This concise article will give you all you need to know about ripple. What it is, why major banks across the world are using it and how you can invest in ripple with the minimum of effort. It is an informative guide for you to learn more about ripple without having to do the huge amount of research needed to make an informed decision of your own. The information is NOT meant as financial advice, nor to encourage or dissuade you from investing in ripple. The step by step guide is easy to follow and contains links for further reading and taking action. I recommend you right click on the links to open pages in a new tab on your computer or device so you can keep reading without losing your place. The trademarks used in this publication are for clarification and recognition purposes and used under the Creative Commons copyright license agreement.

What is Ripple & How Can I Buy Some?

Ripple is an internet protocol for financial transactions. It uses a shared

ledger to track balances among parties, regardless of their geographical

location. This allows each payment to clear in seconds rather than days.

It also makes it possible for a person who uses one currency to

seamlessly pay a person who uses a different currency, making it easy

to transfer nearly any currency to anyone in the world in just seconds.

The Ripple platform makes the archaic system of sending money

through SWIFT or Western Union obsolete and is being used by

individuals and businesses who want faster and easier ways of

managing their funds.

Consider this hypothetical example. Directly transferring currency

inexpensively from Japan to Nicaragua, JPY/NIO isn’t generally feasible.

Instead, an individual or bank will usually trade JPY to USD and then

USD to NIO.

At each step, the fees add up, making for an expensive way to send

money internationally. By using Ripple, one can trade JPY to XRP

(Ripple’s currency) relatively inexpensively, send XRP to the recipient,

either an individual who has a Ripple wallet or a bank in Nicaragua, and

from there, trade XRP into NIO. In other words, XRP is the grease that

allows any currency to be easily exchanged for any other currency on

the Ripple platform.

There is no doubt that real time worldwide payments are the future. The

Ripple platform gives banks a huge advantage both over their

competition and financially.

How Does It Work?

The Ripple network is, at its core, a shared public database. This

database includes a ledger, which serves to track accounts and the

balances associated with them. Ripple supports any currency and gives

users complete freedom to transact in their chosen currency. A user can

hold balances in one currency and send payments in another; the ripple

network takes care of the conversion on the fly.

What is a Ripple Gateway?

A Ripple gateway is a bridge between the Ripple network, a FIAT

currency, and other virtual currencies. It enables customers to do three

things:

● Deposit funds in exchange for a balance issued by that gateway.

● Transfer their balance to another customer of the gateway.

● Withdraw funds by redeeming a balance issued by that gateway

Why Are Banks Using Ripple?

A few banks have embraced the Ripple platform including, Santander,

Axis Bank, Yes Bank, Westpac, Union Credit, NBAD, and UBS, among

others. According to Ripple, banks can save an average of $3.76 per

payment by using their protocol. Considering that banks perform

thousands or perhaps millions of transactions every year, this represents

a significant savings.

If there is one thing that captures the attention of banks, it is how to

make more money, while saving more money. This is why Ripple, or a

real time, inexpensive, global settlement network similar to it, has a

bright future ahead of it, as they are offering a new way to conduct

business that brings financial institutions up to speed in the Internet age.

If people and banks from around the world turn their fiat into XRP and

collectively decide not to move back into fiat, the price of XRP will no

doubt skyrocket.

How to Buy Ripple in Simple Steps

Get a Ripple (XRP) wallet

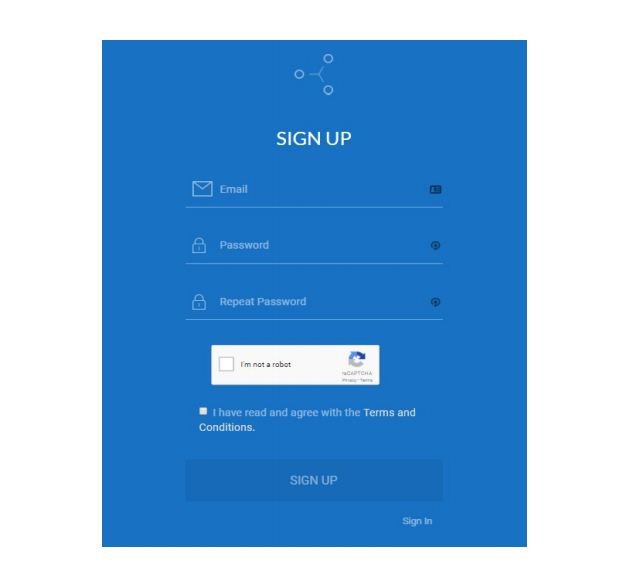

Gatehub is an exchange that supports XRP. First, sign into GateHub

and go through their KYC process. GateHub accepts SEPA transfers

and bank transfers, although there is a $15 fee for bank transfers.

After receiving USD or EUR, it can be traded for XRP on the GateHub

trading platform or ‘gateway’. Ripple Gateways are businesses that

provide a way for money and other forms of value to move in and out of

the Ripple network. Gateways can be banks, money service businesses,

currency exchanges, or any other financial institution.

https://signin.gatehub.net/signup

(Right click and open in a new tab)

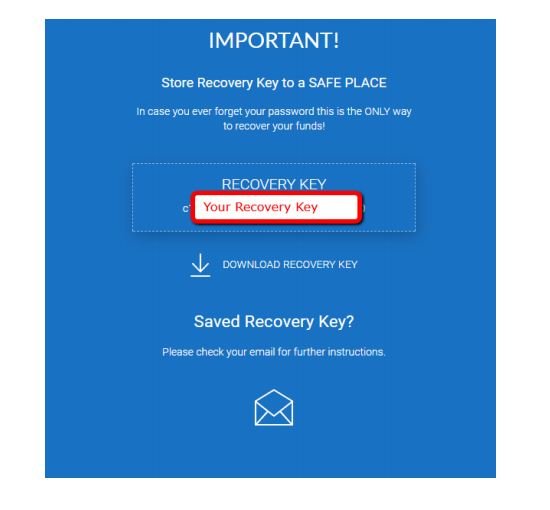

The main thing to note when using a wallet to store XRP is to write

down the secret key and store it in a secure location offline.

Better yet, write down the secure key many times and store it in many

secure locations. This secret key will give users access to their wallet no

matter what. XRP wallets generally operate the same as Bitcoin wallets.

Store Recovery Key to a SAFE PLACE. In case you ever forget your

GateHub password this is the ONLY way to recover your funds.

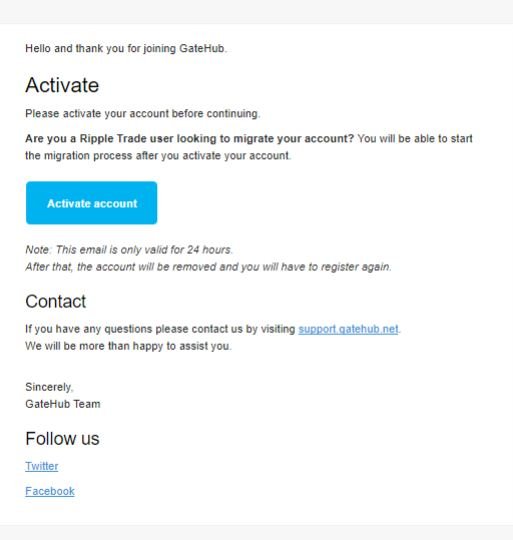

Confirm Your Email

After you stored Recovery Key activate your GateHub account by

clicking Activate account button in the email you received.

Sign in with your email and password.

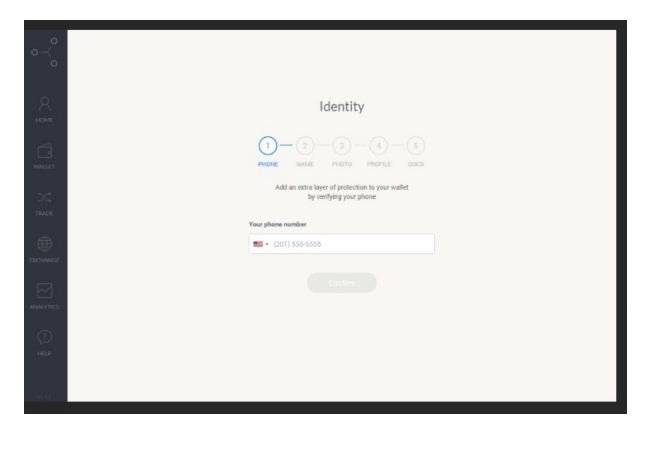

Verify Your Account

Type in your phone number and click Confirm. Enter 4 digit verification

PIN you received via SMS and click Verify. Click Continue after phone

number has been successfully verified. Follow the instructions and

complete all 5 steps before connecting a gateway.

NOTE: You can skip steps 2, 3, 4 and 5 by clicking Skip, I'll do this later.

When depositing a cryptocurrency (such as BTC, ETH, ETC or REP)

GateHub doesn’t require full identity verification.

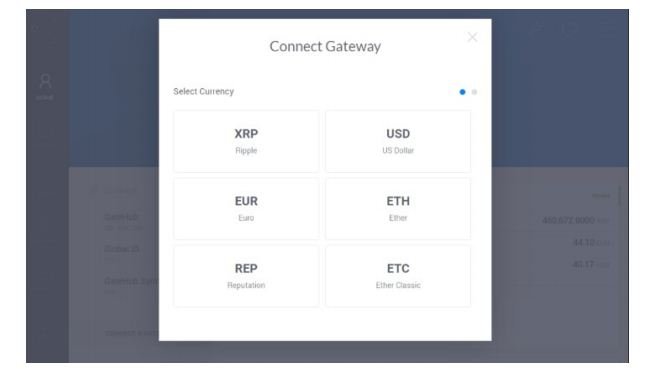

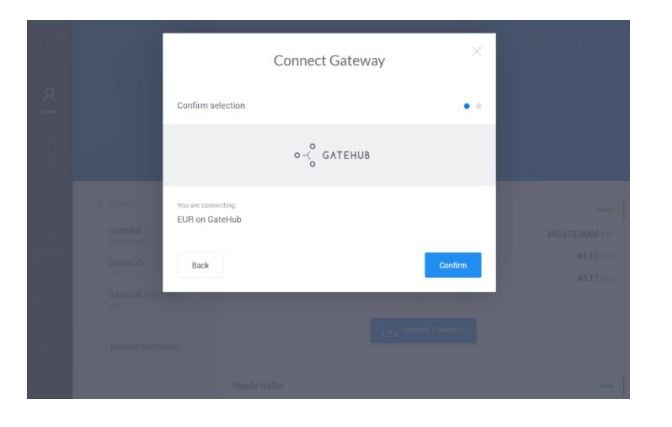

Connect a Gateway

Before making a deposit you have to connect a gateway. On the Home

page click Connect a Gateway. Select a Currency (EUR) and click

Confirm. You will receive an email once gateway confirms your account.

Deposit Funds

After the gateway confirmed your account you can make a deposit by

clicking Deposit / Receive button. To deposit EUR select EU BANK tab.

Go to your bank and deposit any amount using the information provided

on the deposit screen. You will receive an email when deposit has been

received.

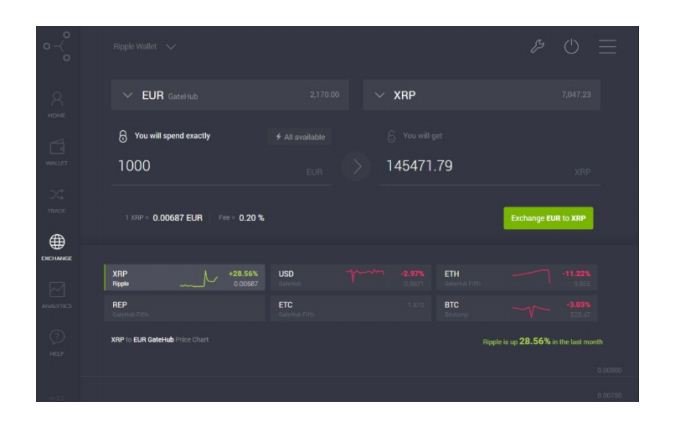

Buy Ripple (XRP)

Once your wallet has been funded you can buy XRP using Exchange

page. Select EUR in the left dropdown menu and XRP in the right. Type

EUR amount you would like to spend and click Exchange EUR to XRP.

It should be noted that every Ripple wallet must initially be funded with a

20 XRP reserve in order to protect against low level spam attacks

Need More Help?

For more information, see GateHub’s Help page.

If you have questions, you can send an email to support@gatehub.net

for additional information.

Withdraw XRP to Your Wallet

I don’t recommend leaving your XRP on the exchange you bought them

from. This is due to the fact that you don’t actually control the private key

for your coins and therefore they are not actually yours.

No matter where you got the coins from remember to withdraw them into

your own Ripple wallet that you hold the private keys to. Once the

transaction is confirmed you’ve successfully finished the process of

buying Ripple.

Hardware, Desktop and Paper Wallets

For top security it is best to keep your XRP on a hardware wallet for

maximum security. Ledger Nano S is currently the most reliable

hardware wallet for storing XRP and a number of other cryptocurrencies

Rippex offers a desktop wallet for Mac, Windows, and Linux that gives

users full functionality. Here is a guide to setting up the Rippex desktop

https://cryptorum.com/threads/rippex-guide-for-storing-ripple-xrp.89/

wallet and sending XRP there for storage or trading.

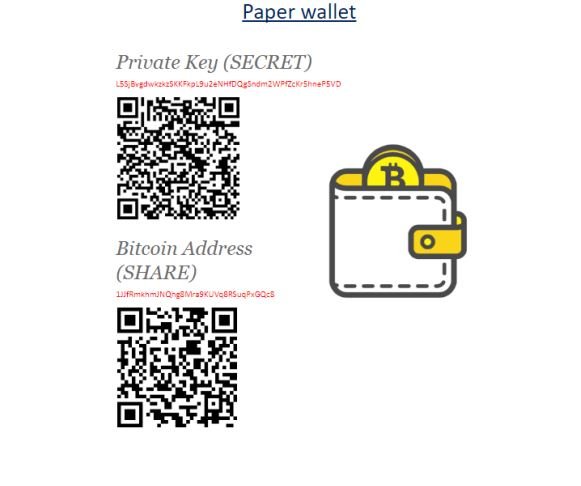

A paper wallet is a very simple way to store your bitcoin for the long run.

The paper wallet is good for non-tech people and is a very robust offline

way to store your coins. If you put the paper wallet in a plastic bag and in

a safe nothing can happen to it. Get a paper wallet at BitAddress.org.

At the current time, there doesn’t appear to be any highly rated mobile

wallets for XRP so I can’t recommend any of the options available. I am

sure that will change relatively soon.

Alternative Ripple Exchanges

There are several options for buying Ripple today. You can either buy it

with fiat currency (i.e. USD, EUR, etc.) or you can trade Bitcoins for

Ripple on specific exchanges.

Buy Ripple With Fiat Currency

The best way to buy Ripple for people who don’t already own Bitcoin is

to purchase it directly through a wire transfer or a credit card through

Gatehub or Litebit.

Bitstamp is another exchange that supports XRP. After signing up and

following their KYC (Know Your Customer) procedure, it is easy to send

EUR through a SEPA transfer or USD by a bank transfer. As soon as

the transfer clears, fiat currency can be traded for XRP directly on their

exchange

Bitstamp also allows people to move funds onto the platform with a

credit card payment or trade Bitcoin directly for XRP. Here are more

details on using Bitstamp to purchase XRP

Buy Ripple with Bitcoin (trade BTC for XRP)

Throughout the Ripple community, the consensus is that the least

expensive way to purchase XRP is by uying bitcoin from Coinbase or

another provider first. Then, bitcoin can be sent to any number of

exchanges and traded for XRP.

The easiest way to trade Bitcoin for XRP is by quickly exchanging it on

Changelly or Shapeshift.

Kraken is another popular exchange that allows users to trade bitcoin for

XRP. XRP can also be purchased with bitcoin by trading it on Poloniex,

and Bittrex, among other exchanges.

Japanese customers can use Coincheck or Bitbank to buy XRP.

Individuals located in Mexico can use Bitso to buy XRP.

Customers located in South Korea can use Coinone or Korebit to

purchase XRP.

Invest in Ripple via a Trading Fund

Platforms like eToro don’t give you actual access to your coins and you

can’t send coins from eToro to other people. The only thing that can be

done with the platform is to buy and sell Ripple for fiat currency (i.e.

Dollars, Euros, etc.). Meaning this platform is good if you only want to

speculate on the price.

The Rise of Ripple

XRP, Ripple’s native currency, took off in value in 2017 when it went from

under $0.01 to over $0.30 a coin. This huge surge in value is due to

both bank adoption and speculative interest.

As it currently stands, Ripple has the third highest market cap behind

Bitcoin and Ethereum.

XRP allows for seamless financial transactions from any given currency

to any other currency with negligible fees. In a sense, XRP is the

reserve currency on the Ripple platform that enables users to trade

nearly any currency of choice into XRP and send XRP globally to

anyone. The individual who receives XRP can then trade it for the

currency of their choice.

Every time any given currency is traded into XRP, liquidity increases, as

does the value of XRP, due to greater demand. In other words, Ripple is

attempting to turn XRP into a global reserve currency of such even

though it may not seem that way just yet.

However, transferring XRP is the easiest and least expensive way to

send value over the Ripple protocol. At some point, it may not make

sense to move into any other currency, while instead, simply using XRP

exclusively for global payments.

Is bit coinIf people and banks from around the world turn their fiat into

XRP and collectively decide not to move back into fiat, the price of XRP

will no doubt skyrocket.

The goal is to turn XRP into a stable currency that doesn’t deviate in

value much so banks would be comfortable moving into it without fear of

volatility. As it stands, many banks don’t want anything to do with XRP

because it can dramatically change in value overnight or even in

seconds. In order to assist banks and payment providers Ripple has

partnered with BitGo to mediate these risks so expect further bank

adoption relatively soon.

A long-term appreciation in the value of XRP is ultimately the end game

strategy for Ripple, as they hold the majority of XRP in existence. This

means that a bet on XRP is a bet on Ripple. It should be noted that

Ripple also offers consulting services to financial institutions and has no

problem securing funding when needed. In other words, it looks like

Ripple is likely to be around for a long time.

How Many XRP (Ripple coins) Exist?

Of the 100 billion XRP tokens in existence, Ripple holds 61 billion of

them. With the company holding the majority of the coins. In order to

build investor confidence, Ripple has locked up 55 billion XRP with 55

smart contracts. One by one, each contract, holding 1 billion XRP,

expires monthly throughout the course of 54 months.

As it currently stands, Ripple has spent about 300 million XRP a month

for the past 18 months to handle expenses. This operational

transparency should give skeptical investors a reason to believe that

Ripple is in this game long-term and would not benefit by selling off their

holdings, thus plummeting the value of XRP.

What Are The Advantages Of Ripple?

There are a number of advantages that XRP has over other

cryptocurrencies, most notably, Ripple is working directly with banks.

While anyone opposed to the banking cartel monopoly may not want to

invest in Ripple on principle alone, there is no doubt that Ripple is

focused on smart business decisions by making ties with the very

corporations that control global finance.

Investors who want to capitalize on the hard work Ripple is dedicating to

their global settlement network are likely to witness a steady increase in

value over the long term by simply holding XRP. Simply put, buying XRP

and forgetting about it could result in 10x or even 100x gains over the

long-term.

Ripple is fast, with transactions confirming in under four seconds. In

other words, it can be used to purchase everyday items, assuming that it

is adopted by both merchants and users worldwide. In addition, Ripple

is scalable, as it regularly handles 1,000 transactions a second. It has

even been shown to handle as many transactions as Visa, more than

50,000 transactions a second.

What Advantages Does Ripple Have Over Bitcoin?

Bitcoin is great, but it isn’t a fast way to exchange value, while Ripple is.

In addition, the cost to send bitcoin has increased significantly as more

and more transactions are taking place on the blockchain, while

transferring XRP is still relatively inexpensive. In addition, the Ripple

network doesn’t get bogged down by transactions like bitcoin currently

does.

The original goal of Ripple was to develop a platform that didn’t consume

huge amounts of electricity like the process of mining bitcoin. In order

avoid mining entirely, all 100 billion XRP were “instamined” that

inherently has drawbacks to anyone who appreciates the benefits of

mining.

Many argue that Ripple is centralized, but the company is working hard

to change that. Ripple is becoming increasingly decentralized through

validator node diversity on the Ripple Consensus Ledger (RCL). In fact,

Ripple argues that it is more decentralized than bitcoin at this point in

time.

One of the biggest advantages, at least from an investor’s standpoint, is

that Ripple is making connections with the banks around the world, while

many see bitcoin and other cryptocurrencies as competition to the

established financial order.

In other words, banks are far more likely to embrace a protocol like

Ripple and its native currency XRP, rather than support bitcoin.

What Are Some Drawbacks To Ripple?

While XRP has some huge advantages over other cryptocurrencies,

some would argue that it is a big brother platform for making global

transactions. Since the original vision of Ripple was focused on allowing

everyday people to make global transactions, like remittance payments,

inexpensively and quickly, the pivot to focusing exclusively on banks was

seen as a turnoff by many. Anyone who likes the Ripple platform, but

doesn’t like Ripple the company may want to use Stellar, a Ripple fork

from Jed McCaleb, as it has more of an altruistic vision.

As stated before, XRP was created all at once and Ripple owns the

greater majority of these tokens. Even though these coins are locked up

in a smart contract and the likelihood of a sell off is small, it is still

something to consider. In a sense, Ripple is the central bank of XRP.

Researchers at Purdue University have determined that the Ripple

platform has security vulnerabilities. Due to its open nature, nodes

within the network could be subject to attack, preventing some users

from accessing funds.

Many people may decide not to invest in XRP for personal reasons,

especially if they are invested in cryptocurrency because they see

cryptocurrency as an escape from the banking cartel and government

control.

On the other hand, investors who are looking for profits and don’t see

anything wrong with Ripple’s business model have every reason to buy

XRP.

Is Ripple Worth Investing In?

Ripple will probably appeal to larger banks throughout the next couple

years, as they offer a global settlement network that enables real time

payments internationally, while reducing transaction fees.

Anyone who purchases the innate digital asset, XRP, has the potential to

earn huge returns on their investment, if Ripple keeps making headway

throughout the banking sector. The concept of XRP becoming an

established global reserve currency is an ideal scenario for investors.

Even though XRP has increased in value significantly in 2017, I believe

this is just the beginning of its ascent. However, as always, were there is

great reward there is also great risk involved.

Please make sure to invest responsibly.

Nice blog.. In case you want to know how block chain tech works you can follow us and if you like our blogs kindly upvote!!

Very informative article on ripple.

Congratulations @sherozealiawan! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!