It's been a crazy week in the crypto 'verse.

First, the ever-controversial Craig Wright told a Florida federal court that the keys to Satoshi Nakamoto's Bitcoin billions - which would have been proof of his claim to the Nakamoto throne - had arrived by bonded courier.

Then, just days later, his lawyers turned Wright's claim on its head, announcing that not only did he NOT have the keys, but that he never claimed to have them in the first place. Kinda ballsy, considering they filed a notice of compliance with the court on January 14th.

On the regulatory front, Malaysia has published new guidelines establishing a legal framework for initial exchange offerings (IEOs) while simultaneously outlawing initial coin offerings (ICOs).

The U.S. Securities and Exchange Commission has been on the warpath this week, too. In addition to continuing to turn the screws on Telegram, the regulatory body has issued an investor warning about IEOs and brought charges against an ex-con who used a fake identity to launch an illegal ICO that raised more than $30 million.

Impact on the Crypto Market

So how has all this craziness affected the crypto market? The overall market is up by more than 14% over the past 7 days - from $216.6 billion to $248.24 billion - while the total trading volume increased by more than 33% - from $85.46 to $114.51 - over the same period.

Top 10 Cryptocurrencies

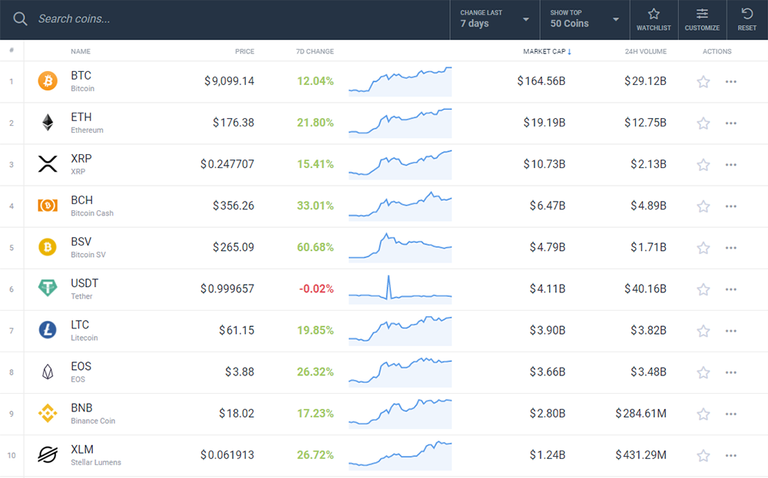

Here's a quick glance at how the top ten cryptocurrencies (by market cap) performed over the past week:

Bitcoin Price (BTC)

- Current price: $9,099.14

- 7 day low: $8,085.84

- 7 day high: $9,157.49

- 7 day change: +12.04%

Ethereum Price (ETH)

- Current price: $176.38

- 7 day low: $142.75

- 7 day high: $178.02

- 7 day change: +21.80%

XRP (XRP)

- Current price: $0.247707

- 7 day low: $0.210434

- 7 day high: $0.249411

- 7 day change: +15.41%

Bitcoin Cash (BCH)

- Current price: $356.26

- 7 day low: $262.41

- 7 day high: $396.60

- 7 day change: +33.01%

Bitcoin SV (BSV)

- Current price: $265.09

- 7 day low: $152.78

- 7 day high: $424.06

- 7 day change: +60.68%

Tether (USDT)

- Current price: $0.999657

- 7 day low: $0.998930

- 7 day high: $1.02

- 7 day change: -0.02%

Litecoin (LTC)

- Current price: $61.15

- 7 day low: $49.16

- 7 day high: $62.75

- 7 day change: +19.85%

EOS (EOS)

- Current price: $3.88

- 7 day low: $3.03

- 7 day high: $4.04

- 7 day change: +26.32%

Binance Coin (BNB)

- Current price: $18.02

- 7 day low: $14.97

- 7 day high: $18.34

- 7 day change: +17.23%

Stellar Lumens (XLM)

- Current price: $0.061913

- 7 day low: $0.047618

- 7 day high: $0.064534

- 7 day change: +26.72%

If I Had Bought at the Bottom and Sold at the Top...

Hindsight is 20/20, friends, but for a moment, let's pretend that I had purchased $50 worth of each of the top ten cryptocurrencies at their lowest point of the week and sold it at their highest - what would my ROI be?

To calculate profit / loss I used the following formula:

[50 / by lowest price (LP)] x highest price (HP) = profit (P)

Then to calculate my ROI, I used this formula:

[Profit (P) - 50] / 50 = ROI in decimal (ROId) x 100 = ROI in percent (ROIp)

- BTC: 13.24% ROI

- ETH: 24.7% ROI

- XRP: 18.52% ROI

- BCH: 51.12% ROI

- BSV: 177.53% ROI

- USDT: 2.1% ROI

- LTC: 27.64% ROI

- EOS: 33.32% ROI

- BNB: 22.5% ROI

- XLM: 35.5% ROI

My total investment of $500 would have returned $703.11 - a profit of $203.11 or a 40.62% ROI.

Sadly, I did not make those investments.

Did you like my first Top 10 cryptocurrencies weekly roundup? Let me know in the comments below or on Twitter @Bitcoin_Mafia.

Cryptocurrency price data courtesy of CoinCodex