I've always liked things that require calculations. I studied engineering, and I spent almost all of my professional career analyzing data. I started wondering if I could predict asset prices when I could apply analytical methods at a certain maturity level. If you can predict the price development of a stock or currency, you can become rich in a very short period of time. So the prize is huge.

There are thousands of people in the economy media who express views on the development of asset prices. There is also millions of people that follows these people. When I look at the situation, I conclude that asset prices are predictable. On the other hand, I witnessed extraordinary intelligent, well-educated, experienced and hardworking managers in the bank I used to work who could make these predictions well in accordance with their profession and they didn't care. Who was right? Those trying to predict stocks or currencies or the bankers who focus on their daily business without worrying about such a prediction?

I have always followed the prices of currencies, stocks, real estate, bonds, although it is never my primary hobby to predict asset prices. I followed the economic media by my profession and tried to understand the price correlations between general economic trends and asset classes. I experienced the Asian crisis, the 2001 crisis, where the 9/11 disaster was exacerbated, and the 2008 crisis, which could led to the end of capitalism, as a banker and as a modest investor. My mind was always engaged in the money markets with an instinct to understand the relationships between events. However, I never fully focused my mind on the subject, like Director Darren Aronofsky's film PI's main character.

Image source: indiewire.com

As stated in the movie PI, if nature speaks with the language of mathematics, the secret of asset prices is to be hidden in the equations. Money markets are unfortunately not expressed in simple mathematical equations. In fact, the mechanism is very simple, this simple mechanism creates complex patterns. We know that price is the result of the relationship between supply and demand. However, supply and demand are not at all a harmonious pair, they give us many surprises. A small spark or sensational event can cause markets to get out of control. After major price changes, everyone is trying to explain why the major price change actually occurred. Of course, the dramatic price movement, which is made up of these explanations, does not explain us why it did not happen in the past months or even years, when there were almost the same conditions. Markets have a chaotic structure, which makes it very difficult to predict the future. I came to this idea after reading a book that describes the order and chaos in the money markets through Mandelbrot sets. Mandelbrot sets show us how complex numbers form complex patterns with equations that appear to be simple.

Source: https://giphy.com

The irrational price formations in the markets are of course not only due to the chaotic nature of the markets. When prices over-fall or over-rise, people start to believe that the trend will last longer. It is a good example that even after oil prices fell from $50 to $20 in recent years, no one came back to buy oil, and oil prices dropped to about 14 dollars. The price of Brent oil is at 75 dollars today. The times of untimely pessimism are followed by exaggerated euphoria. Human psychology is so dominant on the market that behavioral economics has become very popular in recent years.

When director Darren Aranovsky's Black Swan film was shown in year 2010, it attracted a great deal of interest and was widely acclaimed by large audiences. Contrary to movie PI, the film had nothing to do with money markets. The author, Nassim Nicholas Taleb's book, Black Swan, which has the same name as the film, described how the "Black Swan" events in the money markets overrule the traditional methods of analysis. The author gave examples such as the rise of the internet and personal computers, 9/11 disaster and First World War to the events of "Black Swans", indicating that great fortune changes occurred during these events. The author stated that people developed collective blindness against the possibility of such events. The book describes how these events, which are very rare, but which have profound effects on the market, invalidate complex models.

When we consider;

- chaos math, which is inherent in money markets and can create butterfly effect,

- people tend to be easily overwhelmed by panic or euphoria,

- and the Black Swan events,

we see how difficult it is to predict the price of crypto currencies. So shall we put aside all the analysis methods and act with our feelings? I believe in determinism, in essence, that points to a foreseeable future. There may be ups and downs in the market in the short term, but in the long term history continues to flow softly in its bed like a river.

Alan Greenspan stated in his book The Age of Turbulance that the world economy had a growth average of 3 percent for many years. This growth rate represents the annual capacity of humanity to innovate. In some years, even though it has occurred below or above this rate, asset prices will rise steadily in a growing economy. This indicates that asset prices are predictable. With a long-term investment perspective and a diversified portfolio, you can always win. In the same book, it is stated that an investment bank knows the value of the dollar in a stable way, compared to other currencies. When Greenspan asks wondering how this is possible, they tell them that they set the price. This anecdotal shows that only those with a very large financial asset can predict the prices in the short term. The lesson I learned from this was that since I didn't have the assets to dominate the market, I should not try to predict short-term price movements.

CONCLUSION

Although technical analysis methods that try to predict short-term price movements sometimes produce useful results, I think it is very difficult to predict the price of crypto currencies for short term. On the other hand, long-term prices can be predicted since there is a concrete economy working behind. My investment strategy is to invest in reliable assets when their prices are very low.

How do we decide that the price of an asset is low? I think we can take the average of prices until the oldest date we can find for that asset.

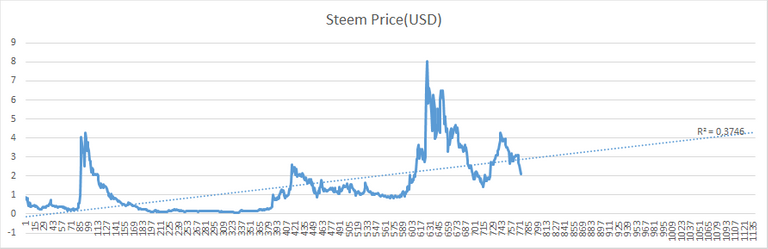

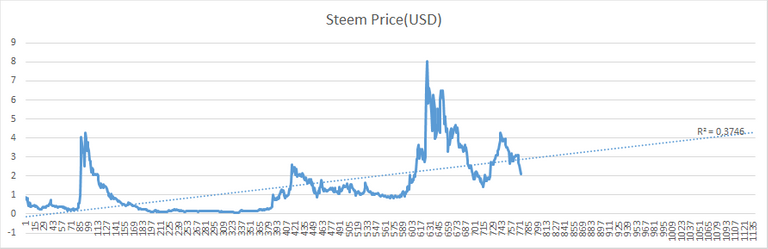

I analyzed the prices of Steem to link all these theoretical discussions to a concrete conclusion.

Since 18 April 2016, Steem started trading on the market, 772 days have passed since. I put the prices of these days in the chart below and added a trend line in Excel. The graph below shows the trend line of the price of Steem. The R square value of the trend line is quite low, but the price of such a frivolous asset would probably not be considered a different situation. I have made a price estimate for 365 days by extending our trend line forward for exactly 365 days.

The formula of the above trend line:

Steem Price(USD) = number of days since the beginning of steem * 0.0039-0.1277

According to the trend line above, Steem's expected actual price is 2.89 USD and the forecast price for 365 days is 4.31 USD.

You may wonder why I used such a simple model. When the model becomes complex, the risk of overfitting incresases.

The amateurish comments I made about the Steem price above are not investment advice, as I am not an investment expert.

Thanks for reading.

Cover Image Source: https://pixabay.com

YAZININ TÜRKÇE VERSİYONU

Hesap gerektiren işleri öteden beri severim. Mühendislik okudum ve çalışma hayatımın neredeyse tamamında veri analiziyle uğraştım. Analitik yöntemleri uygulamak konusunda belirli bir olgunluk seviyesine gelince varlık fiyatlarını tahmin edip edemeyeceğimi merak etmeye başladım. Bir hisse senedi ya da para biriminin fiyat gelişimini kısmen de olsa tahmin edebilirseniz çok kısa bir süre içinde zengin oluyorsunuz. Dolayısıyla merak edilmeyecek gibi değil.

Ekonomi medyasında varlık fiyatlarının gelişimine ilişkin görüş bildiren binlerce insan var. Bu insanları takip eden çok geniş bir kitle de var. Bu duruma baktığımda varlık fiyatlarının tahmin edilebilir olduğu sonucuna ulaşıyordum. Diğer taraftan çalıştığım bankada meslekleri gereği bu tahminleri iyi yapabilecek olağanüstü zeki, iyi eğitimli, deneyimli ve çalışkan yöneticilerin varlık fiyatlarını tahmin etmek konusunda hiçbir gayret göstermediklerine tanık oluyordum. Hisse senedi ya da para birimlerini tahmin etmeye çalışanlar mı haklıydı, böylesi bir tahminle hiç ilgilenmeden gündelik işlerine odaklanan bankacılar mı?

Varlık fiyatlarını tahmin etmek hiçbir zaman birincil hobim olmasa da para birimlerinin, hisse senetlerinin, gayrimenkullerin, tahvillerin fiyatlarını hep izledim. Biraz da mesleğim gereği ekonomi medyasını takip ettim, genel ekonomik gidişat ve varlık sınıfları arasındaki fiyat korelasyonlarını anlamaya çalıştım. 98 Asya krizini, 11 Eylül felaketinin iyice alevlendirdiği 2001 krizini, kapitalizmin artık bittiğini düşündüren 2008 krizini bir bankacı ve mütevazı bir yatırımcı olarak yaşadım. Olaylar arasındaki ilişkileri anlamaya eğilimli zihnim bir yanıyla hep para piyasalarıyla meşgul oldu. Ancak hiçbir zaman zihnimi yönetmen Darren Aronofsky'nin 1998 yapımı filmi Pi'nin baş karakteri gibi konuya tümüyle odaklamadım.

Pi filminde ifade edildiği üzere doğa matematiğin diliyle konuşuyorsa varlık fiyatlarının sırrı denklemlerin içinde gizli olsa gerektir. Para piyasaları ne yazık ki basit matematiksel denklemlerle ifade edilemiyor. Daha doğrusu aslında mekanizma çok basit ama bu basit mekanizma karmaşık örüntüler ortaya çıkarıyor. Fiyatın arz ve talebin ilişkisi sonucu oluştuğunu biliyoruz. Ancak arz ve talep hiç de uyumlu bir ikili değil, bize birçok sürpriz çıkarıyorlar. Ortada hiçbir geçerli neden yokken piyasalarda aniden çok büyük ani fiyat hareketleri olabiliyor. Küçük bir kıvılcım ya da sansasyonel bir olay piyasaların kontrolden çıkmasına neden olabiliyor. Büyük fiyat değişimleri oluştuktan sonra herkes kendince krizin aslında neden oluştuğunu açıklamaya girişiyor. Bu açıklamalar oluşan dramatik fiyat hareketinin neredeyse aynı koşulların geçerli olduğu geçmiş aylar hatta yıllarda neden gerçekleşmediğini elbette bizlere göstermiyor. Piyasaların kaotik bir yapısı var bu durum gelecek hakkında öngörü yapmayı çok zorlaştırıyor. Bu fikre para piyasalarındaki düzen ve kaosu Mandelbrot setleri üzerinden anlatan bir kitabı okuduktan sonra vardım. Mandelbrot setleri bize karmaşık sayı dizilerinin basit gibi görünen denklemlerle ne denli karmaşık örüntüler oluşturduğunu gösteriyor.

Piyasalardaki irrasyonel fiyat oluşumları elbette sadece piyasaların kaotik doğasından kaynaklanmıyor. Fiyatlar aşırı düştüğünde ya da aşırı yükseldiğinde insanlar oluşan trendin daha uzun süre devam edeceği inanmaya başlıyorlar. Petrol fiyatlarının geçtiğimiz yıllarda 50 dolar seviyesinden 20 dolara düştükten sonra bile kimsenin dönüp petrol almaya yanaşmaması ve petrol fiyatlarının bunun üzerine 14 dolara kadar düşmesi bunun güzel bir örneği. Fiyatı 20 dolarken halen alınmayan brent petrolün fiyatı bugün 75 dolar seviyesinde. Geçtiğimiz Aralık ayında Bitcoin'de yaşanan abartılı fiyat hareketleri de piyasa aktörlerinin bazen ne denli büyük bir coşkuya kapıldıklarının güzel bir göstergesi. Abartılı coşku dönemlerini yersiz karamsarlık zamanları izliyor. İnsan psikolojisinin piyasalar üzerinde o kadar etkili oluyor ki bu etkilerini araştıran davranışsal iktisat son yıllarda çok popüler hale geldi.

Yönetmen Darren Aranovsky'nin 2010 yılı yapımı Siyah Kuğu filmi gösterildiği zaman büyük ilgi görmüş ve geniş kitleler tarafından çok beğenilmişti. Başrol oyuncusu Natalie Portman'a en iyi kadın oyuncu Oskar'ını kazandıran filmin Pi'nin aksine para piyasaları ile bir ilgisi yoktu. Yazar Nassim Nicholas Taleb'in film ile aynı adı taşıyan Siyah Kuğu isimli kitabında ise para piyasalarında gerçekleşen "siyah kuğu" olaylarının geleneksel analiz yöntemlerini nasıl geçersiz kıldığı anlatılıyordu. Yazar "siyah kuğu" olaylarına internet ve kişisel bilgisayarların yükselişi, 11 Eylül saldırısı ve I. Dünya Savaşı gibi örnekler veriyor, büyük servet değişimlerinin bu olaylar sırasında gerçekleştiğini belirtiyordu. Yazar bu türden olayların gerçekleşme olasılığına karşı insanların kolektif bir körlük geliştirdiğini ifade ediyordu. Kitapta çok seyrek görülen ancak gerçekleştiğinde piyasaya köklü etkileri olan bu türden olayların karmaşık modelleri nasıl geçersiz kıldığını anlatılıyordu.

Para piyasalarının doğasında bulunan ve kelebek etkisi yaratabilen kaos matematiği, insanların panik ya da coşkuya kolayca kapılma eğilimi ve siyah kuğu olaylarını dikkate aldığımızda kripto para fiyatlarını tahmin etmenin ne denli güç olduğunu görüyoruz. O zaman tüm analiz yöntemlerini bir kenara bırakıp hislerimizle mi hareket etmeliyiz? Hayır, ben özünde öngörülebilir bir geleceği işaret eden determinizme inanıyorum. Kısa vadede piyasada iniş çıkışlar olabilir ama uzun vadede tarih bir nehir gibi usulca yatağında akmaya devam eder.

Alan Greenspan Türbülans Çağı isimli kitabında dünya ekonomisinin uzun yıllar büyüme ortalamasının yüzde 3 olduğunu ifade etmişti. Bu büyüme oranı insanlığın yıllık inovasyon kapasitesini ortaya koyuyor. Bazı yıllarda bu oranın altında ya da üstünde gerçekleşmeler olsa da büyüyen bir ekonomide varlık fiyatları da istikrarlı bir biçimde yükselecek demektir. Bu durum varlık fiyatlarının öngörülebilir olduğuna işaret eder. Uzun vadeli bir yatırım perspektifi ve çeşitlendirilmiş bir portföyle her zaman kazanmak mümkün olabilir. Yine aynı kitapta bir yatırım bankasının doların diğer para birimlerine kıyasla değerini istikrarlı bir biçimde doğru bildiği anlatılır. Greenspan hayretle bunun nasıl mümkün olabildiğini sorduğunda fiyatları kendilerinin belirlediğini anlatırlar. Bu anekdot çok büyük finansal varlığa sahip olanların kısa vadede de fiyatları bilebildiğini gösteriyor. Buradan çıkardığım ders piyasayı domine edecek kadar büyük varlığa sahip olmadığıma göre kısa vadeli fiyat hareketlerini tahmin etmeye çalışmamam gerektiğiydi.

SONUÇ

Kısa vadeli fiyat hareketlerini öngörmeye çalışan teknik analiz yöntemleri her ne kadar bazen işe yarar sonuçlar üretse de, kısa vadede kripto para fiyatlarının ne yöne gideceğini tahmin etmenin çok güç olduğunu düşünüyorum. Diğer taraftan, arkada çalışan somut bir ekonomi olduğuna göre uzun vade için fiyatlar öngörülebilir. Yatırım stratejim belirli bir ölçeğe ulaşabilmiş görece güvenilir varlıklara fiyatlarının çok ucuzladığı dönemde yatırım yapmak yönünde. Bir varlığın fiyatının ucuz olduğuna nasıl karar vereceğiz? Bunun için bulabildiğimiz en eski tarihe kadar giden fiyatların ortalamasını baz alabileceğimizi düşünüyorum.

Tüm bu teorik tartışmaları somut bir sonuca bağlamak üzere Steem fiyatlarını analiz ettim.

Steem'in piyasada işlem görmeye başladığı 18 Nisan 2016 tarihinden bugüne 772 gün geçmiş. Bu günlerin saat 12:00 Steem fiyatlarını aşağıdaki grafiğe yerleştirdim ve üzerine excel'de eğilim eğrileri ekledim. Aşağıdaki grafikte kesikli çizgi Steem fiyatının eğilim eğrisini, diğer bir deyişle trend çizgisini gösteriyor. Trend çizgisinin r kare değeri 0,3746gibi oldukça düşük bir değer ancak fiyatı böylesi oynak bir varlık için farklı bir durum düşünülemezdi herhalde. Trend çizgimizi bugünden tam 365 gün ileriye doğru uzatarak 365 gün sonrası için bir fiyat tahmini yapmış olduk.

Yukarıdaki trend çizgisinin formülü:

Steem fiyatı = Steem'in başlangıcından beri geçen gün sayısı * 0,0039 - 0,1277

Yukarıdaki trend çizgisine göre Steem'in bugün "olması gereken" fiyatı 2.89 USD ve 365 gün sonraki tahmini fiyatı 4,31 USD.

Yukarıda Steem fiyatı hakkında yapmış olduğum amatörce yorumlar yatırım tavsiyesi değildir, zira ben yatırım uzmanı değilim.

Okuduğunuz için teşekkür ederim.

Great analysis my friend for giving your prediction on pruce of Steem. Short term trading is riskiest thing we could imagine and it could burn our hard earned money in just an hour if not minutes.

I could say that I am an investor not a trader. I think you made very conservative prediction of Steem price in 365 days but the good news is it is still bullish in long term and better that stocks that gives you only 200% for long years. I want share to you that I only invested less than 2,000 SP at first but accumulated 8,000 SP in a year putting me in total of more than 10,000 SP and I am happy to that result. Thank you @muratkbesiroglu

it's hard to know what happens in future for the crypto im trying to invest on the legit coin with huge support , thanks for sharing nice idea and information

You received a 45.78% upvote from @brotherhood thanks to @vahidrazavi!,

)

Delegate to Bot and Get High Return Fix 100% earning return,

bidders will always win something and it will adapt to distribute all the 100% upvote ,now we reached to 12000 SP and recommend. send the 0.15 to 0.4 sbd or steem.

👍👍

Its difficult to predict the prices of crypto due to its being volatile but of course there is a pattern in which we can see a hint wherein it will rise or fall and there are so many factors affecting its price movement.

Can you please help shear with me how to check mate the rise of crypto price?

You can learn trading from Mark Douglas.

Visit: cryptoexchange4u.com

Visit: https://cryptoexchange4u.com/

Hi ANNYENGEL. use Coinmarketcap

Or see how I did in this June top 5 cryptos ... https://bizdynamicx.com/the-top-5-best-cryptocurrencies-to-buy-in-june-2018-total-analysis-picks/

I agree. The cryptomarket is still run by sentiment. It is almost impossible to use TA. TA can be used in market where there is lot of historical data and in sectors which aren't as volatile as the cyrptomarket.

One can do all the TA which he desires but FUD or suddenly global acceptance can turn the market within seconds!

Couldn't agree more on this. Dont you think its a pretty weird that humanity as a whole is acting in a way, we cant predict nor 100% understand? All of us work in patterns, but seen as a whole its so chaotic we had to invent a scientific field to understand us.

visit: cryptoexchange4u.com

It's unpredictable every passing second 😀

We just need to hope for better days

but, I think the price do goes up around December, but let wait and see what will happen this time.

I can get you into a discord where you can learn if you will.

crypto is easiest to predict market

You can use the Elliott Wave theory to identify key pivot points in any market and I use it on cryptos. This is not prediction but discovering key probable turning points. See some of my posts and see my prediction last October that would hit $5 by January and it did. I didn't lean on time, but the price target was clear with Elliott Wave Theory. But along with any target I identify supports where my view is invalidated and forces a different view. Keeps trading objective and I have done very well. Timeframe is irrelevant. Elliott fractals exist no matter the timeframe you want to trade.

Elliott wave is the wrong kind to trading

It's impossible to know what will happen in the short term.

But just like you I'm looking for the long term. It will be a roller coaster ride the whole way but that's why I don't let it drive me crazy. When I see an asset with good potential at a low price I don't drive myself crazy setting buy orders up, I just MARKET BUY and HODL.

Thanks for sharing the chart.

👍

I just can predict the reason for the deep of crypto, we are expecting it to be pumping.

It is hard to know. Interests are increasing globally. Thay may be the reason.

Darren Aranovsky is an amazing director. It's pretty fresh that you've used his films and an allegory for your analysis. I can tell you're quite a deep thinker @muratkbesiroglu. Do you blaze at all?

Thank you☺

but am very sure this price will put up before the end of this year.

It is very important to know that the basis of the economy are human beings, since they are developed to meet our needs. This also makes it difficult to predict what will happen in the long term with any type of currency, but it is very important to study this, as it would take us a step further in our economic action. Excellent publication, God bless you.

Thank you

Yes,it's hard to predict the price.

Murat bu emek isteyen yazı için teşekkürler.

İyi tüccarlar ki bazıları bugün holding sahibi alırken kazanmanın önemine vurgu yaparlar ve o zaman daha borsamız bile yoktu. Öte yandan pozisyonuna aşık olma diye bir bakış açısı da var ne dersin...

Kesinlikle. Ben de onlardan biriyim. Zararına satmak istemem😃

interesting and food for thought though. i think as per my opinion, that the value, of things, goods and services can never remin thesam. they turn to rise or fall( drop) depending on external factors as well as some internal factors. but i should firmly say here that the population influx, or speedy uphill population growth allows for decrease in crptocurrencies no matter the source as per my opinion. never the less, good and great research. more openings are to be made available hopefully in the upcoming days so as to keep the integrity of the cryptos

Pretty realistic approach rather than making big claims i.e. to the moon. I am in support of your formula and prediction.

👍🤠

I agree predicting crypto prices is really hard, holding is a good strategy but not for all coins

👍Holding the ones that have a solid use case like steem can be a good idea.

Based on everything I have seen the last few days it looks like Bitcoin has been building higher lows over the last year. Breakout may be coming

👍👍

Well Fibonacci working well even with crypto!

But my advise is avoid trading based on any technical parameter, take fundamental call here, think , read and Invest!!

The simple answer is "YES". people predict the projected price of cryptocurrencies on a daily basis, nut the problem with the prediction of the prices of cryptocurrency, is that it is rarely accurate. That is what actually makes cryptocurrencies to be so mysterious, because no one can accurately predict the price of cryptocurrencies, unless if such a person can accurately view the future.

well said sir

"How do we decide that the price of an asset is low?"

One great way to determine this is by using a momentum technical indicator called RSI (relative strength index). When RSI is above 60, it is considered overbought and may be time to take profit. When the RSI is below 30, it may be time to start buying in. It all depends on the scale you use (days, weeks, months).

You might be wondering: "So what can I buy that shows an oversold RSI currently?"

I'd be glad to show you!

Bitcoin just bounced from 30 up to 40 RSI (daily chart)

In most cases when Bitcoin has hit 30, it has made moves higher, I am personally waiting for trend confirmation.

The Dollar (DXY) just hit a low long term RSI level and has moved up to 50.

Moving your capital into the dollar all depends on where you think assets are heading. Are we going to see a bit of deflation? or will they continue to head higher. The dollar moves opposite of assets.

Personally I tend to just use simply 10k path stochastic simulations to model crypto but with very high volatility. The problem is that the variance in also highly unstable and therefore volatility also hard to predict. I suspect volatility will settle over time as the market for digital assets matures so you will see a comeback of traditional quant models in this space.

I agree with this view

That's very difficult to find out the price crypto currencies for long time .

But i hope you will test a great success in your quest . Best of luck amigo.

hello there!!!

nice post, also i think it is so hard to predict the market.

good luck!!!!

have a great day!!!!

Visit: https://cryptoexchange4u.com/

Interesting viewpoint and a great in-depth anaylsis, thanks for sharing. I've smashed the upvote button for you! Personally I don't think it is possible as cryptocurrency is now becoming such a global trend. It can take one catalyst that has a huge impact that nobody apart from people in the know of every political / soco-economic decision in the world.I think the most sensible trend is to use what has happened in the past to calculate trends.

Also, if you are looking to get some tokens without investing or mining check out Crowdholding (https://www.crowdholding.com). They are a co-creation platform were you get rewarded for giving feedback to crypto startups on the platform. You can earn Crowdholding's token as well as DeepOnion, ITT, Smartcash and many other ERC-20 tokens.

You got a 25.94% upvote from @postpromoter courtesy of @muratkbesiroglu!

Want to promote your posts too? Check out the Steem Bot Tracker websitevote for @yabapmatt for witness! for more info. If you would like to support the development of @postpromoter and the bot tracker please

if only there was a way to repair a reputation. lol

You got a 19.88% upvote from @upme thanks to @muratkbesiroglu! Send at least 3 SBD or 3 STEEM to get upvote for next round. Delegate STEEM POWER and start earning 100% daily payouts ( no commission ).

Excelente post , análisis y contenido @avance . Gracias.

Yes you 1005 CAN predict these prices, That is why I have been bearish for multiple weeks and telling EVERYONE the BULLS here are WRONG, for now.

The bounce here was clearly predictable and we are HEADED LOWER AFTER.

https://steemit.com/crypto/@heyimsnuffles/snuffles-called-for-bitcoin-lower-against-the-trending-bulls-now-what-20180529t012019434z-post

Thanks for the detailed information. The post not only informative, it increases the confidence on the crypto. I liked the line: My investment strategy is to invest in reliable assets when their prices are very low.

As I am executing thatstrategy I bought Steem in the morning after publishing my article. I thought the prices were reasonable.

Thanks for being transparent with this response

👍👍

Trust me this guy has experience in markets

I think that currently it is very difficult to predict the prices as the market is relatively small, meaning it may be subject to manipulation by large holders and investors. Hopefully in the future if the market size increases we may be better able to analyze and predict.

I'm not so good in math as you are, but I'm good enough in understanding the charts! Your forecast for STEEM is way too conservative.

My view on STEEM:

Here's more proof that I have some understanding about this: https://steemit.com/introduceyourself/@andriustovis/never-invest-in-something-you-cannot-understand

I am an ex-banker. Bankers are conservative 😃

I presonally only see cryptocurrency as a total randomness.

Everything can happen anytime.

This is not a good news for crypto investors😃

Liking your thinking in this article... I myself have tried the deep focus that daytrading requires...and while it might seem random... there are folks that can predict (on an average) with funds that can weather the ups and downs and succeed in the long term. I have come to the conclusion that the longer term, more gentle slopes are the method of investment for me.

Day to day trading is hard to achieve. It is not up to me.

I like day to day trading sometimes, I like to see the volume go up or down and how they go, It's like seeing the engine working instead of watching the car drive trough It gives me perspective . but sure I love best long term investments.

Your post is very nice, you can learn a lot from your post, waiting for your next post

FUD (Fear, Uncertainty and Doubt) and unconfirmed media reports cause widespread panic buying and selling which makes normal trend and sentiment analysis almost impossible.

There are many variants that make this takes really unpreciable... So exactly as everyone wants, from my point of view, no possible.

Cryptocurrencies are like bananas given to monkeys , it never becomes stable 😅

😂😂

Im this case Who the monkeys and who has given out the bananas?😂

No one can predict assets future price, otherwise he would be the richest man on earth.

No one can be an expert to predict every thing however, if you focus on a few areas such as share prices, crypto-currencies you can make a fortune. I believe it's possible see the likes of Warren Buffett.

i really doubt anyone can predict the cryto prices. Last year i was predicting all the best ICO you would have thought i was a mini Ian Balina.

Wait untill 2018 february and all the ICOs i predicted and invested in turned in to a bull when i seriusly needed them to be a cow so i can have them calf some profits.

I then lost most of what i made last year

Wow ..awesome post... Its more important..

Prediction holds if there is no FUD in crypto trading...

After predicting, then FUD set-in and everything crashes..

Stop loss+smart trading=Minimal loss

Thanks for your contribution 😃

Güzel konu olmuş üstad :) son konum adestek olurmusun acaba rica etsem :)

"Yes we can". Tried several tools but stay with forecast.ws.

Hi I got your post very interesting as , after reading your post, I learned something new and found new ideas.

This post has received a 15.48 % upvote from @booster thanks to: @muratkbesiroglu.

Noooo we can't.

🤓

very good if it can!

I agree that we can't predict the price of any cryptocurriences, I haven't been involved in crypto for a long period of time but that's my newcomer observation. It seems right when we think we know what's happening we get thrown a curveball

Most predictions are easily just educated guesses. If you know whats behind the project and follow the trends it goes on anyone can make a prediction thats why you pretty much see a 60/40 ratio of moon vs tank and not too many people are realistic. Given the volatility both a skyrocket and derailment are possible but this market will definitely become more stable in the months/years to come with adoption and regulation.