800000 dollar worth of BitShares marketcap are floating......... they float.... they all float.....

As coinmarketcap is one of the most visited sites in the world, one can only assume that BitShares as the number 31 show on the list is being looked at over and over again. But most people watching the show, seem to leave the theatre, clearly dazed and confused. It is a complex performance for sure.

“They float, they all float... and when you're down here with me, fat boy, you'll float too.”

Once worth over 1 billion $ in terms of marketcap, what happened to all that money that was once part of BitShares?

Somehow over 800000$ that once touched upon one of the best acts in the world: BitShares, is now floating somewhere.

Don’t blame Pennywise though, the usual suspect.

There must be something else going on, @oudekaas has been on the case for a while now, trying to unravel this complex issue.

Trying to solve this mystery and like any good detective, he will start by collecting evidence.

Other clowns

First suspects would be the other top 31 coins around. So what acts are they performing? Could the missing 800K $ accidentally have landed in the wrong hands?

A detective must be trustworthy

I must try to be unbiased, keeping an open mind. For I have seen the act of BitShares and the other acts, therefore I can’t understand why this top performer is now dealing with reduced interest, whilst it’s act is just getting better every day.

Top performers

Some of the better well-known performing acts in terms of marketcap are: Bitcoin, Bitcoin Cash, Litecoin, Ethereum and Ethereum Classic.

Most of us know their act, but I also have to research all top 30 clowns to understand what their performance and act is like.

Concluding with an overall comparison between clowns in the same field versus unique operators. Perhaps the truth can be unraveled through this investigati

Coming clean

“Allright, stop the malarkey @oudekaas, the only one floating is you, we all know you are invested in BitShares and want to become rich!”

Darn, you bursting my balloon here. But hold on a minute, let me explain where I am coming from.

I have done a lot of research and right now based on the information available to me, I can only conclude BitShares has the biggest long term growth potential of all acts around. In the meantime I can’t sit still and just assume I am right, I will need to keep myself up to date to all investment opportunities available to us.

In order to feel better about my decision to go for BitShares, my ultimate plan is to give a full overview of the top 30- coins explained what they stand for and what relation they have.

Eventually trying to give each crypto a number in terms of longterm/ shortterm potential based on facts, properties, graphs, usage the whole shebang. Let’s see where this takes us.

So I started out with an initial layout of the first top coins, explaining what they do and what their differences are.

Hopefully building on it.

Ultimately I want to create a page that explains crypto and covers a coin in the minimal amount of words/ sentences without selling itself short. Covering the most important aspects and reasons for shortterm/ longterm growth.

A steemportal that any new investor can study and make it easier to choose, which coins are best to invest in based on facts

Ultimately trying to prove that there are better investment opportunities then BitShares as this is my current number 1.

For those new to crypto, I will endeavour to make links [blue words] to every difficult concept, so you can study whilst reading through it.

Slowly I will try to make the text more readable updating all coins and asking the devs to provide latest news updates.

So let’s start!

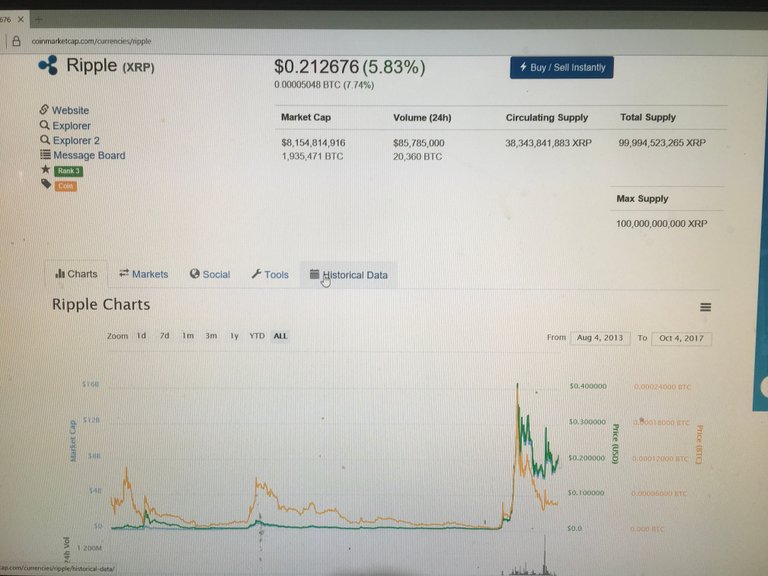

Ripple

Ripple works with banks, payment providers, digital assets exchanges and corporates.

It provides a clever way of transferring anything but mainly not-perishable, fungible goods (cash is good, gold is OK, as are cryptocurrencies, but can also be extended to beer and flowers, if the gateways want to deal in them.)

Rather then moving physical gold or actual money between gateways, IOU’s are tracked on the electronic ledger.

It is a clever clown which uses ripple to create shortest trust routes between gateways in order to move different currencies/ assets IOU’s between gateways. Trust is a major factor in transferring wealth between gateways, through using XRP (ripple) an optimal route between trusted gateways is used. Allowing for almost instantenous transfers.

Transactions dealt with per day: around 200K to 600K now but goes up to 2.8MM 6 months

Transaction fees: very low less than a cent.

Transactions per second: ripple's consensus ledger (RCL) can support up to 1500 txps.

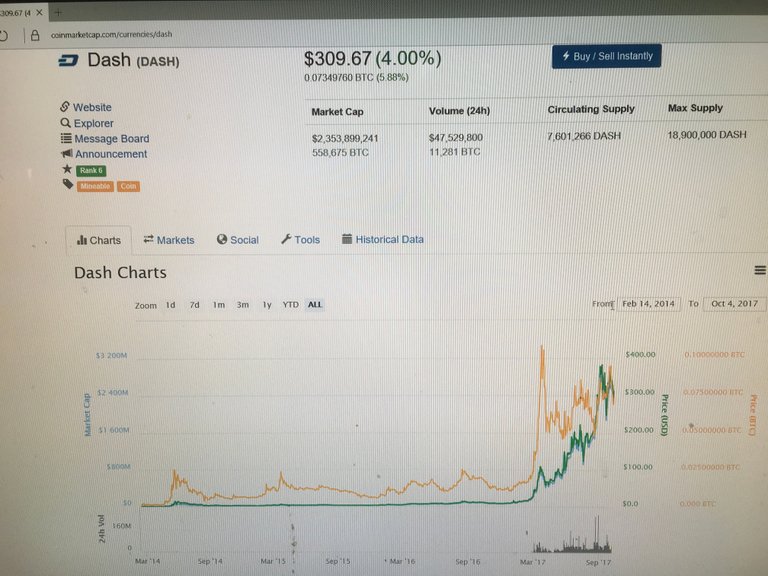

Dash

Dash is very much like Bitcoin.

Bitcoin is a decentralized, peer to peer distributed system. In order to get a grip on how decentralised crypto systems work it is worth having a basic understanding of The Byzantine Generals’ Problem (BGP) .

Which is a classic problem faced by any distributed computer system network.

The biggest difference between Dash and Bitcoin is their governance model. Dash is governed by masternode owner/s, while bitcoin is governed through consensus on the blockchain.

The community members who own a masternode can vote in favour or against proposals that help build the Dash Ecosystem.

Transactions dealt with per day: around 8000.

Transaction fees: today approx. 0.18$

Transactions per second: Dash Evolution should allow for 1500 tps, old data shows 13 tx per second.

whitepaper

Nem

Fueled by a theme known as the “New Economy Movement” the Singapore-based non-profit organization NEM Foundation started in 2014 inspired by the cryptocurrency Nxt and wanted to enhance it.

NEM is the engine behind the cryptocurrency known as XEM, it also functions as a peer-to-peer solutions platform that delivers services like payments, messaging, asset making, and naming systems.

It does this by using smart assets.

Smart asset system

The NEM Smart Asset System allows you to totally customize how you use the NEM blockchain. First, your Namespace defines your home on the blockchain where you can name your own Mosaics, provide easy-to-remember names to user addresses, and more.

Mosaics then are the basic building blocks of Smart Assets that you can use to represent lots of simple things: it could be a coin, a signature, a status update or more.

To create truly Smart Assets however, NEM allows you to create Addresses that act as containers for Mosaics that can be connected with Multisig rules. An address can simply represent a user, such as an account holder. But it can also represent an individual unique asset such as a document, or a song, or a package. You can then update that asset through configurable Transactions.

Check out the “example use cases” to see how Smart Assets can be used to create a wide variety of blockchain solutions, quickly and reliably.

NEM is currently regarded as one of the best funded and sustained blockchain projects in the cryptocurrency industry with its technology currently used by a variety of financial institutions and industries, including the Japanese company Hitachi with its 150 million customer base.

NEM possesses both a standard public blockchain and a permissioned or private blockchain.

It utilizes a tiered architectural structure common to the Internet but unusual in the blockchain world.

As a result, running a node in order to utilize the ecosystem is not a requirement. Therefore NEM has the ability to facilitate web, mobile and other thin clients without leading to a costly footprint on devices.

Lon Wong (President NEM foundation) says that he is confident that NEM is one of the few blockchain projects in the market that has a production quality solution.

Nem has a strategic alliance with Blockchain Global, one of Australia’s leading blockchain companies providing international auditing and network infrastructure services.

Later this year, NEM plans to work with Blockchain Global to develop a cryptocurrency exchange for the NEM ecosystem. Blockchain Global previously built ACX.io, Australia’s largest Bitcoin exchange by

NEM is built from scratch as a powerful and streamlined platform for application developers of all kinds, not just as a digital currency. Using NEM in your application is as simple as making RESTful JSON API calls allowing you to configure your own "Smart Assets" and make use of NEM’s powerful blockchain platform as your fast, secure and scalable.

Configured for your use, NEM is suitable for an amazing variety of solution classes, such as direct public transactions via streamlined smartphone app, efficient cloud services that connect client or web applications, or a high-performance permissioned enterprise back-end for business-critical record keeping.

Transactions dealt with on a daily basis:

Transactions per second:

Transaction fees: After the latest fork on 3rd aug 2017 not more than approx 1 XEM (today 0.22$)

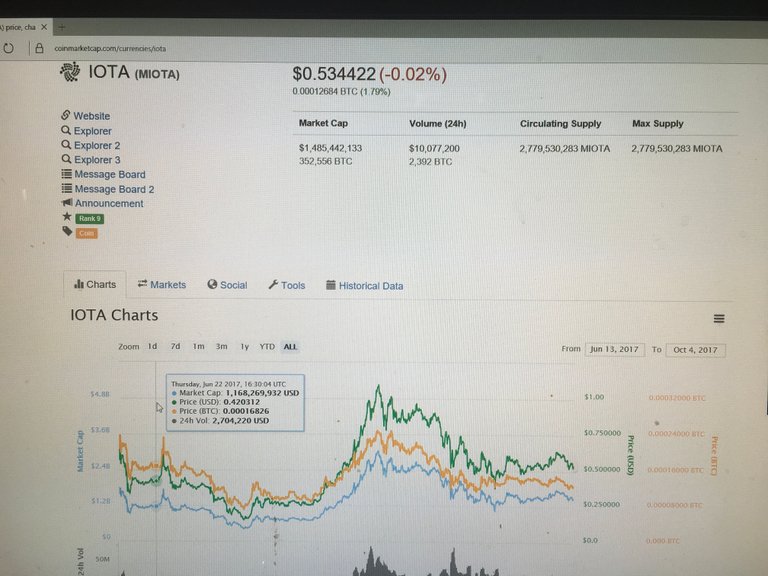

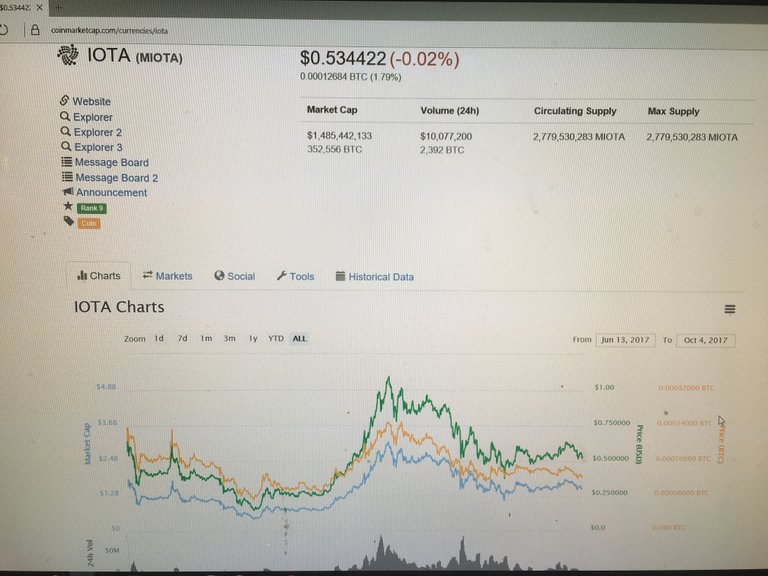

Iota

IOTA is not a Blockchain, it is based on a directed acyclic graph (DAG) aka the Tangle, not a Blockchain.

IOTA is an innovative new distributed ledger technology to function as the backbone of the Internet of Things.

Born in 2014, it is the only technology of its kind that is able to function as the lightweight distributed ledger with scalability, quantum resistance and decentralization for all IoT devices.

It is far more advanced then the block chain and is recognized in the innovation-press like Forbes, Techcrunch, International Business Times and Huffington Post.

IOTA has no mining, no blocks, no difficulty, no transaction fees.

IOTA scales almost infinitely, unlike Blockchains

IOTA is not solely made as a currency but as an interoperability protocol that solves the problems of the IoT

IOTA wants to enable the machine economy

many articles about how IOTA will be used

Its field of application is set in the Internet of Things as the technology for data integrity and industrial appliances. Furthermore pay on demand, micro-payments, and machine to machine communication like sensor technology, smart cities, adaptive systems etc.

It is quite evident, that Bitcoin and nearly all other cryptocurrencies weren’t made to function as such. Considering hundreds of thousands of nano-payments each day in the near future, these Blockchains would generate an enormous amount of fees, just for conducting transactions, while costs of these nano-payments oftentimes undermatch the fees.

Therefore, it is indispensable to use a secure, fee-free system, which IOTA is. This technology, therefore, is a novum.

The underlying technology, the Tangle, is a third-generation Blockchain-technology, based on a directed acyclic graph, made for the problems of tomorrow.

Beyond that, the Winternitz one-time signature scheme enables quantum resistance, which makes it perfectly equipped for the future.

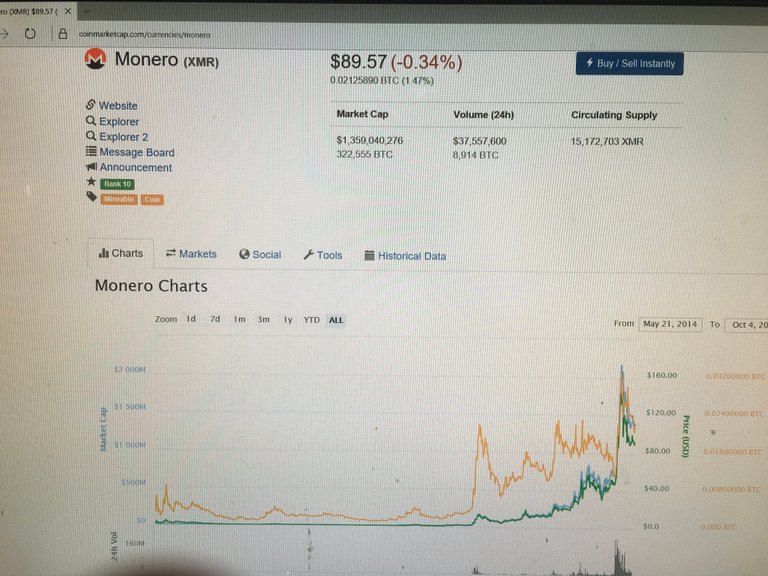

Monero

Monero is created from the ground up to deliver genuine privacy and anonymity.

Every transaction, is confidential, which means every user’s activity enhances the privacy of other users.

Transaction amounts are encrypted to prevent them from being traced by the amount sent.

Dynamic blocksize allows for fast transactions and at low fees.

Fungibility: no fear of couns being tainted, by association with the activity of previous owners.

The funds you own will not be associated with your public address, like they would with Bitcoin. This means if you tell someone your public address, they can’t see how rich you are.

When you send funds to someone’s public address, what happens is that you actually send the funds to a randomly created brand new one-time destination address. This means that the public record does not contain any mention that funds were received to the recipient’s public address.

For the same reason, the funds that you are sending were not associated with your own public address either in the public record. Therefore, when you send these funds, the public record will not show that the funds originated from your public address and will not show that the funds were sent to the recipient’s public address.

In Monero, your public address will never appear in the public record of transactions. Instead, a 'stealth address' is recorded in a way that only you, the receipient, can recognize the incoming funds.

When the recipient checks for funds, they need to scan the Monero blockchain (the public record of all transactions) to see if any transactions are destined for them. The recipient has a secret view key which is used to check each transaction to see if it was addressed to them. Because the recipient is the only one that knows the secret view key, only the recipient can see that funds have been sent to them.

This is why, if you launch your Monero wallet, you will see it ‘scanning’ the blockchain. This is done to check if any transactions have occurred that have you as the recipient. Note that you can give your ‘secret view key’ to others so that they can also see what funds you have received. They will only be able to view the transactions and not make any transactions on your behalf.

So far, we’ve discussed the concept of ‘unlinkability’. This means that received transactions are associated with a one-time address that is not linked to your public address. It also means that two transactions sent to your public address cannot be associated as having the same recipient.

We don't want the sender of a transaction to notice when the recipient of the transaction then spends the funds in a new transaction. Monero solves this problem through the use of ‘ring signatures’.

Ring signatures enable ‘transaction mixing’ to occur. Transaction mixing means that when funds are sent, the sender randomly chooses several other users’ funds to also appear in the transaction as a possible source of the funds being sent. The cryptographical nature of the ring signature means that no one can tell which of the funds were really the source of the transaction – not even the person that gave the funds to the sender in the first place. A system of ‘key images’ associated with each ring signature ensures that although no one can tell the true source of the funds, it can be easily detected if the sender attempts to anonymously send their funds twice.

The number of people that are added to the list of possible senders in a transaction is often referred to as the ‘mixin’ level. Because using a larger mixin level increases the size of the transaction for the Monero network to process, there is a slightly larger fee associated with your transaction if you increase the mixin level. Note that because you may be often included as a possible source of funds every time any transaction is made on the Monero network, no one can tell if you are or are not spending any funds that they sent you. It will look like you’re very busy continuously transacting with people everywhere at all hours of the day and night, even if you’re doing nothing at all!

In addition to providing that no one can tell whom they have received funds from, an extension to the system of ring transactions has been developed known as RingCT. RingCT (Ring Confidential Transactions) went live on 10th January 2017. It hides not only the source of funds being sent, but also hides the amounts of the funds being sent from being visible on the blockchain. This is achieved by applying a mathematical function to all funds such that public observers can see that the transactions are legitmate, but only the sender and receiver can know the actual amounts. This prevents theoretical attacks through blockchain analysis that could otherwise be possible if the real amounts of transactions taking place were a matter of public record.

Finally, project Kovri, which is currently in development, will hide your internet traffic so that passive network monitoring cannot reveal that you are using Monero at all. This is achieved by encrypting all of your Monero traffic and routing it through I2P (Invisible Internet Project) nodes. These nodes pass your messages along and have no visibility over what is in them. They do also not know whether the destination they’re sending your messages to is the final destination or just a waypoint which will further forward your message. Passive listeners can tell you are using I2P, but cannot tell what you are using it for or what destinations you are interacting with.

Monero can even withstand the attack scenario where every exchange is leaking details about your identity and the funds that you own, and where every vendor has a severe security breach that exposes their wallet. If you need the absolute highest levels of privacy and are dealing with exchanges that know your identity, you can perform a 'churn' immediately after withdrawing Monero from an exchange and immediately prior to depositing your received Monero into an exchange. A 'churn' means sending all of your funds to yourself 12 times over. Since Monero will automatically assign 5 possible sources of funds for every transaction, your funds will be hidden within a theoretical 5^12 = 244 million other transaction funds, which at the time of writing is more than 10x the number in existence. It will look like almost every customer of the compromised exchange could have been transacting with each exposed vendor. This gives you extreme privacy on the blockchain.

In summary: Monero ensures no one can tell where funds came from. No one can tell when they are then spent or whether they have been spent at all. No one can see the amounts of the transactions of others, or even that others are using Monero at all. Everyone appears to be repeatedly transacting with almost everyone else almost all of the time.

versus Bitcoin fees (XMR/BTC) Txn fee USD

Monero (lowest) 0.004000 $ 0.3919

Bitcoin (lowest) 0.000800 $ 3.3098

Monero (median) 0.014000 $ 1.3716

Bitcoin (median) 0.001000 $ 4.1373

Monero (highest) 0.661000 $ 64.7608

Bitcoin (highest) 0.005036 $ 20.8354

Transaction speed between 1 and 10 minutes.

Transactions per second 1700 TPS

Neo

Best way to understand what Neo encompasses is by making a comparison to Ethereum.

Neo is often called the Chinese competitor of Ethereum.

backing

NEO is backed by the Chinese government. This has become the most important factor for NEO’s popularity in China, making it China’s first open-source public blockchain project. NEO is also backed by WINGS, Alibaba, and various Microsoft-like giants.

Ethereum is not backed by any nation’s government, but it is supported by the EEA-Enterprise Ethereum Alliance. This speaks volumes about its popularity and potential success on the world’s stage.

consensus mechanism

NEO uses a delegated Byzantine Fault Tolerant (aka dBFT) consensus mechanism, which is an improved form of proof-of-stake.

Ethereum uses a proof-of-work mechanism.

dBFT is believed to be more energy efficient than proof-of-work, as POW is a very energy-intensive and expensive. But I don’t see this as a big advantage for NEO because we can eventually expect Ethereum to move to an efficient proof-of-stake mechanism.

Divisibiliy

The native crypto-fuel of NEO’s blockchain is not divisible. It only exists in whole numbers (1,2,50,1000, etc.).

The native crypto-fuel of Ethereum is divisible. It can be divided (3.4352, 283.399403, etc.)

Fueling the blockchain

NEO produces a special crypto asset called NeoGAS (or GAS)which is used as a crypto-fuel for NEO’s blockchain.

In Ethereum, small units of Ether are used as “gas” to fuel the network.

Language

NEO’s smart contracts and DApps can be written and compiled in C# and Java. In the future, developers will also be able to write smart contracts in Python and Go. This will drastically reduce the entry barrier for all developers around the world.

Currently, if you want to write smart contracts and DApps on Ethereum, then you have to learn a new programming language called Solidity. Very few people know this language.

Direction

NEO is focused on making a smart economy by digitizing traditional real world assets via digital identity, along with running smart contracts and DApps.

Ethereum is going in the direction of becoming the world’s only supercomputer based on the blockchain by hosting numerous use cases of digital identity, computing, decentralized exchanges, remittances, and KYCs (to name a few).

International audience

There isn’t much information available about NEO for the English-reading audience due to its Chinese roots.

Ethereum is already a global enterprise which fully caters to its international (and English-reading) audience.

Transaction Speed:

At present, NEO can handle 10,000 transactions per second.

Ethereum can handle 15 transactions per second.

Quantum computer-proof

NEO is quantum computer-proof. Quantum computers are believed to have the ability to break into and hack the cryptographic math on which blockchains are based. NEO claims that they have already developed an anti-quantum cryptography mechanism called NeoQS (detailed in their white paper).

Ethereum, and every other cryptocurrency, is not quantum computer-proof.

Transaction fees: tba

omisego

Omisego is an extension of the company OMISE, it is a payment gateway for Asia.This is an established company that has been around since like 2013 they are based in Singapore, Thailand, Japan and they have offices all over in Asia.

Also it's a proof of stake blockchain and an Ethereum ERC20 token.

They help businesses Implement payment methods that customers will use.

It's built on the Ethereum blockchain so it's going to offer peer to peer money transferring, storage and decentralized trading.

Building a decentralized exchange on their platform that is going to allow people to trade back and forth and store all the money in one place.(more to come on this)

They have a strong development and management team, and they are being advised by Vitalik Buterin(creator of Ethereum) himself.

Next to that: The co-author of the lightning Network Joseph Poon has done a lot of research and he has developed the Lightning Network, Co-founder of Ethereum, founder of Golem.

They are going to have a mobile wallet and it's going to support fiat as well as cryptocurrency.

They're offering payment loyalty points when transferring money.

It will be accepted at 240 McDonalds locations in Thailand.

One of the big problems that they're trying to solve is that in Asia a lot of people are kind of cut off from banking, with this platform you don't need a central bank account to work with them or to put your money on this platform.

We're used to carrying around physical cash, they're going to have a mobile wallet and decentralized exchange that they can put all their assets on and manage them. This offers a solution to traditional banking out in Asia.

The properties will be based on Ethereum, I will get back to this.

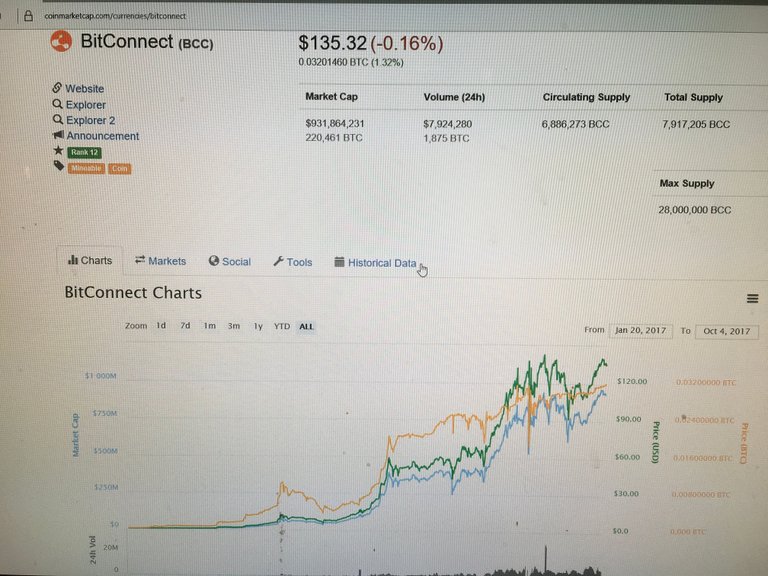

BitConnect

BitConnect is an open-source platform where you can buy, sell and trade bitcoins to the other trusted community members. Bitconnect system members interact directly with each other in a peer to peer fashion, enabling buy, sell or lend operations to all other members.

Bitconnect was not formed to be a company nor financial institution but to function as a collective. Our mission is to make Bitcoin the main payment system in use by the world. We propose bolstering bitcoin acceptance by providing this peer-to-peer community where all members interact directly with each other. To accomplish this, we have provided you with several modules designed to connect you to our marketplace. Some of these modules include Buying, Selling, Lending, and listings services (where we act as the bitcoin payment custodian on your behalf.) Bitconnect has designed these modules from the ground up to provide extensive verification and security so that the highest ranked service providers are promoted first, providing an opportunity for honest participants to earn supplemental income or procure bitcoin through our product offering.

How does Bitconnect System work?

Bitconnect system is divided into four major modules. They work independently of one another but do contain a linked integrated feedback system used to enforce quality and reputation parameters on the system. Each Bitconnect member receives a feedback for each completed transaction for each given module.

Bitcoin lending platform

Bitconnect members can potentially earn Bitcoin through peer-lending to other trusted community members. Using our Peer rating system, we can help you best identify potential microloan opportunities to earn a substantial return on your investment! Let us do the hard work of vetting qualified collateral holders so you can rest easy and let your investment do the heavy lifting.

Bitcoin trading platform

Bitconnect members can potentially earn Bitcoin through peer-lending to other trusted community members. Using our Peer rating system, we can help you best identify potential microloan opportunities to earn a substantial return on your investment! Let us do the hard work of vetting qualified collateral holders so you can rest easy and let your investment do the heavy lifting.

Bitcoin e-commerce platform

This third bitconnect module allows the ability to create listings for other members to buy or sell your goods & services using bitcoin as a payment processor. To become a registered vendor you need minimum 1000 transaction feedback from previous modules to submit product listings through seller portal. This is necessary for trust verification set by the Bitconnect system.

BitStore

Bitconnect final module is called a BitStore. This is an official Bitconnect store equipped with bitcoin ATM to serve the local community. As this level has special functionality, all accounts must be verified and peer-determined and limited in issue.

Googling Bitconnect ties it to a lot of negative news, unlike the above coins we spoke off. Main accusation is, that it is a ponzi scheme.

The moment you acquire BitConnect Coin

it becomes an interest bearing asset with Up to 120% return per year through PoS minting. All you have to do to earn with this method is to hold coins in your Bitconnect-QT wallet. This means anyone holding BitConnect Coin in their wallet will receive interest on their balance in return for helping maintain security of the network.Learn more.

The BitConnect service, takes your Bitcoin, immediately converts your Bitcoin into BCC (their own token), and pays you interest from their earnings on their trading bot.

On the initial post onBitcoinTalk, they performed a pre-mine to generate at least 4.8 million coins. 17% was sold the rest is being used for development.

They have adopted a Proof of Stake / Proof of Work system. Proof of Stake essentially means that you’re rewarded interest in exchange for not selling your coins. The interest rate they will reward you is shown below:

The main question is, how are they able to give such high returns?

One theorie is that their tradingbot is so superior that they can offer these returns, the other theory is explained below.

They use a Proof of work/ Proof of Stake system,allowing them to accumulate interest on their pre-mined coins. Let’s assume they kept only 2,000,000 BCC from their pre-mine. Their current holdings would look like this: 1,543,122 BCC (interest from Jan 2017 to June 2017) + 160,000 (interest from July 2017 to August 2017) =1,703,122 BCC accumulated in interest from Jan 2017 to current. In USD at the current USD/BCC rate, this would be $102,187,320. Remember, this is from interest alone.

If you could generate that kind of income passively, would you ever consider trading?

This could explain how BitConnect is able to provide their users with BCC tokens on a daily basis. They might have a virtually infinite supply of them due to the fact that they have staked millions of BCC which they are accumulating interest on. So in essence, the interest they are paying you is not their returns from trading, but simply just the interest they get from their Proof of Stake system!

[no whitepaper]

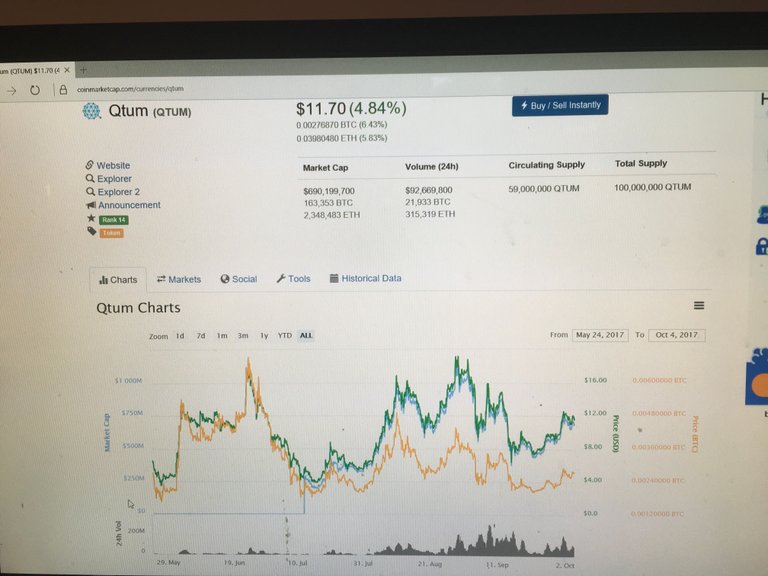

Quantum

Quantum calls itself the next generation blockchain application platform. Qtum is a singapore based, global project that aims to be the bridge between the Bitcoin and Ethereum communities, the real world and blockchain world and is aiming to become the blockchain of China.

Their ultimate goal is to bring blockchain technology into industries spanning finance, social, mobile, the Internet of Things (IoT) as well as other sectors.

founder

Patrick Dai, the 27-year co-founder of Qtum

The founder of Kuaidi, a major Chinese car-hailing service that merged with DiDi.

foundation

It is the Qtum Foundation, established last November and headquartered in Singapore, that is the decision-making body driving the project’s development.

investors

They have gained a prominent group of Angel investors and signed up a top four accountancy firm for project governance and risk control.

As well as Chen Weixing, the billionaire founder of Kuaidi being in the fold, there is Anthony Di Iorio, Ethereum founder and CEO of JaxxWallet; Jeremy Gardner, co-founder of Augur and EIR at Blockchain Capital; David Lee Cuo Chuen, founder of Left Coast, Libai, and DLEE Capital Management.

Xiaolai Li, one of biggest bitcoin holders in the world and a Blockchain Angel backer.

governance

These problems span the lack of business-oriented smart contracts in that the current smart contract platforms are mainly based on 'Proof-of-Work' (PoW). However, according to a recently published Qtum whitepaper the “consensus mechanism of Proof-of-Stake is more suited for business applications.”

Smart Contracts Platform technology

Combining a modified Bitcoin Core infrastructure with an intercompatible version of the Ethereum Virtual Machine (EVM), Qtum merges the reliability of Bitcoin’s unfailing blockchain with the endless possibilities provided by smart contracts.

Designed with stability, modularity and interoperability in mind, Qtum is the foremost toolkit for building trusted decentralized applications, suited for real-world, business oriented use cases. Its hybrid nature, in combination with a first-of-its-kind Proof of Stake consensus protocol, allow Qtum applications to be compatible with major blockchain ecosystems, while providing native support for mobile devices and IoT appliances.

A major Qtum goal is to build a so-called Value Transfer Protocol, which along with decentralized applications (dapps) can be used to support and enhance various industries. Another goal is to maintain compatibility with existing processes from Bitcoin and Ethereum, to be as secure as possible and to be used not just in the finance industry.

Bringing a superior version of the Ethereum Virtual Machineto the UTXO modeldoes more than just allow the standard smart contracts you can perform on Ethereum.

currency

While Qtum can in theory be used just like Bitcoin to send and receive digital currency - except for the PoS modifications - the real power of Qtum centres on the Smart Contract system.

critics

Some have expressed the view that it is basically just another bitcoin fork with extension to the bitcoin scripting language and a new altcoin platform. The founders counter those claims.

Founders view

“Primarily Bitcoin is used for sending value. On the other hand, ethereum allows for many use cases; but the source code is not as stable and secure as bitcoin’s source code,” Therefore QTUM is providing the best of both worlds.

“All current ethereum projects can be easily ported to Qtum platform since the Qtum platform is compatible with EVM,” explained John Scianna at Qtum, who has worked for several startups included CoinPip and been following bitcoin since 2012. “The only thing a developer needs to do is to construct the states of contract and account based on the Qtum Account Abstraction Layer.”

two community projects

Springemail (BiSMTP: Blockchain integrated SMTP), which we hope everyone will use their email as a wallet address, so people can send and receive cryptographic tokens through their email address. It aims to improve the usability of the blockchain industry.”

Qloha, is another project that will integrate into WeChat’s new mini app platform whereby people will be able to send and receive tokens through WeChat. Both these projects aim to improve the usability of the blockchain industry.

Qtum’s Roadmap

The startup has revealed that it is “constantly looking” to implement not just what designs they have now, but also to ensure that the designs they are building will be extensible and work well as a foundation to build on for their future activities.

While these are "in-flux designs", some ideas currently being discussed include: better and faster interactions with smart contracts from SPV wallets, making data feeds a ‘first-class citizen’ on the blockchain with efficiency and usability improvements and Automatic/periodic contract execution, plus enhancing side-chain support with smart contracts.

They have also not limited themselves one particular industry, which is why they have talked to many different potential stakeholders so that they could build an "industry agnostic" platform and not be oblivious to actual business needs.

oracle

An Oracle is a particular agent (i.e. entity, node or address) that is trusted by the participants in the blockchain. An Oracle network can be used to implement a system for off-blockchain computations and (total or partial) contract code execution.

Partly Smart Contracts might have to be run outside of the blockchain to maintan performance

“Useful and exciting smart contracts operating on public blockchains may need or require to process certain data (e.g. financial, economic, business, meteorological, social) that is external to the blockchain (i.e. out-of-blockchain data),”

For example, the result of a smart contract execution could depend on external data such as exchange rates, the GDP of countries, temperatures in cities and sports scores amongst other data. The term data-feed refers to any system, procedure or technique used to fetch ‘off-blockchain’ data and feed it to a smart contract - or decentralized application - being executed on the blockchain.

“Platform approaches based on a blockchain with a built-in virtual machine have the limitation that every node must execute (run) all of the smart contracts in real time, leading to slower speeds and redundant processing,” Dai stated. “Then, it’s possible that smart contracts that are computationally expensive would consume (take) an enormous amount of resources when being run on the blockchain.”

Therefore, in such cases a full execution of the smart contract on the blockchain may not be the best choice. And, he indicated that it might be “better or even necessary” to run the contract or part of its source code off-blockchain, where computations can be done at a much lower cost.

Also, given the public nature of the blockchain - where data and computations are publicly visible - and the privacy requirements of many financial transactions, off-blockchain executions could be necessary to preserve the privacy of smart contracts data and transactions.

compatibility

Bitcoin’s UTXO model, for example, is not compatible with Ethereum’s account model, Qtum is.

other blockchain issues it is planning to tackle

The lack of consideration for business compliance requirements (i.e. identity and KYC/AMLrequirements of the financial industry, which the current blockchain implementations cannot fully support).

Furthermore, current blockchain systems are not open enough, with most of the triggering criteria for smart contracts being set on the blockchain itself. And, there are no triggering criteria from 'off-chain' data sources, which can be used to build a connection with the real world.

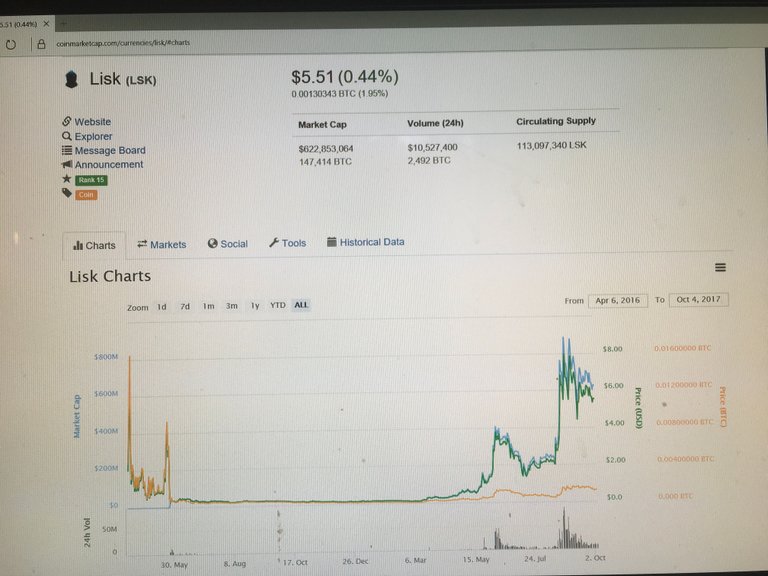

Lisk

Decentralised blockchain applications will be built on Lisk from the ground up in pure Javascript and take advantage of the powerful Lisk APIs. In addition, every app will run in its own sidechain to ensure that Lisk itself stays safe and scalable. Currently in development, these features will become available towards Q4 of 2017.

Lisk strives to make blockchain technology accessible for everybody by building a blockchain application platform likewise for users and developers.

On May 24th 2016 the Lisk blockchain network went live with its own cryptocurrency called LSK. From that date, the Lisk Foundation is working hard together with its contractors towards the release of their Software Development Kit (SDK). The SDK is a framework written in JavaScript to deploy your own blockchain network next to the main Lisk network. Decentralised applications can be built on top of your own blockchain.

technical

Like Ethereum, Lisk also supports apps that run on top of a blockchain. What’s more, the platform is designed to let every app has its own sidechain, separate from the main blockchain. Even better, these blockchain apps are written using NodeJS/JavaScript on the backend and CSS3/HTML5/JavaScript for the frontend. Meaning, there are already hundreds of thousands of developer who practically know how to write apps for Lisk. This feat alone could make it one of most widely used blockchain platforms out there.

Lisk is the world’s first modular blockchain-based platform, which involves “modules” that serve as the basis of its design and construction. The system allows anyone to construct their own decentralized apps that (as noted) run on their own sidechains.

Decentralised network

Lisk is a decentralized network such as Bitcoin, Nxt, or BitShares. It doesn’t utilize Proof of Work like Bitcoin, or Proof of Stake like Nxt. Lisk uses a simplified implementation of BitShares’ original consensus algorithm called Delegated Proof of Stake.

That means every LSK holder can vote for mainchain delegates which are securing the network. There are only a maximum of 101 active mainchain delegates which always got the most votes on the whole network, and only they can earn block generation rewards, that means there is a financial incentive to become an active delegate. Every other delegate is on standby awaiting to become elected, or alternatively, securing a Lisk sidechain.

cryptocurrency

Lisk is a cryptocurrency and its token is called LSK. To send LSK from one account to another takes 10 seconds, after about 1–2 minutes the transaction can be deemed immutable.

framework

The Lisk App SDK is a framework to deploy your own sidechains and develop blockchain applications on top of them. Everything is written in JavaScript. That means you can develop platform independent social networks, messengers, games, financial applications, prediction markets, exchanges, storage platforms, contract execution platforms, sharing economies, online shops, IoT applications, and much more on your own blockchain, fully decentralized, and without the hassle of complicated consensus protocols or P2P networking algorithms.

sidechain platform

In the previous section, you read that the Lisk App SDK enables you to deploy a sidechain to Lisk. This sidechain is a fully customisable blockchain, free of pollution or spam on the mainchain or other sidechains. All specifications, parameters, and transaction types can be changed to fit perfectly to your blockchain application.

In order to prevent spam on a blockchain there is always a token of value which is required to save any data on the blockchain, e.g. a fee to send transactions. In your Lisk sidechain you can either use the LSK tokens from the mainchain or an entirely new custom token.

In the case you want to use mainchain LSK tokens within your sidechain you have one limitation. You can’t simply transfer tokens between different blockchains. Remember, a sidechain is a completely new and independent blockchain! You also can’t send Litecoin to the Bitcoin network.

That’s why there is a special transaction type to transfer LSK tokens from the mainchain to a sidechain. Practically, the LSK tokens never leave the mainchain. They simply get transfered to the sidechain owners Lisk account (on the mainchain!). At the same time, the equal number of LSK tokens will be replicated on the sidechain and can be used by yourself as normally.

That means in the case of a badly written sidechain or blockchain application, all LSK tokens are safe and can be retrieved easily by the sidechain owner. However, this also means that you have to trust the sidechain owner. This doesn’t make sense for all types of blockchain applications, only for some owned by startups or reputable individuals.

It is important to note, that thanks to the Lisk App SDK you are not only able to develop the back end of your application (i.e. the functionalities), you are also able to develop a front end (i.e. user interface). This way you can easily create complete blockchain applications ready to download and use in one convenient package. In this case the front end can also be accessed in a decentralized way, what is currently a unique feature within the blockchain industry.

Team

On June 8th 2016, Lisk CEO Max Kordek announced the addition of Charles Hoskinson (ex-CEO of Ethereum) and Steven Nerayoff (ex-advisor for Ethereum) as Senior Advisors of Lisk, to facilitate Product Development.

partners

Microsoft is one of Lisk’s partners (be aware there are many blockchain partners which you can find in the anouncements of the previous link: lisk’s partners), with the two parties agreeing to integrate Lisk into the Azure Blockchain as a Service (BaaS) program. This in turn enables developers to develop, test, and deploy Lisk blockchain applications using Microsoft’s Azure cloudcomputing platform and infrastructure.

Controlled but unlimited supply

You may have heard that Bitcoin’s algorithm is set to stop rewarding miners once the 21 million bitcoins have been issued. Like Ethereum, Lisk doesn’t have that limitation; but it won’t make it easy to get new Lisk coins after some time, either.

Lisk’s system utilizes an inflationary forging rewards system which creates new LSK for every successful block. During year 1, the forging rewards are set at 5 LSK per block. Every 3,000,000 blocks (~1 year) forging rewards are reduced by 1 LSK, ending at 1 LSK per block after 5 years. The forging rewards will then stay at 1 LSK per block indefinitely. These rewards will be equally distributed through all active (top 101) delegates, same as any network fees.

transaction fee = 0.1 lsk (0.54$) which is high

Might change in the future.

transaction per second: Last thing I read was around 25 tx per sec but scalable to a very high number, need to investigate more.

[whitepaper couldn’t find seems removed]

roadmap

Part 2 didn’t fit check my blog 😄

Very detailed. I like it but i guess i will start at Part 1 :P

You got a new follower!

Thank you martl0g, There are now two parts you can start at 10.0, but I try to add a coin every for your comment.