I am going to start this post with a simple question: What would happen to the history of astrology if memes were invented 400 years ago? Just imagine living in a parallel universe in 1616, listening to astrological analysis from a local intellectual of the time:

"Scumbag Steve has entered The Doge.

Much fortune and wow happiness await for you".

No, seriously now. People back in the day would swear that the stars guided daily life. They had no idea what they were—other than little lights on the sky. The knew nothing about the vast distances between them that ultimately made gravitational pulls on earth irrelevant. They just draw seeming lines, had a couple of mushrooms, and voila—animals were popping up in the sky. Shapes of animals that dictated their very life. They called this "The Zodiac". I mean, why not?!

Fast forward 400 years later, the majority of people still gaze high up in the stars, see the "signs" and still swear by their patterns. Most people insist on reading astrological charts even if astronomy has made all these archaic notions redundant. Astrological books still dominate the ones of astronomy 4/1 in many libraries. Who cares about the science factor though; Look at it! It is clearly a capricorn and the forecast talks about me finding my soul mate!

Sounds familiar? Yeah, it's you! It's all you!. Don't blame yourself though. There is an innate reason this random astrological prediction flared up your ego the moment you read it. More on this in a shortwhile

Technical Analysis is to Trading what Astrology is to Science

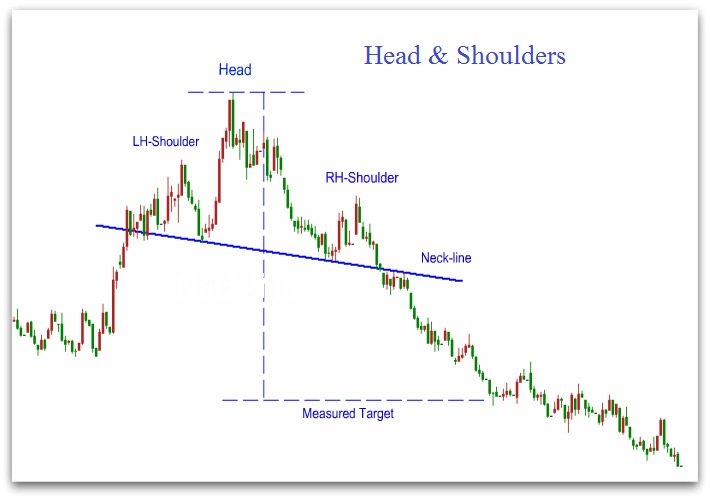

Right about now, the avid "Day Trader" might be filling up with angst. He swears that he can beat the market and make a steady income based on chart analysis. He lurks daily in the dark pits of finance to find secrets about trading. He knows about patterns like "Head and Shoulders" and uses "trend lines". He is a pro.

I have as much fun listening to traders explaining me their "job", as I had back in the day listening to Aboriginal Australians, explaining their sexual habits based on moon phases. Humans are not that different when it comes to falling victims to the phenomenon of pattern deception. We all carry the same instinctual mechanism and it is definitely not designed to be precise.

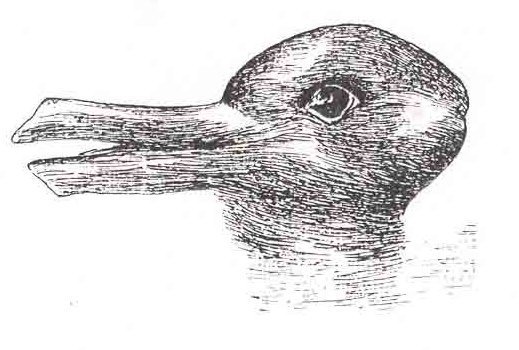

Patternicity is an innate ability that all humans possess. It helps us finding meaningful patterns in meaningless noise. Traditionally, scientists thought that patternicity was an error in cognition. Later on it was identified as the default autopilot of our brain in order to make sense of its surroundings. We did not evolve a separate *BS Detector* in the brain to distinguish between true and false patterns. We either saw something or we didn't.

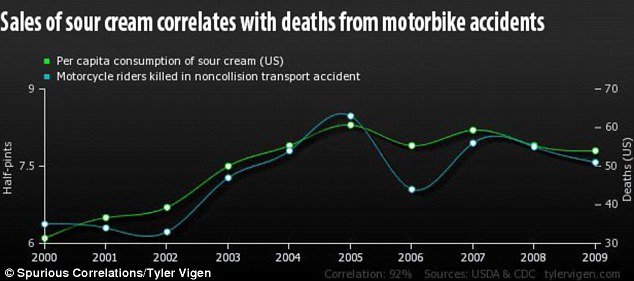

Most people swear they see signs in the clouds. Others see faces on Mars. I even saw a post from a popular anarchist recently (you know who) that was explaining the crash of the dollar in respect to the gold. We seem to be able to identify patterns for just about anything. We always see correlations. We rarely examine factual causation because it almost never applies anywhere in this universe. The world is way too chaotic because already entropic systems interact with one another. There is actually a website that one can generate bogus correlations at will.

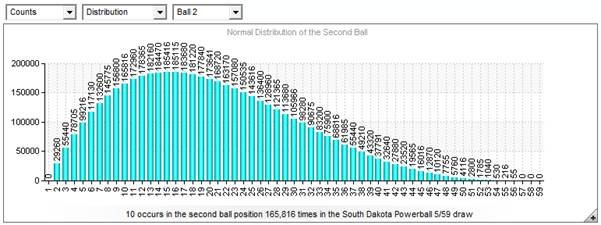

Here is a "professional" pattern that almost all traders swear by. Yes, people make financial decisions based on these. I am not kidding you.

I could go on but I am sure you get the idea. A reasonable human being, employing some critical thinking, can predict that some people will make money based on these observations. Let us take as an example a sample of 1.000.000 traders. Some of them, lets say 1%, will follow the patterns shown above for any given time and/or market intervals. They will make money almost 100% of the time. The rest 20% will have less success but still hit most market trends. This is not proof that technical analysis works. It is simply a normal statistical distribution much like it happens with the lottery. Most loose, very few win. One's Ability is irrelevant. In fact if one draws a normal distribution of successful traders based on the human population it won't be much different from lottery winners.

Who benefits from all these?

There are billion dollar companies employing supercomputers specialising in making specific market investments to the point of manipulation. Almost all the market movements are laid out from the "big players" working on these firms under fully automated bot systems. A day trader cannot possibly go against such technologies. They will have better luck following their horoscope. If a day trader is indeed successful is only short term. In the long term, much like in a casino, people lose money. A suceesful winning streak, ultimately, loses against entropy. These billion dollar companies know this very well and they plan accordingly to make profits from small time traders. People that work there have astronomical salaries. While I was in New York I met such an individual netting sometimes 100K per day just for his programming skills in one of these firms. He was paid by the hour. A NASA scientist barely makes 100K a year. Fo these firms 6 figure costs are next to nothing. They will pay millions just to get 0,1 second faster ping in transactions.

In the crypto world the situation is much worse. A few whales can manipulate trends and literally draw trading lines with their volume in order to convince people to start investing. Once they lure them in, they go short , becoming even more *whaley* while you are left holding the bag. Technical Analysis in the crypto world is straight up theft. A similar parallel would be the driving of cattle to the slaughter house by building fences around them.

What can you do about it

If you belong to the 90% of people on this planet that suck at math then stay completely away from trading. If you belong to the other 10% then investigate technical analysis a bit. You are allowed to gamble. You will find out sooner or later that it is not only a meme, but it also uses massive mathematical jargon theories.

Much like any other scam out there, try to educate yourself and people around you. Try to teach about the inability of humans to assign causal probabilities to events. Point that, as fallible humans, we will often force causal associations with non-causal ones just to make sense of the world. It is no different, whether we look up to the stars or arbitrary lines on our computer screen. Evolution has crafted us to be fools with patterns, but I am sure we can do better than that.

Feel free to share your thoughts on the subject. Knowledge is all about sharing

kyriacos

kyriacos

Let's not forget these gems:

http://www.marketwatch.com/story/how-hedge-fund-geniuses-got-beaten-by-monkeys-again-2015-06-25

http://www.telegraph.co.uk/finance/personalfinance/investing/9971683/Monkeys-beat-the-stock-market.html

http://www.forbes.com/sites/rickferri/2012/12/20/any-monkey-can-beat-the-market/

"Ten million portfolios containing stocks randomly selected as if by monkeys managed to produce better profits than a tracker fund over 40 years, academic research has concluded."

"The average hedge fund has produced a worse investment performance in the first half of this year than a portfolio consisting of a savings account at your local bank and a random collection of stocks picked by a blindfolded monkey."

Don't have the source, but there was also a study with a cat throwing a dead mouse on stocks, who did better than professional traders :D.

Moral of the story: If someone tells you that they know the future, don't believe them. They are full of shit.

Cats and mouses? This is getting better and better ahahahaha

I laughed so hard with these. indeed gems @alexgr

I'm not a trader, but yours explanation sounds very reasonable to a regular person..

No one know's if it's going up, down or in circles; all that matters is the MF fees!

This scene actually went through my mind while I was writing this @renzoarg

Long time ago I used to think the way you described: that technical analysis is BS.

But then I gradually understood this: in most cases the market behaves the way people think it will behave. This is just an inherent feature of a market: it creates its own future.

So even if what people believe in is BS, if enough of them share this belief when they watch the chart, this BS will materialize and it might turn out it was not BS after all.

Thus on the rational level your are right. In reality however, you are totally wrong.

"in most cases the market behaves the way people think it will behave", no, only half of the time, market only goes up, when everyone think it's going up but a few of them have bought in, but when everyone think it's going up and most of them ALREADY bought in, there is fewer buyers left, it will crash. it's 50-50, so it's still random

There is some of that but also when you feel you missed something it creates an urge to hop on. charts often show the urge as it flows through the population of traders. There is always too much uncertainty about the right price.

Yeah, this is true... if enough people believe that if the market does a loopty oopty, then it signals a bullish reversal, it will be a self fullfilling prophecy... These shapes and signs of course don't mean shit, but the fact that so many people believe that they do mean something can make meaning out of nothing. Just like how money has value... we make it so...

it does not mean shit how many people believe anything, it also depends on how much money those believers have to invest, if those many people believe price will go up, but they already went all in, and no more to buy, it does not matter how firmly they believe in it. the hard part is to estimate, at which point it's overbought, it's almost a random event, harder than predicting earthquake

I never understood the technical analysis part either.

The only strategy that works for me is to look at coins that have a good long term strategy and hold them long term.

Day trading is just too risky - seems too much like gambling to me and just like gambling most cryptos are rigged. In this case it is by the people who hold large amounts of BTC and can shape the markets to their will.

Unless you know these people and you know what they are going to do before they do it you are taking a huge risk.

complete bullshit article.

you are confusing front-running to technical analysis and are only referring to day traders whereas most technical analysis works for swing traders.

Chartism has to do with reading behavioral finance, the charts are tools to make decisions based on pure mass psychology.

In no way, shape or form does it work 100% of the time, it is only a tool to make an educated guess about where the market will go. It also allows you to put stops to limit your losses, and more importantly your psychological loss.

Price is the only true information that can be trusted in a market and TA is just that... analysing the price and its past to anticipate the future.

Big banks and hedge funds do indeed manipulate the market but not based on chartism, there is no way to code visual shapes from a chart, it is all based on statistical analysis, which is different (think: MACD, RSI, etc.).

I have been trading equities for years and learned TA from the best in Europe.. I am telling you it works, it is just an constant internal fight with your own ego and greed. TA helps you deal with it if you know how to use it.

How can you possibly use "mass psychology" @jurisnaturalist. Seriously. Can you predict how the masses react? Even if you predict how the masses react, how can you then predict how the rest of the traders will react?

I can argue that charts are not any better than coin tossing.

I specified that this only applies to crypto markets.

I don't buy it for a second that it works in the long run. Swing trading often requires some insider info. This is where you battle ethics with legality.

big difference between prediction vs. anticipation. It's a matter of probability, that's all... no one can predict.

I agree with you in a sense that DAY trading is kind of the same as coin tossing because of the reason you mentioned (esp. because of lighting-speed trading algorithm and given the fact that 80% of the trading today is done by these algorithm machine).

But back to swing trading and too illustrate the point. Let's take AAPL, please explain me why you think the support is tested 4 times at the same price... why is the downward trend line tested 3 times and then it broke upward including the 50-day moving average... a simple swing trader seeing that end of July could position itself by buying the SPX once the price reaches the moving average and put a stop 4/5 % lower in case it remains bearish. In the case of the graph, you would be in the money today. luck?

or another example, on SPX (SP5000 ETF). please explain me why you think the support is tested 4 times at the same price... then when it breached the resistance it went straight up?

This can be found in so many charts, and it is far from being just random luck.

But again TA is not for everyone, and we need people like you. You are the ones selling when we need to buy it and make profits.

luck. in other cases it doesn't so that. google post-hoc argument. in fact let me do it for you

https://en.wikipedia.org/wiki/Post_hoc_ergo_propter_hoc

Because there is a psychological barrier that says that this specific stock or etf is NOT worth less that this exact price, so it bounces up. It's just the market dictating that to all.

All we are saying is that because A, B and C occured MAYBE D will occur as well... again.. its a probability of happening and is based on observations made, doesn't mean it is a rule of nature. And it is very different to state something that has occured in the past and deduce something from it than observing something and ANTICIPATING that it could likely occur again and so positioning onself in entering that trade while managing the risk (stop orders). It's that simple.

having a rough idea of what an asset may be worth is something that could come from a number of factors, but that has very little to do with actual technical analysis... technical analysis is silly, but may work in some cases solely due to how many other people also think it may work...

I've been trading for ages and yes i agree with you..

laughed so hard reading this lol

LOL shared this with a few friends who do trading and they thought that it was hilarious.

The connection to memes and astrology was brilliant.

Literally laughed out loud at this line.

Long I studied the technical analysis, but I haven't found application

No one has. Whoever tells you otherwise they are lying to you @rucoin

Put your money on a "Dead Cat Bounce" FTW !

Actually, I agree .. but in trading currency ... you can see trends ... it MAY be a bet, but if you can spot a trend, realise the momentum and timing ... You can make money ... Have a good one !, that was some funny stuff !

well @jtstreetman . I don't think I am THAT crazy but I guess I will take it as a compliment

Hence the revision my good man ...

If it goes down, it might go back up... and vice versa. That's about the only trend that holds any weight...

All markets must be trusted in order to have a bright future!

Whales play a big role for sure!!!

Must research, question, and protect yourself before to start trading...

@alexoz

Trusting the market is like trusting the weather for securing your house. Sure some sunshine will protect you from mold but a hurricane can destroy it.

I'm just into applying deep neural nets for trading but from what I've learned so far, I'd rather stick with Burton Gordon Malkiel's book 'A Random Walk Down Wall Street' :-)

@mcsvi

I am highly reccomending the book "Fooled By Randomness" :-)

I do think it measures psychology, all the persons participating are human that get too excited and too depressed (mr. market). If you don't believe technicals also need to throw out value investing and stick with Emh.

@dennygalindo

I am not rejecting trading all together. I believe that long term investing is something viable one can do as long there is diversification. Everything else is plain gambling.

Here NOW ! We prefer the term "Speculating" Gambling just sounds so vulgar !, lol

And btw, before I go sleep, I would like to say I do admire your "Cognitive Virility ! /bow

thank you :)

how about speculative gambling? lol..

I think the trading algo's have made actual analysis moot and have clearly severed pricing from any underlying sane measure of the real valuation.

funny

Tell you what, this is by far the best string of comments I've seen yet!!!

Bottom line - when it comes to trends, patterns or theories - People will find data that supports their argument. Could be right, could be wrong.

In the end everything is just probabilities and percentages. Do the best you can to put the odds in your favor.

you're drawing skills are out of this planet! im blown away!

kyriacos very well done upvoted and following

This post has been linked to from another place on Steem.

About linkback bot. Please upvote if you like the bot and want to support its development.

I just want to tell a couple of things to the next readers.

About the experiment with the monkeys throwing darts... It's not that difficult to understand if you know how risk works. If you happen to invest in a little company with low market cap and variable volume, you do have more chances to earn a noticeble profit in the medium - long term than investing in a already consolidated firm. And that's where the monkey's did better. Because as a professional you want to lower the risk of the long term investment, that means lower profit. Do you get that analysis paying bananas? On the other hand, as a day / swing trader you aim for the profitability. I really doubt a monkey can do better on a day trading throwing darts randomly.

I partially agree with "It's not for 90% of the people"... maybe it's only for the 1% that educate themselves before making an investment. If you don't understand what is the business, you are totally right! It's not for you! Stay away from it! Go and open a paper trading account and take lots of tutorials and if you still don't understand... well you can always eat a dart and throw a banana to the charts to randomly choose the best option for your investment (did you note the sarcasm? or are you one of the 90% that don't understand math as well?).

If you have a degree you have more chances understanding some concepts like Fibonacci numbers. Actually, I believe you don't need the degree, all you need is WILL to look for the truth and don't stop until you find it.

You should try Technical Analysis with a professional that teaches you how to trade before giving a wrong conclusion about the subject. Pay attention who you listen to, it might be someone who only wants to missinform you.

Peace.

Many people dont know about technical analysis yes this includes haejin, cnbc, fintwit and every cow chicken, duck avi genius on crypto twitter and steemit....

technical analysis bullshit? its comments like these that makes u wanna print out 4000 pages of stock charts, pile them up and then beat the person who says such things with the actual desktop