As an investors or traders, you goal is to make money, by making positive transaction with profits, or by holding an assets, and receive a positive cashflow.

Of course, some time, it can take time, before this begin a positive cash flow, and it is why, I will go back in the past, and make my analyses, to see how those investment did go.

For a positive investment, you will do the following calculation:

Cost - monthly expense + monthly return = Profit/Loss. (Plus you can also add the appreciation value.) on X period of time.

Let's compare stock market ROI% during certain period and gold. Adding to the equation , expense,revenue and appreciation.

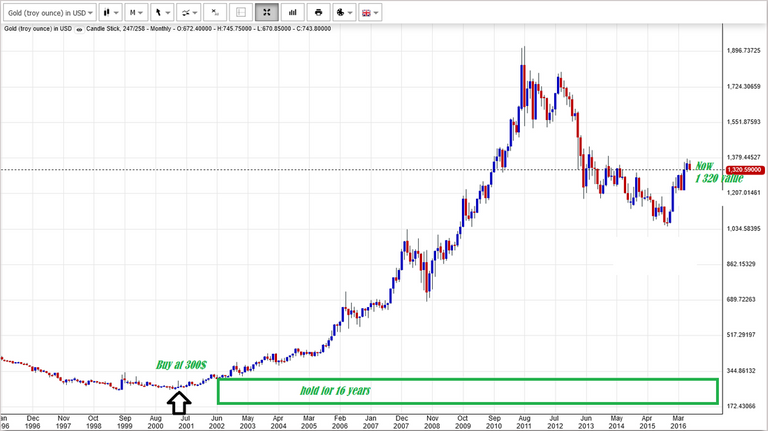

Bot first, let's look on something. This it is not to criticize anyone, but I have to put you in context. The following chart and numbers, was used by "gold & silver broker" , to sell they idea, of why you should buy & hold gold and silver.

The had all right to do so, when we understand, they are a sellers, and need to make a good presentation for they products.

In following chart, I will show one one person who both Stocks at 2000. And another person both for the same amount Gold or Silver at 2000.

Let's look on numbers with a 10 000$ investment in stock market starting 2000 at the pick.

-> increase value after 16 years: 4 000$ (40% ROI in value, or 2.50% a year.)

-> Dividend revenue over 16 years with an 5% yield, and not taking in consideration of increase or decrease value: 8 000$

-> total gain: $4 000 + $8 000 = $12 000

Note. an experiment investors, will make much more, by hedging his position, and knowing when to buy and re-sell etc, and how to use dividend properly. But for this case, will take, someone who , go to a banker. He listen the banker, and did exactly what he was told, by "BUYING AND HOLDING" strategy.

*NOTE: even when time was hard, he got a revenue over his investment , cause of dividends.

Looking on Gold, starting with the same value of $10 000.00, with the same example of time & duration, we are getting those following number.

-> Increase value over 16 years: $44 000 (340% ROI in value, or 21.25% a year.)

-> Expense Storage cost: $35 a month: 12 month x 35$ = 420$ + 16 years = -6 720.00$

-> total gain: $44 000 - 6 720 = $37 280

Looking on both of those example, used by gold broker, at the end of 2010, in marketing, we understand why gold, was a good have a good potential investment for the futures.

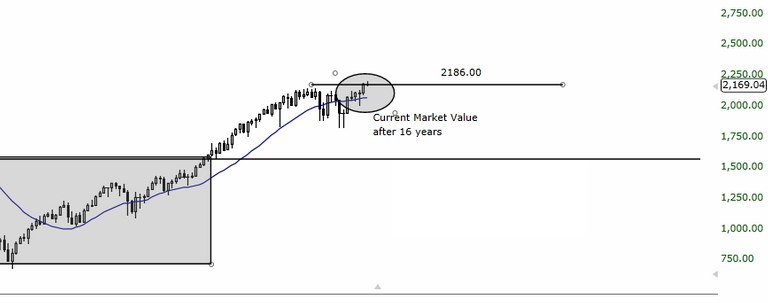

But now...let's make a review of the situation, from 2010 to 2016 (now).

Stock Market: $10 000.00 start capital: Buy at 1 550.00 points. till now, 2 186.00 points. with an increase of dividend 5%/years

Increase in value: $4 100 (41.03% ROIor 6.8% a year)

Dividend revenue with 5%yield not taking in consideration value increase: 3 000$ in income over 6 years.

total gain: $4 100 + $3 000 = $7 100.00

Gold Market: $10 000.00 start capital: Buy at 1 150.00 points. till now, 1 400.00 points. with an storage expense of 35$/months.

Increase in value: $2 175 ( 21.75% ROI , or 3.6%/year)

Expense Storage: $35 x 12 x 6 =$2 520

total gain: $2 175 - $2 520 = ($354)

In conclusion: there's no right , no wrong. We ca , make money on both market, and make losses, depending on how you make your derision. How ever, with this example, wouldn't you agree to say, that Gold, may not be the best investment in the past 6 years, since it is start to be marketing?

let me know, what do you think:)

Thank's for Upvote & comments/sharing:)

KV

Great post, Thanks for sharing it. Followed and upvoted. Have a great day @minimalpris