Thanks for the reply, this is really interesting. Please help me understand your idea here.

Your thought is that regardless of the pie, a larger share of funds should go to directly financing small businesses, with emphasis on this financing not simply serving as a clearinghouse for bank dealings?

This seems to make a lot of sense to me. Any idea what might be some of the drawbacks? THANKS!

I can't really think of any drawbacks. Everyone is pretty literate these days and most forms are online with instructions.

https://www.grants.gov/web/grants/learn-grants.html

and believe the whole thing could be replaced with crowdfunding, VC's getting involved in local community and a simple hotline help-desk.

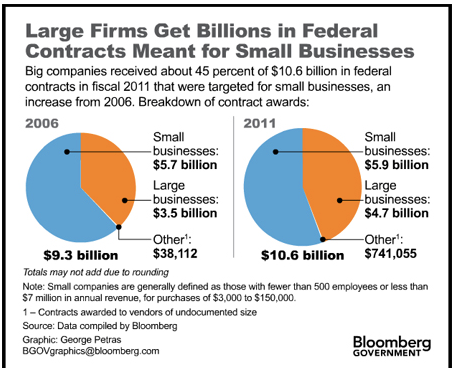

Pushback by the banks and by lobbying legislation. Also, finding out who is getting the 98% of prime government contracts and redirecting that. Doubt that list exists.

http://gtpac.org/2012/11/16/big-firms-edge-out-small-businesses-for-billions-in-awards/

Oh Wait! Here you go. It's from 2011 but doubt it's changed much.

http://pogoblog.typepad.com/pogo/2011/06/take-it-from-the-top-ten-contracting-behemoths-pull-in-25-percent-of-all-federal-contracts.html

Thanks for digging that up! You gave me a lot to consider that will definitely shade my thinking going forward. Cheers!

Wow Thank You! These are the questions we need to ask and I don't trust 21 year old interns to do the reading for the bi-focal class of 2017.