As Tech giants Google and Facebook seek to return in China, fast-growing startup Bytedance now aims to tap another market where foreign competitors are missing: streaming videos.

With starring products like short-video sharing App Douyin, news aggregator Toutiao, and newly launched AI research center, Bytedance is now entitled “the King of Content in China” and “the one that knows the best about Chinese Millennials” with a majority of the users aging from 15-35. The company is especially famous for spotting market segments with the least competition.

Since 2017, Bytedance initiated a series of mergers and acquisitions to align its grander ambition. Besides launching offices across the world and aggressively acquiring competitors, the company also expanded its business lines including mini-programs and mobile games to directly combat Tencent.

Today, BAT’s profits remain heavily dependent on China market performance despite endless efforts overseas, according to Wall Street Journal reports. Domestically, the three tech giants now face fiercer competitions from second-tier challengers like JD and Xiaomi. With a more impressive performance overseas and continued rapid growth domestically, Bytedance has become another promising challenger to China’s BAT paradigm.

Rise of Douyin: Missing BAT in Photo & Video Category

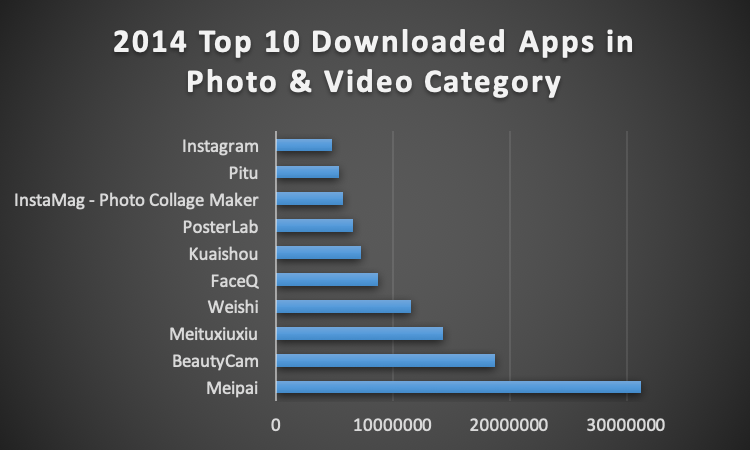

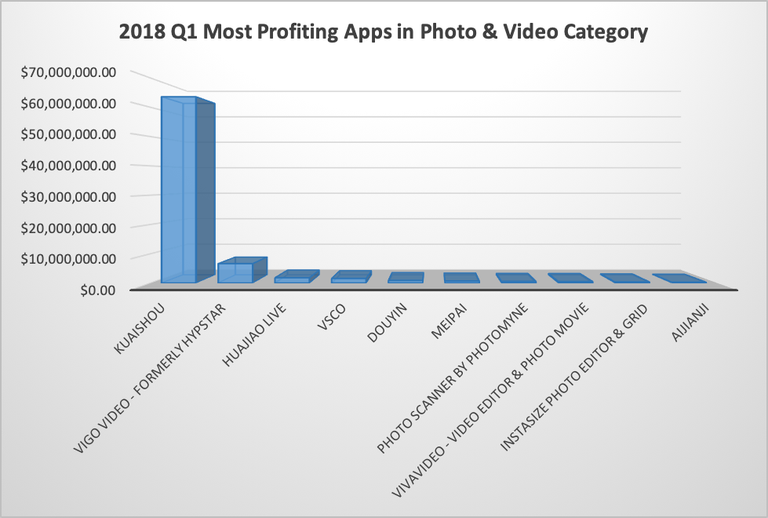

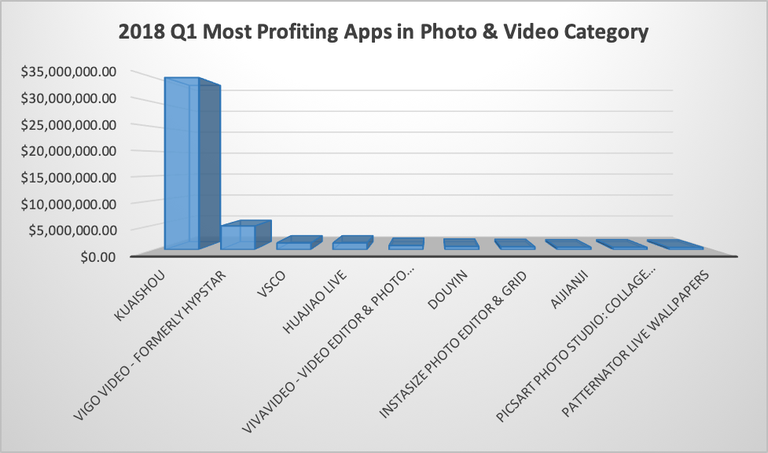

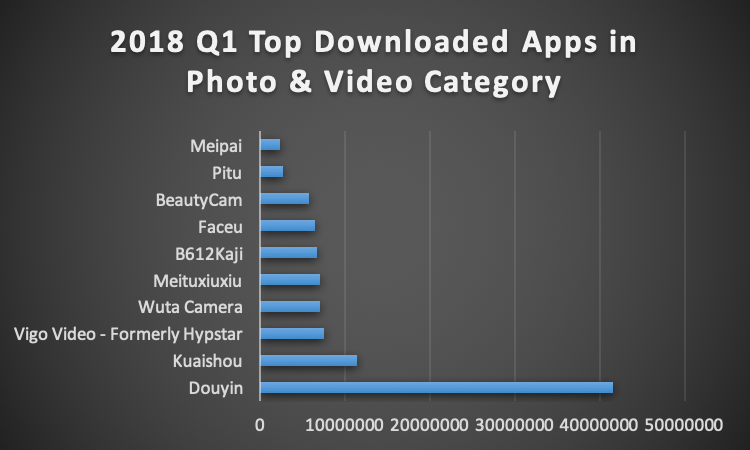

Douyin is no doubt one of the most successful products of Bytedance as world’s most downloaded App in 2018 Q1 with 150 million DAU. Unlike many other categories which are primarily dominated by the BAT, the Photo & Video segment provides an opportunity for smaller companies to survive, according to AppBi, a data analytics consulting firm and leader in search ads optimization in China.

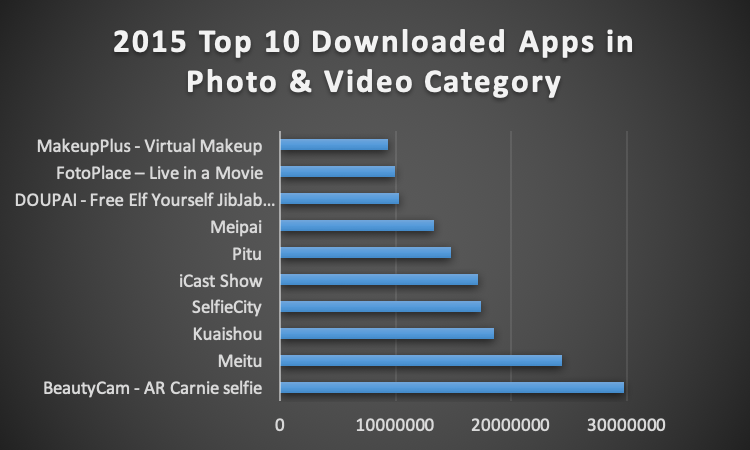

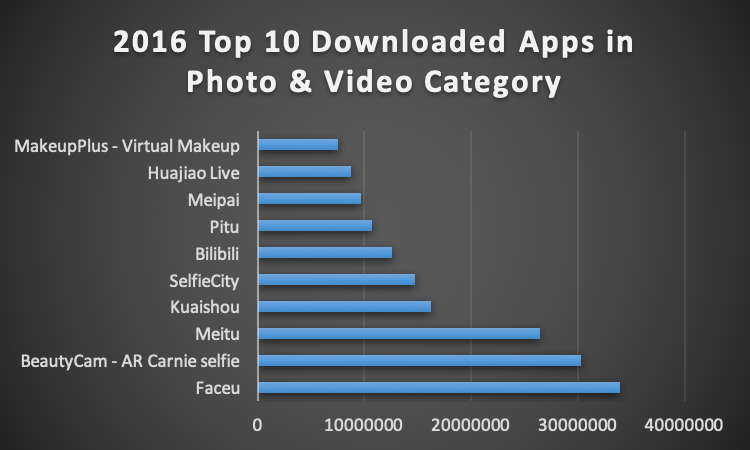

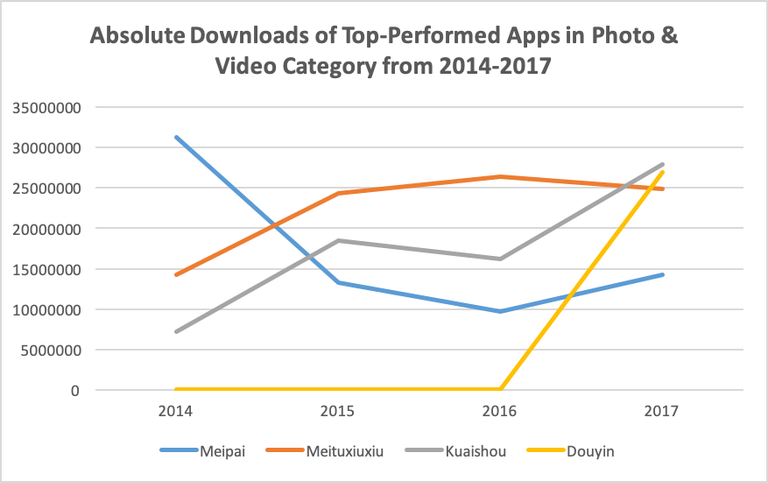

AppBi shows that Meitu Technology and their photo editing Apps gained unprecedented popularity in China from 2014-2017. In this category, while small video sharing platform like Kuaishou was able to make in Top 10, the number of downloads was relatively minimal compared to Meitu.

As BAT and smaller companies began to invest heavily in photo editing Apps, short-video sharing platforms like Douyin and Kuaishou were able to break into the market with significant advantages. The 15-second video sharing model was not only new to the market but also satisfied the needs of the new generation who prefer snippets rather than length, in-depth content.

In 2016, while BAT was fighting over video streaming services and copyrights, Douyin and Kuaishou rose up quickly with unique contents mostly generated in third- and fourth- tier cities in China. Bombarded by stories of glamor, these down-to-earth videos made by ordinary people immediately connected a large number of users who were previously underrepresented on the internet.

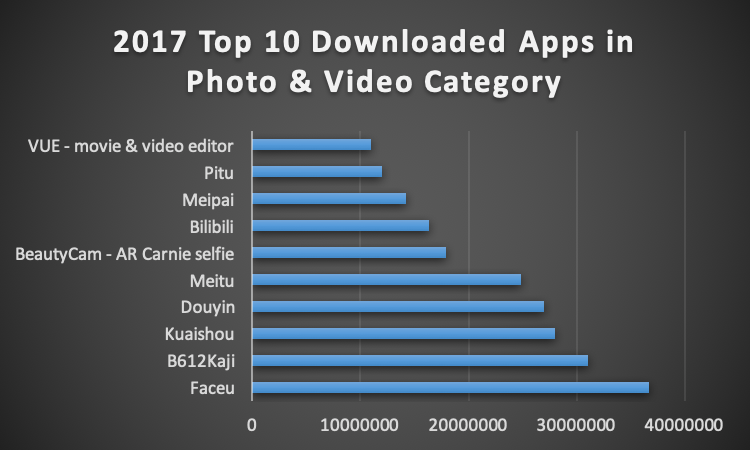

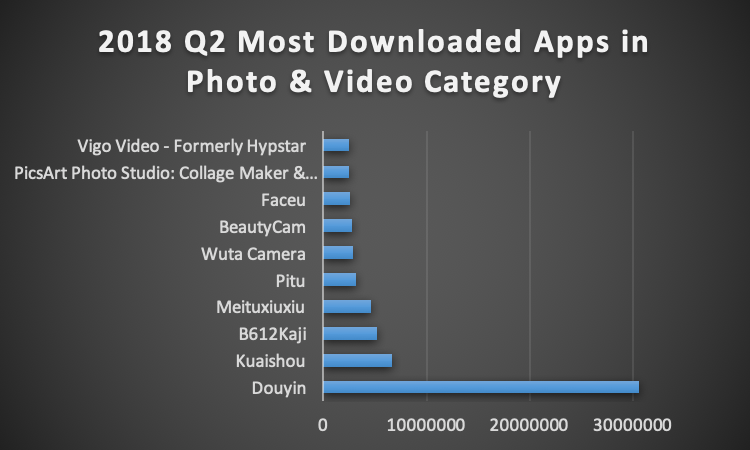

The success of Douyin provided Bytedance the resources to go deeper and further in the Photo and Video category. At the beginning of 2018, Bytedance acquired Faceu, the second products of China’a popular emoji company Lianmeng, with $300 million. Since 2018 Q1, Douyin has become the leading App in this category with 41,479,865 total downloads, according to AppBi.

Douyin’s Dominance: Industry’s Anxiety

Meitu’s fall went simultaneously with Douyin’s growth. While one represents artificial beauty, the other gains a reputation of revealing reality. Since 2016, downloads of short-video sharing Apps proliferated whereas the growth of photo editing platforms slowed down. Some smaller developers even vanished after only one or two years in the market.

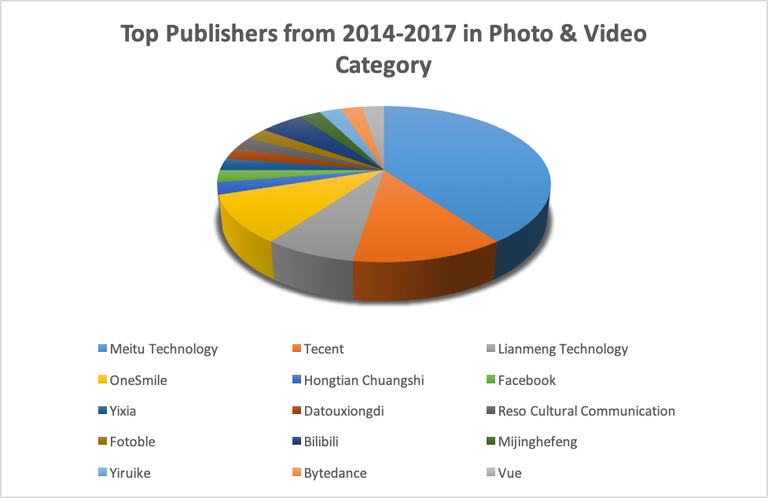

From 2014-2017, Meitu Technology remains the top publisher with the most Apps listed in Top 500 lists. However, very few were able to stand out like Douyin or Kuaishou. Many lasted only a few years and then vanished with very little loyal users.

At the same time, BAT performed poorly in this category compared to smaller companies like Meitu and Fotoable who stood out as the publishers with the most Apps listed in Top 500. Bytedance rose to become the star in 2018, but it was considered almost invisible in this category before 2016.

Compared to other categories, the change of players in Photo & Video is swift and unpredictable. Not only larger players like Bytedance, Kuaishou, but many smaller startups were able to shine for a while with strong support from teenagers, who seek “new and cool” Apps that could connect them with their peers.

In 2018 Q1 and Q2, this category experienced the fall of photo Apps and saw a rise of short-video sharing Apps. Kuaishou remains the most profiting one whereas Douyin dominates the download ranking. More independent, smaller players entered the market, but BAT still plays a minor role in this category.

The rise of Douyin and unpredictability caused major anxiety in this industry. Previous top players like Meitu Technology began to invest heavily in new product development. While the change of players happens almost every quarter in this category, we could hardly predict any long-term players due to the nature and user base of these Apps.

The dilemma of short-video sharing and Bytedance

After the peak in 2017 and the beginning of 2018, the download of Douyin begins to slow down as policy tightened in Beijing. Besides being criticized for vulgar contents, user-heavy platforms like Douyin and Kuaishou also scrutinized for data security and inappropriate ads.

Today, nothing could attract young users more than photo & video sharing. As one of the most volatile category, developers and advertisers see endless opportunities. However, AppBi analysis shows that the life expectancy of these products globally remains short and unpredictable.

Today, Bytedance is trying to follow the BAT model and become “too big to fall”. Nonetheless, the future its online loaning products, big data and AI development, as well as content business remain dim with stricter policies in Beijing.

AppBi

AppBi is a leading data analytics consulting firm specializing in App Store Marketing and industry insight analysis in China. We help developers and marketers with effective BI platforms powered by AI technologies and advanced algorithms.