BANKING IN THE CRYPTOSPHERE – CAPVERTO

I've always wondered how banking came about and why i embraced it. Going down the memory lane, i discovered that security topped the priority in the establishment and the public embrace of banks.

Security

Questioning guide

Have you forgotten there were rich men owning gold bars in the olden days?

How they sought the services of goldsmith to safeguard their golds in exchange for paper note as security?

How the notes backed by gold served as a means of exchange then?

How envisioning the lucrative nature of the trade; goldsmiths ventured into other areas of gold safekeeping like; time deposits, interest rates, lending, etc.?

How the governernment hijacked the processes to create a formal institution we now know today as banks?

Everything seems the same, save for evolution from the smith’s innovations; which came about with improved tech innovations. It didn't just stop with that, the currency notes changed from that backed by gold, to another backed by the laws of the government; resulting in the use of the word: "Legal Tender".

Still on the whole issue, having a huge stash of the government backed fiat (currency) is considered a security risk, necessitating the reason why we own bank accounts.

Safeguarding valuables

So we can generally say that the security of valuable commodities necessitated the innovative ideas that brought about the role played by goldsmiths and currently; that of government backed banking.

Outside the need for security, other needs for the services offered by banks, appears to prevail. These services can generally be categorized as:

- BANK ACCOUNT CREATION

- DEPOSITS, WITHDRAWALS, AND TRANSFERS

- ADVANCING LOAN FACILITIES AND GUARANTEES

- E-BUSINESS, (ATM CARDS, MOBILE BANKING, POS TERMINALS, etc.)

- BUREAU DE CHANGE

- CONSULTANCY

- INSURANCE, etc.

BANK ACCOUNT CREATION is a means of identifying the ownership of the respective funds at the domiciliation of banks. Without such identification, there is likely going to be lots of identity thefts and impersonation to collect other people's fund.

DEPOSITS, WITHDRAWALS & TRANSFERS to and fro such accounts were basically, to ensure safety from physical thefts. Deposits do attract interests; especially the term deposits, while the others incurs charges.

LOAN FACILTIES & GUARANTEES, involves the provision of funds by the banks, to help individuals and companies in the execution of businesses and contracts, while benefiting from such gestures by charging a percentage of such fund as a interest.

E-CHANNELS on the other hand; are basically an internet / online enabled ways of handling deposits, transfers, payments and withdrawals, using prepaid cards, automated Teller Machines, Internet enabled mobile and web applications, etc.

INSURANCE: It’s obvious that banks are not immune from robbery and other forms of theft attacks. Acknowledging this fact will prompt banks into insuring funds within their possession. This service can be anchored by the respective bank, or through a third party insurance company.

BUREAU DE CHANGE as a banking solution helps in the exchange of currencies from one to another; while CONSULTANCIES in a bank entails advisory services from the think tank team of a bank.

These services are unique to banking and forms part of the reason why a whole lot of people do embrace the services still; the challenges associated with the transaction costs on customers, stringent loan conditions, incompetent cum highly priced e-channels, and some unfavorable government regulations do force a good number of the banked and the unbanked into reconsidering their options.

Considering options

Thinking twice about a system normally comes up when there are options. It's not cool to stay unbanked with the unhealthy consequences that go with it. This has resulted in the proffering of alternative solutions to financially related issues, with the entry of Cryptocurrency.

THE CRYPTOSPHERE

The cryptosphere is in dire need of a complete or near complete alternative solutions to that offered by banks. This is why Capverto is at the forefront in delivering a solution that'll bridge such gap and still proFfer solutions to the high costs, system reliability and other challenges that comes with banking.

THE CAPVERTO SOLUTION

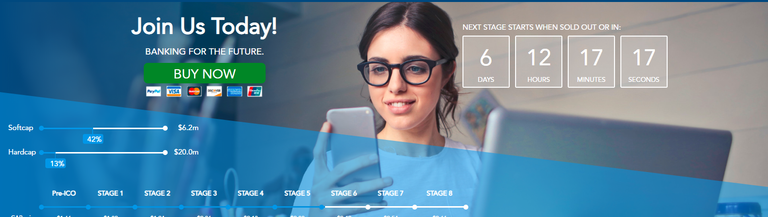

It's already confirmed; work is progress and ICO funding on course for the closest banking solution in the cryptosphere. As obtainable in the fiat based banking solutions known to us; the Capverto banking solution featured similar solutions through the following packages:

- The capverto prepaid cards

- The Capverto Peer to Peer (P2P) Lending

- The Capverto Copy trading

- The Capverto Insurance

- The Capverto Exchange and

The Prepaid Cards

Capverto cards

One of the smart moves made by the project is the integration of Fiats into the cryptosphere and vice versa, to enable the active participation of the Fiat based population, who may fall within the category of the unbanked. This feature, alongside the ATM and POS terminals; can ease the integration of fiats to cryptocurrency.

Again, while we discuss the physical prepaid cards that we can see; the Capverto card system also comes with the virtual form, to ease online based transfers, as alternatives to cheques and the likes in a banking system. Outside such transfer roles, they acts as a cover to the physical cards.

This partly takes care of the e-channels, deposits, withdrawals and transfers that is associated with the banking solutions.

PEER TO PEER (P2P) LENDING

.png)

P2p lending

If you've ever had access to loan facilities in a bank, you must have passed through some forms of scrutiny. Your transaction history will be weighed, amongst other stringent measures will have to pass some set hurdles before gaining access to loan facilities. Outside the checks conducted to ascertain one's qualification, you may still have to put in some valuable time to see the facilty disbursed.

The Capverto banking suite, offers a lending opportunity in cryptocurrencies, to the people that may be needing it. The only requirement is that you will have some tokens or coin in your wallet, which qualifies you to borrow about 50% of it's worth from other users of the platform. The platform helps in facilitating the lending for a 2% cost of the amount borrowed, while 8% goes to the peer giving out the fund, for a year. The maximum tenure for such loan is a maximum of 6 months, but the token can be sold off automatically if it tends to fall below 40% of its value through triggers.

The primary reasons why people may go for such solution, may lie in their unwavering expectation of their coin/token to appreciate in no distant time, and the resolve to keep such coin/token in their wallet till such benefits are achieved.

This package is relatively cheaper, easier and stress free; compared to what we have out there in the banks hence; taking care of the normal loan facility we know.

COPY TRADING

Copy trading

Most of the things we do today, were learnt from others. If we can copy and execute the functions of an outstanding professional in a field, we'll definitely get the same result. This seems a lot better compared to series of consultations that may not turn out so good as the advisories.

This is part of Capverto's concept to ensure that cryptocurrency traders on their platform, always end up in profits, compared to the series of advisories banks may give you.

This package involves copying and investing in the moves of a proffessional and an outstanding trader for a mere fee of 10% of the profit to be made. The billing mode is reminiscent of the fact that the concept is a productive one, compared to efficiency of consultancy one can get from a bank.

CAPVERTO INSURANCE

insurance

Insurance has often been attributed to a process that brings you back from a disadvantaged position, back to the position from where you drifted. Capverto, alongside Riskpoint insurance has come up with a solution that guarantees you the safety of your fund, irrespective losses due to cyber attacks, system downtime, etc. This is a very good proposal compared to the losses that have been incured via crypto exchanges, especially in japan. The happy news starts with your purchases at the Initial Coin Offering, where the coins purchased were brought under such cover. Capverto insurance cover excludes losses incured via exchange rates, trading and other user actions that exposes them to risk.

To be part of the insurance cover, you must have fulfilled the requirement of belonging to the Capverto platform, which entails been KYC and Anti Money Laundering compliant, 2FA compliant amongst other measures. This measure also meets up with the banking requirements.

CAPVERTO EXCHANGE:

exchange

This is the central part of the Capverto platform, on which other platforms were based. Primarily, the exchange is a platform in which currencies are been exchanged from one form to another. In the cryptocurrency exchanges, it can be the exchange of one cryptocurrency to another or, to fiats and vice versa.

The functioning of the other features were deeply integrated to the exchange and functions through a means, provided in the exchange utility token called CAP.

CONCLUSION

While the features expressed so far suffices in providing the crypto enthusiats the missing banking experience in the cryptosphere; measures to ensure a robust token valuation of CAP were put in place through reinvestment of tokens generated from the prepaid card purchases, transaction charges, interests on loans, etc. Some of these Reinvestments, helps in the implementation of buy backs of token to ensure enhanced token.

With this and other measures, your investments in the first cryptobank in terms of functionality, becomes safe and appreciating, while you thrive in the banking solutions proffered to all.

A complete banking suite, a decentralized integration of the unbanked and a robust and ever appreciating token. What more can the crypto and global community ask of than to join in the saying;

"Banking in the cryptosphere is here to stay".

Thanks

Karlblaise1

https://bitcointalk.org/index.php?action=profile;u=2248258

Ether add: 0x88b8c3cC5B6B33EEa93141443E95f9ff3B6634a3

i

REFERENCES

Website: https://capverto.com/landing

Whitepaper: https://capverto.com/landing#whitePaper

Telegram: https://web.telegram.org/#/im?p=@CAPVERTOOFFICAL

Facebook: https://web.facebook.com/CAPVERTO/

Twitter: https://twitter.com/capverto

Medium: https://medium.com/capverto

Linkedin: https://www.linkedin.com/company/capverto

Bitcointalk: https://bitcointalk.org/index.php?topic=2042235.0

Karl, do you know why i always like checking out your articles?

Your use of illustrations are very captivating and lively, and still; you get your points convincingly down to the readers.

Good write up once again, but i already invested in this.

Thanks Vera,

i always love it when i see your comments coz they give me that extra boost to keep it up.

Stay good dear ...

Well written, i'll go through the whitepaper to see if that reflects the value i see here, then i can decide on investing

Thanks for that compliment.

While you go through the whitepaper, hope you make it snappy to avoid missing out on the opportunity.

another wonderful article from you @ karlblaise, i am still checking their white paper, I will give a proper opinion when i am when done with it.

thanks dear for checking out on me.

Please, don't miss out on this golden opportunity.

I see another ethereum, in the making.

Congratulations @karlblaise! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Awwww,

very glad to have this reward.

Thanks to steemitboard, thanks to all my friends out here!