As a lot of you know I put a lot of work into my YouTube channel where I talk about Crypto but suddenly YouTube keeps changing the criteria to get monetized which I'm still way beyond. So I'm not monetized for that channel and anytime I make a video that isn't overwhelmingly positive about a coin then I have all these people that have been in crypto two and a half weeks telling me

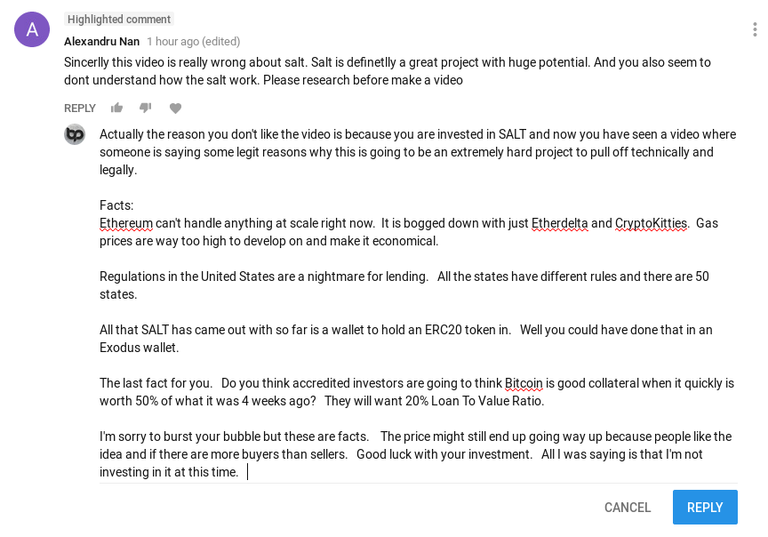

"You Don't Know What You Are Talking About!!!!"

I have stopped reading as many comments and replying to them on YouTube because I don't get paid there but sometimes I can't help myself.

I hope SALT can pull off what they are trying to do. That would be awesome but basically all I was saying in the video is that I'm not investing at this given time but I wish them good luck. This video was from over a month ago.

Investors hate this video.

Here is the original video. (Trigger Warning For SALT Investors)

Earn $10 Of Free Bitcoin From Brian Phobos!

Thank you for reading my post and please consider following me @brianphobos

I know Lending Club and Prosper are very popular so I could see some interest in an crypto based platform, however like you point out every state has it's own money transmitter and money services business laws which would make this project impossible to pull off legally.

Furthermore as someone who has actually used Lending Club it absolutely sucks. They show very high rates of return, however they purposely don't re-calculate it after your chargeoffs are applied so while they may show me earning 8% in reality I'm earning more like 1.25% after chargoffs.

Whether you pick "D" grade credit people or "A" grade credit people you still get chargeoffs. I suppose maybe its better than interest paid in a savings account but your tying your money up for anywhere from 3 years to 5 years depending upon hte loans you pick and the returns are pretty pathetic so while it's cool they are using crypto I still wouldn't use it.

Yeah I looked into Lending Club and Proper a couple of years ago because I thought they were doing something different but in Arizona you can't even invest in loans. You can only buy notes on the platform and from a borrowers perspective it didn't look that sweet. I still get letters saying "Your Approved!!"

I was in bitlendingclub before they folded and lost about 3 of 5 total bitcoin before I pulled out. The vast majority of borrowers actually did pay off their loans, but it only takes a few to wipe out your profit on tens or hundreds of loans(assuming you are trying to be smart and do tons of microloans.)

Another big issue is that when someone defaults, how do you go after them? If they are in your country and your country has a decent legal system you could try and get a lien put on them if they won't pay and pray that you eventually get your money back. However, how do you think you are going to get your money back from borrowers in second or third world countries? You're not!

It is a tough problem to crack and if anyone ever does figure it out they will become filthy rich. I just don't see anyone who has the solution yet.

Nice reply.

Haters be hating. I mostly ignore comments now. Steemit at least so far it's fine for me. Other blogs... forget it.

I hate just feeling like i have to ignore every comment but that is basically what I usually do on YouTube at this point. But this time I was like "What am I doing" Then I decided to monetize the comment by posting it here. LOL

hahahah smart move brother.

Yeah, it's hard for me to imagine how lending can happen without something very stable to back it up.

It makes me think of mortgages - how if the value of a property dips below the outstanding loan, the bank can foreclose (which I think sucks, if you're up-to-date on payments). But would SALT have to implement a similar policy to avoid losing all its collateral in a crash?

I think it will be very tough to find that balance for both investors and individuals trying to take a loan. On one side if you want a loan will a person be willing to put up their BTC but only receive 20 or 30% of the value of it in US Dollars....... It might not be worth risking it for so little cash.

For the investors they are trying to loan on quicksand and could end up upside down in a matter of weeks. So Imagine this. Let's say they did give 50% LTV and then Bitcoin drops 70%. Well the borrower could just not make their payment and let the lender "foreclose" on their Bitcoin and the borrower would have the USD to just go and buy another Bitcoin at a lower price.

From what I understand SALT is mainly a 3rd party bringing the borrowers and lenders together so they aren't really taking on the risk. It is the accredited investors who are taking on the risk. And if you think about it most accredited investors are older and would likely not want to have something so volatile be the collateral.

I'm sure they must have some safeguards in place for this but what's to stop people from taking loans and just walking away with a 70% profit? It happens on Lending Club and Prosper I see the same thing happening here. Maybe once you burn the community your out but your still up 70%.

That is what I figure. A reputation system like on eBay or Amazon but if you cut and run you just burnt that situation out for the short term gain!

Is that really a true a bank can foreclose on you even if your up on payments but property value falls? That's crazy

Someone can correct me, but I'm pretty sure it's true. Mostly because it stuck in my head because it is so crazy. Luckily it hasn't happened to me though, so I can't tell you from first-hand experience. :)

I guess it runs parallel to the idea of any market crash: if value is dropping, they want to sell the house at current price before it gets much lower - to cut losses.

Yeah I guess none of us probably actually read all our mortgage documents but if someone read that it would make you not want to sign. I wonder how the situation would be handled as well. It's not as if they can force you to liquidate your house and take a huge loss, assuming your still paying for it you could have lived there forever and never had to take a loss as at the end of the day for most homeowners a home is a residence moreso than an investment. That's relaly messed up

Did a quick search. Maybe I'm wrong after all. It's called an upside-down mortgage when you owe more than it's worth. And that definitely causes problems. But nothing's coming up where the bank can automatically foreclose on you.

Okay makes me feel better about my mortgage lol. Yeah I suppose as long as you are able to make the payments it doesn't really matter if your upside down. I have one rental property and never really understood how landlords properly managing their funds get into such deep trouble. I think what happens is its flippers because at the end of the day if my mortage is $700 and my place rents for $1400 it doesn't really matter what home prices do.

Great Stuff .. I have known to Salt lending..keep up the good work

Buy Ripple.