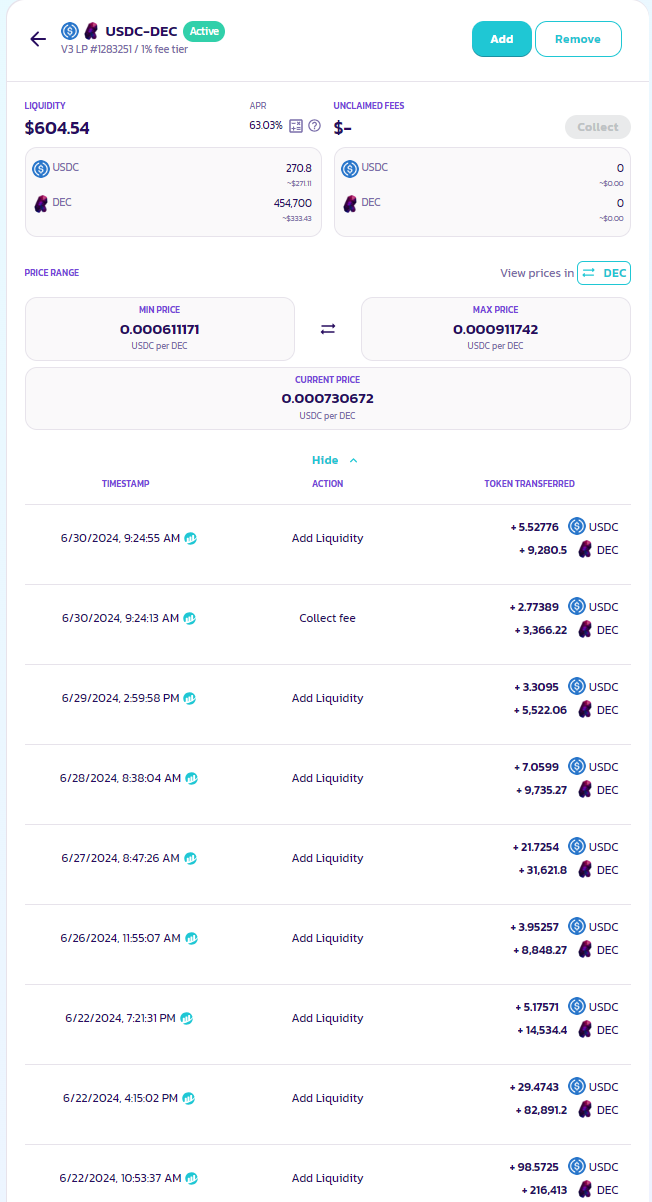

Have been re investing a portion of my game earnings in the DEC LP daily and have averaged a 63.03% APR which is higher when compounding but either way the fees are higher even with out rewards than any of the fees with rewards ever were and adding to the DEC-USDC LP in a targeted range that the team and the dao conduct there buying and selling within is a strategy that allows you to remain within the trading ranges in all likely hood if you stay with your range on the outside of the buy and sell points typically used. Also look at selling liquidity in DEC inventory when DEC rewards are ready and are enough to be sold for USDC and have the fee not take up a huge portion of the fees earned then setting a buy order with a one sided LP order on the low side to acquire additional DEC that was sold at a lower cost to add to the LP for additional fees and appreciation as it climbs and falls within its normal range for trading and have orders set to sell and buy as well to catch any spikes down if you can get it when the spikes are happening you can pull the liquidity and then then it spikes back up add it back again. Looks like there is a slow average down in the SPS price over the past few days and there has been a lot of activity since June 11th from the .0085 to .007 price ranges for SPS and looks like there was a big spike down to .0065. It may be a good strategy to place buy orders on spikes and far enough outside hives normal trading range volatility or on the edges of it to take advantage of the swings and the price fluctuations to buy when hive is near the top of its range and sell SPS when is near the low using DSWAP and do the same with DEC and use a wider range and capture a larger spread which may be more effective with DEC as it has a sideways range overall and SPS overall has a downward range and a sideways range is better for buying at highs and lows using a grid bot strategy.

Sort: Trending

[-]

splinterboost (60) 2 years ago

Loading...