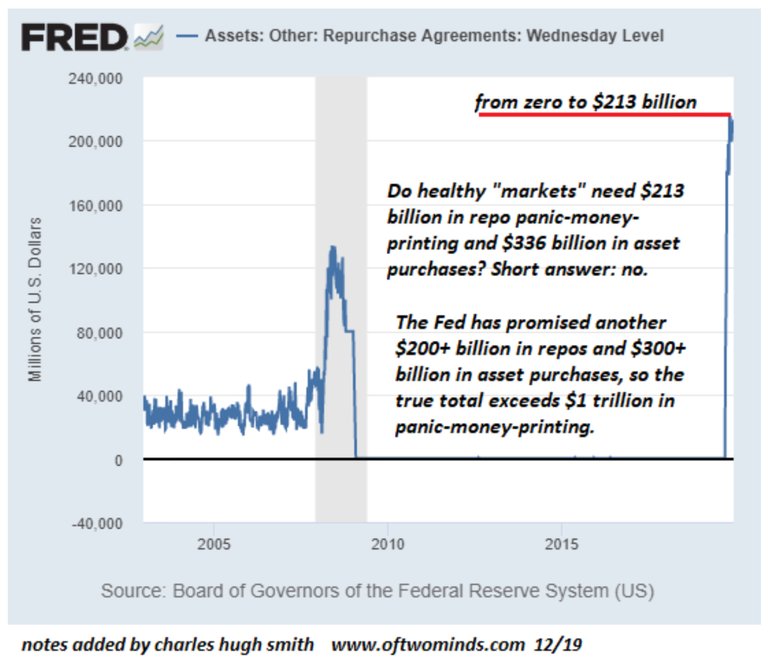

Nothing even remotely like this has happened since 2008, right before the Global Financial Crisis blew up.

Charles Hugh Smith’s annotation on a FRED (Federal Reserve Economic Data) chart from the St. Louis Fed should give us pause.

The Fed is pumping buttloads of currency into a system where banks already have tons of excess reserves. Might this be an indication that banks no longer trust each other?

If this happened right before the last global financial meltdown and is happening right now, what actions might/should astute investors such as yourself be contemplating?

Disclaimer: This should not be construed as financial advice. I am not a registered financial advisor; I don’t even play one on TV. Do your own due diligence. Batteries not included. Objects may be larger than the appear in mirror. Some assembly required. Do not taunt Happy Fun Ball.

Post beneficiaries:

5% - @steemchiller

5% - @zoidsoft

This is all about trust or the lack of.

The banks do not trust each other enough to even lend overnight.

This is a referendum on the European banking system which is still a mess. They did not shore things up like the US did. Now, nobody is sure who has exposure to the European banks hence the lack of liquidity.

The Fed is providing the funds to keep things liquid.

This could end up very bad.

What goes up must come down, right? I’m still hoping for a gentle correction.

I think this is setting the stage for another big bank bailout. When the banks to default the government will have no choice but to dilute the banks with trillions to keep the system running. Billions are nothing compared to trillions. What is after trillions? Zillions? Inflation has been running through many years. This will be no different.

This time, bail-IN will be the new normal.

Hi @preparedwombat!

Your post was upvoted by @steem-ua, new Steem dApp, using UserAuthority for algorithmic post curation!

Your UA account score is currently 5.117 which ranks you at #1001 across all Steem accounts.

Your rank has not changed in the last three days.

In our last Algorithmic Curation Round, consisting of 98 contributions, your post is ranked at #15.

Evaluation of your UA score:

Feel free to join our @steem-ua Discord server

Hiring the resume writer https://skillroads.com/resume-writing-service is a good decision especially if you do not have enough skills to write an outstanding application paper.

Congratulations @preparedwombat! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!