☞Bitcoin Price and Prospect☜

Let's look at the Bitcoin quote and prospect. Bitcoin is the representative currency of the virtual currency and acts as a key currency in the virtual currency. We will analyze the market price of Bitcoin in various ways and try to predict the price and prospect of Bitcoin.

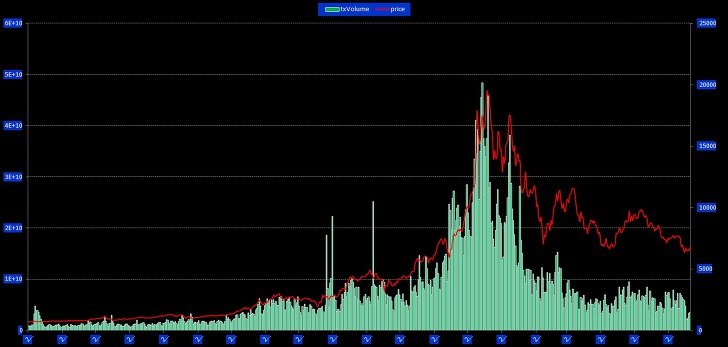

This is the chart of the bit coins first. Based on 600 days, which includes most of the crossbars, raises, and downturns

As you can see, the price of Bitcoin and trading volume are strongly correlated. The correlation of 0.78 is based on 600 days. Very high. What this means is that the market price of Bitcoin is very closely related to trading volume and it can be thought of as difficult to increase the price of Bitcoin without a rise in trading volume.

Given the current limited amount of the won deposit and the huge kimchi premium, it seems clear that the Korean exchange's limit on the amount of the won deposit is a big stumbling block to the rise in the price of Bitcoin.

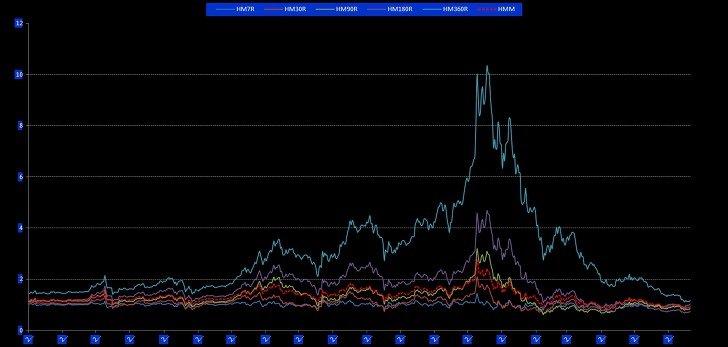

Let's look at the average line of the Bitcoin market.

In the case of the quadratic, we applied a separate standard, not five days, 20 days, 60 days, 240 days. The average line in the stock represents one week for five trading days, one month for 20 days, quarter for 60 days, half a year for 120 days, and one year for 240 days.

For virtual currency, the market is maintained 24 hours, 365 days, so we applied an average line of seven, 30 days, 90 days, 180 days, 360 days. In addition, the harmonic mean was used to mark the isometric curve to prevent distortion of the mean number due to rapid increase.

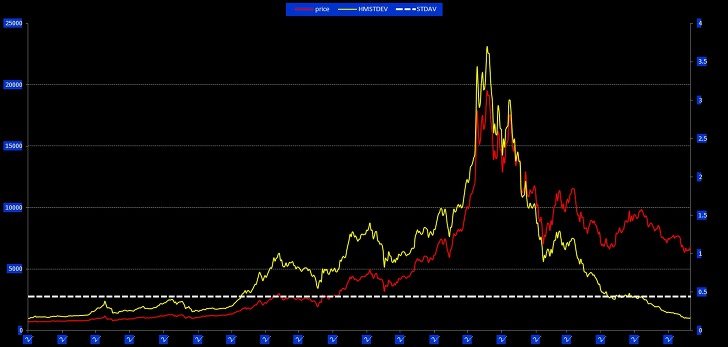

The horizontal dotted lines show the arithmetic mean of 600 days for white and the harmonic mean for yellow. The arithmetic average is $ 5100, and the harmonic mean is about $ 2100. Also, if you look at the Inpyeong Line, the 360 pyeong line is still rising, but the 180 or less line seems to have collapsed.

So let's look at this chart, which is a good chart for stock charts.

For this chart, the current stock price / the ratio of this period is displayed. On the basis of each average line, it shows where the stock price is currently located. Now, the gap is decreasing after the dramatic rise of the past.

Let's look at the deviation of these degrees separately.

Red line is the stock price of the bit coin, yellow line is the deviation of the line, and white dotted line is the average of the deviation. The deviation is rapidly decreasing and is below the average. What this means is that the price of the bit coin is gradually stabilizing and given the correlation between the deviation graph and the price of the bit coin, a sharp rise is unlikely for the time being.

The chart below shows the deviation in degrees as variability.

The volatility is clearly declining, and it is expected to be difficult for the market to jump for some time as the volume of transactions has decreased. However, no sharp decline is expected, and lateral or gradual decline is expected.

At this point, it seems difficult to make a profit from a large capital injection, and a long-term approach is viewed as a way of dispersing risk.

✅ @kkb041, I gave you an upvote on your post! Please give me a follow and I will give you a follow in return and possible future votes!

Thank you in advance!