Friday July 29, 2016 6:00 AM

We are at key points for both Steem and ETC. The patterns say they need to go up NOW. Time to get serious about getting out of these trades.

First, if I've managed my money well I can add aggressively to a position where I'm setting a tight stop. In these cases I raised both ETC and STEEM to 75%. Great chance for a great return with a very defined risk. Next, here's how I decided on my stops.

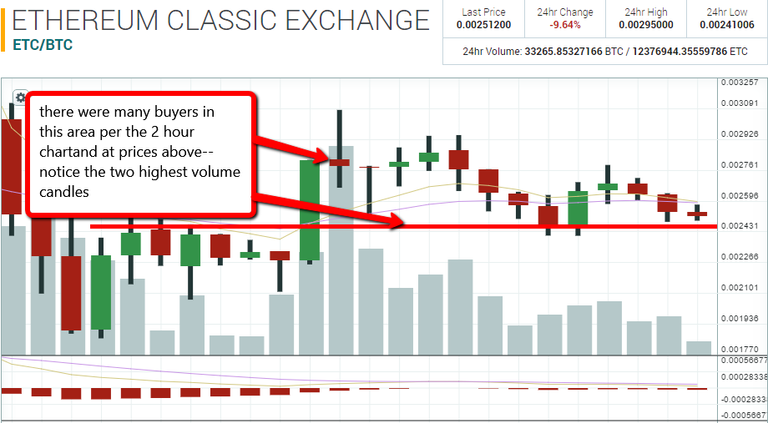

ETC (showing first because it's a much bigger trade for me)

The 5 minute chart above shows a clear patter of buying dips at around .0025. Add to that this 2 hour chart that shows strength at a similar price range and you can see why I've got a stop set

in the .02375 range. (I'll exit the trade around here based on the patterns at the time.)

NOTE As I was writing this post this price was hit. without going into details I held for an additional 5 minutes based on time of day, and it has recovered above .0024. If it drops below this 5 minute candle at .2335 again I will exit HARD STOP.

You could set the stop above .0025 if you are more conservative, but the upside here and my profitable position justify the risk of giving a little more room.

STEEM

This is the kind of trade I try to avoid, but this time I chased it. STEEM is a brand new coin (ETC is not new, as it has the history of ETH behind it), so patterns are far less reliable, and when volume dries up as it did here, it's even harder to make good trading decisions.

Fortunately, the best decision I made was to follow good position managment here so my small position, while down a lot, is not down much in real dollars. Here's how I set my stop at:

.00325 range (I'll get out around here based on the patterns at the time)

Daily chart shows no reason to expect bottom if we don't go up today

It will be tough to exit these positions that I feel strongly have great upside, but you can't win them all, and if I manage my money right, I can always get back in when I see a strong buy set up.- The key to staying in the trading game for the long haul is to never ignore the signals that say there's a high probability you're wrong.

I'll update how these trades worked out on twitter and review here and on Steemit

NOTE: NOTHING IN MY POSTS IS INTENDED TO BE TRADING ADVICE. Please do not base your trades on any information presented in the materials on this blog as it is for information and entertainment purposes only. You are 100% responsible for your own trading decisions.

thanks for sharing your insights, maybe we should consider a new category for #trading ?

I'll try it on future posts. thanks.