FAQ

Q. I have a bunch of STEEM. Why would I want to “power up” to STEEM Power (SP)?

A. SP influences how much influence you have in the STEEM blockchain when it comes to the content. For example, it influences how much your upvote means, how much of the total curation reward you will receive, how much “bandwidth” (ability to do things over time) you have, etc. SP is found ubiquitously in the math equations for all of these things.

Q. So then I should just switch all of my STEEM to SP?

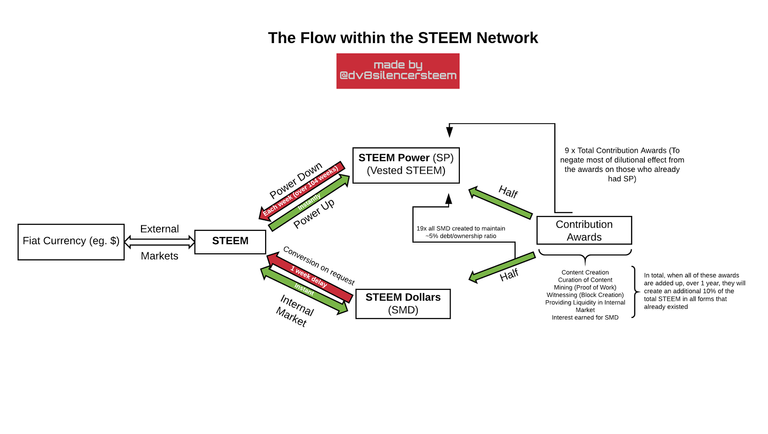

A. I personally have but that does not mean you should. If you look at the diagram, you can see that converting from SP back to STEEM (“powering down”) happens evenly over 2 years. This reduces your liquidity. What I mean is, if you want some dollar bills in your physical wallet, it will take a while because you have to convert SP into STEEM into the dolla billz you can use at the grocery store. There is an inherent risk in that.

Q. So if I do not want any influence in the community, I can keep it in STEEM form and be okay?

A. There is a slight caveat. If you keep it in STEEM format, it will reduce in value over time because of dilution. If you look at the diagram, you can see that the earned interest rate for STEEM Dollars (SMD) as well as contribution awards are multiplied by 19 or 9, respectively, and distributed to already-SP owners. This means that even though all that new STEEM is produced (~100% increase per year…), a much larger portion is created and goes back to already-owners of SP. If you just have pure STEEM, you don’t get this benefit. So holding STEEM Power protects you against the dilutional effect of all that new STEEM production. Thankfully, holding STEEM for a short time (less than a week) will not cause much loss in value.

SUMMARY: SP is a good place to keep your STEEM-worth overall to protect against dilutional loss of real value but you will have to wait a while before you can exit the STEEM economy if you need your tangible currency quickly (US Dollars for example).

Q. What all makes up the “contributory awards” and what influences each?

A. In short:

10% of the already total value of STEEM is given out each year (but in small parts). 9x this is given back proportionally to already-SP owners, so that their value isn’t diluted out (See above).

Curation Award

This is what you get for your voting. All voters will share 50% of the content award. You get a portion that depends on your SP, and it also depends on when you voted relative to everyone else. Early voting = much better. Half of this curation award will be in STEEM Dollars (SMD), and half will be in SP (see diagram). Be warned though, every time you vote, your “voting power” goes down—this is to hurt people who vote everything up. Use your votes wisely. Your voting power will recover over 24 hours to 100%.

Note that depending on your voting power, if you submit a vote near the payout time, it may extend the payout window. This helps make sure high powered voters don’t “snipe” right when the payout time hits to capture most of the award.

Content Award

This is what you get when you post or comment/reply. How much you get depends on how much SP the voters of your content have compared to all the other posts’ voters that exist in the STEEM universe. The relationship is not linear. This means 10x more SP of the voters, means you get 100x more award. You also get 50% of the award of each of the reply comments for your post (down to 6 levels deep).

Mining

This is for proof of work. See mining related posts for more details. Let me know if you want me to do a post on that.

Witnessing

These people work on extending the blockchain. They create the blocks and depend on POW created by the miners. There are 21 total “witnesses.” 19 are based on approval voting. 1 is the person giving the most liquidity (see below) for a specific time period. 1 is a miner who is in a queue after he or she finds a POW. I believe the 19 likely stay stable (but they can be kicked out), and the 1 miner-witnesses changes constantly.

Liquidity

This is a reward that goes to people who provide buy and sell orders on the internal STEEM <-> SMD market. Their orders have to be available for more than a minute and must get filled for them to earn “liquidity points.” This allows an opportunity for people with SMD to “escape” into STEEM quickly and then into the fiat currency. Hence they provide liquidity. They need to provide it on BOTH sides of the balance (ie. buy and sell orders equally). There are liquidity points assigned based on a formula depending on volume of STEEM or SMD offered and the top person is the one who takes a spot in the witnesses list. Then this person’s points are set to 0 and then another is chosen (it might be the same person) for the next time period.

SMD Interest Earned

This is set by the 21 witnesses. It is a percentage. For every 1 (split 50/50 between SP and SMD) earned by a person who has SMD, 19x will go proportionally to people with SP, so that the debt/ownership ratio stays around the goal 5%. The interest rate is part of “monetary policy” (along with the “Feed rate” (SMD/STEEM) ratio that you can use to convert to STEEM from SMD over 1 week)) and influences how seductive the SMD appear. Likely, thankfully, these people likely have large stakes, and have the best interests of the economy in mind.

Q. What happens if I post or comment too much at once? What is stopping some bad actor from spamming the hell out of the STEEM network?

A. Everyone has something called “bandwidth.” This depends largely on your SP compared to the total SP that exists. If you are very active in a short time, and your SP is low, you might be paused (silenced) because your bandwidth runs out.

Q. Why should I ever buy STEEM Dollars (SMD)?

Good question. Unlike SP, SMDs are more liquid because you can use the internal market to exchange for STEEM (this is a type of “Free market”) and then go to US Dollars or whatever fiat currency you want. You can also use the “feed rate” established by the witnesses to ask the system to give you STEEM from your SMD. This is delayed by 1 week though so that people do not buy/share in large amounts and abuse the feed rate. The feed rate is “laggy” intentionally for other reasons. If someone could convert instantly, they would “game” the system because they know what the feed rate will be in the future (because it lags).

It is more liquid than SP which takes 2 years to turn into STEEM. SMD also gains an interest earning set by these witnesses as well. Compared to pure STEEM, is may be equally or less liquid depending on the internal market state. This is why there is an award to “liquidity providers” (see above). They reduce risk a person takes by converting to SMD because they ensure that SMD-carriers can “trade” back to STEEM quickly on the internal market, instead of waiting the 1 week.

Q. Why would this SMD be offered anyways?

This is so that capital can be infused into the STEEM system. Think about it. A person starts with some STEEM he or she got from an external market w/ fiat currency. That person might not want to give up significant liquidity so that person will not power up to SP. One option for that person, is to exchange his or her STEEM for SMD, and earn interest, while keeping most of the liquidity, in case this person needs to exit the STEEM economy. When that person gives up his or her STEEM for SMD, that STEEM is “Destroyed” temporarily and can raise everyone else’s STEEM’S value.

As explained by the white paper, a big goal of the monetary policy, is to keep the SMD at about $1 value (they will try). SP's value will go up alot if STEEM's value skyrockets vs the US Dollar (because it is "slow" STEEM), but if you hold SMD for a long time, you will not benefit as much because the monetary policies will change so it stays at about $1. Think of SP as a form of "ownership" of the STEEM network while the SMD is more of the "cash" within the STEEM world.

Q. If the richer people have more voting power, can’t they just vote their own stuff up and just keep getting richer?

What is important to note is that there are many more people who are not “rich” than there are “rich.” If you look at the math that goes into the rewards, the non-rich numbers add up. So if the majority of the voters are prudent with their votes, they can “overrule” the bad actor’s voting quite easily. The negative is that this requires people to think more about what they vote for. Also remember that the vote count’s influence increases by a square value, so that 10x votes give you more like 100x within the calculations. This leads to power in numbers as well. Overall, the economy should be safe. A rare few covert bad actors might benefit though. This requires a community effort to punish them.

Also remember that people who have significant holdings in STEEM, would not want to ruin the system. This will hurt their equity. We should all vote up good content. This will raise all of our STEEM net worth and also create a great product.

Q. Why shouldn’t I just use the market instead of the offered SMD - > STEEM conversion? Is there any difference? Why wait 1 week?

The market is a “Free market” that is bidirectional and the SMD-> STEEM conversion is set by the witnesses and is unidirectional. The former is instant, the latter takes 1 week. You have to think whether or not you are willing to wait 1 week, and also consider the ratio differences. You might get a better deal using the system conversion.

References:

- The Whitepaper found here: https://steem.io/SteemWhitePaper.pdf

- Several website pagers on the official website as well:

https://steem.io/getinvolved/market-maker-rewards/

https://steem.io/getinvolved/paid-to-curate/

https://steem.io/getinvolved/steem-backed-dollars/

https://steem.io/getinvolved/steem-currency/

https://steem.io/getinvolved/paid-to-curate/

https://steem.io/getinvolved/posting-rewards/

Is there a bandwith allocation for subitting new stories?

I honestly do not know the details. If I read the source code I could find out, but the white paper refers to it in terms of "Transactions." I am guessing that includes primarily posting, replying/commenting, and voting.

Update: yes there is: https://steemit.com/steemit/@dv8silencersteem/how-rate-of-posting-affects-content-award-and-how-to-calculate-the-penalty-if-you-have-one-detailed

So what exactly is the benefit of SP over SMD? It seems like they're both more stable currencies, but SMD has the bonus of offering more liquidity. Is the 10% annual interest exclusive to SP?

The 10% is not really an interest. If you add up all of the contributory awards over the whole year, they will equal 10% of the total STEEM + SP that exists. This will go in 50/50 form to the awards (SP and SMD format).

SP is much slower to change back into the more liquid assets but benefits from giving you much more power within the community. When the 10% is given in total to the award-earners, 9x that is given to the SP. This ensures that their value isn't that diluted. SMD does not have that, so it might suffer. The goal of the monetary policy is to keep the SMD equal to about 1 US Dollar. So if you have SP, and STEEM goes up in price relative to USD, you will benefit. You probably will not benefit as much holding SMD for a long time.

Did this answer your question?

Wonderful post by the way, answered a lot of my questions as a newbie here. Thanks for making it!

Ahh gotcha! Yes that clears things up perfectly. Thanks for clarifying!

great posts, needs to be read by all new users

I appreciate it.

very helpful!

New Post regarding posting frequency and penalties: https://steemit.com/steemit/@dv8silencersteem/how-rate-of-posting-affects-content-award-and-how-to-calculate-the-penalty-if-you-have-one-detailed

73 upvotes and only $0.48 reward. Your content is I think worth more than 48 cents.

I do too. I appreciate it.