Tokenized silver? Alright, I know what you’re thinking; physical silver is obviously the superior option. When it comes to investing in silver, owning physical bullion is the safest way to go, as you bear no third-party risk. In the crypto world, there’s a phrase that says, “not your keys, not your coins.” When the market heads to goblin town, companies like Three Arrow Capital or Voyager will default and use customers’ savings to pay for their debt. Not every company leverage like a degen, but one must be cautious.

At the moment, I think PAXG is the only metal-backed cryptocurrency you can trust. Paxos is the custodian of PAXG, which is backed by legit gold bars. They are also the company that issues BUSD together with Binance. So, we have tokenized gold in crypto, but what about tokenized silver? Well, as far as I can tell, there isn’t a reliable company that issues tokenized silver for now. After doing a quick search on Google, I came across: AurusSilver ($AWS) and Kenesis Silver ($KAG).

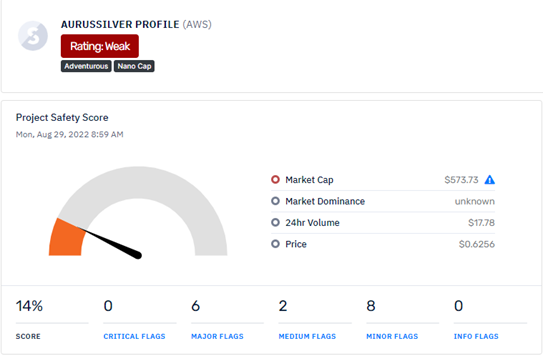

[source: https://isthiscoinascam.com]

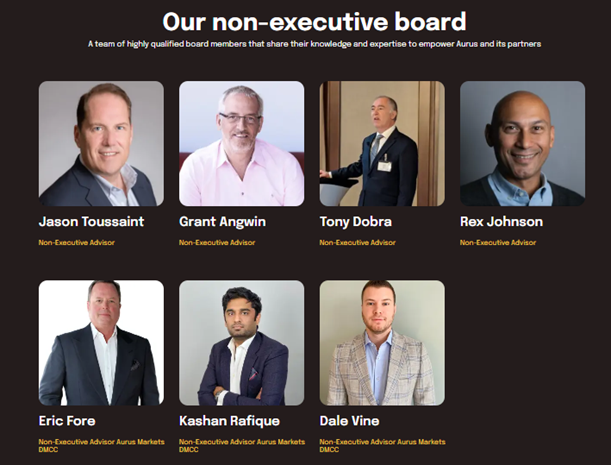

$AWS is completely not credible. In fact, a quick background check reveals that it could very likely be a scam. No one should risk their capital and invest in a shady project like this. At first glance, the website looks promising. Then you look at the team behind the project; it appears that someone does not know how to use Photoshop properly.

[The team photos are low quality and appear to be Ai generated or photoshopped]

Another option for tokenized silver is from the company Kinesis Money. I have no knowledge of the company. It looks legit with a blue checkmark on Twitter. But in the end, I think it’s still too risky. Who knows, maybe the company has some sort of liquidity or debt problems. Perhaps they run their business like a degen by utilizing high-risk strategies such as crypto, or DeFi carry trade. Everyone believes 3AC is a safe and respectable corporation until it is proven otherwise.

Conclusion

Tokenized silver is not worth the risk. On the other hand, PAXG (tokenized gold) should be a safer option if you really want to buy a metals-backed cryptocurrency. The reason for even considering buying tokenized gold or silver is because they are convenient. For traders, those tokens can be traded 24/7, which is insane if you think about it, as the metals market only operates 23 hours a day. If you know for sure that the gold market is going to gap up when it opens, just buy PAXG and earn some spread.

Silver always have the edge no matter what

Posted Using LeoFinance Beta

Thanks for the info although I think sliver might be tokenized maybe next year or if we get to the bull runs again

Posted using LeoFinance Mobile

There are still some big developments coming up. Also, your blog is phenomenal 😊

Yay! 🤗

Your content has been boosted with Ecency Points, by @blockbunnyorg.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Not the best option for me, but like you mentioned this could be nice for those with no access to the physical stuff or a safe option for storing it.