In mid-2013, Japan had overtaken the U.S. App market in cash revenues and rose to become the world largest. While the U.S. remained No.1 in free App downloads, the profit extracted from Japanese market had far exceeded expectation. Until today, Japan remains one of the most important markets in Asia and worldwide for App developers, especially companies in neighboring China.

This June, Apple launched the Search Ads service in 6 more countries, including South Korean and Japan in Asia. In August, the advanced version was available in Japan, South Korean, Germany, France, Italy, and Spain. Meanwhile, Apple made Search Ads Basic available in 13 countries in total.

AppBi, a leading Data Analytics consulting agency in China, has studied extensively on App performance in 2018 H1 in Japan. While the political history between two countries remains rigid, China’s business influence in China had grown extensively over the past year.

- Executive Summary

In 2018 H1, 967 Apps are listed as Top 500. 38 was made in China, accounting for 4.2%. The 38 Apps have generated a promising profit of $54,396,878.06. Downloads of Top 500 App hit 332,971, 902 times, generating $1,614,729,535.

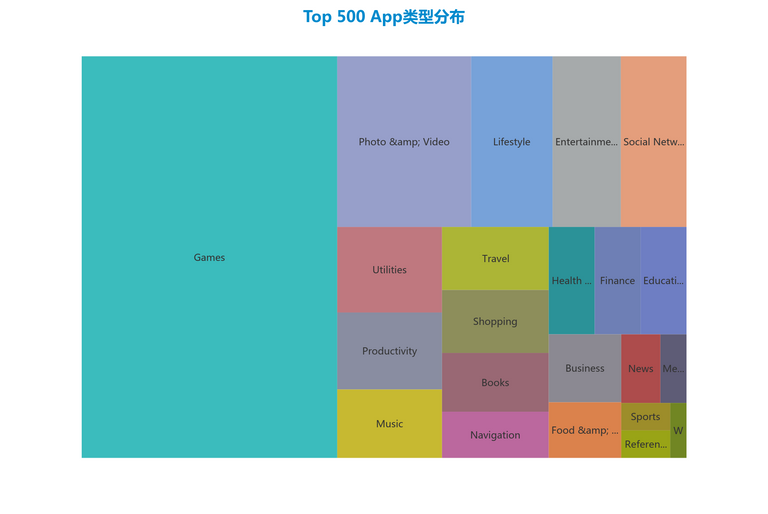

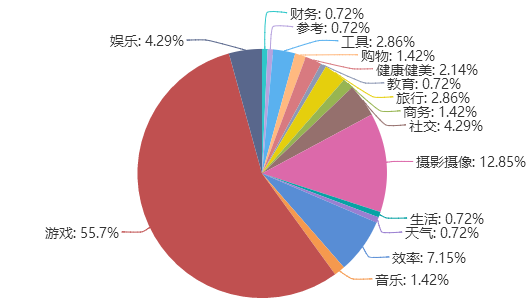

(1) Category

Japan App users from age 15-30 often called as “the generation of comics and games”. Among Top 500 Apps in market revenue, game category accounts for 43% and is followed by Photos and Lifestyle. With a solid user base, those three categories will continue to grow in the following five years.

Among Top 150 Apps in bidding keywords, 78 are games and 18 are photos & videos. Music ranks the third with 12 App selected on the list. Those three categories accounted for 72% of total search ads market share. For Chinese companies aiming to penetrate the Japanese market, understanding search ads and the use of keywords can be pivotal.

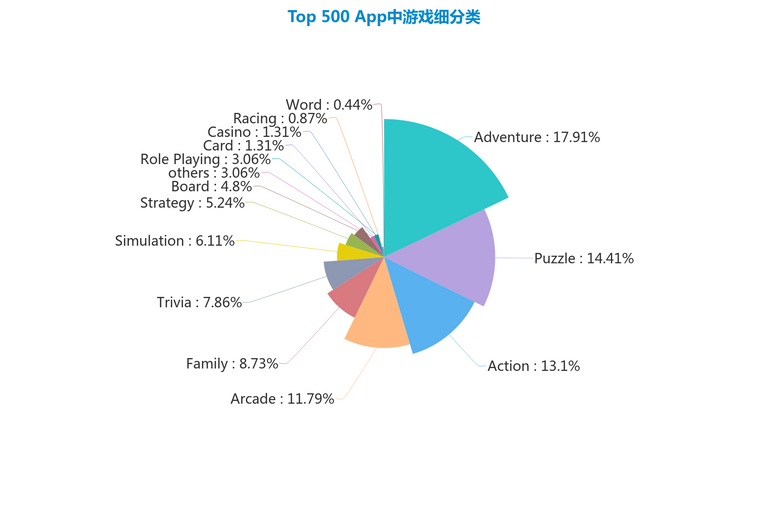

In game categories, adventure, puzzle, and action games received universal popularity. From 2012-2017, Japan ranks the top 1 in game spending with $214 per person. From the game revenues, 90% comes from mobile.

In game categories, adventure, puzzle, and action games received universal popularity. From 2012-2017, Japan ranks the top 1 in game spending with $214 per person. From the game revenues, 90% comes from mobile.

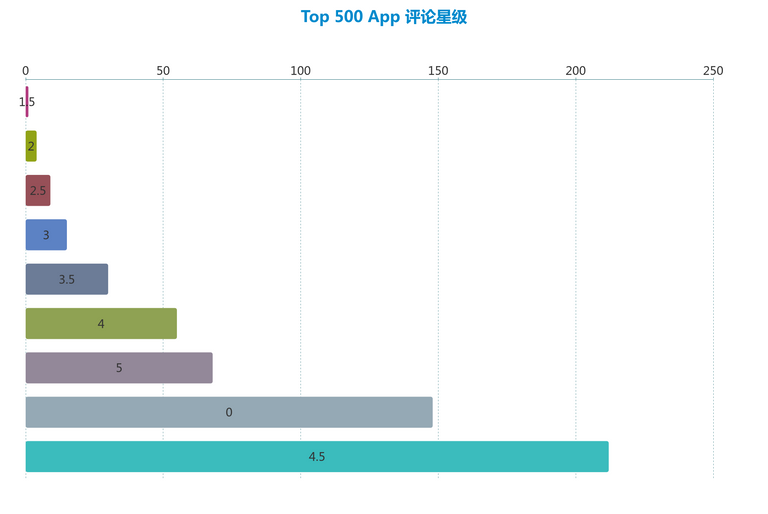

(2) Rating

61.8% Apps receives 4-stars and above. Most 0 rated Apps are brand new products. As regulations tightened, App quality has improved simultaneously.

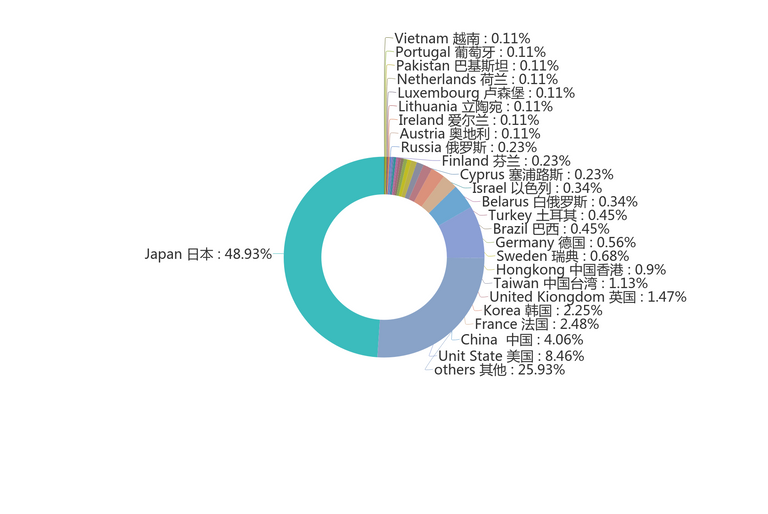

(3) Country

Among Top 500 Apps in market revenue, nearly half is made domestically. Other developers mainly came from the U.S., China, and France. South Korea, U.K., China Taiwan, and China Hong Kong also played a role in this competition.

Among top Chinese producers, Cheetah, NetEase Game, Baidu Japan, and TopBuzz are the most profitable tech giants in the Japanese market.

- Details and Trends

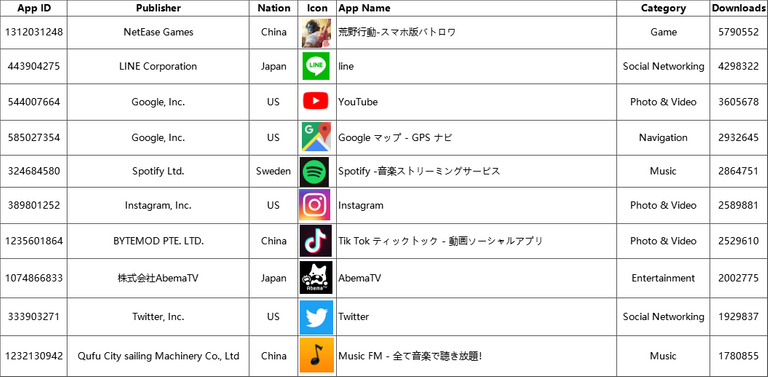

(1) Top 10 most downloaded Apps

Two out of Top 10 downloaded Apps were made in China. One is NetEase’s popular action game Knives Out, and the other is video snippets sharing platform Douyin. Douyin was launched on November 1, 2017 and immediately rose to the 6th. Knives Out published in Japan in November 14, 2017 and ranked as the 11th.

(2) Top 10 most profitable Apps

In Japan, downloads and profits are not necessarily correlated. While Chinese products topped the downloads list, most profitable Apps are domestic games. Japan’s version of WeChat Line and NetEase’s game Knives Out topped both lists.

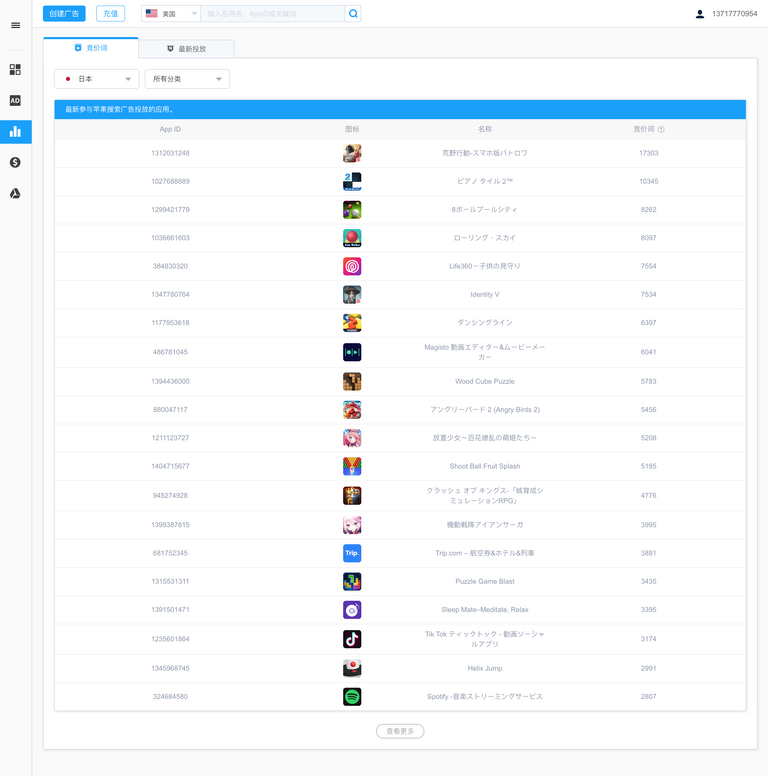

(3) Companies used most keywords in Search Ads

Search Ads Bidding data shows that China’s ads spending in App markets are on the rise. Among top 20 Apps in search ads bidding, NetEase, Cheetah, and several independent developers are leading investors. Douyin/Tik Tok also injected heavily in Search Ads. The number of bidding keywords ranges from 2,000 to 20,000. Many have provided positive feedbacks on Search Ads ROI.

According to Apple’s latest news, Search Ads might be launched in China in 2018 H2. As leading consulting agencies in data analytics and search ads optimization, AppBi will continue to provide actionable insights and updated market trends to support App developers with decision-making.