In our on going study of Steem Energy Value, we have projected a "fair value" with respect to the number of posts on the network allowing us to find a rough intrinsic pricing model for the value of Steem (the token). However, there are many other metrics which play an important role in this price discovery process and today, we'll look at "Metcalfes Law."

What we can hope to understand or get a better picture of is :

- How much network effect do we have with Steem, does it have the the properties of Metcalfes Law?

- What are the potential consequences of introducing side-chain tokens, smt's, steem-engine tokens etc.

Now just to be clear, I am not a Bitcoin Maximalist, my participation on Steem should be evidence enough that I do believe in the value of blockchains and tokenisation of various kinds of platforms. However, I have my fair share of qualms with the idea that "everything can be and should be tokenised." And there are fairly good reasons both fundamentally and ideologically to support that stance.

A brief look at what happened with Bitcoin and Alt-coins

When users believe that a token that is not Bitcoin, has better social welfare, or has values more closely aligned with their own, they have the option of either creating a new network, or exercise their capital (either monetary or other) in support of another network. In simple terms, this is the dichotomy of Bitcoin vs Altcoins but recently has parallels on a smaller scale with internal network partitions like with STEEM and it's SMTs.

If we take a look at coinmarketcap and analyse it's history, we can gather a few things :

- Bitcoin was the dominant (and continues to be) the main network, but the creation of thousands of "alt-coins" suggest that there are many people who believe that other networks match their personal values more closely.

- The underperformance of alt-coins post 2017 with a re-assertion of Bitcoin Dominance suggests that a large number of the original people who "split off" from Bitcoin to pursue networks matching closer with their own personal values, have switched back to Bitcoin.

- This shift of preference in social welfare is analogous to the culling of the altcoins, but also contributed to the decline of Bitcoin's price and more importantly the total market cap of crypto-currencies.

Is splitting off destroying overall value?

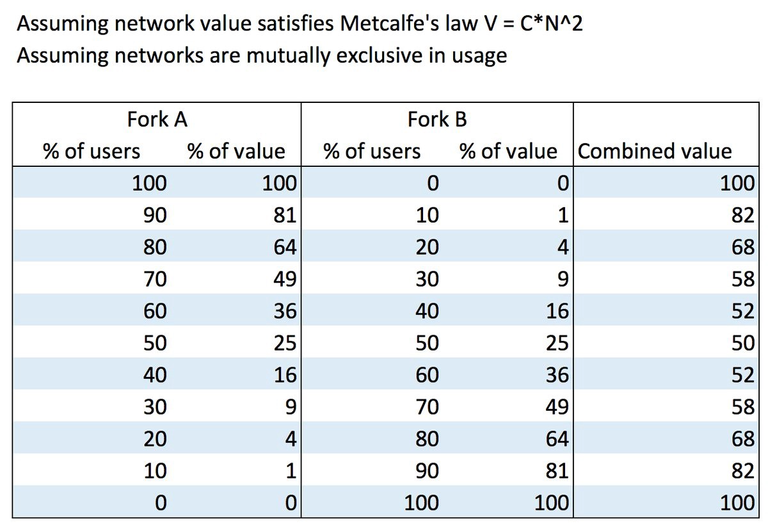

From a quantitative point of view, I refer to Vitalik Buterin's study on ecosystem splits, in particular, how Metcalfe's Law plays a role in determining the overall value of a system and what happens when this system splits from one system, into many.

Understanding how the network effects of a system creates value plays hand in hand with how the disruption of these network effects also destroy value.

Metcalfe's Law attempts to model the value of a network as the number of users grow.

From the table above, we see a simplified example where we have two systems, A and B, A being the original and B being a fork of A. At some point in time, enough people decided that network B could provide better social welfare, as well as align more closely with their personal values.

However, you will also see from the table that assuming the system remains closed, the combined value of BOTH networks is below the value of the original network pre-split. It is only when one system or another has 100% of the users in this closed system that the value is maximised.

This means, that assuming both networks satisfy Metcalfes Law, the sum of the parts is worth less than the whole. A network is better off (at least in terms of "value") if it doesn't split.

Now, going back to what we said about Bitcoin and Altcoins, this explains why the total market cap of all crypto today (229 Billion) is much lower than just the total market cap of Bitcoin at it's peak (369 Billion). That doesn't necessarily mean that all value lost from Bitcoin was destroyed as a result of splitting off into the thousands of different altcoins, but in hindsight, we can intuitively see that the vast majority of coins ended up offering no extra value vs Bitcoin, and that has been represented by the underperformance of altcoins vs Bitcoin.

On a macro time scale, we can't say that the decline of Bitcoin was a result of all the value lost in other coins that ended up doing nothing, or provided no extra value over Bitcoin, but we can say that in the short run, the choice to rush to competing factions of coins from Bitcoin led to an intermediate decline in total value of Bitcoin as well as the crypto market. What happens from here on out in layman's terms is the culling of projects with zero value, and the ones that remain will drive the total value back up some time in the future.

This however, requires breaking out from our "closed" model where we assumed that no further competing factions enter and that the total number of users remains fixed. We will likely require an increase in the number of value creating projects that capture scopes outside of Bitcoin, as well as an increase in total number of users.

This is why there is constant emphasis on expanding the user base. Whether that's by drawing them in with ideologically superior altcoins, or direct to Bitcoin, the Metcalfe Law remains the same. Value accrues exponentially as the number of users increase.

Suffice to say, Metcalfe's Law works very well in explaining what happened with Bitcoin, altcoins etc. for the last couple of years.

Now that we've covered Bitcoin and Altcoins, what does this mean for Steem and it's Steem Engine Tokens, SMT's?

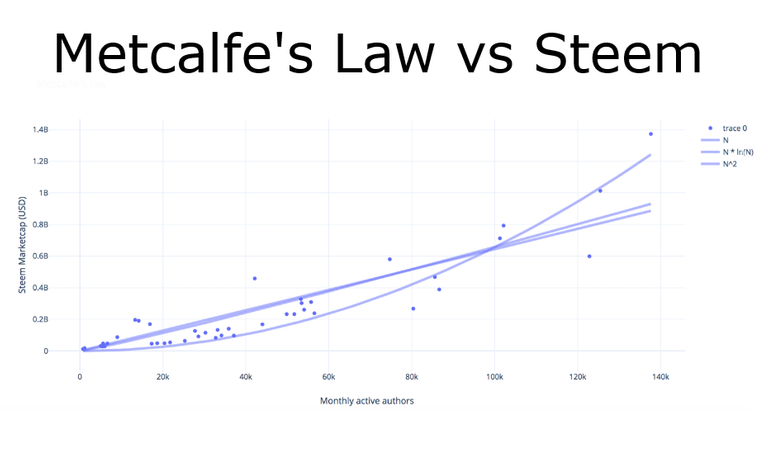

Well, let's start off by looking at STEEM itself. From the above chart, I have plotted the relationship between Steem's market cap and monthly active authors (no. of authors with at-least 1 post in that given month) and plotted some curves to try find a fit.

A cursory glance will show that the N^2 relationship mostly holds true, we just don't have very many data points for active users above 100k. This is likely because insofar as the number of users and therefore posts are concerned, we know that price leads the activity level, and highly volatile price movements both up and down mean that we have highly price sensitive users.

On the flip side, the good news is if Steem was ever to start increasing it's active number of users again, the Metcalfe Law would see it's network value increase non-linearly, instead with a power law (N^2) and we would once again see asymmetric value appreciation of the price of Steem.

What about SMT's and Steem Engine Tokens

By this point, you must be seeing the parallels of what I have discussed above about Bitcoin and Altcoins with respect to Steem and it's own alt-coins. While we have had the introduction of Steem-Engine-Tokens see an influx of steem alt-coins emerge, I am actually not assigning Steem's large decline to the emergence of these tokens. The main reason being that the tokens on Steem Engine are traded primarily against STEEM and not against any other token such as Bitcoin, USD or other off-ramp. The value is largely preserved and we have to thank the (lack of) Lindy effect for this.

However, should the introduction of SMT's from Steemit Inc catch significant interest, and the SMT's start getting listed on a wide variety of other trading platforms, trading against assets other than STEEM, then I do see the value of STEEM being (at first) over valued as a result of the need to purchase STEEM to purchase these SMT's, and then the eventual correction of STEEM as a result of Metcalfe's Law and the majority of the SMT's failing to deliver value.

On the plus side, because of STEEM's unique plug and play model, a lot of long term socially beneficial, value-generating projects can be built on top of STEEM without the need to issue another token. Even with the large corrections we will see with STEEM, as long as there are just a handful of projects that come out of the culling with growing communities, then I do believe in the long run, SMT's can generate significant value surplus over STEEM alone.

Remember, markets are irrational and take time to price things correctly.

Congratulations @holdo! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!