Come and listen to my story about a man named Jed

Bitcoin dominance in the crypto markets fell below 50% for the first time ever recently, driven almost entirely by the steep rise in the price of XRP. Even while the bitcoin price dropped, the price for Ripple and Stellar tokens kept rising. The market has since seen a reversal, with bitcoin and many altcoins getting a huge boost while Ripple keeps dropping.

Why now?

What's going on with bitcoin to provoke this shift? What about with Ripple? How does Stellar fit in? What do all of these things have in common?

Looking at the available data, I’ve come up with a theory (not proven, just conjecture, but I’ll show you how I got there):

Ripple’s recent incredible price increase was caused by one of its founders, Jed McCaleb, finally cashing out his XRP through what can only be described as a legendary pump to over 40x the starting price. XRP's bull run was led by a steep increase in trading of the FCK/YOU token pair on the Ripple network, by an address beginning “rJed”.

Fundamentals

Before we get into it, let's acknowledge there are some real fundamental issues happening with bitcoin and Ripple that could have an effect on prices.

Bitcoin transactions are slower and more expensive than ever before. That’s partly caused by an increase in transactions due to increased adoption, and partly caused by disagreements among developers and miners over how to solve the problem. When will it end? Who knows, but even with occasional drops, BTC is trading at or near the all-time high right now.

Ripple, on the other hand, has very fast transactions. That’s due to its trust-based validation method. Centralized, trust-based networks are always faster than decentralized trustless ones. While participants don’t need to use Ripple’s list of trusted nodes, their only option is to make their own list of trusted nodes, putting Ripple somewhere in between centralized and decentralized. Ripple is also signing up more and more partners in the banking world to use their network, and more off-network exchanges have started to offer XRP trading.

This is no doubt good news for Ripple the company, and its stock price. It’s less clear what that should mean for the price of Ripple’s network token, XRP. After all, using the Ripple network does not require using XRP.

In fact, through a partnership with Earthport, Bank of America Merrill Lynch has been using the Ripple network to conduct certain transactions since 2013 without using XRP in any way. The InterLedger Protocol allows network fees to be denominated in other currencies, meaning no Ripple user ever needs to own XRP.

But if we look at the charts, the price went up; that must mean more banks signing up led to more demand for XRP, right? Well, maybe. But what else is happening with Ripple?

I said this was going to be a story about Jed, so let’s get to that part:

Uncle Jed

There is perhaps no more controversial figure in cryptocurrency today than Jed McCaleb.

In 2010, Jed founded Mt. Gox. Initially conceived as a way for fans to trade “Magic: The Gathering” game cards, the site became popular for trading bitcoin. In 2011, Jed decided to jump ship and sold majority interest in Mt. Gox to Mark Karpeles, retaining 12% ownership of the company for himself. It quickly became the world’s biggest bitcoin exchange.

Mt. Gox later infamously collapsed into bankruptcy, amid claims of hacking theft and “transaction malleability.” Jed says he lost $50,000 on the Mt. Gox exchange and never received any payments from Karpeles beyond the initial sale, and that the exchange was entirely recoded after the sale. Whether that account is true or not, the stink of Mt. Gox seems to follow Jed around. Rumors abound suggesting he may have been behind its problems, or even its theft and subsequent collapse. But these are rumors.

In 2012, Jed cofounded Ripple with his partner Chris Larsen. Together the two of them created the OpenCoin corporation, rebranded in 2013 as Ripple Labs, and again in 2015 as Ripple. The Ripple network was built on technology developed by Ryan Fugger in 2004. (The first iteration of the system, built by Fugger prior to Jed's involvement, was ripplepay.com)

Jed left Ripple (less than amicably) in July 2013. Later that same year, Jed founded his own crypto project, Stellar (a Ripple clone). Where Ripple focused on banks, Stellar was supposed to focus on individuals using its platform for payments. More recently, Jed started a company called Lightyear to help attract banks to the Stellar platform.

Still, Jed's separation from Ripple seems to have helped attract more traditional financial players to the Ripple platform. Since such partnerships only increased with Jed's absence, so it's hard not to think Jed was holding Ripple back. But the drama didn't end there.

"XRP Dump Incoming"

Here's where the story starts to get spicy.

Because Ripple has no mining, all 100 billion XRP tokens were created immediately when the network started. In one of the most controversial decisions in crypto history, the founders of Ripple granted themselves 20 billion XRP, with the remainder held by the company to be slowly distributed using various giveaways and strategic partnerships. Both the company and the founders have also made charitable donations with portions of their XRP holdings.

After leaving Ripple in 2013, Jed still held most of his founder XRP tokens.

According to Ripple, 61 billion+ XRP are now held by the company, with 38 billion+ XRP out in the wild (including the founder coins). How many are really circulating is less clear. Many XRP that have been distributed by Ripple are bound by contractual obligations with partners to be released only on a predetermined schedule, to avoid flooding the market.

Ripple has previously announced its intent to release 50 billion XRP (half the supply) by 2021. The fate of the remaining 50 billion is less clear. Some are used to pay liquidity providers as a way of compensating for thinner margins. Others have been promised to early investors in agreements that are not public. With the recent run-up, concerns from the community led to most of the remaining XRP tokens being locked in escrow contracts. These escrow obligations are key to understanding XRP's recent rise (one in particular).

On May 22, 2014, Jed announced his intention to sell off his remaining 9 billion XRP (representing roughly one-fourth of the circulating supply) two weeks from the date of the announcement. Naturally, the market took a nosedive; XRP's price dropped 40% that day.

The announcement led to more chaos, with Ripple board member (and Kraken CEO) Jesse Powell resigning in disgust. Announcing his resignation, Powell wrote:

"I’m no longer confident in the management nor the company’s ability to recover from the founders’ perplexing allocation to themselves of 20% of the XRP... Unfortunately, unlike the founders, I don’t have swathes of XRP to dump if I don't think it's working out."

The drama continued as 2 days later, Chris Larsen announced he would donate 7 billion of his XRP to a charity, sparking a price recovery. It was not clear if this was all of Larsen's XRP, or what restrictions were placed on the donated XRP, though there must have been some.

Ripple wanted to prevent the sell-off from actually happening, so they entered into negotiations with Jed. In August 2014, they announced they had reached a deal. The terms of the deal restricted the amount of XRP Jed could sell, rising as time went on:

- $10,000 per week during the first year

- $20,000 per week during the second, third and fourth years

- 750m XRP per year for the fifth and sixth years

- 1bn XRP per year for the seventh year

- 2bn XRP per year after the seventh year.

In April 2015, Jed attempted to sell a large quantity of XRP on Bitstamp. (Why Bitstamp? It was a Ripple gateway, and Jed was invested in it.) Ripple saw this sale as a violation of their agreement, so they froze the funds.

The XRP had been sold, so Ripple froze the $1 million USD from the sale. This did not require intervention by the courts; Ripple simply used their power to freeze any transactions on the network (!) and since it happened through Bitstamp's Ripple gateway, the funds were on-network. Jed objected to the funds being held (of course), arguing that the XRP being sold were not his.

Here Come the Lawyers

A lengthy legal battle ensued (no pun intended), with Jed suing for return of the funds, among other issues. Almost 2 years later, Ripple and Jed reached an agreement.

In settling the lawsuit, Ripple returned the million dollars to Jed, found a buyer for Jed's Ripple stock at a favorable price, and agreed to a less restrictive schedule (based on daily on-network trade volume) for Jed to sell off his XRP. Jed was also required to donate 2 billion of his XRP (subject to his same restrictions) to a donor-advised charity, something he said he had been wanting to do. Jed viewed the settlement terms as a victory.

So what was the new timetable?

"for the first year of the agreement Jed and the DAF will be able to collectively sell 0.5 percent of the Average Daily Volume of XRP for each day of the week, including weekends and holidays.*

for the second and third years of this agreement, Jed and the DAF will be able to collectively sell for each day of the week 0.75 percent of the Average Daily Volume.

for the fourth year of the agreement, Jed and the DAF will be able to collectively sell for each day of the week 1.0 percent of the Average Daily Volume.

for any time after the fourth year of the agreement, for each day of the week Jed and the DAF will be able to sell 1.5 percent of the Average Daily Volume."

How do they figure out average daily volume?

"*Under the settlement agreement, Average Daily Trading Volume is calculated by dividing the Weekly XRP Trade Volume for the week that commenced two weeks prior to the week at issue by seven (7). Weekly XRP Trade Volume is defined as the total amount of XRP traded on the Ripple consensus ledger during a given week between Sunday midnight Pacific Time through the following Sunday midnight Pacific Time. Significantly, this definition excludes XRP traded on third party exchanges, unless in Ripple's reasonable judgment, the XRP market has changed so that the majority of legitimate XRP transactions have occurred off the Ripple consensus ledger during the prior 365 days.

Looking at the Ripple forum post on the agreement, we see that there was immediate concern over the terms:

"Basing the selling cap on a percentage of something that can be as cheaply and easily manipulated as the daily volume is tantamount to removing all transaction limits Jed was subjected to in the scope of the lockup agreement."

Along the way, co-founder Chris Larsen resigned from Ripple in November 2016, with Brad Garlinghouse taking over as CEO. But market-wise, things stayed pretty much normal until March 30, 2017.

Achievement Unlocked

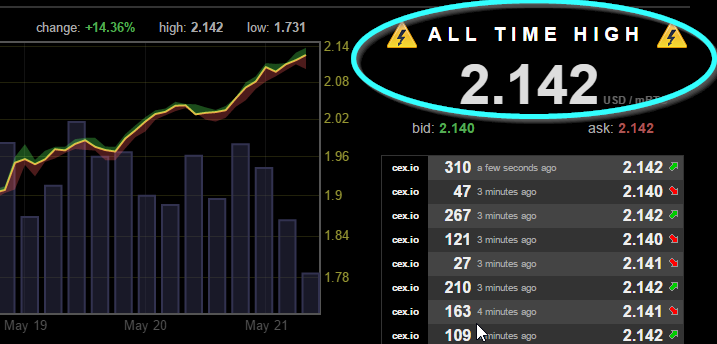

On March 30, XRP started to see a run-up in price. XRP prices had been around 500 satoshis just 2 weeks earlier; starting March 30 and continuing over that weekend, the price went up to about 7000 sats. More than 10x! But the surprises weren't over yet.

Trading cooled off for a few weeks. The price settled around 2500 sats. Volume dried up; then, round 2. On Friday, April 28, the price started on another big climb, this time led almost entirely by trade on off-network exchanges. What could explain it?

Remember what I mentioned earlier – escrowed XRP, sell limits, and escrow conditions are important to understanding this bull run. Let's look at some charts to see what that means:

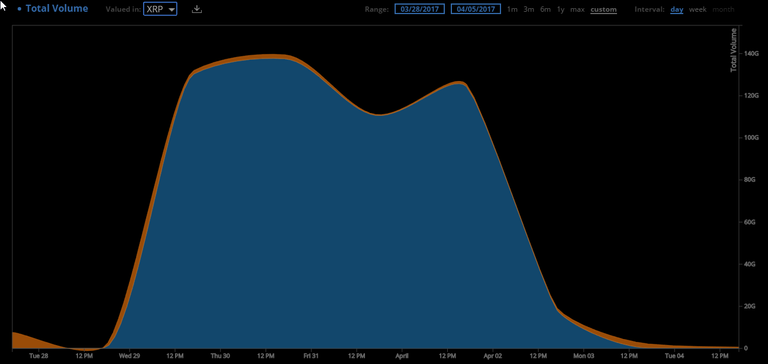

Ripple's on-network trade volume had a HUGE anomalous spike the weekend of March 30. That spike in network trade volume coincided with the initial 1000% price climb for XRP. Ripple's on-network payment volume was flat by comparison. To be clear, this spike represented a 1000x increase in Ripple network trade volume, which lasted only for those few days and corresponded with a 10x increase in price.

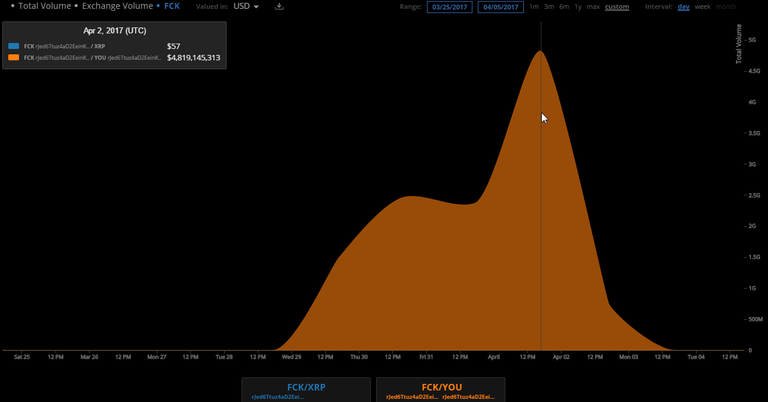

But what accounts for this massive explosion in trade volume? Looking more closely, we see that the volume consisted primarily of one trading pair – FCK/YOU. Is there perhaps a message behind this? The same account traded a smaller amount of FCK/XRP.

The address of the account responsible starts with "rJed" – coincidence?

The rJed account traded trillions of dollars "worth" of the asset it created. Over the course of that weekend, this amounted to an on-network trade volume valuation of over 500 billion XRP. For those keeping track of the escrow conditions, Jed gets to trade 0.5% of on-network volume: 0.5% of 500 billion = 2.5 billion XRP freed up for Jed, and 2.5 billion more for the 'donor-advised' charity subject to the same restrictions.

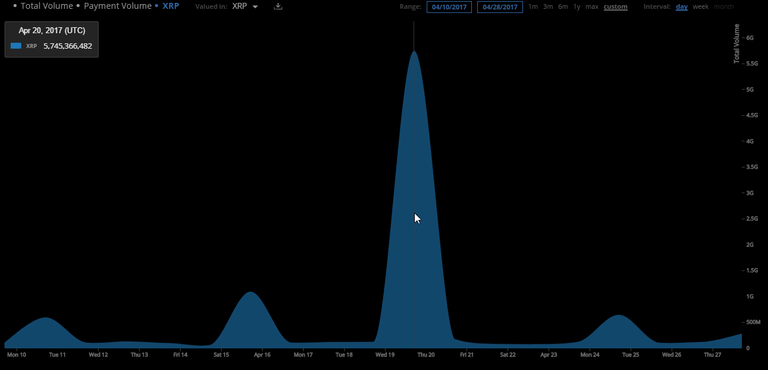

And sure enough, just over 2 weeks later on April 20, we see over 5 billion XRP in one day of on-network payments:

(Typical daily Ripple network payment volume is around 200 million XRP, sometimes spiking to 1 billion. This is a big jump.)

Jed said that (after sales under the previous agreement and making the donation required under the current agreement) his XRP holdings at the time of the new settlement were down to 5.3 billion, meaning that even after the huge FCK/YOU volume spike, he had withdrawn less than half his XRP holdings. He had 2.8 billion acknowledged XRP remaining.

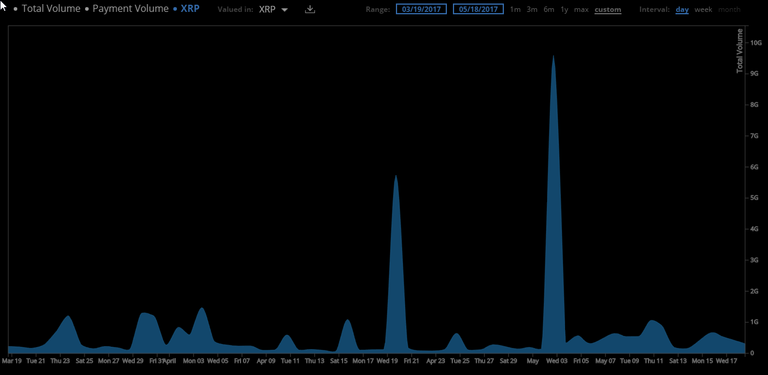

Two more weeks go by, and we see another spike with 9 billion more XRP moved over the network May 3:

What accounts for this? Hard to say whose it is, but it's also hard not to notice where the volume went. The second 10x price run-up (which had exploded beyond the price beyond all-time highs the weekend before) started on off-network exchanges (while Ripple network trade volume sank).

No doubt many long-time holders were removing their XRP to off-network exchanges. Maybe they wanted to find a more active market than the Ripple network itself; maybe they wanted to ensure their funds weren't frozen on a Ripple gateway. In any case, whoever made this huge transfer of XRP seems to have been one or more very large holders cashing in on the spike.

Another curious bit of timing is that, under the agreement, off-network trade volume was excluded from the amount considered for Jed's escrow conditions unless the majority of volume over the preceding 365 days occurred off-network. Not all of those numbers are readily available, but it's easy enough to look at total volume.

For the week of the off-network trading explosion, volume was over 100x the typical Ripple network trade volume, so it's entirely possible that off-network trade for that week was double the volume of the previous year. (I don't have time to make the charts, check it for yourself.) That would mean that off-network volume now counts toward the escrow conditions, which would mean Jed would now qualify to withdraw the rest of his founder XRP.

It seems we can safely guess that some of the 9 billion that moved that day was the rest of Jed's XRP, now out in the wild for real. It had always been part of the circulating count, but now it was unbound by legal agreements. What would Jed do with all his newfound crypto-wealth?

Stellar Moves

Two days later on May 5, Stellar tokens (Lumens, XLM) started to climb. Over that weekend, they climbed 10x from half a cent to 5 cents. Someone must have had some serious money to pour into those markets that day, right? Hmmm :rocket:

Finally, we see another curious movement on the Ripple network 2 weeks after that, as someone withdraws 700 million XLM on May 15. I'm guessing that the list of people storing hundreds of millions of Lumens on the Ripple network is not long.

The price of XRP has been slowly descending ever since the end of the month, and the only question is how much further it will fall without a crypto billionaire propping up the price for his own benefit. Personally, I think it will drop back below 1000 sats, but Do Your Own Research.

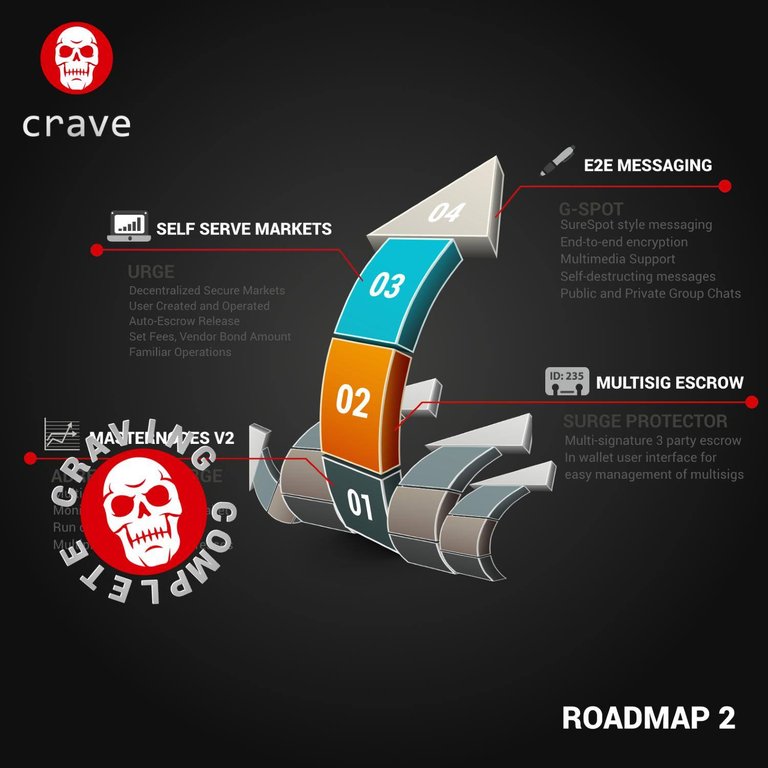

What's more amazing is that despite the public availability of this trade information, I have seen it mentioned nowhere else. This is the biggest movement in the crypto markets in a long time, and it seems to be driven solely by Jed trading FCK/YOU tokens. As trolling goes, this may be my new favorite for sheer ballsiness. My previous favorite was the anonymous developer of Crave, who dumped all his coins after releasing a development road map (driving up the price because people loved it) that no one noticed until later looks an awful lot like somebody giving you the middle finger:

Ripple is good tech for banks, but that is not very likely to drive up the price of XRP. The crowd of off-network exchanges could fuel more speculation, but don't kid yourself that this price jump is about fundamentals. It was all about FCK/YOU money.

A few points:

"Others have been promised to early investors in agreements that are not public."

Absolutely false. We very carefully made the decision that no XRP would go to early investors. At the time, the legal landscape was entirely uncertain and people even argued that all cryptos were inherently counterfeit. We absolutely did not want to put any of our early investors at any legal risk and we absolutely would never have considered an agreement like this.

"The XRP had been sold, so Ripple froze the $1 million USD from the sale. This did not require intervention by the courts; Ripple simply used their power to freeze any transactions on the network (!) and since it happened through Bitstamp's Ripple gateway, the funds were on-network."

Absolutely false. Ripple has no such power. Bitstamp froze the funds because there was a legal dispute over their ownership. The same thing would happen at, say, Poloniex if there were a dispute over the ownership of funds there.

With respect to Jed's agreement: Ripple has the primary right to determine what volume is legitimate and what volume is not. As you can probably figure out, Ripple and Jed are not exactly buddies right now and we have historically done everything we possibly could to keep Jed from dumping. I can't imagine us releasing XRP to Jed (remember, Ripple holds it) if we weren't convinced the volume was legitimate. He would have to sue us if that was his plan.

Ripple's litigation with Jed was not about us trying to take anything from him or keep him from making money. In fact, because he was prevented from dumping, the XRP he holds is worth much more than he would have gotten by dumping it. Ripple's litigation posture has always been to protect the market for XRP from insider dumping.

Also, Chris Larsen resigned his position as CEO. He's still a board member and almost as active as ever. In fact, I still report to him, as do two other people.

This article gives a very good explanation as to why a valueless token has clbed to #2 cryptocurrency.

IF YOUR SAYING WORTHLESS YOUR AN IDIOT, IF YOU MEAN PRICELESS YOUR EXACTLY RIGHT. YOU DO UNDERSTAND RIPPLE IS TAPPING A 27 TRILLION DOLLAR INDUSTRY RIGHT?

It is still centralized.

What is the "it" you are referring to? Bitcoin -- where three companies in China choose which transactions go in?

I don't have anything that satisfies my trust requirements that the actors in control are not colluding. These are the types of trust assumptions Bitcoin builds on.

With bitcoin, the actors are whoever has the best price on power and the best ASICs. There's no way to know whether or not such actors will collude and, today, they're all controlled by the government of China should it choose to exercise such control. By contrast, Ripple's consensus algorithm is not inherently centralizing in this way. It won't decentralize itself, but it's possible for it to be, and remain, truly decentralized. Ripple is committed to making this happen and has absolutely no incentive not to make it happen.

Well, RCL is a very worthy technology for a mostly decenteralized settlement network, I hope to see better node decentralization in the future. The same does not apply to XRP IMO.

Bitcoin and Ripple are very different projects - I do not find it entirely accurate to compare the projects in this way. I don't want to argue about the hypothetical collusion between Chinese miners; we can do that some other time :).

I disagree with this statement. See, I just don't like taking your word for it.

Nobody knows how to build a perfect system yet. If you're not interested in an objective comparison of Ripple to its "competitors", I'm not sure what other conversation we can have.

Hate on Bitcoin security all you want. Your a developer? for a pseudo-decentralized consensus ledger.

I don't hate on bitcoin security. I just have a realistic, rather than a naive, view of what it can, and has, accomplished. If you don't realistically see the weaknesses of one scheme, you can't rationally compare it to another.

The problem with bitcoin is that the stakeholders are chosen by external, inherently centralizing, factors. And worse, the stakeholders have a strong incentive to see the transaction fees be high. This is not by any stretch a fatal flaw, and bitcoin would probably have already gotten past it if people were honest about it. It just shows that the naive view that mining is inherently decentralizing and governance will take care of itself through everyone acting selfishly, doesn't always work out as well as you might hope.

I'm still very bullish on bitcoin and expect it to be the dominant cryptocurrency for some time, maybe forever. But it will always have poor censorship resistance due to its reliance on PoW -- unless that reliance changes.

Not to mention that some actors are much more selfish than others.

Thus, you have inherently different levels of selfishness which ultimately lead to the emergence of some dominance hierarchy that creates a disproportionate power differential over time.

As you, I am not saying that this is bad, but I am far more willing to place my trust in a company that has something to lose from fucking up (e.g.: 20 billion Ripple). The stake that the owner's of the company hold are what insures their integrity.

Are we talking about the RCL or XRP... Becasue I have a realistic understanding of the security that Bitcoin offers.

I think there are a lot more to these two statements than you make it seem. I agree with most of what you detail, although with with many small caveats. I think there is a place in this space for many different systems - each offering degrees of 'security', 'decentralization' and such. XRP and BTC will coexist dispite their large differences in centralization.

I agree. I'm a huge supporter of both systems. Since XRP doesn't have to fight the inherently centralizing tendency of PoW, XRP should be more decentralized that bitcoin by the end of the year. And, I suspect, bitcoin will improve its decentralization and censorship resistance as well.

Are u a part of ripple company?

I am the first employee, hired in November of 2011. I was on Ripple's Board of Directors during the Jed fiasco. I am currently Ripple's Chief Cryptographer.

Wow!! That is impressive glad to know u. I'm big fan of ripple. I like the system n the transaction.. very fast.. u do a good job buddy

@olyup @joelkatz Thanks for post

For interesting read for ripple https://steemit.com/cryptocurrency/@pps/ripple-things-you-need-to-know-about-ripple

Ripple is the king of shitcoins. If you are into Ripple, you are against the very ideology of blockchain, against free market and freedom in general.

Choose the future you want to build with your wealth wisely or crash with your friends banksters. Natural selection... ;)

https://steemit.com/cryptocurrency/@evolutionnow/how-to-make-millions-on-shitcoins

Current 4H chart. Selling 9Billion coins back in 2015. How much are they worth now?

It is going Up to next target $5.

Or, to put it another way, the XRP/BTC price has finally recovered to previous levels. Current 1-year chart:

Looking at this chart, where do you think it will go next?

That is pretty ironic looking at the chart today. Thumbs up.

great article, really good stuff.

What a wonderful writeup. Very in depth on the history of this coin, many thanks

@itsdanmark

Very good analysis. This shows many of the reasons I find XRP and XLM to be sketchy assets. Expecially coupled with the not decentralized network. These are not cryptocurrencies.

I wish you made it more clear what the actual purpose of XRP is in the first place: a method to make less hop transactions between currencies.

This bit of added information is appreciated for a beginner like myself.

In addition to Kyle's great explanation above there is one other point. Ripple's block-chain technology is what is primarily being pushed by Ripple. The Ripple network has the potential to save banks 33% of their remittance costs; however, if those banks use XRP as the transfer-of-value unit, total transaction costs can be cut by 60% versus what is currently paid. This is how Ripple will try to promote XRP. Whether or not XRP ever ends up being used by large financial sectors, I believe Ripple's current business plan will definitely make them a front runner in working alongside banks that need to badly update from their current practices.

Good points in this blog. I was about to post a similair thread. The cryptospace definitely feels a bit inflated. However we also said that about the S&P 500 40 years ago I found this amazing platform: https://www.coincheckup.com Since I use this site I make so much less basic investment mistakes. On: https://www.coincheckup.com/coins/Ripple#analysis For a complete Ripple Indepth analysis

This really opened my eyes to drama behind XRP and XLM. First off, thank you for your time and effort in publishing this. Lots of really helpful information to help understand the XRP XLM relationship. Second, after reading the article, I’m wondering if Jed will be able to successfully lead XLM to compete with XRP.

Time will tell.

Eye opener :flushed: This one is news to me. Don't know how to take this, for XRP seemed like a great example I can show my friends as to the power of blockchain to solve real world problems!

It is not really a blockchain ... reference ETH and the UN and hundreds of other companies building applications for a "real" blockchain

Interesting theory, but the large XRP payments on April 20 and May 3 are not from Jed. The funds originate from Ripple's initial 80% share of the XRP's. Likely just a re-allocation of Ripple's funds.

Tx hashes:

5D35D4DD29ED0FDC1B0412AE6B2C2BEB0A44DA7252413A9F96BA163CA58114E6 (20 April 2017)

1BFF320DCA8FA0792C935208E2DBD3BC0EB226D3B61CEDEBC24DC2AD84F46449 (3 May 2017)

Also, the rJed doesn't seem to be Jed's wallet https://bithomp.com/explorer/rJed6Ttuz4aD2EeinKZWPrGK9KiepX2iWL

The price of XRP is 0.35 cents US. When the price hits 1 cent then we have an issue, as of today XRP is all good.

What pile of rubbish.

What a great post. A true eye opener.

Ripple is centralized , and this thing (alone) IS a DEALBREAKER to me. Good luck to you with all your xrp's. Support banksters.

Long live Bitcoin

excelent analisys! very complete!

This was the best FCK/XRP article I have ever read. Whether it is true or not I don't care. Ripple has no place in the world of Decentralized Crypto Currency.

Its not a crypto currency, its a token!

In the end it's always who to trust: a top brain at Ripple with a credible resumé everywhere you look or some dude who creates a fictional FUD story to get some dollars per click.

Thank you, it was very well attempt of connecting all the dots together and building an impressive story... However all your analysis was based on historical events that are more or less behind us. I believe Ripple/XRP has bright future given that XRP is not challenging the existing establishment 'read banks' but making it much smoother, faster and transparent.

Moreover @joelkatz has removed some of my doubts and now I have even more reasons to remain invested in XRP

Nice investigative report but read it too late. I am in on the two coin and hope I will be able to salvage what I have.

The market cap has gone way out of Jed's control for quite some time now. Asian markets took over.

rJed doesn't seem to be Jed's wallet to me. Here is the full address https://bithomp.com/explorer/rJed6Ttuz4aD2EeinKZWPrGK9KiepX2iWL

olyup, care to comment?

nice article, good job!

Amazing, although it's a long read, I enjoyed every bit of it.

please keep on blogging.

After some research I came to the same conclusion. He is a genius who scammed the financial world by pitching the idea that you might be able to compete against bitcoin if you use it. A centralized ledger would never work because the underlying fundamental of greed is just too blatantly exposed in this case.

This post has been ranked within the top 80 most undervalued posts in the second half of May 20. We estimate that this post is undervalued by $12.79 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: May 20 - Part II. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Interesting theory

I read this for the lolz. Who knows what's true and what's not.

Great article and it explains so much. Thank you!!! I'm moving my XRP to ETH.

Thank you for your work! Wow, keeps me thinking! Great job.

Wow thank you for your investigative market research! I have been avoiding these two cryptos and feel blessed with some sort of fishiness sense. Although I could have made some money i guess..

Jeez, you make it sound like all Jeds are bad haha! You even put up a tag specifically for the name. The trolling is top notch though, you have to admit. From the exchange to the charts and even to the infographic. It all tied together.

great share...

Wow, great article!

Congratulations @olyup! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPIf you want to support the SteemitBoard project, your upvote for this notification is welcome!

I'm not sure what to think. I've seen advantages and disadvantages pertaining to Ripple's value but want to be sure this is passed along to XRP token value. I've seen Ripple referred to as both a public and private blockchain so i'm unsure whether it has both centralized and decentralized options. I think Joel Katz appears to be a very standup guy, and has been more than forthcoming about the history that's unfolded although there seems to be a lot of confusion going on and misperceptions with all the ventures Ripple has on the go with the banks signing up and the history that's unfolded. Olyup brings up some interesting information and myself trying to ascertain fact from fiction. I think there are some advantages/disadvantages to both decentralized and centralized currencies and i do think Ripple has a place in crypto. It may not be favoured by the 'types' that want 'decentralized' cryptos that don't work with big banks/big gov.t. but wouldn't pass on an investment opportunity just because of this.

Honestly, I cannot wait for the 'Made for TV' movie to be made about Jed!

Also thanks for getting the Beverly Hillbillys theme song stuck in my head :\

I dumped XRP around $0.45 - 2 months ago when Jed was manipulating the market. Haven't seen it get higher than $0.33 since then. I am hopeful that investors see a return on XRP, but knowing what I know about the inflation, lock up and scandals, I can't support them. (Similar to the reasons I don't support ETC). Thanks for the article!

Great analysis! thanks so much for the valuable insight ;)

That was fantastic review of what had happened in the past... Looking ahead if One has to choose between RIpple and Stellar, I would go for Ripple... here is why

https://steemit.com/cryptocurrency/@bsameep/forget-stellar-invest-in-ripple-comprehensive-review-of-two-blockchain-based-payment-companies

Can we say that ripple future would be as good as of bitcoin?

Geeat write up!!!! Thank you!

Instant transfer & zero transfer fee (#Nexty) - Do you believe it ? This means that when dealing with NTY you will not lose time (instantaneous transactions)

and no charge (this is the time pass bitcoin or eth will understand it uncomfortable and tired how tired). #blockchain #eth