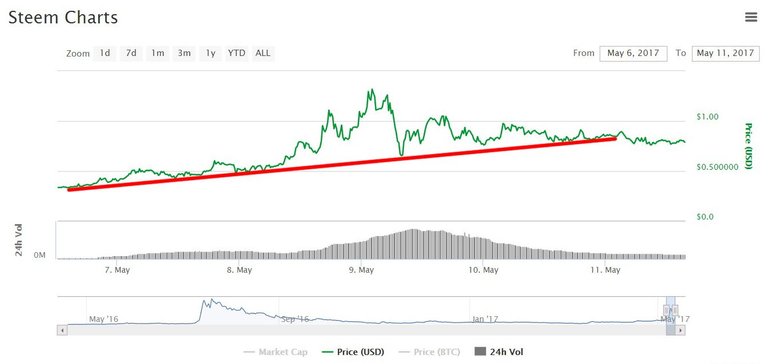

The STEEM price continues to trade sideways after the recent spike in price and volume.

It was an expected pull-back after a quick run up to 77K+ satoshis (STEEM-Bitcoin price) a few days ago. Some important technical levels are being tested or have been broken. So let's take a look at where we are now and what we can reasonably expect to happen next.

In this first chart, I want to look at the STEEM-BTC price movement and a few different support lines.

The first thing we notice is that the red uptrend line was broken. This occurred right around 47K - 48K satoshis.

The black line is the current line of support and it comes in around 40K - 41K satoshis.

The blue line is the next level of support if 40 - 41K does not hold. This line is at 36K - 37K satoshis.

The orange line will likely serve as the lowest level of support from the recent uptrend that began about five days ago. This line of support is between 31K - 33K satoshis.

The Fibonacci retracement lines confirm two levels of support (black and orange) at 38.2% and 23.6%. The zero-line, which would be a full retracement, would bring the STEEM-BTC price back to about 1850 satoshis. Again, I don't expect this to happen and I'm fairly confident that if the price breaks the current support level, it likely will not fall below 31K - 33K satoshis.

Also notice where breaks and support/resistance have already occurred and have kept the STEEM-BTC price in its current range, post-spike. The price recently bounced off of the 38.2% line. It will likely test it again very soon.

We also need to pay attention to what appears to be a bearish wedge forming on the charts. The price will need to climb back up between 55K - 57K in order to ease some of the anxiety there. If lower highs continue and the price keeps skirting the 40K - 41K support line, it will likely take a dive below it soon. Keep an eye on volume as well, which has dropped a fairly significant amount over the last two days.

The STEEM-USD chart is nearly identical to the STEEM-BTC chart. The uptrend line was broken and prices have been moving slightly down and sideways over the last couple of days. Current prices are mostly bouncing between $0.75 and $0.90 per STEEM.

It's not all scary and the price can certainly increase and resume its uptrend. It would need to jump above 55K - 57K satoshis in order to do that, so a little bit of work still needs to be done. However, it appears that the price still has a little more correcting to do.

If you're trading right now, you can take advantage of the fluctuating prices and hope that STEEM-BTC remains range-bound. This will provide an opportunity to make some profits and also build up some long-term support for the price. If you're buying long-term, you can probably start averaging in if the price starts breaking lower through some of the support lines.

Never invest or trade what you cannot afford to lose and put tight stop-losses in when prices creep lower towards the support lines.

As always, if you have any critiques or comments about my non-professional analysis, please let me know. If you're excited to trade this market, good luck to you!

Disclaimer: I am not a professional adviser and this info should not be used for trading. I would be flattered that you think so highly of my fairly basic analysis, but it would not be prudent to use this for transacting with real money.

*Charts are from Poloniex and Coinmarketcap.com. Analysis is current as of approximately 12:30pm EST, May 11, 2017.

The daily chart lines up with some of the support/resistance points you mention, which is good. .00045 is the prior intraday high back in Dec. After breaching that this week we really need to hold an establish that price. .00050 would be even better as that was the last bounce/point of consolidation on the long down move before we flattened out.

Good analysis @ats-david, if the price holds above 70 cents I would be happy.

Yeah, same here. I'll take $0.70 or even $0.50 compared to the $0.10 that I had grown accustomed to over the last several months.

No candles then?

Hmm...um...the candles are...

Implied.

Ah, OK. I like candles.

Thanks for sharing :-)

Thanks for reading!

You are very welcome @ats-david :-)

Nice post, Thank you. @ats-david

Excellent post! I like your work My friend

thx for putting in all the work and sharing w/ all :)

Great analysis, thank you. I was impressed by how accurate your last post was. Please keep them flowing!

Thanks for breaking this down in a factual, comprehensive way.

Good news @ats-david

Interesting analysis David, thanks! I'll keep this in mind! But long term, I'm positive we'll see a dramatic climb. :)

Thanks for the info keep sharing !!

Nice post

Upvoted and followed

Thanks for sharing

Has Steem come back to the top to stay forever? Staying afloat is very important for us since it may prove their critics wrong. We are waiting to see if it could conjure the magic it did in the summer of 2016.

Can you also predict the lottery numbers too please? :p

4, 11, 16, 27, 52

Thanks. I'll share the prize with you :p

Good analysis, thank you @ats-david!

Nice that you shared... i will try to upload chart with my short input ☺... spikes make currencies volatile and its good for traders like me to catch uprun or plunge... but so far i am trading only physical currencies but i love to have info. of steem...

Great analysis, thanks man!

Nice analytics through graph and candles.

It's all in the Fibonacci retracement for me :0)

Thanks for sharing!

Hi,

from the second graph, I could challenge the idea that your lows trend line has been broken and restested.

It's currently holding a mildly bearish trend but I've spotted another resistance at 2285. There could be a leg down incoming.

For now 4850 seems to be where I would check to sell on a short to mid term and a long term buyer at 2285.

Thanks for reading my point of view and make green!

GOOD analysis!

Maybe you can answer this question or someone else.

I've tried to buy steem this morning at 11am on Shapeshift, and the trade is still not confirmed 3 hours later. Could be cause by:

Here is a screenshot https://goo.gl/zgWj6j

I'M still learning

thank you

OK I found it.

A question of fee in my bitcoin wallet.

Entire market of cryptocurrency is quite unpredictable . Is growing very fast, for me it means that a lot of new people ale investing money. But probably they are mainly newbies and they are duch smart in the market.

Interesting stuff, thank you for the post!

Hope Steem Gets back above $1.00 USD pretty soon.

resteem/upvote

Check my BTC round up! https://steemit.com/bitcoin/@zchfx/bitcoin-isn-t-dead-we-re-doing-just-fine

Excellent analysis and well constructed arguments with good caveats thrown in - you explained this very well. I do, however, believe that there should always be a very large warning over the supply demand situation and the tiny number of influencers. Both these factors add an enormous variation factor which can be triggered in any regression lines (fibonacci or otherwise).

Bittrex, poloniex and blocktrades (though the traded portion is not clear) hold the keys to steem which only has 40% being tradable right now and the pricing precludes more - a self-perpetuating spiral?

Thanks for your great work.

Namaste.