This Week’s Property Market Highlights:

- The number of auctions across the country increased from last week.

- Demand for Sydney housing seems to have fallen to its lowest point since April 2016.

- Adelaide was the only capital city where home prices didn’t fall week-on-week.

- New home sales across the country fell to its lowest point since 2013.

- The RBA left the cash rate on hold at a record low 1.50%.

The Latest Preliminary Auction Activity

There were about 200 more homes available at auction this week than last week, and about 350 more than this time last year. This boost in supply swings some power back in the buyers favour as it offers them more choice. That tends to result in them not willing to pay as much.

As expected with rising auction volume, Sydney’s auction clearance rate fell significantly from last week’s figure. It will likely drop further after all the results are counted later this week.

Don’t be fooled by Melbourne’s strong preliminary clearance rate of 77.2 percent. Last week’s preliminary rate was 79.4 percent before falling to 73.8 percent after all the results were counted.

source

Expect auction volume next week to fall back closer to last week’s numbers, around 1,650. With supply falling, we may end up seeing a boost to clearance rates, and perhaps even a rise in the median house price.

Last Week’s Final Auction Results

Sydney’s final clearance rate last week recovered back into the 70s for the first time in nearly two months. Although Melbourne’s preliminary result looked strong last week, it ended up even lower than the previous week once all agents’ reports came in.

Here are all the final capital city results for last week:

source

Buyers in Sydney were a little more spread out. The Eastern Suburbs were shining bright with a clearance rate of 90.0 percent. Baulkham Hills and Hawkesbury, on the other hand, failed to even find a winning bidder for 40 percent of its properties.

The sub-regions of Melbourne were a little more balanced, with the North East and Outer West mustering the most demand.

source

Recent Changes in House Prices

Last week I mentioned that the median house prices for Sydney and Melbourne were climbing week-on-week from mid-June through July before leveling off last week with the rise in supply. With auction volume increasing again this week, home prices pulled back, declining 0.25 percent in Sydney and 0.14 percent in Melbourne.

With a decline in supply expected for next week, I’ll be keen to see if house prices recover and erase this week’s falls.

source

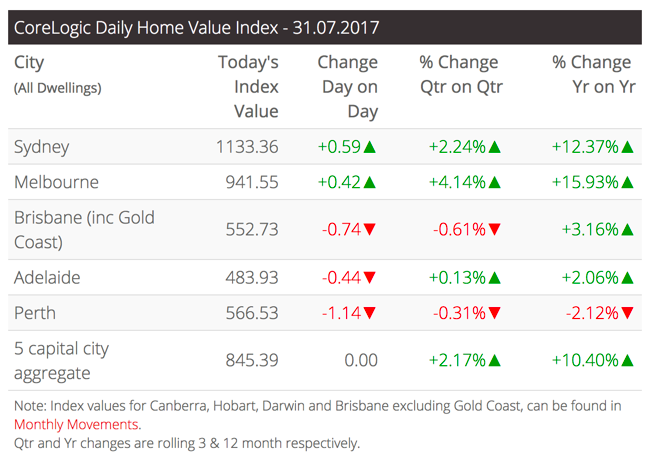

As we’re now into a new month, CoreLogic just posted its monthly housing price index data for the month of July. Melbourne prices rose 3.12 percent and Sydney jumped by 1.37 percent.

Adelaide units were the standout performer – they were up 5.55 percent in one month!

source

Market Analysis

My point last week about how price movements lately seem to be most closely related to supply played out again this week. As supply increased, prices fell. But what about auction clearance rates?

As clearance rates dip into the 60s we’ve traditionally seen home prices level off. That has been the equilibrium point. Once the clearance rate drops consistently into the 50s, we tend to see home prices begin to fall. As I reported last week, unless we see a dramatic shakeup in the bond market, the home price growth curve will probably flatten out for the remainder of the year.

That said, the Spring supply surge will test demand, and it’s possible that we’ll reach the peak of debt serviceability sooner rather than later. If clearance rates start to hit the low 60s, falling prices could be just around the corner.

This Week’s News

The RBA’s August Monetary Policy Decision

Yesterday was the first Tuesday of the month, which means the RBA bankers gathered to decide the cost of money, something that should be up to the free market. They decided to leave the cash rate on hold at a record low 1.50 percent.

There were no surprises there as Philip Lowe has had his hawkish hat on lately. He recently acknowledged that additional interest rate cuts could have the unintended result of further inflating the housing market and household debt. He stopped short of begging for forgiveness for enslaving an entire generation to our banks for at least the next 30 years.

Fingers crossed, the RBA will be able to resist the temptation to cut rates as the US dollar devalues to infinity in the coming months or years. In light of recent weakness in the Greenback, the Aussie dollar has strengthened significantly and is trading near 80 US cents for the first time in over two years.

A strong Aussie dollar makes life difficult for our exporters and works against the RBA’s stated goal of boosting inflation. They really need wages to rise faster than 2 percent per annum to keep the banks afloat and the property and debt bubbles growing.

New Home Sales Just Hit a Four-Year Low

Speaking of wages, anyone earning money from the housing industry got some bad news this week. The Housing Industry Association (HIA) just reported that sales of new homes across Australia fell 6.9 percent over the month of June. That’s bad enough, but even worse considering sales actually increased in Victoria and Western Australia. That could mean that housing demand in New South Wales, Queensland and South Australia, at least, is rolling over.

No matter how you cut it, 7 percent is a sharp decline, and the latest figures wiped out two months of gains and brought the new home sales figure to its lowest point since 2013. New housing starts are a reflection of demand, especially from investors who have been hammered by tighter lending restrictions from APRA.

Settlement Risks Are Rising

I just uncovered another potential lending challenge this week when a client out in WA who also happens to be an agent sent me a report on mortgage valuation activity. It reveals that an increasing number of valuers are opting for desktop property inspections rather than showing up in person to inspect properties internally, or even from the kerbside. The report called this a “trend towards simplification and reducing turnaround times,” but switched-on investors will see some potential problems.

If this trend continues, it could hurt bank lending valuations, especially for investment property loans. When the valuer fails to show up in person, it can compromise the accuracy of the valuation.

This is a problem for sellers because if the valuation comes back too conservative and below the contract price, the bank will not be willing to lend as much as the buyer is assuming they can borrow. That would mean the buyer must either pony up more cash to settle or they back out of the deal. Then the seller must either lower the sales price to match the valuation or find a new buyer willing to pay a higher price.

Where this can really get interesting is when you’ve got a developer who has sold 200 apartment units, only collecting a 10 percent deposit from each buyer. The apartment building is then built, but as valuations start coming in low, buyers are forced to walk away from their purchase and lose their deposit.

The bank still wants its money from the developer, so they come and take it by seizing developer assets. Then developers go out of business and people lose jobs. We’re not quite there yet, but a significant settlement risk remains in both the Melbourne and Brisbane markets in light of an extreme oversupply of apartments that will soon need to be settled. Oh, and just in time for tighter lending restrictions from APRA.

Watch this space closely, as it could be the demise of the Aussie property market if contagion breaks out and banks need to tighten up even on established housing lending.

How much longer do you think the RBA can prop up the Australian housing market?

Jason Staggers

I wouldn't be surprised if they do what is happening in the US. As people start defaulting on the loans and the houses get repossessed. Instead of putting the houses back on the market, they keep the house on their books to keep prices high. That's my opinion, the government wouldn't want the housing bubble to pop before the US stock market pops.

True, it will be easier to blame our woes on someone else overseas. Regardless of when there's a correction, I think you're right about banks doing anything they can to keep supply low. Thanks for sharing your insights.

Nice article! I always enjoy reading something to do with housing. How is Australia? I am in the USA

Australia is a great place. You should pay us a visit someday.

Thanks Jason, top article with excellent research and information once again.

Thanks lucky. Appreciate you stopping by.

This deserves some attention. Upvoted and resteemed...

Thanks

Excellent post dear friend @jasonstaggers, very interesting, congratulations for the research work and all the information gathered. Many thanks spor share this wonderful work

Congratulations @jasonstaggers! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP