Rather bizarrely, Yobit exchange announced a Pump and Dump of an unnamed cryptocurrency on the 11th of October.

They planned to buy one random coin for 1 Bitcoin every 1-2 minutes, 10 times, in the total amount of 10btc.

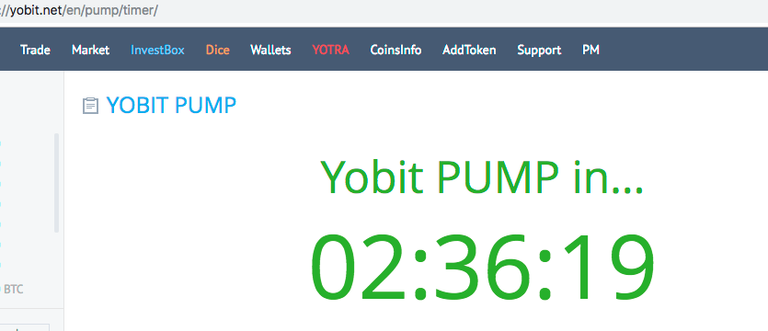

In what seemed like ‘we don’t give a damn’ moment, they have even put a countdown timer on their homepage.

They also made it clear in the email received by their subscribers that “Only one coin will be pumped, not 10”.

According to the twitter comments section, followers seemed shell-shocked.

Yobit decided to pump Putin Coin!

However, it's Pump and Dump of $PUT looked more like a pre-Pump and Dump.

See how it looked like LIVE on Coined Times: https://coinedtimes.com/yobit-volume-up-181-prior-to-pump-and-dump/

This tactic has obviously paid off, since their daily volume spiked 181% after the announcement and prior to pump. Yobit is now ranked as 39th exchange on the Coin Market Cap with $33 million daily volume.

This crypto exchange is hosting 482 cryptocurrencies. 315 of those have less than $100 daily volume as of press time. It is fairly easy to pump and dump them.

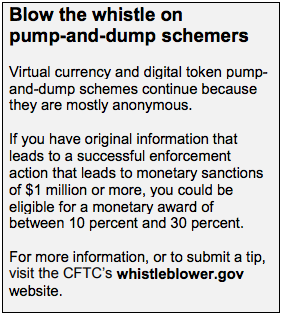

Even though Pump and Dump schemes are believed to happen often on exchanges, they are still unlawful. Well, at least in the USA. Some of the exchanges are doing it covertly by organizing giveaways to the top 24hr volume traders. Yobit is the first crypto exchange which has announced publicly their intention by brazenly wording it as “pump and dump”.

The U.S. Commodity Futures Trading Commission – CFTC is on a mission to investigate and prosecute crypto pump and dump schemes.

As CFTC said: “Commonly, it is the people pulling the strings who get out first making the most in the scheme, and leaving everyone else scrambling to sell before losing their investment.”

Considering that Yobit was founded in Russia in 2015, but accepts US customers, it is unclear if CFTC has a jurisdiction to act in this case.

Yobit has a history of fraudulent claim investigations. In March 2017, Russian telecommunications regulator Roskomnadzor had apparently opened legislative proceedings against Yobit, according to reports.

WAVES also had an issue with Yobit exchange. Its token appeared as a BTC pair on Yobit at a stage when it was impossible to withdraw it from private Waves wallets.

It is left to be seen how the crypto community and regulators will react to the Pump. There is a fear this kind of activities may have a broader negative effect due to the potential to attract harsher regulations and restrictions.