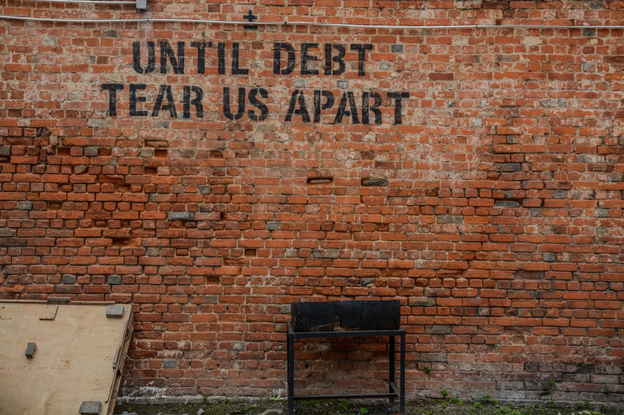

Looking back in retrospect, I find it interesting that Nicholas Nassim Taleb’s The Black Swan series' release coincided with the emergence of Bitcoin around the same period, 2008 – 2009. At a time when the world experienced the worst financial crisis in my lifetime, both offer different solution strategies to a common shared problem; the legacy financial system. The undoing of the current financial system is attributed to the unreliability and lack of trustworthiness of the people whose responsibility it is to dispense the correct services. For instance, one of the reasons attributed to the financial crisis was the credit bubble. People spending what they didn't have could not pay for mortgage prices, because the lending institutions had no money to lend. And going up the food chain, the lending institutions could not be able to borrow from the higher authorities above them. At the end of the day this resulted in an economic gridlock. This might not be the comprehensive solution but if there was professional conduct to avoid giving out non-existent loans, then perhaps the financial crisis could be greatly reduced or avoided altogether. While Taleb references historical ‘skin-in-the-game’ solutions to people who held public responsibility, I believe blockchain technology is the digital version of bootstrapping the credit component of the financial system from the bottom up.

Credit rating

Especially in developed countries, one’s credit score is an important badge of your reputation that will pop up every now and then. To be able to go into heavy investments such as mortgages or loan or even seeking employment opportunities, one’s credit-worthiness is usually the reference meter. The personal credit rating will govern the loan limits that one can be able to access from centralized financial institutions, which are the de-facto legal lenders in most countries around the world. This rating is held by certain institutions in the form of data.

Current flaws

Usually most countries have centralized data centres to store most of the citizens’ data. As expected, most of these are highly bureaucratic. The totality of one’s data is very important and this has led to emergence of corporations who take that advantage to limit the access to that data. That means that the data is not easily accessible not to you nor to other interested parties: individuals or businesses. Individuals and businesses who are interested in accessing that data can do so at a cost of money and time. In addition, the centralized nature of these companies means the logistics are a pain considering most of these companies have a lot of paperwork and administrative bottlenecks. The large amount of data that is processed means it could take a while as well. To top it off, these centralized databases are easy targets for hackers.

What Does DCC offer?

Distributed Credit Chain (DCC) is the world’s first distributed banking public blockchain with a goal to establish a decentralized ecosystem for financial service providers around the world. By empowering credit with blockchain technology and returning ownership of data to individuals, DCC’s mission is to transform different financial scenarios and realize true inclusive finance.

The DCC platform will be an end-to-end blockchain ecosystem bringing together borrowers, credit institutions and data certification institutions, in a loan and data marketplace. To be able to access services on the DCC platform, the DCC token will be the token of use. For instance, a borrower will have to pay a certain amount of DCC to apply for a loan. Transactions will be effected through the use of smart contracts making it possible to access the information faster and in a trustless manner.

✅On the DCC platform, interested borrowers will be able to open an account, save their data and securely store it. This data is digitally signed to their unique member ID and recorded on the blockchain, making it immutable and tamper-proof.

✅It is the place of data certification institutions to make sense of the data by using inbuilt algorithms. Algorithms make sense of the data and categorize users depending on pre-coded requirements. Processes such as this were previously done manually in legacy institutions and could take a lot of time. The credit-worthiness report generated one time can be easily accessed in the future without having to go over the same process repetitively. Unlike traditional institutions, the user retains the right of ownership of their own data, through controlling the permission to it.

✅Credit institutions can be able to register on the platform and meet borrowers who have already met approvals. The rigorous process of cross-checking profiles is no more, making it more cost-effective in the long run.

✅To incentivize professional credit behavior, borrowers who pay in time will accrue rewards that are obtained from a dynamically-adjusted daily pool, obtained from all loan applications that credit institutions have received in a day.

✅What makes the DCC platform even more robust is that it can be referenced across borders. Much like what can be accessed in some of the cryptocurrency exchanges today, users can be able to access loans or data reports from the DCC platform regardless of their geographical location.

✅The fact that it can also be accessed by multiple lending institutions creates a ripe opportunity for liquidity for borrowing and settlement of loans.

Conclusion

The DCC platform is a revolutionary opportunity to restore trust and empower the credit infrastructure. Currently, the ICO has already been held and the token has already been listed on exchanges. The DCC mainnet is planned for release in 2020.

You can be part of the DCC community today by following the following important links today:

Website: https://t.me/DccOfficial

Website: https://dcc.finance/

nice

Thank you buddy. I have peeked at your blog and followed you. Hope you follow me back.