Apple has launched a massive country update to Search Ads availability in H1 2018 after two years it has become available to advertisers.

09/2016 Launched in the U.S.

04/2017 Launched in the U.K., Mexico, New Zealand

10/2017 Launched in Canada, Mexico, Switzerland

12/2017 Both Basic and CPI modes available

06/2018 Announced expansion to Japan, Korea, Germany, France, Italy, Spain

08/2018 Officially launched in six countries above. Both primary and advanced ads platforms updated

Despite its late arrival in China, Apple Search Ads has already become familiar to Chinese marketers whom, in many occasions, have acknowledged the importance of this growing technology and its revolutionary role in the advertising industry. Some pioneers have already launched some small-scale campaigns to test the water and explore potential opportunities in this new field. According to the previous results, Search Ads has massive potentials and often leads to high-quality traffic and ROI.

AppBi is one of the leading Tech companies in China specializing in data analytics and Search Ads. Over the past few years, the company has strived to provide the most trusted data to support developers’ decision-makings and promotion efforts. Using data extracted from the App Store and internal database, AppBi released one of the first China-focused Search Ads reports.

This report aims to explain the nature of Search Ads, its growing impact, and address concerns from developers. Which categories perform better with Search Ads? How many shares are occupied by Chinese Apps in the U.S. market? How to correctly select keywords? All of those questions will be discussed in-depth through this report.

- Trend in the U.S. App Store

Traditionally, the U.S. is often considered the very first stop when a company launches its global campaign. As one of the first established App market, the role of U.S. store is indispensable. However, the expansion of Search Ads is about to change this hegemony. With Apple Search Ads being available to increasing number of countries and regions, the role of U.S. App Store will evolve and transform accordingly. In this report, AppBi summarizes several key changes that will ultimately shift the future of App advertising.

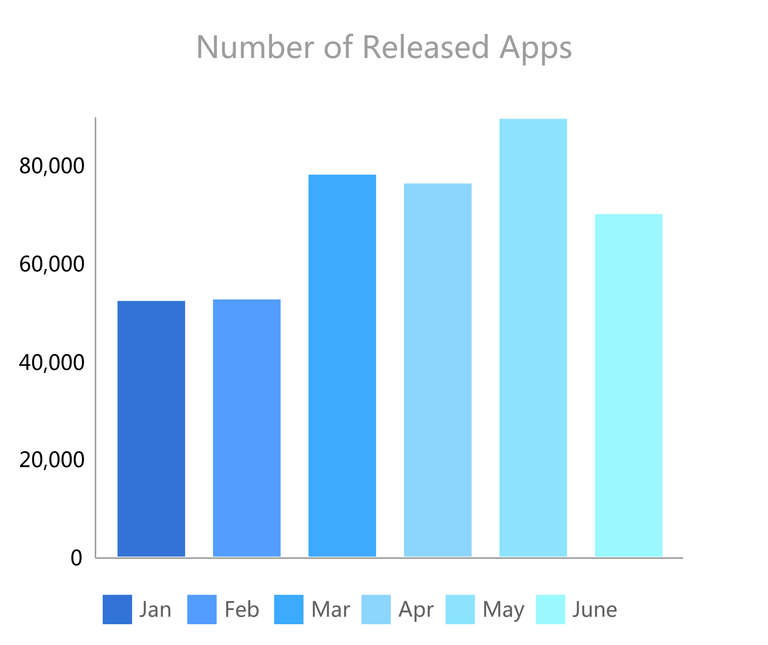

- The Number of Apps Released

In 2018 H1, the average of monthly App release reached 60,000. The number of releases remains low in January and February, but hiked up in March and peaked in May. At the end of this surge, the number of App release hit an all-time high of 90,000. As Apple Store tightened its policy since March, the number of App release starts to decline in June and returns to a slower pace of growth.

Starting in June, an increasing number of companies readjusted their strategies to align with Apple’s new policies and direction. Developers need to follow closely with Apple’s updates to make better decisions with their objectives and strategies.

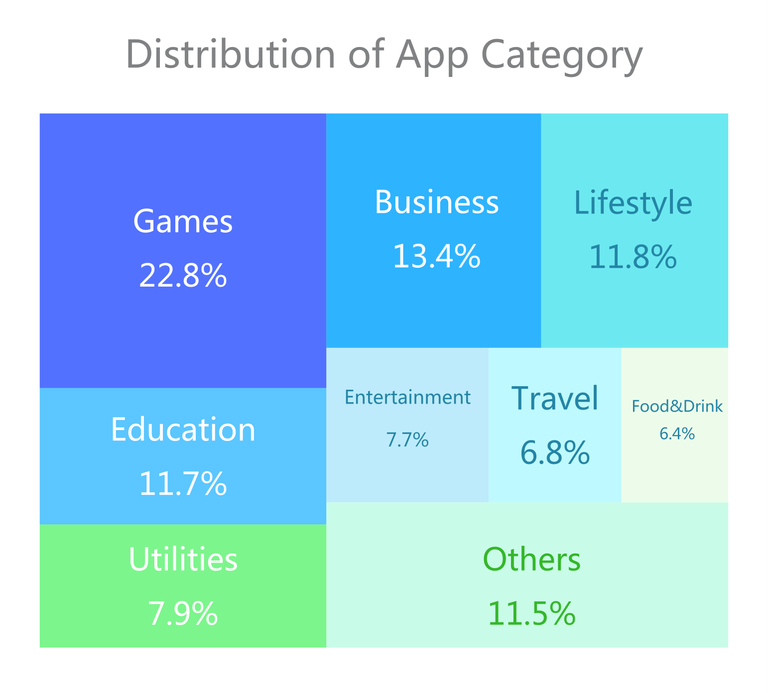

- Distribution of App Categories

Similar to statistics from previous years, Games remains the most popular category in the U.S. App stores. Business and Lifestyle stay the second and the third, accounting for more than 30% of the total. As online education becomes matured and prevalent, education developed into the fastest growing category, accounting for 11.7% of all Apps in the U.S. market.

The decline of traditional educational institutions worldwide has given online education an unprecedented opportunity to grow and thrive. Apps like Udemy, Coursera, and Lynda experienced radical user and profit growth over the past few years. Users are more willing to pay for online education and short courses that could teach them concrete, technical skills as a substitute for well-rounded liberal arts education. Furthermore, parents are more willing to pay for “Education + AI” which have the capacity to provide customized and most needed study materials with data-driven methods.

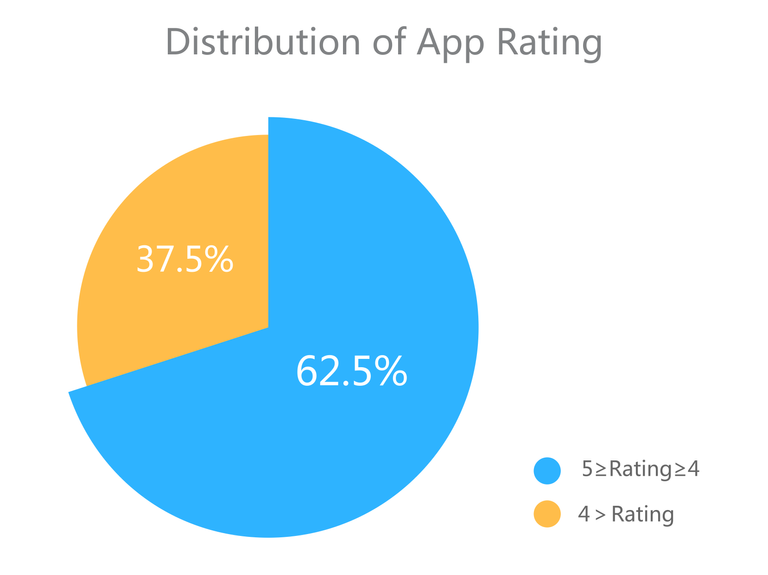

- Distribution of App Ratings

In 2018 H1, the updated system has created massive opportunities for Apps to improve their ratings and start once again from the scratch. Once the user upgrades their system, previous negative comments would be cleared out, and developers will have a new opportunity to adjust and reestablish their brands. The 2018 H1 also shows an overall improvement of App quality. More than 62% received a rating between four and five stars.

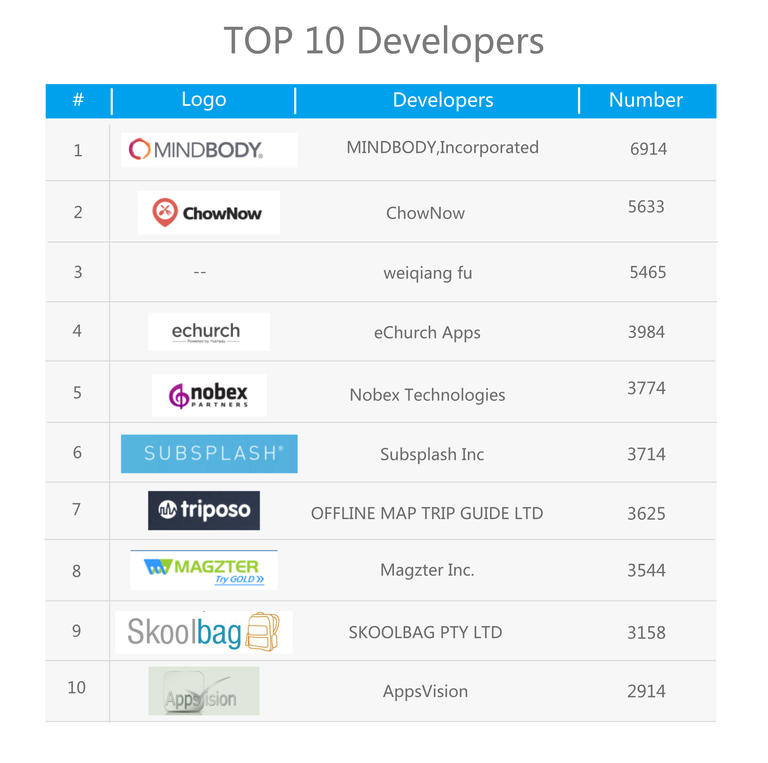

- TOP 10 Developers

In 2018 H1, most top developers are massive producers. The No. 1 developer, Mindbody, has released nearly 7000 Apps in total. In the U.S. store, the majority of the top ranking publishers concentrate on Food, Health, and Online Retail. This very phenomenon creates opportunities for China’s e-commerce giants who have the ambition to conquer markets not only in China, but also global arenas.

- Search Ads Report in 2018 H1

Introduced by Apple in 2016, Search Ads has grown to become one of the most popular tools for App developers and marketers. In the following section, we will look at the performance of Search Ads in the U.S. and its implication to the Chinese market.

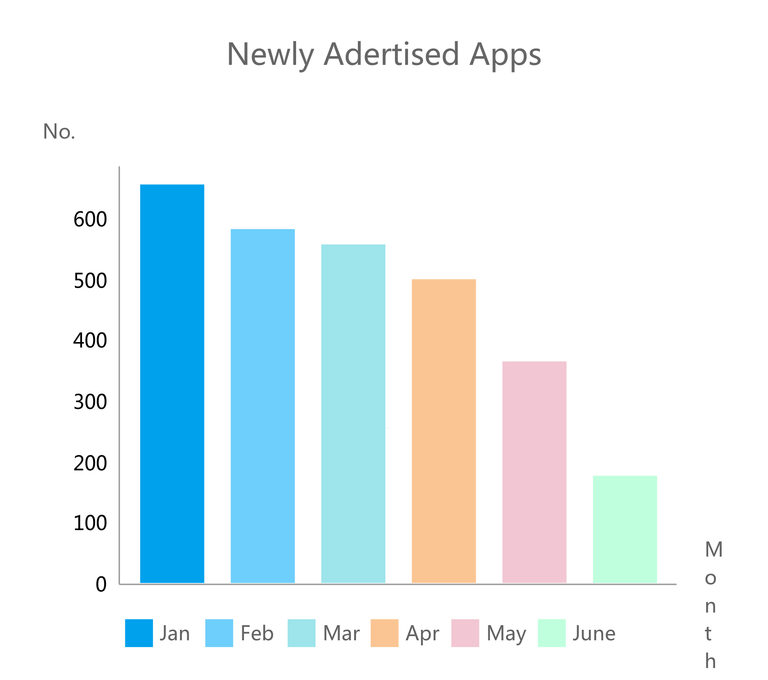

- Newly Advertised Apps

As the first market to launch Search Ads, the U.S. market was appealing to many App developers and markers. In 2018 H1, however, the profits of Search Ads began to decline, and newcomers were no longer given the opportunities for “easy money.” Since the beginning of 2018, Search Ads becomes available to an increasing number of countries and regions, challenging the U.S.’ dominance and carving up its market share. In 2018 H1, newly advertised Apps in the U.S. dropped rapidly whereas other markets rose up with opportunities. Analysts from AppBi believes the use of Search Ads could experience another peak in markets outside of America.

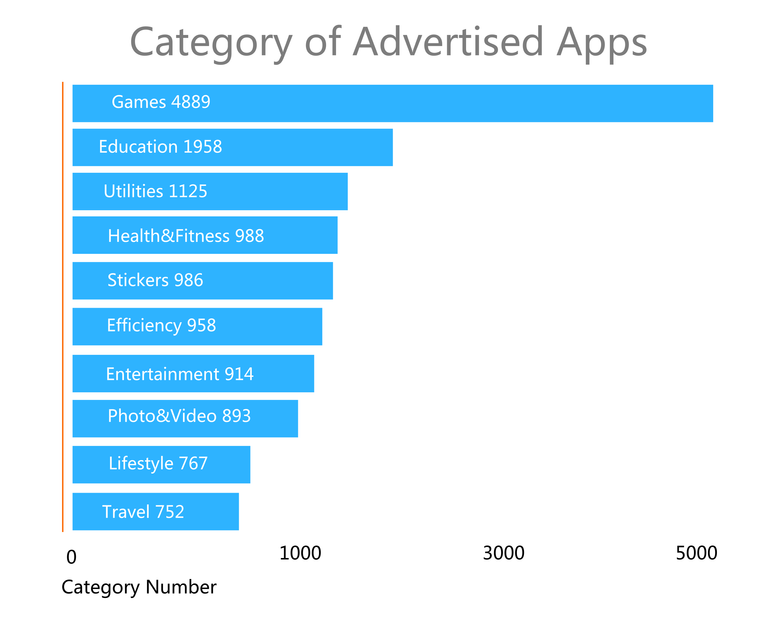

Categories of Advertised Apps

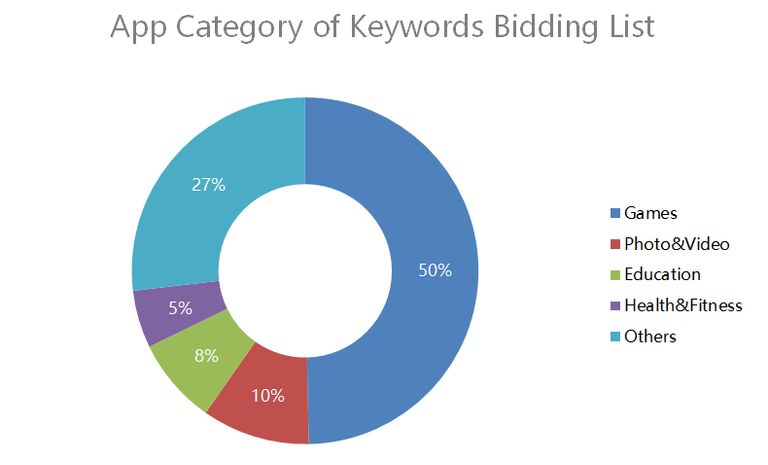

The Top 3 categories of advertised Apps are Games, Education, and Utility. According to AppBi research, paid Apps are more willing to experiment with different types of promotion methods. Search Ads were especially favorite to companies that produce paid games whom embraced its high retention rate, effectiveness in acquiring accurate users, and promising conversion rate.Distribution of Search Ads keywords and Apps

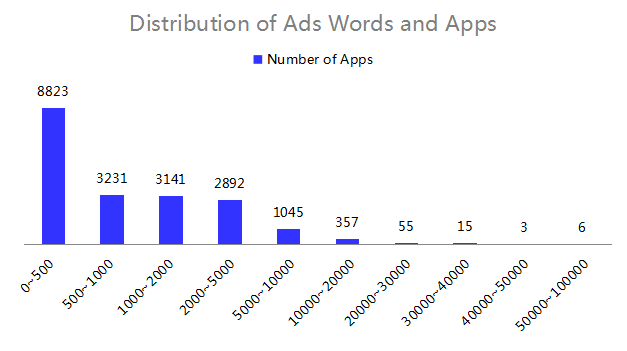

As a result of AppBi data, developers still remain hesitant in going full-scale with Search Ads. Most developers chose the range of 0 to 500, and only 6 purchased the 50,000-100,000 package. According to Apple’s policy, each keyword must be set to a corresponding bid, which often leads to higher budget consumption and no guaranteed ROI.

Specializing in Search Ads Optimization, AppBi provides solutions that could tackle all these concerns with functions like “one-click word selection”, “thousand words selection”, and “intelligent advertising.” Through advanced algorithm and continuously evolving BI system, AppBi could provide the most optimized solutions for developers.

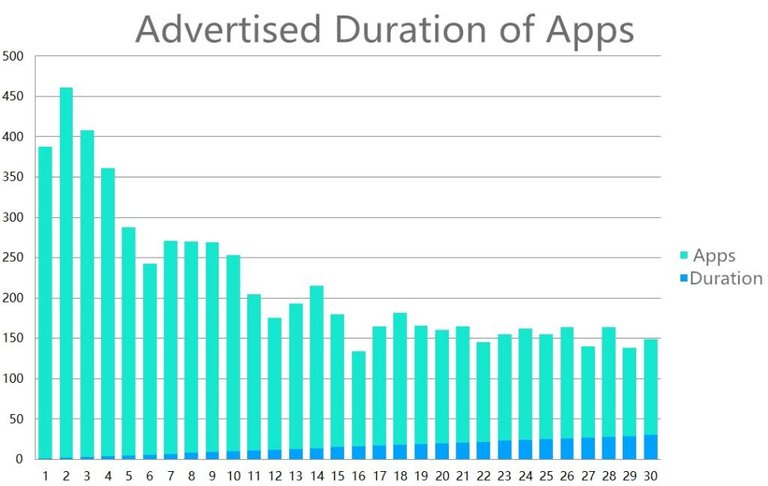

- Advertised Duration of Apps

In 2018 H1, the advertised duration for most Apps is less than seven days. Analysts from AppBi suggests no set rules should be imposed on the number of keywords and length of advertisements. While some Apps chose to advertise for only one day, others may have selected the 184-days option. In 2018 H1, the duration is not the direct cause for App performance, but it does have implications for marketers. With AppBi real-time ad performance, advertisers could terminate their bidding at the most optimized timing and avoid further costs.

- TOP 10 Developers of Search Ads

The Top 10 developers for Search Ads revealed a diverse background of companies who are interested in the potential of this marketing tool.

- Search Ads Charts Analysis

- Geographic Features

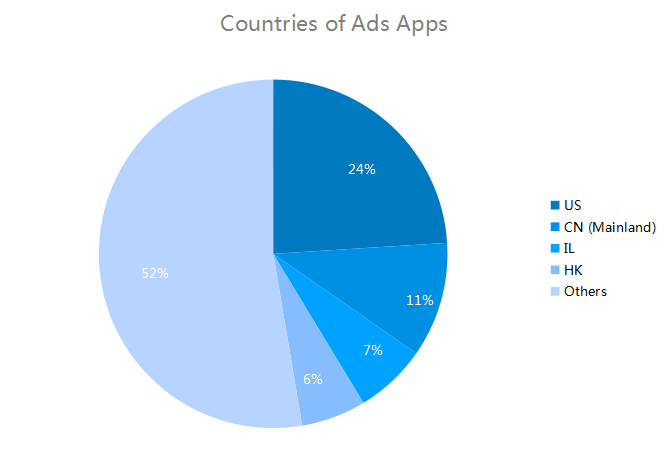

Among the Top 150 Search Ads Apps, the U.S. accounted for 24% with 36 Apps. China (Mainland) ranked second, accounting for 11% with 16 apps. This followed by Israel and Hong Kong.

70% of top bidding Chinese companies produce games and entertainment. Compared to the U.S. developers, Chinese companies are more enthusiastic about the use and potentials of Search Ads.

- App Categories of Bidding Keywords

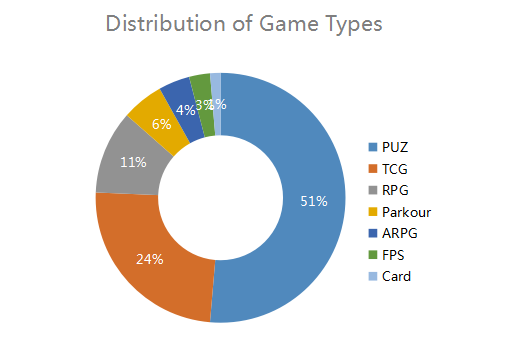

According to AppBi, Apps in the field of Games, Photo & Video, and Education are more willing to integrate Search Ads into their marketing strategy. Developers for “casual games”, like cards, are more willing to bid for keywords.

3)Top 10 Apps overseas by Chinese publishers

Among the top performers, more than 70% are games, and none of them are developed or published by three largest Tech giants in China---Tencent, Alibaba, and Baidu. While their focus remains in the domestic market, second-tier Tech companies like Cheetah Technology and Avocado Mobile have dominated the “going global” arena.

The top performer was launched by a medium-size game publisher called Super Tapx. The company is known for its innovation in games and high-quality distribution capacity.

Among all, Cheetah has become the biggest winner. Over the past years, the company has invested massively outside of China market and becomes a benchmark for the industry of “going global.”

- Strategies for Overseas Publishing

As Search Ads continues to expand its influence globally, Chinese developers could benefit significantly from this dividend period. To fully utilize this new technology and find new possibilities for your business. Below are some critical suggestions for overseas publishing:

Tip 1: “SCLF”

Search optimization: to select keywords with high cost-effectiveness to improve competitiveness;

List optimization: to learn the rules and enhance app ranking;

Conversion rate optimization: to make some adjustments to the product detail page through A/B test, maximizing the conversion rate;

Rating optimization: to improve user experience and rating.

Tip 2: Adopt proper strategies

Unlike other industries, games often experience fiercer competition and have shorter life cycle. While other Apps could maintain a sustainable and long-term Search Ads plan, games require higher standards for keywords precision and concentrated bidding.

Tip 3: Adopt the right keyword

Word selection and pricing are the essential parts of Apple Search Ads. As the core of Search Ads Optimization, factors like relevance to the Apps, word popularity, and competitiveness of the keywords should all be considered.

Over the past 2 years, Search Ads has brought more traffic and profits to developers on the App Stores. According to Apple, Search Ads will go alive in up to 106 countries shortly. We’re looking forward to what it would change the ads field worldwide. We expect ASM to enter China market very soon. After all, the battle over market share should never exclude China.