Hello friends! Starting this week, I will try to release gold news regularly. Links to useful articles for you. They will also be in the description. As you know, I work in the cryptocurrency industry. Recently I was interested in the project. Which is a stablecoin. It is called Digital Gold. This project is very interesting for me as an investor and a trader! It makes it possible for me to trade safely and brings additional profit.

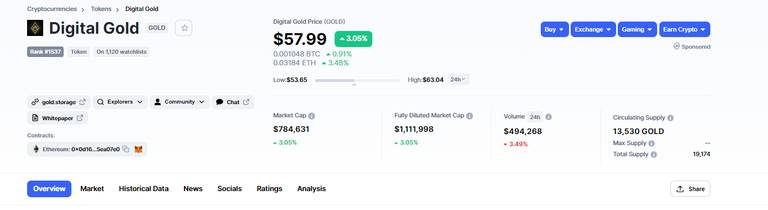

You can find Digital gold on Coinmarketcap. There is a lot of information collected here. Daily turnover, rate and more.

You can trade on www.bitforex.com You will have access to many trading pairs. USDT BTC or ETH - Of course, it's up to you to decide which currency to trade.

Digital gold is an interesting asset. Easy to handle and safe.

Prospects for gold

Jeff Christian of CPM Group believes that gold and silver have a good chance of continuing to rise in value. Although the price of gold has declined recently, it is still higher than the level that we saw until June 2020. The precious metal price is far from its maximum, which means there are good prospects for growth. Investors are showing an increased interest in the yellow precious metal.

According to the representative of CPM Group, the growth of gold in 2021-22. will be more restrained. According to the forecast, the average price of the precious metal will grow by 6% on an annualized basis, and in the next five years, gold will be able to set new price records. Silver also has good long-term growth prospects. This precious metal is receiving support from many factors, including growing investment demand.

Gold in China

The Shanghai Gold Exchange (SGE) shipped 92.39 tonnes of yellow precious metal to its customers in February 2021. This is reported on the SharpsPixley portal. Typically, the month of February is considered a period when supplies to the SGE are markedly reduced by one week due to the low activity caused by the Lunar New Years.

Thus, in February there was a decrease in supplies compared to January (159.49 tons), and compared to February 2020 (28.9 tons), on the contrary, there was a noticeable increase (643.6%).

Last year's period of quarantine restrictions had a very negative impact on the supply of the yellow precious metal from the Shanghai Exchange for gold. By the end of 2020, SGE was able to sell 1.205.33 tonnes of physical gold - a decrease of 36.2% on an annualized basis. But for several months in a row, there has been a positive trend on the stock exchange to increase the supply of gold. In general, SGE supplies of precious metals do not reflect the entire domestic demand, but they allow Western analysts to understand the general picture of the Chinese precious metals market.

Gold is protection

The history of gold has shown that this precious metal is a protective haven asset. This can be seen even if you trace the period over the past 40 years. In subsequent years, the yellow precious metal will retain its status as a "haven". Its protective function is now becoming more relevant than ever before since the purchasing power of the dollar has already lost 95% due to its unlimited release. This trend will continue in the future.

Of course, it is worth saying that gold will not show phenomenal returns like stocks or bitcoin, but it will help keep savings from inflation and complete depreciation. Long-term investors are aware of this and continue to increase their positions in the precious metal.

Contacts

👑Website: https://gold.storage/ru/home

📞Telegram: https://t.me/digitalgoldcoin

📞 Steemit: https://steemit.com/@digitalgoldcoin

📞Youtube: https://www.youtube.com/channel/UCUo-D88vDTvntg2QhxDqBGQ

📞Reddit: https://www.reddit.com/r/golderc20/

📞 ANN: https://bitcointalk.org/index.php?topic=5161544.0

🌏 Coinmarketcap: https://coinmarketcap.com/currencies/digital-gold/

Autor:

Bitcointalk Username: anatolij.shishkin

ETH 0xae291938EcF7887cbD6edAa42Dec3d9abC9dEa94

Telegram : @Carbodex

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=2280356

Twitter: https://twitter.com/anatolijshishk2