Note: I am not a financial advisor and this is not to be considered financial advice, it is merely my opinion and any investment should not be be taken without speaking to a qualified professional first.

Prices updated as of 7/3/2018

What Binance has been able to accomplish is nothing short of extraordinary. After opening less than a year ago, it has risen to the top as one of the biggest crypto exchanges in the world. In the first quarter of 2018 alone, Binance recorded profit of $200 million, a figure frequently juxtaposed against 150-year old financial behemoth Deutsche Bank’s Q1 profit of $146 million. Just as staggering as the 36% higher revenue is the fact they are doing it with 0.2% of the employees. The numbers speak for themselves and it is evident that Binance has created a service that the market has responded favorably towards, to the tune of over 9 million users, more than tripling in 2018 alone. While it is evident Binance has been wildly successful, it is unclear how much of that value will accrue to the BNB token that is used for trading discounts as well as commission for referring others to the exchange.

Document source

Assumptions

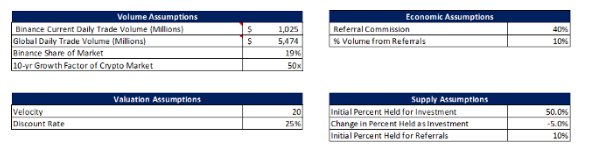

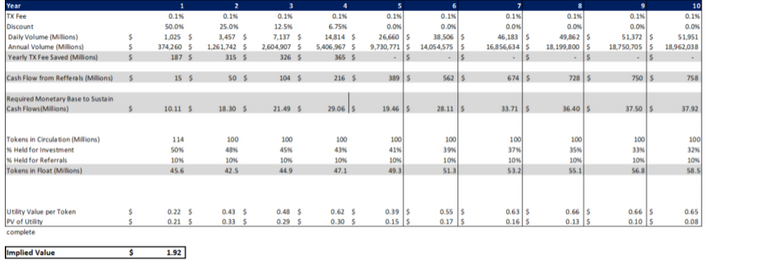

Unlike many cryptoassets, the BNB token produces tangible cost savings as well as inflows through their incentive mechanisms. This makes for a straightforward valuation by taking the discounted cash flows as you would any other cash flow producing asset. The two streams used to value BNB are the discounts for trading, as well as the referral commission. Binance has announced that paying fees will yield a discount of 50% in year one and 25%, 12.5% and 6.5% in subsequent years. In addition, they recently announced that for those owning more than 500 BNB, referring a new Binance user produces an income stream equal to 40% of the new users trading fees.

Document source

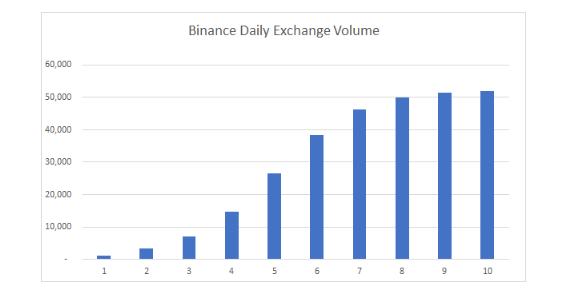

Daily exchange volume is projected following an S-curve under the assumptions that the global volume will increase by a factor of 50 based on current growth levels within the space and Binance retaining its current share of overall volume at 19%.

Two other subjective assumptions are velocity and discount rate, which were estimated at 20 and 25%, respectively. While most crypto asset valuations have discount rates ~40%, BNB has a lower risk profile considering it is producing tangible cash flows and is part of a fully functioning network that one can assert with reasonable confidence will continue to do so into the future.

Lastly, Binance has been using part of their profits to burn tokens quarterly. They have announced this will continue until the supply reaches 100 million. As of this report, the current supply is 114 million. For simplicity, I have assumed they will reach this by year two and the tokens in circulation will remain unchanged for the remainder of the forecasted period. For the purpose of this valuation, it is only pertinent to look at the tokens used for utility purposes so the tokens not being used for trading are removed. Since this is a highly speculative market, the initial percent held for investment was assumed to be 50%, decreasing each year as the exchange matures. The referral mechanism can turn out to be highly profitable as shown by the top referrers that Binance shows publicly, however holding 500 BNB is most likely too costly for the average trader (~$7,000), so that percent is held at 10% throughout the forecast.

Document source

After taking these assumptions and discounting the future streams of cash flows to the present, the model produces an implied value of $1.92. The current price of BNB is $13.88, making the actual utility account for a mere 14% of total valuation. While crypto markets have been plagued by irrational exuberance, this seems to suggest there are other factors at play. It appears investors believe there will be something else driving value in the future. Binance reserves the right to alter the token mechanics of BNB, so in order for them to keep their token valuable they can simply increase the cash flows it produces. To try and capture this, an Upside Case is modeled out assuming Binance decides to make the trading discount at 25% in perpetuity and move referral commissions for those holding 500 BNB to 50%. Even with these aggressive assumptions, the implied value of BNB is only $7.80.

Other Considerations

Document source

As demonstrated, the utility value of BNB measured through cash flows implies a value under the market price of $13.88. That being said, there are a few other factors that could be attributing value to the BNB token

Community Token of the Month: Users can vote for tokens to be listed on the exchange by paying 0.1 BNB per vote Launchpad: Users can contribute to token sales, and will need to purchase BNB to participate Binance Labs: “The profit from Binance labs will eventually flow back to the whole BNB economy and benefit all token holders.” Ella Zhang, CEO of Binance Labs

While these factors could increase the token value, they are difficult to quantify and are unlikely to be on the scale necessary to justify current valuations. This leads to the conclusion that there is significant speculation that the token will continue to evolve and innovate in ways that will accrue value for BNB, which seems probably given their rapid pace of expansion and innovation already.

Risks

A major risk of running any sort of centralized exchange is the risk of a hack. By holding custody of every users’ assets, Binance becomes a massive honeypot for a hacker with the wherewithal to access these funds as we have seen in exchanges from Mt. Gox to Coinrail.

Binance’s success has not gone unnoticed in the crypto world. Any time a company can capitalize on such a large business opportunity, others will try and emulate their success. This has caused the crypto exchange industry to become increasingly crowded. Exchanges will have to compete by offering the best possible user experience and lowest fees, which will cause industry wide margin compression. In this aspect, Binance appears to be leading when compared to other top exchanges that typically charge around 0.2% compared to 0.1% for Binance. The Company’s recent announcement to include fiat pairs are another distinguishing characteristic that could protect their position as an industry leader, something that will be necessary if they are going to drive the volume needed to sustain their token’s value.

Document source

To protect against both of these threats, CEO Changpeng Zhao has announced that he plans on creating a decentralized exchange which solves the risk of a hack by allowing users to self-custody their own assets. In addition, it should further separate the exchange from others that remain centralized.

Conclusion

Binance is undoubtedly a leader in the crypto space that will play a major role in the development of the industry as a whole. The amount of cash they are generating gives them the ability to continually improve the services they provide and even diversify their revenue streams. The underlying BNB token has contributed to their success by allowing a better user experience through cheaper trading and passive income through referrals. However, after careful analysis it appears the current market valuation is not justified by these cash flow streams. If Binance wants to ensure value accrues to BNB, they will have to continue to adapt their token mechanics and create ways to further incentive its usage, which I believe is very much in the realm of possibility. This could be done by adjusting the future discounts using BNB or even implementing a governance system to the future Binance DEX similar to what ZRX is planning to do. Despite being overvalued at the time based on current fundamentals, I still maintain the possibility exists for Binance to turn BNB into a token that is able to accrue much of the value created by the Company as a whole.

Document source

Note: All the content of this document are just shared here to spread the knowledge of crypto, the full content can be found in the Document source

THANK YOU FOR VISIT MY BLOG TODAY!!

STEEMJET IS A DREAM COME TRUE AND WHEN WE LAND ON THE MOON, THE STARS WILL REJOICE FOR THE MISSION IS ACCOMPLISHED

Respect to @dimimp

https://steemit.com/@dimimp

https://steemjet.org/

============================================================================================================================================================

I AM STILL YOUR BOY @MBJ(SF1) HOD STEEMJET ARTS/ PHOTOGRAPHY DEPARTMENT _

LONG LIFE STEEMJET

ON THE WINGS OF SUPERSTARS, WE ARE WORDS AND STEEM!!!

Nice discription in your steemit life . I hope binance coin futur looks definetly brightness . You are really amazing art .

Thanks for sharing @mbj

I think you are only weakening the intention, because in fact you are the one who has intelligent and wise mind in analyzing it. Thanks for sharing @mbj!

Have a nice day!

@mbj it has a great potential to grows up but need time.

Posted using Partiko Android

The future definitely looks bright for binance coin. Whereas,I ask myself one question, is it possible to say that it would be able to bully bitcoin in the nearest future?

Binance is really keeping the Crypto world updated, better than Reddit. It's really amazing how they can keep tracks of almost all the new and old coins coming into the market @mbj

You are really so beautiful art@mbj sir.

Give me a upvote done sir... best of luck sir...

This post has received a 8.0 % upvote from @boomerang.

Wonderful art sir@mbj... thanks for sharing your steemit life...

Binance is the best.

It keeps us updated with all the crypto world and I think the future is bright