Ask your friends, neighbours or your relatives regarding stock market investing. Most of them will discourage you and mention that it is another form of “gambling". Many individuals still believe that there is no "logic” behind the stock price movement. Those who earn big from the stock market are just "lucky". On the contrary, the interesting fact is that almost all billionaires in the world have created their fortune through the stock market, either directly or indirectly. “Directly” refers to the direct stock investing and “Indirectly” refers to listing their companies on the stock market. One of the world's richest persons, Warren Buffet created his fortune from direct stock investing while other well-known billionaires like Bill Gates (founder of Microsoft), Mark Zuckerberg (founder of Facebook), Larry Page (founder of Google) made their fortune by listing their companies on stock market. Even in India, you will find

many billionaire investors (e.g. Rakesh Jhunjhunwala). created their entire wealth from direct stock investing

My question is if stock investing is another forms “gambling” then how these billionaires have created the fortune from the stock market? You may earn one thousand or one million from “gambling" but it is not possible at any cost to become a “billionaire” or to become the world's third. richest person by “gambling”. Can you say they were just lucky enough? Luck can favour once, twice or even thrice. but they are consistently earning from the stock market over several decades. A gambler can't make billions consistently, Moreover, luck is not sufficient enough to create a billionaire. So, there must be some different story.

On contrary to this, 80% retail investors lose their hard earned money on the stock market! In this blog, the term “retail investor” is widely used. “Retail Investors” refers to those who engaged in some different full-time job (or source of income) and investing (or planning to invest) a portion of savings into the stock market. As per statistics, 80% retail investors suffer overall loss from equity investment. Now the most important point that arises is why maximum retail investors (small investors) lose their hard earned money in this market while a group of people is creating their fortune?

This blog will explain in detail why the majority lose money in stock market, how to avoid it and what are the methods to build a fortune from the stock market.

To avoid loss in the stock market, you need to know the reasons why people lose. I am going to share a reallife example that will explain the reasons for losing money. Existing equity investors can also co-relate with the following story.

An example worth sharing -

Few months back, I was having a conversation with an investor (Rohit) and I was surprised to know that he had lost around 10 lakhs (310,00,000) from the stock market. During the last five years in the stock market, he had applied various techniques, followed many analysts and ended up with a cumulative loss of around 10 lakhs! However, at several instances, he made money, but the profit was too little as compared with the losses occurred.

I am dividing his stock market journey into 4 phases. Let's have a detailed look at each phase and let's analyze exactly where he went wrong.

1st Phase

Around five years back, Rohit didn't have any idea on the stock market but was eager to invest. One of his friends was a stock broker who used to trade regularly. Rohit was interested but didn't have any idea how to start. In such a situation, Rohit approached to his broker-cum friend. Without delaying further, his friend opened a trading and a demat account. (As expected from a stock broker) Rohit then handed over an initial amount of around rupees one lakh (21,00,000) to trade on his behalf. That was the best available option as he didn't have much knowledge about what and how to buy and sell.

Initially, everything was running smoothly. Almost, every day his broker used to share some news based tips and asks for his permission to trade on that stock. Then at the end of the day, Rohit used to receive a phone call regarding the earnings. After some initial gain, Rohit handed an additional fifty thousand

to his friend cum broker for trading. It was a nice start, hehe already earned 20% profit without any technical know-how

| All on a sudden, the situation changed. There was me trade confirmation over 15-20 days. His broker no longer used to call him. Rohit was worried. Suddenly, he got to know that 50% of his initial amount was wiped away! Rohit was shocked. For a first time investor, 50% loss on his invested amount is too hard to accept. He came to know that due to unfavorable macroeconomic situation market crashed badly and it won't change soon. With deep frustration, Rohit instructed his broker cum friend to sell his entire holdings, While closing his trading account, he figured out that including brokerage and other charges 55% of his invested amount wiped away!

Where he was wrong?

In stock market blindly following your broker (or friend) may cost you badly. Have you noticed that whether you gain or lose, your broker always remains in profit? You have to pay brokerage for every transaction (buy and sell). Your broker can earn only if you trade. So, it's obvious that your broker will encourage you to buy and sell frequently. All of us are concerned to maximize our income. While you are concerned to earn from stock market, similarly your broker is also concerned to maximize his income. Due to this maximum broker encourages frequent trading. Exactly, here the problem arises. The more you trade; the chances of suffering loss will widen and at the same time your broker's income will keep increasing. In the later part of this chapter, I will mention in details on why frequent trading widen the chances of losing money.

2nd Phase -

Rohit had closed his trading account after the first incident. I was eager to know what inspired him to come back in the market.

After 6 months from his first bitter experience in stocks, he started following few business newspapers regularly. For stock tips, watching television channels like CNBC, browsing internet and reading newspapers became his habit. This was the time when equity market was on bull-run. Almost every day, market touched new heights; most of the stocks were in upward trajectory. Various analysts in television and newspaper were also expressing their optimistic view. Many of them were commenting like- “this time it is different, market will continue to rise for at least next 2-3 year” Rohit was tempted and was eager to make the most out of this situation. Without wasting much time he applied for a new demat and trading account. This time he got associated with a reputed broker. He was eager to enter in the market rally to earn some quick bucks, so he opted for intraday trading; one of the most common ways to earn quick money. The best part is that intraday trading tips are available at free of cost on various newspapers and television channels. There are plenty of market analysts who offer free trading tips. Rohit started following them. His broker was ready to provide up to 10 times margin for intraday trading i.e. for every 100 in his trading account he can trade worth 1,000 in intraday. He dedicated * 50,000, so with this amount he could trade up to 35 lakhs in intraday. Everything was great. There were plenty of free trading tips and enough margin money to trade. There were several instances when Rohit gained from these tips, but the problem was that only one or two loss making trades wiped out the entire gain earned from 5-6 profit making trades.

This is a peculiar problem. Gains are always litt compared to losses. Rohit couldn't figure out exactly when he was wrong. He had applied “Stop Loss” as per analyste but many a times the stock started its upward journey aften touching “Stop Loss”! After 4 months of trading, he took break to calculate overall gain. The result was shocking In spite of various successful trades, his initial capital didn't appreciate at all. Moreover he was suffering from 20% overall loss! The interesting point is that during 4 months around 70% of his trades were successful. He made money on those occasions. Only 30% loss making trade wiped out the entire gain! That was really frustrating. In spite of keeping “Stop Loss” and “Target”, he ended up with booking small profit on successful trade and big loss on unsuccessful ones. For example, once he purchased Reliance at 800, it achieved first target of 3810 and he booked profit of 310. Another day, he purchased Reliance at 800, and put “Stop Loss” at 790. However the stock crashed so badly that it reached 780 without touching 790! So, he was forced to sell at *780 and book loss of 20 per share Rohit was in deep frustration while sharing this "Why every time stock market behaves with me in such way?!”

Where he was wrong?

He was wrong at the very beginning. Intraday trading is almost a sure-shot way to accumulate loses. Can't believe it? Well, show me a single person who is consistently making money from intraday trading for at least 1-2 years. Throughout the world show me a single billionaire who made his fortune only from day-trading. You won't find a single person. You can make money, once, twice or thrice

but you are bound to lose after that. Generally, loss is always larger than profit. Try it yourself. Take day-trading tips from anywhere, from any analysts. There are many paid stock tips provider who claim 99% success ratio. Follow their tips and trade in intraday and check the result. It may sound bitter but the reality is not a single market analyst can help you in creating wealth from intraday trading. Now you may think; if this is the case then why so many people jump into day trading. There are various reasons which I will discuss in detail in the later part of this chapter.

As of now just note the indirect encouragement from your broker. You have 350,000 in trading account, however your broker allows you to trade worth 5lakhs (5,00,00) in intraday i.e. up to 10 times than your original amount. (which is called “Margin Trading”) What will you like to say? Do you want to make money for your broker?

3rd Phase -

Rohit had burnt his finger in day trading. Now he committed not to repeat the same mistake again. He was now more careful but also highly optimistic to earn from stock market. The only problem was that he had limited funds. He started accumulating few well known stocks and planned to hold for next few months. His portfolio was showing around 20% gains over 10 months. In this process he had accumulated around 8 lakhs. During this time, he came across an attractive offer; “Loan against shares”, in which one can keep stocks as collateral for loan. Depending upon the stocks, one can receive loan up to 80% funding of the total net worth. Bank has rights to liquidate collateral stocks if you fail to maintain minimum collateral value.

Rohit didn't think twice. He was getting around 20% annualized return from stocks. Considering 12% interest on bank loan, it was an attractive deal. So, he kept his investment as collateral and didn't hesitate to take loan Th. were going fine as long as market was moving in un direction. Rohit was happy to notice that his investment was growing at exponential rate. For every percentage increase in share value, bank was ready to provide additional loans, Rohit was planning for more leveraged position. While everything was going smooth, stock market suddenly took a U-turn. Within 10 days his portfolio value dropped by around 20% Rohit was supposed to maintain the collateral amount but with further market downfall he was in big crisis.

He was forced to sell a part of his investment to maintain collateral. Things were worsening. Market continued its downward journey. There was a wide spread pessimism. Equity analysts, who were predicting big targets just few months back, were also expressing their bearish view. Rohit was not able to swallow the decline in this investment. Meanwhile, Bank continued to pressurize for maintaining collateral. Things were moving out of control. Finally Rohit sold his entire investment, mainly due to fear and pressure from bank. Over the past 2 years he had accumulated around 10 lakhs, just few months ago he was in good gain but he ended up with 25% loss. The entire loss was just because of “forced selling”. Had he avoided “loan against shares” scheme, he wouldn't have to force sell his stocks during market downturn.

Where he was wrong?

Investing in stocks with borrowed money is a dangerous practice unless you have enough expertise on the subject.

This practice can exponentially increase your gain as well as multiply your loss. Almost all sophisticated investors leverage their position. They know risk management, they know when and how much to leverage and above all they have in-depth understanding on the subject. Figure out whether you have enough expertise or not. For retail investors, it is better to stay away from loan against share. During bull-run any investor can do well, but what separates the intelligent investors from the rest is the ability to minimize loss during market meltdown. Retail investors tend to go for “loan against shares” during bull-run. After 1-2 years of good return, you start believing that you have mastered the game and then market will teach you a lesson. Leveraged position can even create bankrupt situation during market fall. So it is always better for retail investors to avoid the same.

4th Phase -

Enough is enough. After 3 unsuccessful attempts Rohit decided to go with any professional stock tips provider. He did a Google search and found so many names. All most all of them claimed 90%+ success ratio and showcased fabulous past performance. He was confused and so he subscribed for 3 days trial from various stock tips provider. After 3 days trial, he started receiving many phone calls from them. One such service provider mentioned that he can make money not only when the market goes up but also when market goes down through "Futures and Options.” Rohit was surprised. Earlier, he had suffered loss mainly during market crash. So, “making money while market will go down" was attractive enough to catch his attention. He was eager to avail the services provided by that stock tips

provider. The only problem was that they were asking a huge subscription amount. He delayed his decision the other hand, they kept on calling him and insisted joining the package. Finally, they agreed to provide « 2 trial calls”. Surprisingly, both the calls hit the target. Moreover they assured 100%+ monthly return from their “Futures and Options” trading call. Rohit was highly convinced. He paid 30,000 as subscription amount for highly profitable “Future and Options” call.

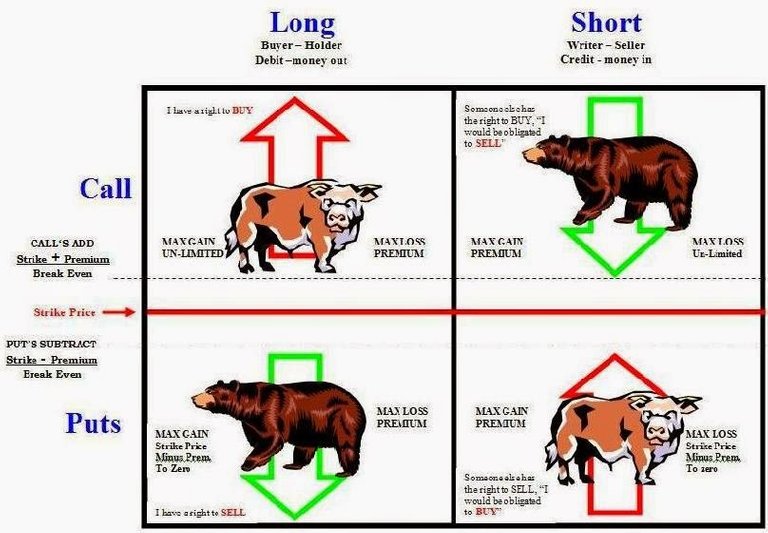

He was ready to dedicate five lakhs (5,00,000) to start with. He started with # 3 lakhs (3,00,000) on the first call. Surprisingly it was showing 50% gain within 15 days. He realized the magic of “future trading” and decided to put extra fund. He had made handsome gain from the first call and was eagerly waiting for the next call. As expected, he invested the larger amount in the next “trading tips”. What he didn't realize was the uncertainty that Futures & Options (F&O) carries. No doubt, F&O can provide extraordinary return but at the same time it can also lead to "unlimited loss”.

For every correct bet, you can earn 50%-100% whereas a wrong bet can lead to 100% loss. The same happened with Rohit. He had earned 50% return within 15 days from the first “trading call” and lost 90% from the second call in the next 20 days.

Where he was wrong?

Trading in “Futures and Options” is the worst ever decision for any retail investor. You can lose your entire life's saving. Many analysts or stock tips provider will claim that one can earn up to 100% return within a month from

“Future” trading. My question is why they themselves don't trade? What's the necessity of selling "tips" when you can earn 100% monthly return from your own analysis? If you can take a bank loan of 10 lakhs and earn 100% monthly return then after repaying bank loan you can become a billionaire within a 2-3 year. Now show me a single person, who turned billionaire through “Futures and Options” trading. You won't find a single person throughout the world.

Next time onwards, if any stock tips provider tempts you for “Futures and Options” (F&O) trading, simply mention them the above statement. Just conduct a Google Search, you will find many stock tips providers claiming such extraordinary return from their trading calls while reality says something different. Don't be get trapped. Stay away from stock tips provider who claim extraordinary return.

Basically, F&O is meant for institutional investors and hedge fund. They are the one to get benefited from this option. Big companies or High net worth individuals hedge their position using F&O. Future trading is a great option for hedging. Retail investors, who jump in F&O for extraordinary returns will surely end up with lots of disappointment.

"Intraday, short term trading and F&O- all those

are nothing but another form of gambling."

One of the best post... Crisp and Clear