Thanks for posting, I'm really looking forward to seeing this grow into a meaningful discussion.

I'll get things started with the Small Business Administration, set to be cut by $43.2MM or 5% of overall budget.

In trying to analyze this, I get a little thrown off by the formatting of this document. They lay out the level of the cut to the budget at the top, then list all of the things that they are planning to do with the remaining money, which is giving me somewhat of an incomplete picture (unless I go back and review the previous year's budget I guess).

Anyway, this cut was a bit surprising to me, especially coming from an administration that has gone to great lengths to brand itself as "pro business".

Thoughts? And also, at a higher level what do you suppose should be government's role in supporting small businesses? THANKS!

Looking at their site I found a couple of documents that might help answer that question. First I noticed this on their "About Page"

That led me to these two performance documents. I would think if the government was pro small american business, they would make sure more than a "goal" of 23% of their "prime" contracts were awarded to small american business...

U.S. SMALL BUSINESS ADMINISTRATION Summary of Performance & Financial Information

https://www.sba.gov/sites/default/files/aboutsbaarticle/SBA_Summary_of_Performance_and_Financial_Information_508C.PDF

Fiscal Year 2016 Total SBA Loan Approvals and - Federal Contracts Awarded by State https://www.sba.gov/sites/default/files/aboutsbaarticle/FY_2016_Data_508C_V3.pdf

The next step would be to address it at the state level and ask them if they are truly an advocate for small business or just a portal for banks to funnel accounts into. My answer, they have their uses, but it's nothing you can't learn with a pell grant at your local community college. Too many "guardrails" on federal and state money slow growth. From what I can tell they are there to help you navigate through all their red tape.

Thanks for the reply, this is really interesting. Please help me understand your idea here.

Your thought is that regardless of the pie, a larger share of funds should go to directly financing small businesses, with emphasis on this financing not simply serving as a clearinghouse for bank dealings?

This seems to make a lot of sense to me. Any idea what might be some of the drawbacks? THANKS!

I can't really think of any drawbacks. Everyone is pretty literate these days and most forms are online with instructions.

https://www.grants.gov/web/grants/learn-grants.html

and believe the whole thing could be replaced with crowdfunding, VC's getting involved in local community and a simple hotline help-desk.

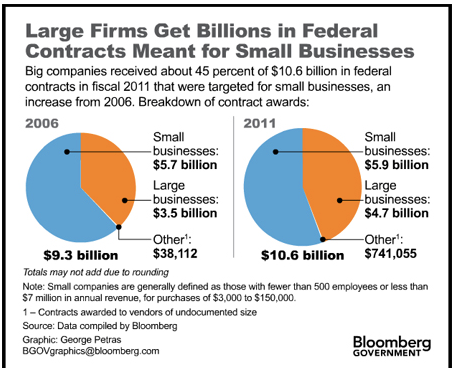

Pushback by the banks and by lobbying legislation. Also, finding out who is getting the 98% of prime government contracts and redirecting that. Doubt that list exists.

http://gtpac.org/2012/11/16/big-firms-edge-out-small-businesses-for-billions-in-awards/

Oh Wait! Here you go. It's from 2011 but doubt it's changed much.

http://pogoblog.typepad.com/pogo/2011/06/take-it-from-the-top-ten-contracting-behemoths-pull-in-25-percent-of-all-federal-contracts.html

Thanks for digging that up! You gave me a lot to consider that will definitely shade my thinking going forward. Cheers!

Wow Thank You! These are the questions we need to ask and I don't trust 21 year old interns to do the reading for the bi-focal class of 2017.