Thorchain is a unique protocol with a goal to enable DeFi using native assets. It is a decentralized cross-chain liquidity protocol that enables the exchange of native layer-1 assets such as Bitcoin (BTC), Ethereum (ETH), and others in a permissionless way.

Unlike most of the other DEXs and DeFi protocols, that are using wrapped versions of other tokens on their network, Thorchain enables native coins to be swapped between each other. For example, the biggest DEX, Uniswap has WBTC (Wrapped Bitcoin) on the Ethereum network and then it allows this Bitcoin synthetic asset to be used on the Ethereum network. This comes with more risk added, as the issuer of the WBTC tokens on Ethereum needs to hold the appropriate amount of BTC on the native network at all times. It’s a similar situation for other tokens and networks.

Insolvency Issues

Thorchain started experimenting with new features and one of them was lending. The thing is the way they implemented had inherent risk into it. No interest, no liquidation. Users can deposit native BTC and borrow USD. BTC is locked in vaults as a collateral, but the protocol uses it to buy RUNE and generate liquidity. When users want to redeem the collateral, the protocol needs to mint new RUNE, buy BTC and give back the BTC. As the price difference between RUNE and BTC grows in favor of BTC withdrawing BTC becomes for expensive for RUNE, minting more and more tokens to give back the collateral. More tokens create sell pressure, pushing the price down, that results in even more new tokens needed, ending in a death spiral. This is just a short description of the situation and not totally accurate.

Since yesterday withdrawals are paused for 90 days from node operators to figure out ways how to safely give back the collateral without causing deaths spiral. Everyone that deposited collateral in the lending vaults have now their tokens locked. The number mentioned is 200M debt. Allocating some of the revenue the protocol generated from fees are some of the option mentioned.

New features are always risky but the speed this situation evolved to a total thread to the L1 protocol is reckless. I remember there were caps on new things slowly raising them. Here this is obviously not the case, and it grows to big to fast.

Here we will be looking at:

- Total value locked TVL (collateral)

- Trading volume

- Transactions

- Top tokens

- Defi protocols rank by TVL

- Price

The data here is compiled from different sources like DefiLama and Runescan.

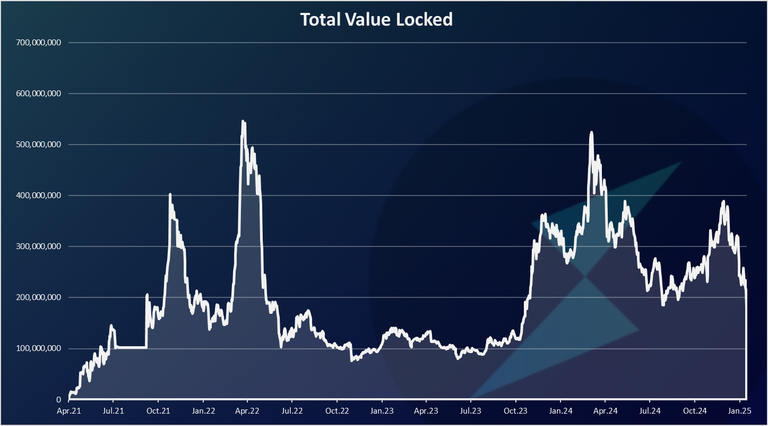

Total Value Locked

Here is the chart for the total value locked in the protocol.

The TVL for the Thorchain has been on a wild ride. It increased a lot back in 2021 during the previous bull market, reaching more than 500M and then dropped to 100M during the bear market in 2022 and 2023. At the end of 2023 and 2024 the TVL increased again reaching its previous ATH to 500M in April 2024. A drop in the summer of 2024 and growth towards the end of the year.

The start of 2025 has obviously not been pretty and there is now a drop below 200M.

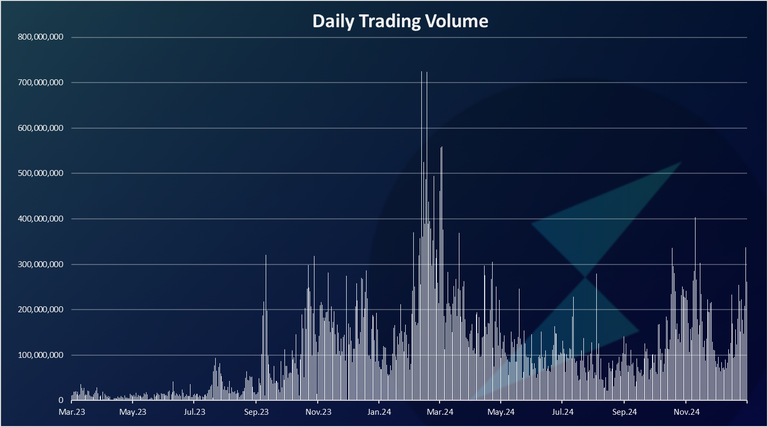

Trading Volume

Here is the chart for the daily trading volume on Thorchain.

We can see the significant growth in the last period in the trading activities on Thorchain. Unlike the TVL where the recent spike is at the levels of the previous bull market, the spike in the trading volume in 2024 is much higher than the previous bull market. Meaning a lot more trading activity has been going on, and the protocol is much more used.

Back in 2024 the daily trading volume reached 1B for a few days. In the recent period it has been in the range of 100M to 300M daily.

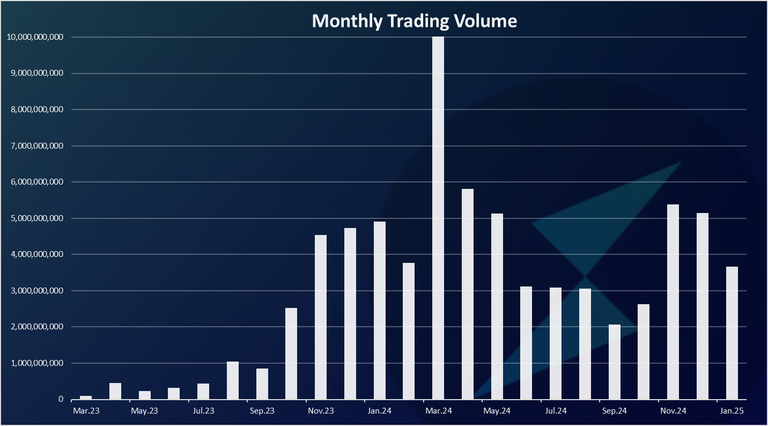

On a monthly basis the chart looks like this:

We can see the spike in March 2024 with more than 10B in trading volume. This is an ATH for Thorchain. A drop since then and the protocol is now around 5B in trading volume monthly.

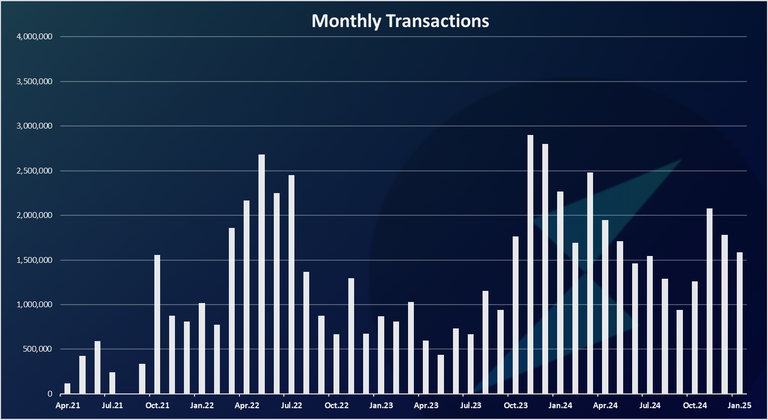

Transactions

The data for the number of monthly transactions looks like this.

These are monthly transactions.

We can see that when it comes to the monthly transactions, the recent numbers are on the levels of the previous bull market at around 2.5M monthly transactions or close to 100k daily transactions.

In the last months this number has been around 1.5M.

Top Coins

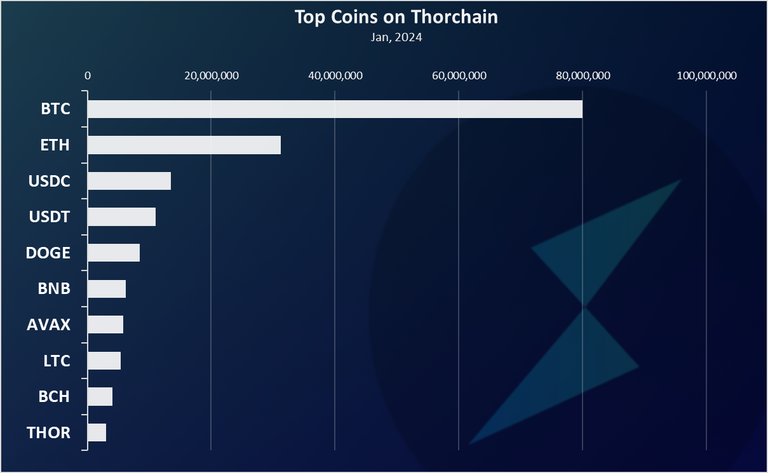

Which coins are deposited the most on the Thorchain protocol. Here is the chart.

Bitcoin comes on the top here with more than 80M liquidity, followed by Ethereum and then the stablecoins USDC and USDT with around 12M each.

Other native coins that are supported are BCH, BNB, AVAX, DOGE and LTC.

Top Defi Protocols Ranked by Trading Volume

How is the Thorchain protocol doing when compared to the other ones? The trading volume is usually one of the metrics these protocols use.

Here is the chart.

This is a one week trading volume.

The Solana DEX Raydium is on top with a massive 50B in weekly trading volume. Uniswap the OG is on the second spot.

Thorchain is lower on the list with 1.3B weekly trading volume. Still a lot of trading volume but far from the top protocols.

Price

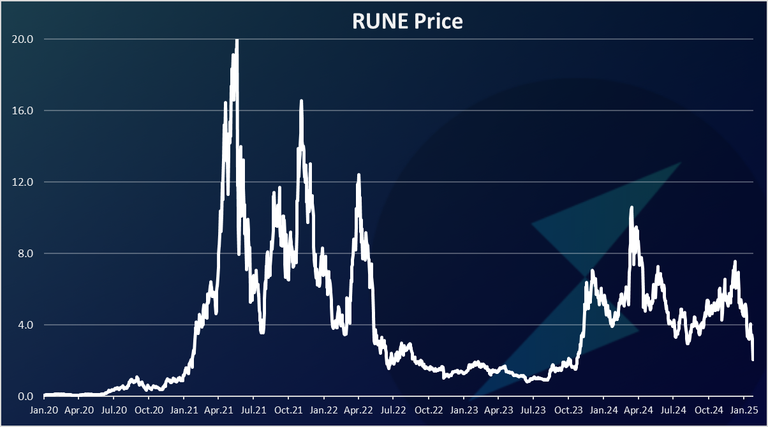

Here is the chart for the RUNE token.

Quite a wild ride for RUNE, going from a few cents in 2020 to $20 in 2021, and down to 0.8 USD in 2023. A growth in 2024 and now a drop again to the 2$ levels.

It is now critically important for RUNE to maintain a price stability in order to be able to survive and go trough the withdrawal process of the remaining collateral in the lending program.

All the best

@dalz

It has currently a nice rebound. I had not expected this.

This is an amazing thing to happen to Thorchain. The promise of decentralized cross blockchain swaps is a huge thing in the future of cryptocurrency. I hope they survive this calamity.

Upvoted, reblogged and support given to your blog.

Consider becoming My Premium Subscriber.

Swap em! Grade, Transfer.. its ALL good.. 😉😎👌

"Bitcoin comes on the top here with more than 80M liquidity"

I have knew that bitcoin will come up with the much liquidity

The rewards earned on this comment will go directly to the people( @tsnaks ) sharing the post on Reddit as long as they are registered with @poshtoken. Sign up at https://hiveposh.com. Otherwise, rewards go to the author of the blog post.

!PIZZA

$PIZZA slices delivered:

(4/10) @danzocal tipped @dalz

Congratulations @dalz! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 370000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPThat was a sharp rebound

YIKES. Thanks for the breakdown -- a cautionary tale!