Nothing in this article is to be construed as investment advice. Neither the author nor the publication takes any responsibility or liability for any investments, profits or losses you may incur as a result of this information.

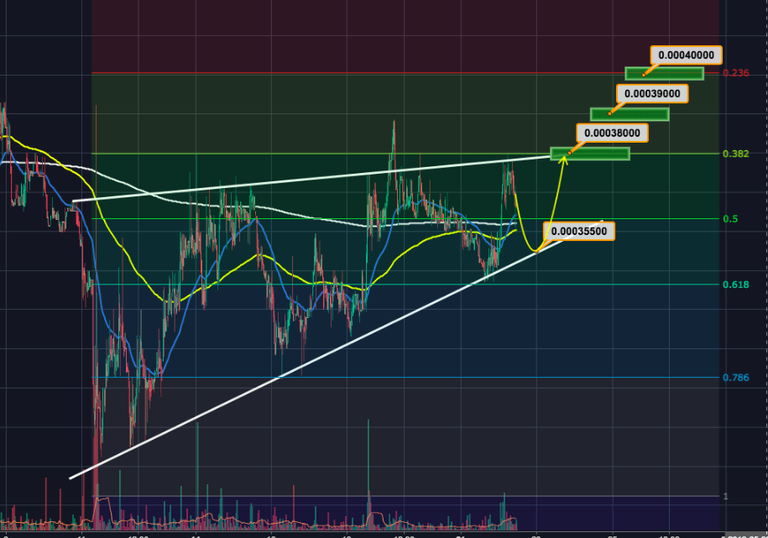

STEEM survives the market haircut today unscathed, in tune with the platform surpassing the 1,000,000th account benchmark.

As their user base continues to grow, trading support for the native STEEM token is also showing signs of improvement with a 3.73% gain against BTC today.

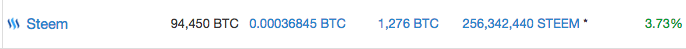

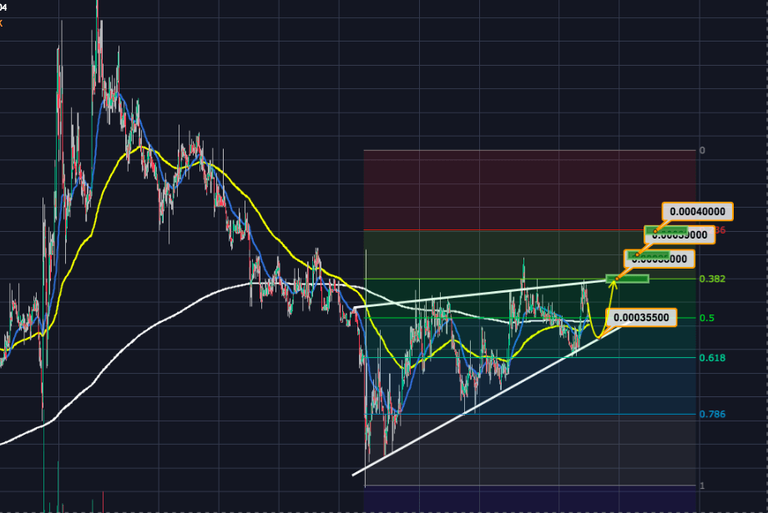

Over 30min candles we can see that STEEM has begun to ascend towards the 0.382 fib level (38,000 Sats) against a strong resisting level (white line).

Looking at the lower uptrending line we can also clearly see the asset track well along fibonacci support areas; with candles wicks extending to the 1, 0.786 and 0.618 fib levels respectively as the price action climbs.

Reviewing a broader range between the Exponential MA’s we can see that the blue line (50 EMA) has been bullishly snaking its way back towards to white line (1,200 EMA) indicating that gradual buying momentum is starting to build behind STEEM since its bearish decline over early May.

It’s also interesting to note that the blue line and the yellow line (200 EMA) are starting to pinch tighter together as they edge closer to the white line. A crossing above the white line will be a strong buy confirmation for the asset.

Ichimoku indicator is also projecting a bullish continuation, with a positive T/K-Sen crossover and a supporting kumo cloud ahead of the price action.

Accumulation/ Distribution line is also rising, showing an increase in investment flowing through the asset.

While the overall trend is looking promising, momentum indicators are starting to favour the bears in the short-term, following the sudden selling pressure fighting to hold STEEM below the 0.5 fib level at 36,322 Sats.

- MACD is plummeting towards the signal line, with a growing distance between the two MA’s signalling a significant drop in bullish support.

- RSI is also downtrending towards the lower quartile of the channel as buying momentum declines.

STEEM Price Prediction

Looking at the current price activity I think we should expect a brief bearish period to swing the asset’s price down to the 35,500 Sats support, before it returns to 0.382 fib level above during the next wave of bullish support.

Our first price target will be here at 38,000 Sats, once the price action returns to the uptrending resistance line. This will deliver a 7.04% ROI from the 35,500 Sats level.

From there, we should expect a continuation to carry STEEM towards the next key resistance area at 39,000 Sats before expecting a correction. This would return a 9.86% gain from the 35,500 Sats level.

Depending on market sentiment at this stage, we could expect to see STEEM continue sideways along the new support at 0.382 fib level, until support can rally again for a second push.

A top price target for STEEM over the coming weeks will be a retracement to the 0.236 fib level at 40,000 Sats. This would give us an overall return on investment of 12.68% from the 35,500 Sats level.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cryptovest.com/news/steem-technical-analysis-steembtc-trading-support-holds-strong-as-platform-celebrates-1000000-account-registrations/

Congratulations @bitvoice! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!