On June 27, a major correction in the cryptocurrency market occurred, bringing the market cap of the cryptocurrency market below the $100 bln region.

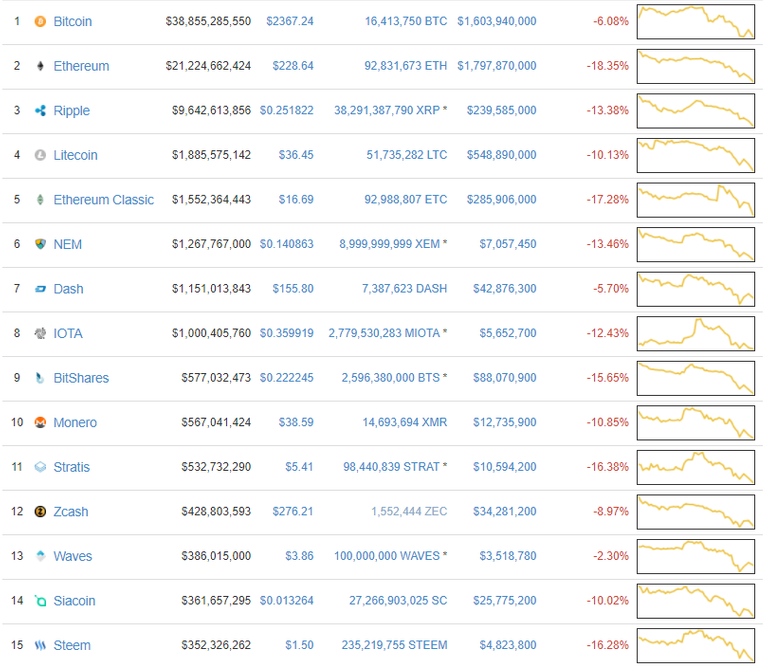

All top 30 cryptocurrencies fell significantly in value, recording nearly 20 to 30 percent decline in market cap. Bitcoin and Ethereum, the two largest cryptocurrencies, also recorded substantial decline in value.

Bitcoin’s drop in value

As demonstrated by previous cryptocurrency market corrections, the decline in Bitcoin price has always led to the correction of the entire market.

Thus, when Bitcoin price fell from around $2,700 to $2,370, the cryptocurrency market underwent a major correction, with Ethereum falling from around $30 bln to $22 bln in market cap.

When evaluating the short-term fall of Bitcoin price, it is important to consider the analysis of two financial and security experts, Max Keiser and Andreas Antonopoulos.

On June 15, after a minor correction, in response to the inquiries of investors and traders regarding the fall of cryptocurrencies in value, Antonopoulos wrote:

“Some of you are wondering "why are cryptos crashing like crazy?" Yet you didn't ask "why are cryptos climbing like crazy?" That's why.”

The value of Bitcoin and other cryptocurrencies are solely based on the demand of the market. Hence, like any other market, the value of cryptocurrencies alter based on the rise and decline of demand from the market. Therefore, if investors can’t justify the increase in the value of Bitcoin or other cryptocurrencies, it is likely that a market correction is imminent.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cointelegraph.com/news/crypto-massacre-why-ethereum-bitcoin-top-30-currencies-declined-in-value