Hello Steemians,

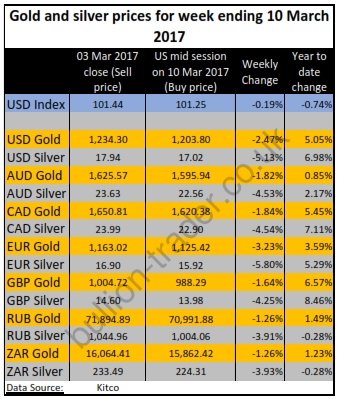

I'm sure you will all have noticed, even if out of the corner of your eye, that gold and silver have been under pressure the whole week and look likely to end the week on the back foot.

This is a continuation of last Friday's silver smash when about $2B worth of silver futures contracts were dumped in about 40 minutes, surprisingly (not) just after the European close. If this doesn't look like a co-ordinated move, we aren't sure what does.

As long as a phoney paper market exists, we unfortunately don't see any reason for this to stop anytime soon. It is interesting to note the difference between the Comex gold price and the Shanghai Gold Exchange (SGE) gold price on 7 March 2017 at 15:30. SGE was showing a 1.6% premium on the Comex gold price. Another interesting observation is that over 90% of trades on the Shanghai Gold Exchange are settled in physical gold, the same cannot be said about the Comex.

It looks like the SGE is possibly a better benchmark for the real gold price than the Comex and we wouldn't be surprised to see the SGE determining the gold price in the future, much the same way the Comex determines the price today.

If the Comex gives us a discount to the SGE, let's take advantage of it.

Keep accumulating both physical gold and silver on the dips and keep your hands strong.

Have a good weekend.