The competition for smart contract chains continues to grow. This is obviously an attractive sector as it positions itself as a sort of banking 2.0. Ethereum the OG is leading here, but there are now more and more competitors with few big ones and countless small ones.

Even Bitcoin is now getting smart contracts. The noise is extreme in the sector! This shows that the smart contract market obviously has a high value, and big players are competing for it.

In the last bull run in 2021 there was an explosion in the smart contracts platforms. More and more kept coming online and a lot of them did well. A lot of them are EVM (Ethereum Virtual Machine) compatible and users can switch between them using the same wallet as Metamask. Some are unique and have their own wallets like Solana, Cardano, Aptos, Sui, etc. When we thought we have enough, there is now x10 more 😊.

Let’s see how things are standing during the current market conditions.

We will be looking at:

- Number of Addresses

- Active Addresses

- Daily Transactions

- Fees

- Contracts

The period that we will be looking is the latest data from December 2024.

We will be looking into the following blockchains:

- Ethereum

- Polygon

- Solana

- BSC

- Cardano

- Avalanche

- Optimism

- Arbitrum

- Base

- Aptos

I have added three new chains, all L2 on Ethereum. Optimism, Arbitrum and Base. This have now gain some recognition. Furthermore, there are now chains like Aptos, Injective, Selestia, Sui, Sei. The Cosmos ecosystem as well. As said, there is no shortage of smart contract chains these days. Even with these more are on the way: Scroll, Linea, zkSync, Manta, Polygon ZK, etc.

The data for the chains will be extracted from their blockexplorers or some other data providers.

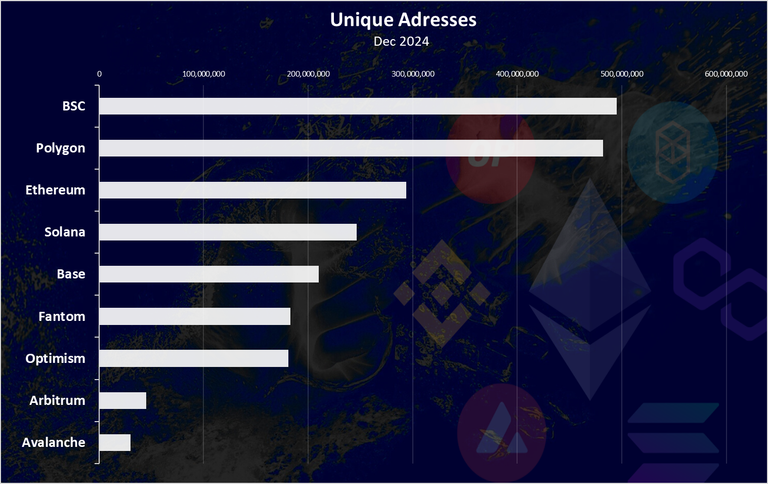

Number of Addresses

One of the key metrics for crypto projects is the number of wallets.

Here is the chart.

The round up numbers look like this:

In the past Ethereum dominated this chart, but that is no longer the case.

Ethereum is now in the third position in number of unique wallets. The Binance Smart Chain is in the first spot, closely followed by Polygon. Both of these are around the 500M mark. Ethereum has 285M wallets.

Solana is around 250M. The Coinbase, Base chain is above 200M.

We can notice the other L2 ETH chains here as well, Optimism with 100M wallets already, while

Note that the Solana data is approximate.

One thing to note about these types of wallets is that they are free and there is no cost for creating a wallet, like for example on Hive. Because of this there can be a lot of wallets created and even spammed.

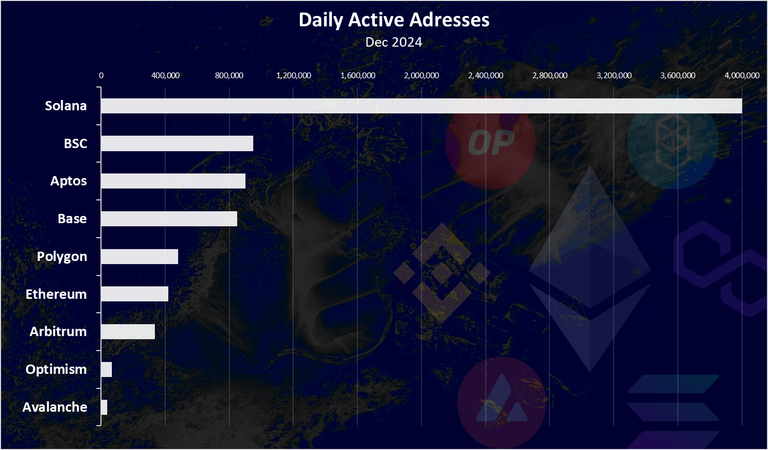

Active Addresses

What’s more interesting in times like this is how many wallets are transacting. How many of those addresses are actually active?

Averages from the last days.

Solana is on the top here with 4M DAUs.

Next is BSC and interesting Aptos. Base is also ranking high now, closing on 1M DAUs.

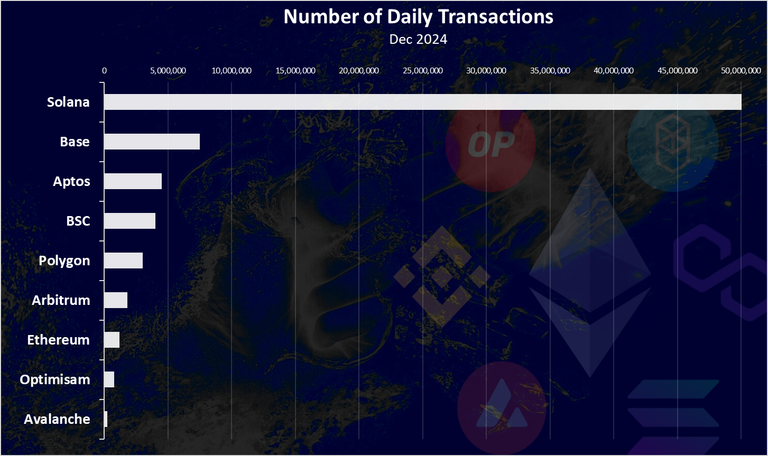

Daily Transactions

The activity on the networks is mostly represented by the number of daily transactions. Here is the chart.

Solana is holding the number one spot by far here. It has around 60M daily tx in the recent period. That is what the blockchain is known for. Its speed.

Base is now in the second spot, outpacing Aptos and BSC.

When looking at the transactions, the cost of them should be kept in mind. Solana has lower fees per tx and is on top. In the case of Base and BSC it is interesting there are chepear options but obviously this is not the one thing to push them higher.

Ethereum is obviously the highest fees, and it comes lower in the ranks.

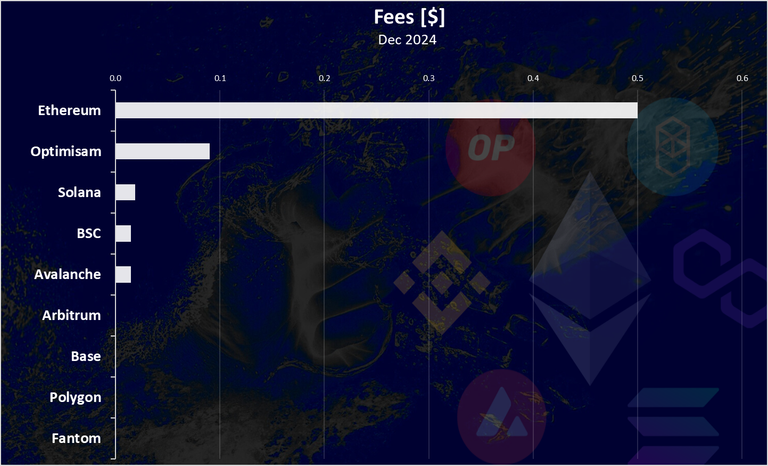

Fees

Fees are quite the unpopular topic and one of the main reasons for the new EVM chains, as users are trying to find a way to escape ETH high fees.

Here is the chart.

The fees here are in dollars.

While ETH is on the top here, these fees of half a dollar are nothing compared to the fees in the bull run. At times ETH fees were going up to 200$ per transaction especially if it was a smart contract transaction.

The other blockchains now have low fees, with surprisingly Optimism on the seconds, spot followed by Solana with 0.02 cents. In the past Solana was even cheaper with fees in the rank of 0.0001 cent. While 0.02 cents is still low, the fees have obviously increased on Solana a lot. This is probably due to its recent activities in meme coins etc.

The other chains have fees under one cent.

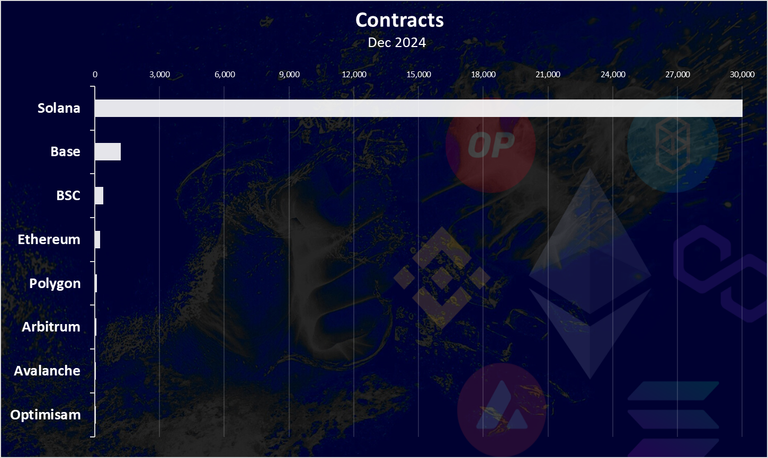

Contracts

These three are smart contract platforms so here is the chart for verified contracts per day.

Note for Solana the data is for daily number of new tokens and NFTs.

Solana is leading by a lot here, since there is a ton of new tokens created daily there. Base is interesting on the second spot, obviously some nice activity there, and next is BSC.

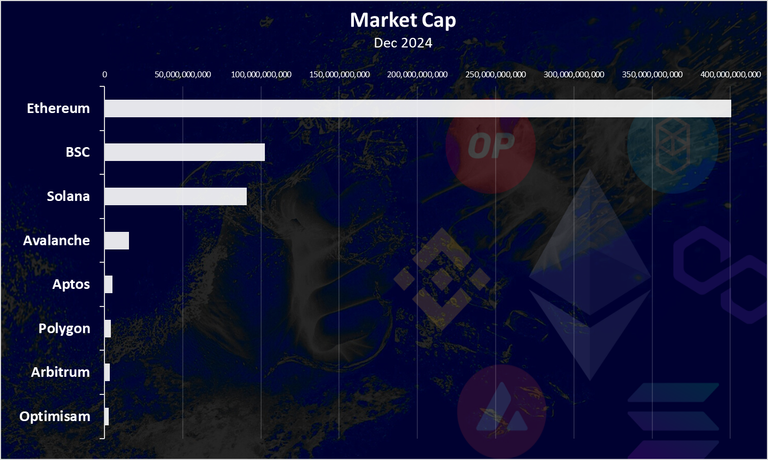

Marketcap

At the end the most important metric the market cap.

When it comes to market cap Ethereum is dominating the market, followed by BSC and Solana. The other coins are much smaller. Solana was in front of BNB, but it dropped in the last few weeks.

One thing is for sure. The market for smart contracts has been very attractive and a lot of new chains have been created. But as for the industries, only a few will dominate it, while the others will be insignificant. The market cap for now separates Ethereum, Solana and BSC. Will these three continue to grow and eat all the rest it remains to be seen. Also, in crypto even if the projects don’t grow, killing them completely is a hard thing.

All the best

@dalz

Solana is nuts with the meme coin frenzy I'm not sure if there's even any legitimate projects launching on there lol. I guess it goes to show ya just how crazy the crypto world still is and how much money there is flying around for wild meme coin projects still. Reminds me a lot of Ethereum first layer two tokens when everyone tried to launch memes or projects that just failed.

Hi, @bitcoinflood,

This post has been voted on by @darkcloaks because you are an active member of the Darkcloaks gaming community.

Get started with Darkcloaks today, and follow us on Inleo for the latest updates.

Yea the amount of money in memes is in the billions.... whats funny though is that I dont expect this to go down, but up only

As I know there's STEPN project based on Solana. As I heard it's really popular but again can we assume that it's legitimate ?🤔

Solana is so popular, but I still hold BSC the closest to myself out of this list.

I lost my interest for Ethereum chain when the Fee's went over a dollar.

I think a lot of people are still trying to escape those eth humongous fees. Solana has really made a statement especially with all that meme projects and all that shiny money

There is often a connection between the increase in the number of active addresses and the increase in price. First, the number of active addresses increases, then the price. Since the network fee is low in Solana, decentralized applications are used intensively. Using them causes the number of active addresses to increase. This is the biggest problem of Ethereum, the network fee is high. This means the number of active addresses decreases. Small investors do not prefer it.

After analyzing your DATA, I realized that Solana token is very good for investing and it is very popular although there are much better tokens in the market.

!discovery 33

!PIZZA

This post was shared and voted inside the discord by the curators team of discovery-it

Join our Community and follow our Curation Trail

Discovery-it is also a Witness, vote for us here

Delegate to us for passive income. Check our 80% fee-back Program

$PIZZA slices delivered:

(6/15) @jlinaresp tipped @dalz

@tipu curate

!PIZZA

I am very disappointed by Avalanche. It has high fees, yet few addresses and activity. If anything changes, games will have something to do with it. I have seen many games getting built on Avalanche for some reason.