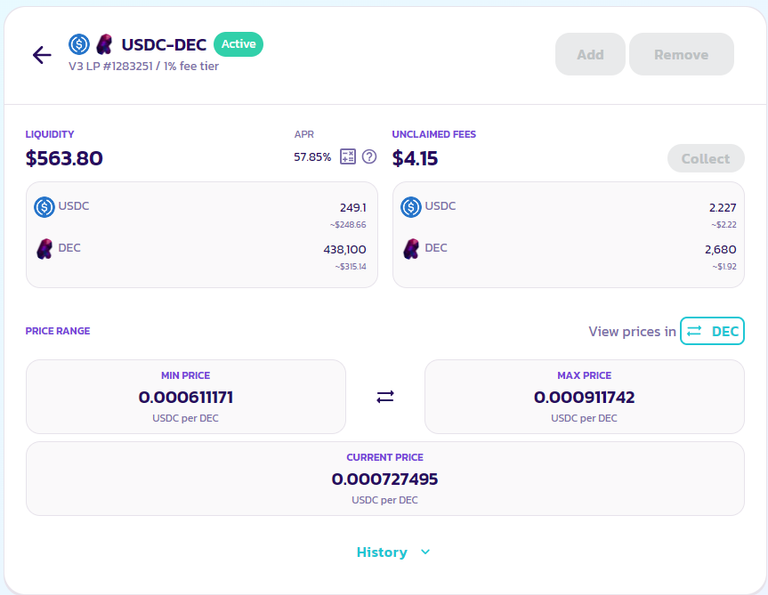

The APR on the USDC-DEC LP has came down to about 60% ish a little under which is lower than it has been but still better than most of the returns in spl and its more liquid than owning the cards as well as it moves with card prices to. Rather than rent cards out it may make sense just to keep money in dec when its low and add to the lp then sell the fees when high and use the sale proceeds to buy back dec when its low by setting a one sided buy for when the cycle goes low again and keep making the fees and then selling them at the high side of the price ranges which gets the highest APR as the DEC side of the returns are being sold on average for more than the price it was earned at if you wait until the top of the cycle so the overall APR will be even higher if you use this method and are patient and hold the dec let it appreciate until the teams sell zone or daos sell zone which is when you want to sell all earnings as prices will likely be lower again in a month or less and everything repeats again and again. It has been a good choice to sell SPS so far instead of keep most of it like I used to as other assets like BTC and ETH can be acquired which can have many more options for defi and earnings like I could have earned more of the ZRO and ZERO airdrops if I had sold more as I would have had more to interact with the chains as well as it would have net appreciated while SPS has mostly depreciated over the same time as my earnings now for land are about 1/3 of what they were a month ago due to SPS decreases making selling now and putting it to work in undervalued outside assets look like a good option for any earnings as you are always diversifying and getting into different returns on different assets and not relying as much on one asset or asset class to provide to much of the cash flow. My SPL assets are to much of my cash flow and it has hurt my overall cash flow as SPL has been lagging a lot behind the markets lately and the dec usdc lp is one of the only lps that make more than staking sps or the hive lps all of which have been much more risky than just holding dec and putting it in the lp and earning 50-150% on average. At that high of a average and a lower risk profile than SPS and the other assets with a superior return in fees make it the perfect asset with a predictable cycle and high fees at the 1% fee level with decent volume to support the fees. I will continue to add to this LP and follow the same strategy of holding the earnings until the prices get to the sell zone area then spreading out the sale over that zone.

Sort: Trending

[-]

splinterboost (60) 7 months ago

[-]

douglas.life (-7)(1) 5 months ago

$0.00

Reveal Comment