Airbnb’s Chinese rival Xiaozhu received $300 million in October from investors led by Tech tycoon Jack Ma’s Yunfeng Capital, an existing investor who poured millions to beef up its presence in China’s heating home-sharing market.

As Xiaozhu grew stronger, Airbnb is facing tougher competition from Chinese rivalries. The US-based company has dominated several markets across the world, but just like Uber which left China in 2016, the rising unicorn is stumbling with the shrinking market share and the departure of senior-level executives.

To understand Airbnb’s struggles in China, we need to first learn about Xiaozhu, a start-up launched in 2012 and now owns 420,000 properties to rent. The company covers 400 cities in China and 252 overseas. Statically, it was small to Airbnb, but its growth in China is now considered the biggest threat to Airbnb’s dominance and survival.

Xiaozhu is called the “Chinese Airbnb”, but they are very different

• Xiaozhu is big on local

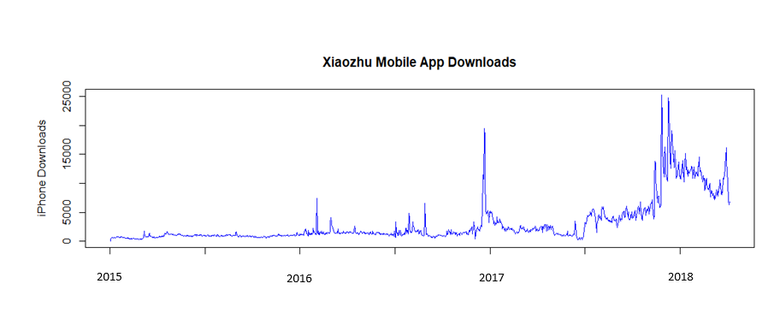

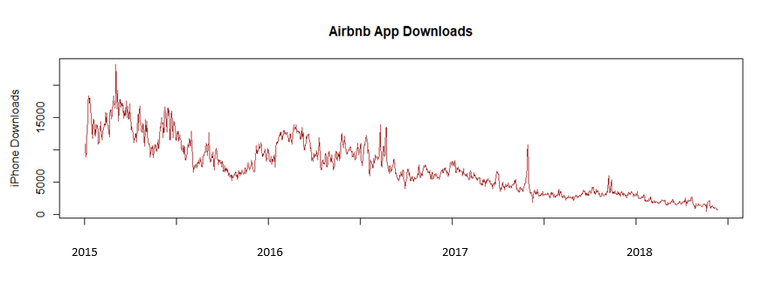

From 2015 to 2018, the download of Xiaozhu has experienced exponential growth whereas Airbnb dropped rapidly in mobile downloads in China. With very little competition in 2015, Airbnb soon dominated the emerging market and was planning to acquire Xiaozhu in 2016.

However, as Tech giants BAT (Baidu, Alibaba, and Tencent) started to battle for dominance and poured millions into home-sharing platforms like Tujia and Xiaozhu, Airbnb eventually lost its control. In 2018, soon after another injection from Jack Ma, downloads of Xiaozhu peaked, and the company rose to become one of the leading players in China market.

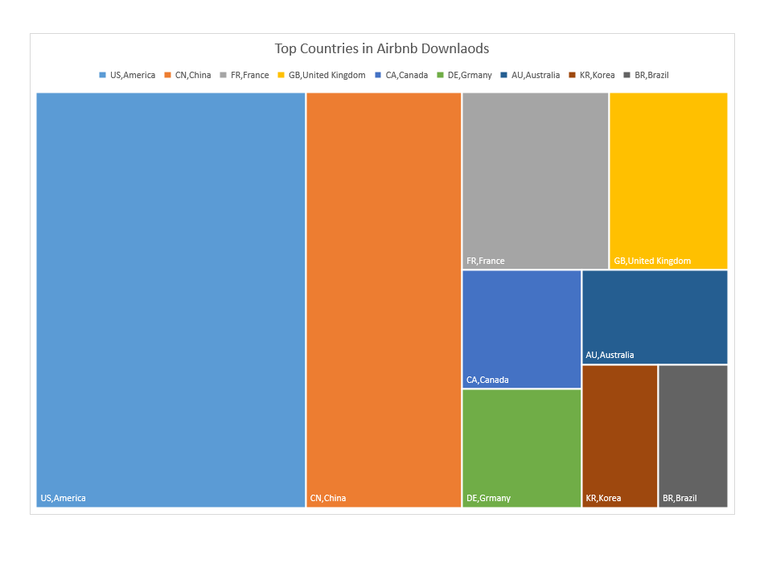

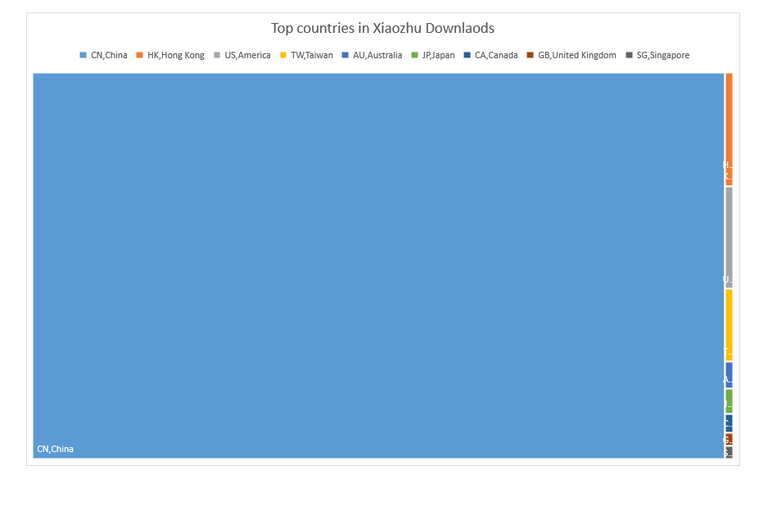

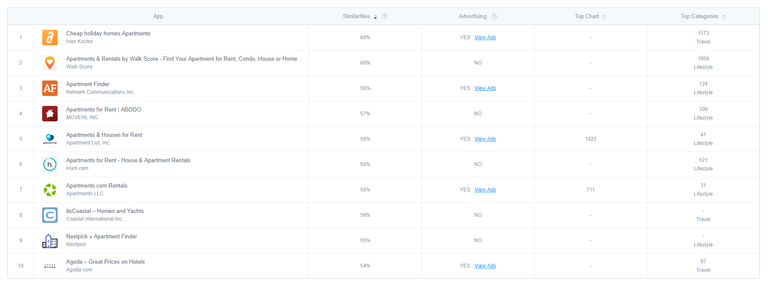

AppBi data shows that Xiaozhu rarely used in countries outside of China, but Airbnb is popular in multiple regions.

• They provide different services

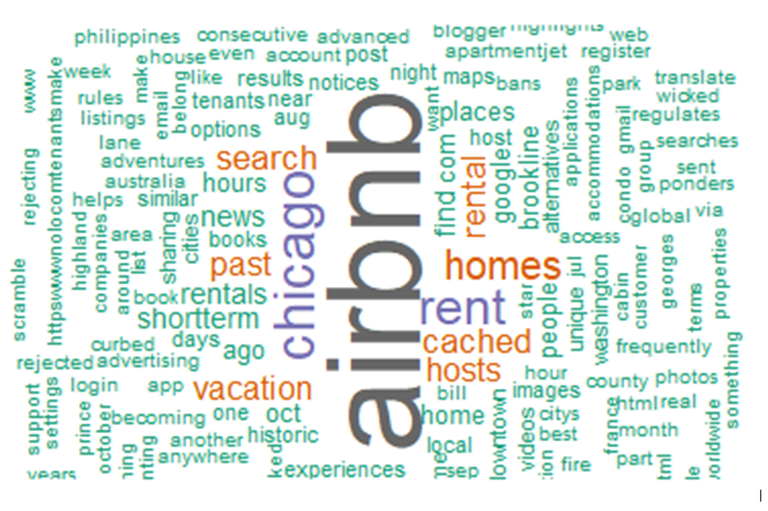

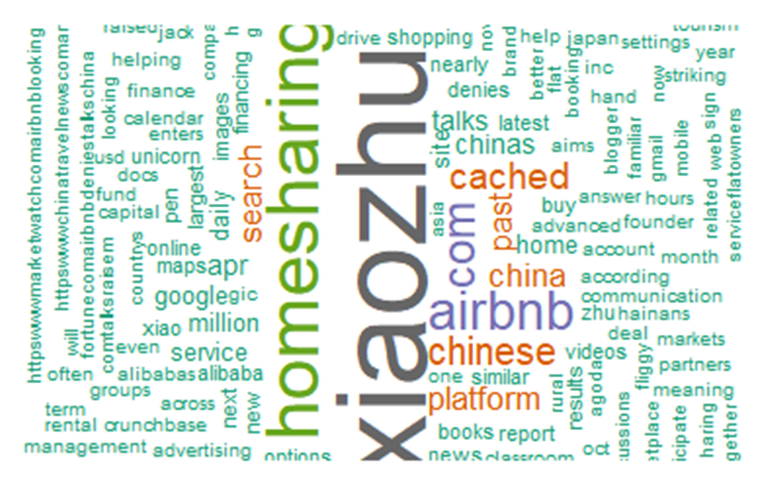

Online user commentaries reveal that users using Xiaozhu tend to focus on local cities and China-related terms whereas Airbnb users often concentrate on outbound travel. Airbnb is connected to words like “adventure,” “lane,” “google,” and “vacation.” Xiaozhu is linking domestic users with terms such as “Alibaba,” “flat,” “shopping,” and “services.”

Many referred to Xiaozhu as “the Chinese Airbnb,” but they are innately different. Xiaozhu targets local users in need of short-term accommodations. The flats they rent are geographically close to shopping malls, hospitals, and schools. Airbnb is often booked by backpackers or seasoned travelers who are seeking adventures.

On AppBi platforms, search words related to Airbnb often connect to heavy travels such as “motels” and “adventures.” However, Xiaozhu’s leading competitors are property rental services.

• Airbnb is hardly present in second-tier cities

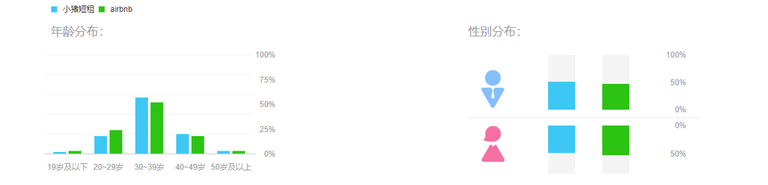

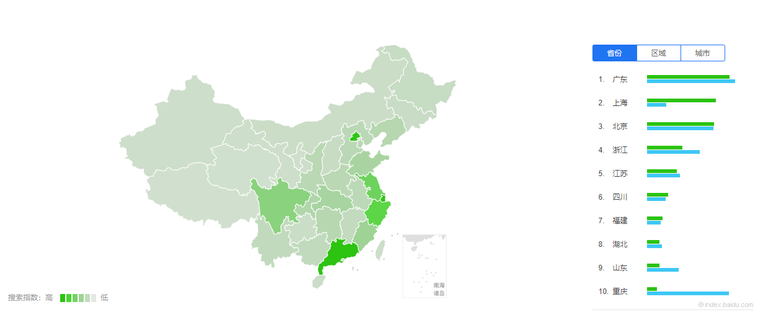

Baidu Index reveals that searches on Xiaozhu spread across China, but Airbnb only concentrates in mega-cities like Beijing and Shanghai. The two Apps have very similar user distribution regarding age and gender. However, Xiaozhu is more popular among the 30s whereas Airbnb is beloved by the 20s.

It’s not about Xiaozhu. It’s about BAT

Today, Airbnb is experiencing growing difficulties to operate in China. After the departure of Uber, some predict that Airbnb would be the next one. Localization efforst in China were heavily criticized, especially the Chinese name translated and pronounced as “Aibiying” sparked massive user discontent on social networking sites Weibo.

• Culture matters, but management is the bigger problem

In 2017, Xiaozhu launched its “one-stop management” services to users so that people who rent their properties do not have to worry about management. Airbnb, on the other hand, requires renters to be responsive at any time. Unlike Chinese who were born in the 60s and 70s, the younger generation shows more interests to earn extra bucks through renting properties and sharing their houses; however, many of them have day-time jobs and do not have the leisure to manage. Hotel-alike operation provided by Xiaozhu not only offers users a sense of trust but also puts less responsibility on the property owners.

• BAT is behind this

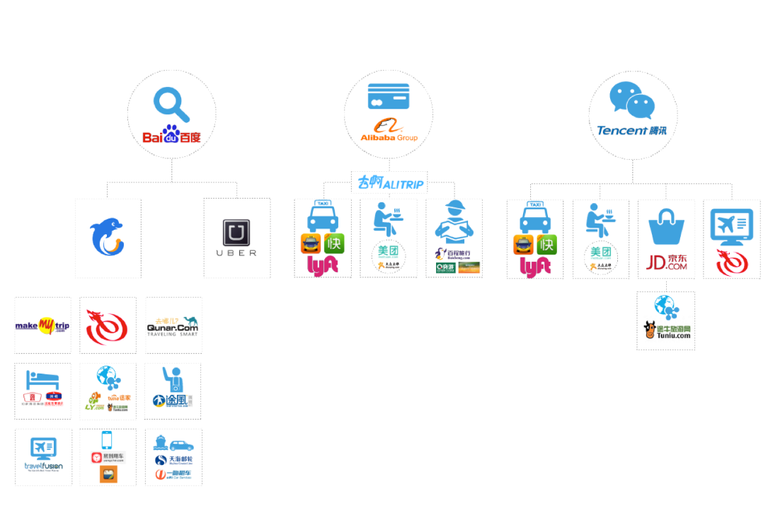

Since 2015, the online travel industry proliferated in China and the combination of sharing and traveling became a new trend for the millennials. While many consider the biggest rival of Airbnb as Xiaozhu, the real players behind this are China’s three pillars in the Tech industry---BAT.

Since 2016, BAT began to back up online travel platforms aggressively. Xiaozhu received strong support from Alibaba and Tujia is connected to Tencent. While Airbnb is only capable of providing home-sharing services, Xiaozhu and Tujia are capable of “one-stop management” from travel, shopping, to payments.

While regulatory measures and the complexity of Chinese culture can be daunting for Airbnb, what’s more intimidating was the bomb thrown by the BAT.

China’s home-sharing market is heating up again, and the benefits can be luring. In 2016, market size reached nearly $8 billion, and it continues with exponential growth. Tujia is now expanding its influence in the overseas market together with Tencent-backed travel tycoon Ctrip. Xiaozhu, with support from Alibaba and its new smart initiative, could soon dominate the market with its aggressive approach.

Although Airbnb also plans to triple its local hires and double its investments in China, the US and the world-leading home-sharing player still need some powerful innovations to impress Chinese users as competition intensified.

AppBi

AppBi is a leading data analytics consulting firm specializing in Apple Search Ads and industry insight analysis. We help developers and marketers with effective BI platforms powered by AI technologies and advanced algorithms.