What is steem blockchain

.jpeg)

Launched in April 2016, Steem is a blockchain-based platform that rewards content creators, curators, rewarders for delivering meaningful content and helping them build their communities. It uses DPoS as a scalable blockchain consensus algorithm for publicly accessible and immutable content. The basic digital asset on the Steem blockchain is a Smart Media Token (SMT) called STEEM. STEEM has an almost immediate settlement and zero transaction fees that make it possible for publishers to have an ad-free business model.

Steem has two unique properties compared to other cryptocurrencies. First, it has a pool of tokens (called "prize pools") dedicated to encouraging content creation and curation. Second, it has a voting system that uses crowd knowledge to determine the value of every content on the network. When coupled together, these two distinct properties are referred to by the development team as proof-of-brain. Proof-of-mind works much like a proof-of-work algorithm where tokens are distributed to participants based on the work they do.

Application: Steemit.com

.jpeg)

One of the successful implementations of the Steem blockchain is the website steemit.com. It is a platform that allows both amateur and experienced publishers to monetize their content like many other social content websites. You can think of Reddit, but in a way the website pays content creators and curators. The proof-of-brain mechanism rewards authors when their articles increase the value of the network and attract new users. To encourage engagement and discovery of meaningful content, it also rewards those who help create the best content by increasing other people's content. Simply put, the system values collective knowledge.

Reward structure

.jpg)

Let's take a look at how Steemit rewards its content contributors. The Materials Prize on Steemit has three important parts: STEEM, Steem Power (SP) and Steem Dollar (SBD).

STEEM is a liquid cryptocurrency that can be bought and sold on stock exchanges, but can also be transferred to other parties as a form of payment. It is an SMT and the backbone of the Steem blockchain. Note that all rewards issued on Steemit are in the form of SP and SBD but not of STEEM. Users must convert their SP and SBD to STEEM to trade on public exchanges.

Steem Power is the STEEM that is committed to an establishment plan of thirteen weeks. SP balances are not transferable and are generally not divisible. Upon request, it can be returned to STEEM for a period of thirteen weeks via 13 equal weekly payments. Because it represents the long-term involvement of users in the website, SP can be seen as the influence of users on Steemit. When users vote for content, their influence on the distribution of the reward pool is directly proportional to the amount of SP they have. Another incentive for maintaining SP is that 15% of annual inflation is paid to SP holders as interest on the balance of SP that remains acquired.

Steem Dollars, also known as Steem Blockchain Dollars (SBD), is the vehicle that has been implemented to protect the stability of the system. It is similar to convertible bonds (short-term debt instruments) in the real world. SBD allows the holder to convert to the support token (STEEM) with a minimal notification at the fair market price of the token. An SBD can be traded for around $ 1 in STEEM. Under normal market conditions, the trade price is expected to fall from $ 0.95 to $ 1.05. When the price falls below $ 1, SBD holders also receive interest.

Every time a writer receives a content reward, 50% is paid as SP and the remaining 50% is paid as SBD. The ratio is the same for receivers. Users also have the option to get paid in 100% SP, as well as refuse content rewards. When a user refuses a reward for content, the amount remains in the reward pools. Thanks to the unique functions, steemit.com has grown enormously since the beginning. It now has an active user base responsible for 1.5 million monthly messages and more than 3.7 million monthly responses.

Annual new STEEM token distribution

.png)

The rewards we discussed above are from newly generated STEEM tokens on the blockchain. The new token generation rate on Steem was set at 9.5% per year in December 2016 and inflation fell by around 0.5% per year; it will eventually stop if it reaches 0.95% in approximately 20.5 years.

Of all the coins generated each year, 75% is sent to the 'reward pools' which, as we have discussed, are distributed to the creator of content and curators on the network. 15% of the new tokens are distributed to established token holders, and the remaining 10% is distributed among the witnesses, also referred to as delegates chosen to produce blocks on DPoS blockchains.

DPoS mechanism

.jpeg)

With Steem, the witnesses are chosen by the collective Steem Power-weighted witness vote of Steem accounts. Each account can cast a maximum of 30 votes on 30 different candidates and votes can be added or deleted at any time.

Once selected, witnesses are responsible for the block production of the Steem blockchain. Although each account can vote for 30 members, there are only 21 active witnesses. Twenty of those witnesses are selected on the basis of approval classification and one is shared by every witness who did not reach the top 20; the chances of being selected are proportional to their total number of votes. The order of the 21 active witness is shuffled each round to prevent a witness from constantly ignoring blocks produced by the same witness who was placed before. Every witness who misses a block and has not produced in the last 24 hours is disabled until the witness updates the blocking test. According to steemd.com we have determined that the witness must vote at least 14% to be in the top 20. We also note that the top 20 witnesses tend to vote for each other to stack the votes. For example, 12 of the 30 votes from the top 1 witness gtg go to the top 20.

As an incentive to remain reliable witnesses, each of the top 20 witnesses receives a block reward in Steem Power (SP), which is calculated as follows (from June 8, 2018, changes to the block reward over time, as well as the STEEM -price):

SP per round: 0.166

Lap time: 3 seconds / block * 21 blocks = 63 seconds

Number of laps per year: (60 * 60 * 24 * 365) / 63 = 500,571 blocks

SP reward per year: 500,571 * 0.196 = 98,112 SP

Monetary value: 98.112 SP * $ 2.28 / STEM = $ 223.625

As calculated, each active witness stands at around $ 223,625 per year at the current STEEM market price.

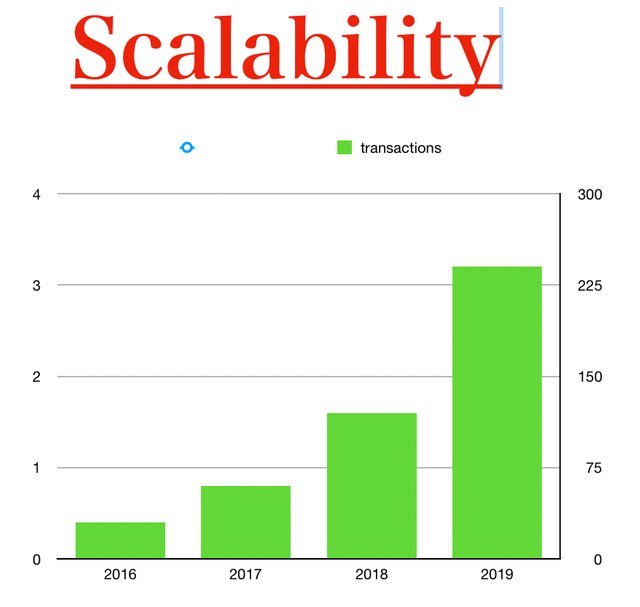

Scalability of Steem

Steem blockchain has proven over the past 2 years that traffic on steemit.com can process on social media. To assess the scalability of the network, we can compare it to the traffic volume of Reddit and determine whether it will survive.

First, let’s calculate how many transactions Reddit was handling on its site. In 2015, Reddit’s 8.7 million users generated 73.15 million new posts and 725.85 million new comments, for an average of 2 posts per second and 23 comments per second. Also, there were 6.89 billion upvotes which is equivalent to an average of 218.5 upvotes per seconds. In total, reddit.com was registering an average of 245 transactions per second. Second, we need to know the actual capacity of Steem. The Steem blockchain is built upon Graphene which powers the decentralized, blockchain-based asset exchange Bitshares. Graphene has been tested that it can maintain over 1,000 TPS on a distributed test network. The technology has the potential to scale to 10,000 or more TPS with relatively straightforward upgrades on server capacity and communication protocols. As of today, the TPS on Steem blockchain is ~18.441 tx/sec according to SteemDB, meaning Steem only uses about 2% of its total capacity.

Thus, Steem is more than capable of handling transactions of large websites like reddit.com and has room left for sudden spikes in the number of transactions as well as upgrade potential when needed.

Conclusion

Steem is a blockchain-based platform that made ad-free, membership-free online publishing profitable for publishers. It presents earning opportunities to content creators as well as their readers in ways that were never implemented within the social media industry before. The unique reward and incentives system of the Steem blockchain are well-crafted to make the system self-sufficient. The performance of the system is designed with mass adoption of the platform in mind and are proven to be reliable so far.

With Steem’s lightning fast processing time, fee-less transactions system, unique rewards system, and its scalability potentials, we could expect more social media websites adopt this innovative blockchain technology.