It’s time to talk about scams.

I am always shocked when I see the numerous internet scams out there.

I am not talking about the obvious ones like “YOU WON THE LOTTERY!” or “I AM A NIGERIAN PRINCE AND NEED YOUR HELP FOR A FUND TRANSFER”.

I am talking about the sneaky ones. The ones you ask yourself about: “What if it really works ?”

We always think that we are too smart to be fooled by these scams and that it could never happen to us or any of our friends. Ok, maybe it could happen to this one friend we have. Yeah, you know which one…

Unfortunately, it is not just about other people. Internet scams are a big industry: worth more than 13 billions of dollars according to last year's statistics ! And it doesn’t look like it will stop anytime soon.

Almost all these scams have similar pattern which makes it possible to spot them early. If you are careful and if you use your critical thinking...

I will not cover internet frauds, "perfect girlfriend" scams, Craigslist scams, or "work at home” scams. Although you should definitely learn about those if you haven’t yet.

I will focus on financial scams because for some reason, people still believe that finance works a bit like magic...

How to spot an internet money scam ?

1. Returns are amazing !

Yes indeed, they will promise you the good stuff. Not 5%, not 10%, but more like 213% or more. Why such high numbers and not something more realistic ?

There is something called the psychophysics of chance that explain how sure events and very improbable ones are overweighted relative to events of moderate probability.

This is why people are actually more likely to risk their money for a bigger return than a smaller one. And they are able to accept much more uncertainty if the reward is bigger. A good example of this is the Lottery. You have more chances of being hit by a meteor than winning very big lotteries, but people still bet against these odds.

This is even more so when people have absolutely no idea of their actual odds or of the mechanics of the system involved. So beware of very high returns.

2. The marketing is flashy !

Here is probably what you will be shown : pictures or videos of nice cars, big houses, private jets, nice suits and furnitures… Basically, anything that remotely looks luxurious. People will speak with authority, from a desk or sometimes from “their” garden. They will do anything they can to appear successful, knowledgeable and somehow like you. This is why they will always have some kind of “rags to riches” story so that you can relate to them or at least to their former self.

So beware of anything that sounds being oversold and if it looks like they are working very hard to recruit you.

3. It is all very complex but not for you !

The “system” is always something no-one can understand except a handful of geniuses. Sometimes it’s not even something that was discovered by humans but by a super computer or came out of some ultra-secret unofficial source.

But fortunately for you, this very complex knowledge is available for only the next 12 hours. All you have to do is click somewhere, give some personal information and probably your credit card details and that’s it !

You will then be able to use the “magic system” and/or replicate what these amazing “unbeatable traders” do.

It’s not always clear why they want you to get rich alongside them. Sometimes, it’s just because they want to “pass the torch” and help someone in need after they made so much money with it. Also at times, they are a bit more transparent and explain that they need the money to scale.

To expand a bit on the subject, let me give you my 3 basic rules about investing. This might help you to avoid these internet scams and also to be able to pass some “too good to be true” deals without any regrets.

3 Golden Rules of Investing

1. Don’t invest in what you don’t understand

I admit I stole this one from Warren Buffett, he said :

“I never invest in anything that I don’t understand”

You might think it’s easy and that you don’t do that, but the truth is that most people have no idea where their money sleeps at night or what exactly is in this fund their banker told them to invest in.

I am not talking about knowing every stock and every company that is part of your retirement plan you invested in. At the least try knowing more about the basics of the financial tools you are using. It’s hard to find someone who knows exactly how much money they have, what their net worth is or what kind of financial products they own.

You don’t want to ignore questions such as: what is the average return of your investments, what is your exposure to a certain kind of risk, and especially what is the fee structure of your investments. Ignorance is not an option, you can either hire people who will take care of your money and monitor what they are doing or you can learn about investing in different types of assets during your spare time.

2. Be ready to lose what you invest

There seems to be a misunderstanding about what investing is. When you invest in something, anything. You might never see your money back. I don’t care what your banker told you, what the real estate agent told you, or what you grandma told you. There is no 100% safe investment. Financial products, real estate, real economy or even raw materials, all of these can lose their value. Know that there are risks and that you can make a profit or a loss. Don’t forget that you will have to pay fees and that everyone will take a cut of your profits and sometimes will charge you on top of your losses. Know your risk and know your investor profile.

Also burn the words of Ray Dalio in your mind :

“He who lives by the crystal ball will eat shattered glass"

3. Diversify

Unless you have superpowers that allow you to know for sure what will happen in the future, you don’t know what’s going to happen tomorrow, which stocks will rise and which one will fall. You also don’t know if that property’s value will be higher, lower or the same in 20 years. One of the biggest moves you can make to avoid losing money is to diversify your investments. William Bernstein in his book The Four Pillars of Investing says that

“The biggest risk of all is failing to diversify properly”

The modern portfolio theory is a good example of putting diversification at the center of your investing strategy. If you know that you will periodically suffer losses and that you are prepared for it, you won’t panic when it happens.

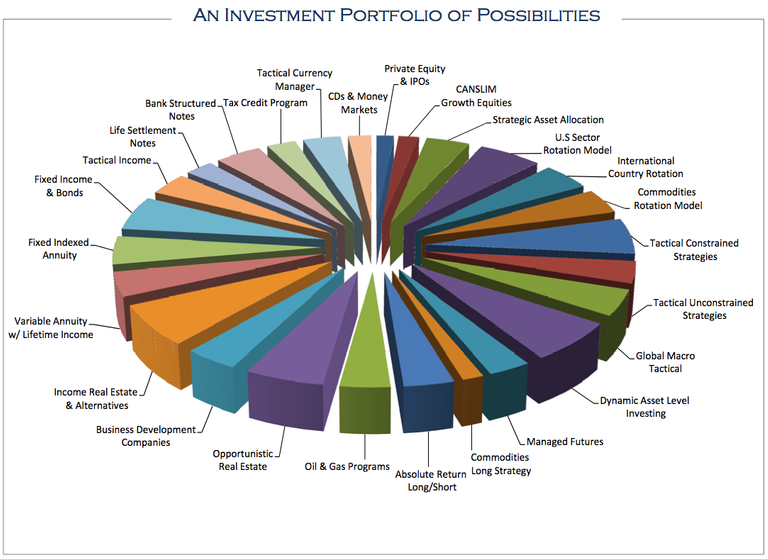

A good way to ensure that you have a better asset allocation is to invest in as many different types of assets as possible: stocks AND bonds AND real estate AND commodities AND business equity.

My goal is to help you think a bit more about what you can do with your money and how you can learn about investing. The more you will know about money, the less chances you have of being scammed or losing all of it during the next economical crisis which means we all experience more stability in the long run.

Here's how you can take action to optimise your investments:

Look at where your money is invested and learn more about the products or the markets you invested in.

Make sure you don't need the money you invest right away and know what is your time horizon.

Choose one type of asset class that you don't own yet and you would like to invest in.

Let me know if you have more specific questions regarding investing.

Bonjour, I am Guillaume.

If you want to know more about me or read more about Finance, managing money and personal improvement go check this out:

Actually the main reason I've not jumped into the whole investment business yet, is because of the number 1 rule! I always want to know what's going on. It's the same way I approached my mortgage.

Hi @playfulfoodie !

This is a good point, sometimes I feel I want to know everything about something before doing anything. If it's a mortgage and it is a huge part of your investments, then it is the right thing to do. If you want to start diversifying and invest slowly in other types of assets, then some basic knowledge is sufficient.

I have a question for you: if you don't invest yet, what are you doing with your savings ?

They are currently on a savings account with very low interest. For now, it's good to have it easily accessible, so I haven't delved into the big world of investment yet. Once life and our living situation settles down a bit, I'll probably be checking out other options, besides a savings account.

I've been spending any leftovers on extra payments on the mortgage to lower my living expenses and debt :-)

It's great to have an emergency basket and to look at other savings accounts options. There are notice-savings accounts that can give you higher interest rates with a bit less flexibility to withdraw your money.

Emergency basket is definitely a must. I've always found it important, even when I was younger and still living with my parents. Now that I own my own house, it's even more important. I would not sleep well without it :-)

Here, we have saving accounts where you can deposit for a set amount of time (years), which will yield a bit more interest. This is one of the options I might look into later.