[Link to article - https://www.finder.com.au/ripple-leak]

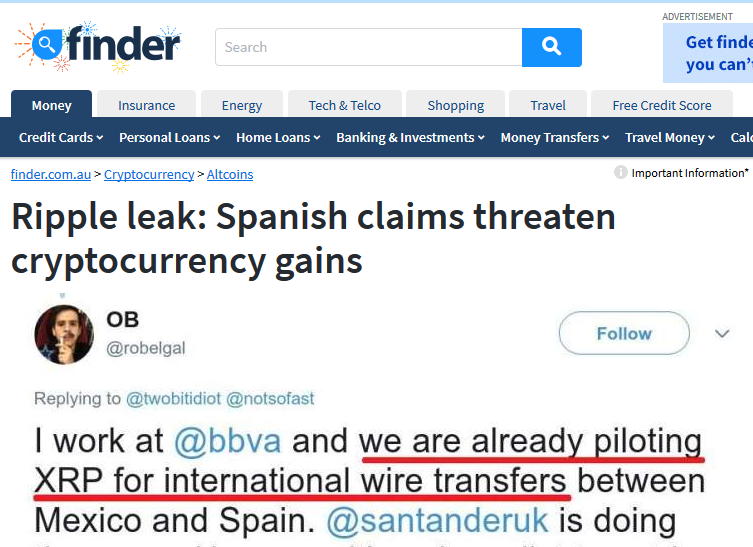

This article came to my attention and with the current rise in the price of Ripple of course I thought straight away it's more fear, uncertainty and doubt from some interested party.

Yes and no....

In particular, I have had some experiences with banks pretending to adopt crypto currency but most of the IT department and legal departments seem to be spending big budgets of shareholder money with no real intention for Blockchain development to actually see the light of day in reality.

So the title of the article did not surprise me because the banks that I have had any experience with have said we want to be in this Blockchain trend but we don't want a public ledger when describing the brief to their department managers and lawyers. Thus, making any efforts to bring a product to market impossible.

But something within the article jumped out at me...

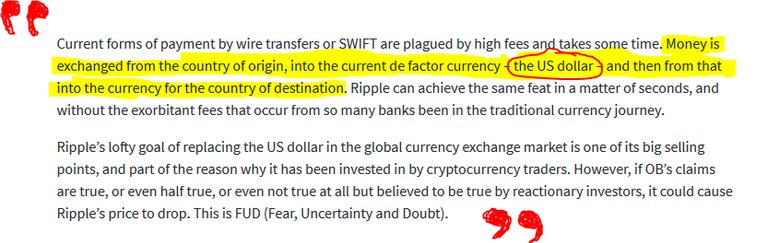

Of course the bank in the article is lying about Ripple not working. (I hate Ripple with a passion as much as the next guy for ideological reasons), but it does work for settling transactions. See.... this part and anyone who understands how the Petro dollar gave the US dollar value, so too, the Swift settlement system props up the worthless USD (below)

I spend all of my time investing in Initial Coin Offerings (ICOs) and the first rule is that there is risk involved in everything, and where there is risk there is reward. And especially, if there was no FUD surrounding a project it would be the exception.

With this in mind, the crypto currency that does get mainstream adoption by the banks will moon in price. While I hope it is not Ripple, if it is, we have not seen the end to it's rise.

Not ideal, but possible,

thefernandaman

Thanks very good post !!!!

Awesome Work!

Keep it up!!!

@cryptoinvestinfo

your CryptoInvestmentExpert

Thanks very much...